Summary

Google's Quantum AI team, which works with NASA and D-Wave Systems, recently announced concrete evidence of huge runtime gains for proof-of-principle optimization problems with D-Wave's latest quantum computer.

The 1000+ qubit D-Wave 2X quantum annealer outperforms classical processors by a factor of over 10 to the 8, or 100 million times.

Central banks, governments and major aerospace firms already employ the technology on a exploratory basis, but financial researchers/directors see massive potential for portfolio optimization in the vein of HFT trading.

This technology not only has massive implications for Google but for the entire financial industry as a whole.

The ability to solve complex, dynamic problems that would take classical computers tens of thousands of years in mere seconds - this has been the promise of quantum computing. The theories and ideas behind quantum computing have been around for decades, but now, Google (GOOG; GOOGL) is starting to demonstrate concrete progress in the quest for a practical quantum annealer that could revolutionize the entire world.

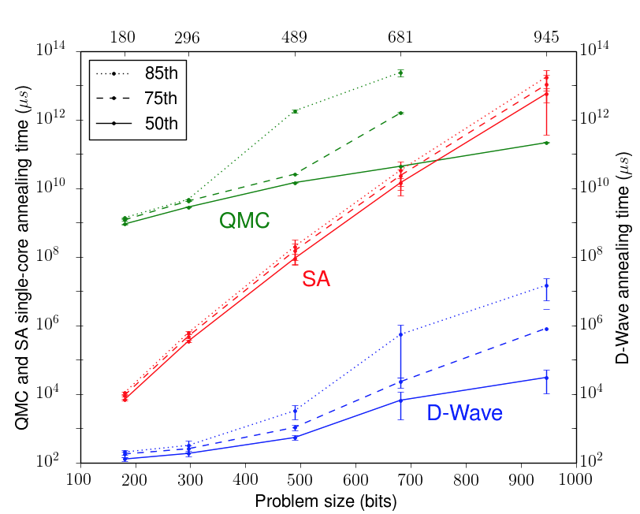

Quantum Annealing w/ "D-Wave 2x" vs SA & QMC

"We are optimistic that the significant runtime gains we have found will carry over to commercially relevant problems as they occur in tasks relevant to machine intelligence." - Hartmut Neven

On December 8th, after an event at the NASA Ames campus in California, in a post titled When Can Quantum Annealing Win?, Hartmut Neven, Director of Engineering at Google's Quantum AI Lab, explained on the Google Research Blog how the team was coming closer to demonstrating the practical application of quantum computing technology. Compared to classical simulated annealing and another quantum hardware algorithm "QMC" (Quantum Monte Carlo), the D-Wave 2X quantum tunneling technology performs far better by many orders of magnitude. The device performs better by a factor of over 108with ~99% success probability than both classical and optimized QMC methods on a single core processor. While the technology still has further hurdles to cross, such as faster cluster finding techniques, the Quantum AI team is confident that the next generation of D-Wave quantum annealers will be able to surpass all known algorithms and quantum hardware.

(A full paper on computational value of finite range tunneling can be foundhere.)

(Source: Hartmut Neven, Director of Engineering; Quantum AI Lab)

Technological Features of D-Wave 2x Quantum Annealer

On August 20th, D-Wave Systems announced the D-Wave 2X available for immediate shipment and installation. At a cost estimated at about ~$10M, it would set any major firm back a pretty penny and while the immediatepractical applications are limited, the possibilities are endless.

(Source: D-Wave Systems)

The newest model features:

- Scaling beyond 1000+ qubits

- Operating temperature below 15 mK, near absolute zero, and 180x colder than interstellar space

- Over 128k Josephson tunnel junctions

- Increased control circuitry precision

- 50% reduction in intrinsic noise

All of these major technological advancements in the device contribute to faster performance and enhanced reliability. Compared to older models which were slower than general-purpose optimization software, the new system is faster than even highly tuned heuristic algorithms and can evaluate 21000possible solutions simultaneously. Along with NASA, Google has a stake in seeing these devices succeed.

Implications for the Financial Sector

Much research has already gone into the possible commercial applications of quantum annealers in major industries like aerospace, defense, meteorological, etc.. In fact, a number of mega firms currently utilize the technology for R&D, including Lockheed Martin (NYSE:LMT), Microsoft (NASDAQ:MSFT), IBM (NYSE:IBM) and even Alibaba Group Holdings (NYSE:BABA). Much like how the advent of algorithmic, high-frequency digital trading shook up the financial world in favor of large institutions who could afford the technology, the same could be said for this new quantum technology, but now on an unprecedented scale.

To illustrate just how important financial firms are taking these developments in quantum computing, D-Wave Systems recently raised over $130M, with Goldman Sachs (NYSE:GS) simply handing the company its own investment capital up front. CME Group (NASDAQ:CME), the largest futures exchange group, along with the Royal Bank of Scotland (NYSE:RBS) and Guggenheim, also have invested in the company. Although spokespersons for both Goldman Sachs and CME have been tight-lipped, declining to comment on what the companies exactly plan to do the technology, the assumption is clear.

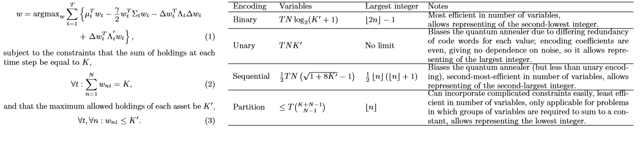

In a recent paper by researchers from quantum software firm 1QBit, Guggenheim Partners, NYU Courant Institute and Lawrence Berkeley National Laboratory, the researchers consider how the technology can be used to solve "optimal trading trajectory" for multiple time-steps across a wide range of assets, i.e. frequent portfolio management. Currently, asset managers for large firms typically still rely on their own intuition to allocate assets and make portfolio management decisions on a day-to-day basis, using the historical data and technical forecasts fed to classical computers, transaction costs, etc. to determine the best course of action. A quantum computing method could perform all of those simulations on a day-to-day basis, thereby freeing up asset managers, bankers, etc., to focus on larger-scale capital trends and movements. While the current size of problems the annealers can solve is small, the researchers expect the technology to be able to solve for larger financial systems and with greater accuracy in future generations.

((Left) base portfolio optimization formula; (right) results using various encoding methods and quantum annealer.)

Conclusion - Implications for Google?

From self-driving cars to virtual reality, Google is positioning itself to be the industry leader in Silicon Valley technology. What remains to be seen is how exactly this quantum computing technology could translate to, for example, higher revenue, better algorithms, more partnerships, etc., for Google itself, and I'm sure Google's engineers and analysts themselves are still trying to figure out how exactly this fast-growing technology will benefit the company financially. No one, not even futurists, expected quantum computing to reach this level of advancement so fast yet, but that is the nature of technology - exponentiality. But one thing is for certain - this technology will revolutionize not only the computing world but all of mankind.

No comments:

Post a Comment