Kandi Panda sales are at their peak; the brand is now the top-selling EV for November in China.

As it quietly penetrates the MPT (Micro Public Transport) segment in various Chinese provinces, it poses a threat to even the bigger players that don't have such a foothold.

A young growth company with an in-demand product and an aggressive growth strategy backed by a government concerned about pollution levels - the perfect formula.

In this article, I'll show you why (in my humble opinion, of course) this little kid is going to run circles around the heavy hitters in its home market of China. In the process, you'll also see why it's ideally positioned to be a future force in the global arena as well. More importantly, I will attempt to highlight why you should put your money on it and companies like it now so your portfolio can keep growing profitably into the next decade.

Overview

Kandi Technologies (NASDAQ:KNDI) has a current market cap of some $447 million. Of note, one of its EV divisions operates as Kandi Electric Vehicles Group Co., Ltd., a 50-50 JV with Geely Automobile Holdings Ltd. (OTCPK:GELYY). You'll see why that's relevant later on.

Very late in Q2 and into Q3, Kandi received two subsidies totaling $103 million ($44.3 million at the end of June 2015 and $59.6 million in August 2015), of which $101 million was paid to the JV over the past 2-3 months. Even before the announcement, Kandi's books were in good shape, but subsequently, they have well over $27 million in cash and a very positive working capital position.

Even for a young growth company expanding at over 50% annually, that's an enviable position to be in. Of course, with its extremely low debt level, that makes the company a formidable competitor in a space that is constantly being enlarged and supported by an ambitious government.

Let's now look at how China itself is an emerging force in the EV segment.

How China Is Acting On Its Needs

First of all, the fact that the Chinese government is willing to pay its subsidies based on sales projections alone is a testament to the commitment and weight that the nation is putting behind cleaning up its air vis-a-vis the EV market.

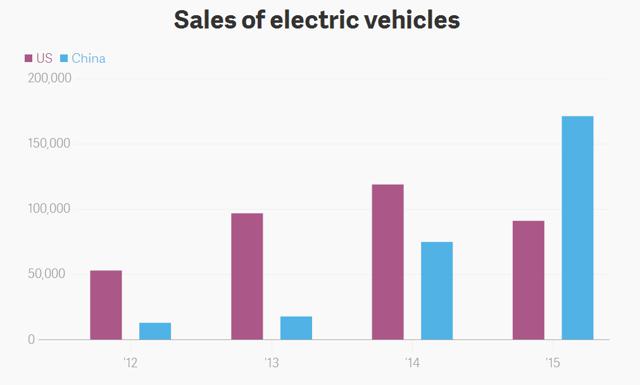

Based on the most recent data, China is set to dominate the EV market, snatching away pole position from the more tepid environment prevailing in the U.S. Chinese consumers are expected to buy between 220,000 and 250,000 EVs this year compared to an estimated sales volume of 180,000 units in the United States. The global market itself is only about 600,000 strong, so don't be surprised if very soon one out of every two EV vehicles purchased in the world is in China. Think about it: As popular as the phrase "Made in China" is, we might see "Bought in China" as an equally prevalent one in the EV market.

Kandi's China Market Share

Kandi is already one of two domestic operators that dominate the Chinese EV market, but the company is slowly strengthening its position further.

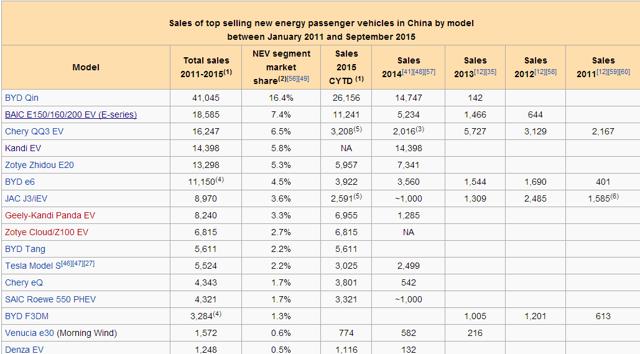

As of November, Kandi Panda (Geely-Kandi Panda pure-electric car (Kandi K11 EV)) sold 6,955 units while the Kandi EV sold 5,969 units. In November alone, the Panda sold 4,153 units, putting it at the #1 position for the month.

BYD Qin is still the YTD leader, but at the rate Kandi Panda is going, don't be surprised if we have a new leader through 2016. The Kandi JV is already in second place for new energy vehicles (NEVs), which include pure EVs, hybrids and fuel cell cars, and let's not forget that the Qin is a hybrid, so not in the pure-EV segment.

The takeaway is that Kandi is already the #1 seller of pure EVs sold YTD in the Chinese market. Not bad for a company that's only made its presence known within the last five years.

Now that Kandi has been identified as a contender for top spot in the Chinese market, let's see what trends are playing out in that market. That will give us a better perspective on how the company will do on the global stage over the next several years.

Chinese Market Trends

Chart Source: Quartz

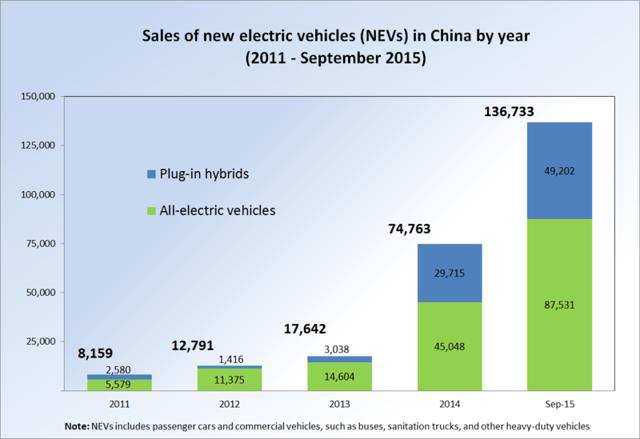

Chart Source: Wikipedia

China's energy vehicle sector has exploded in the last two years as the country continues to grapple with heavy urban pollution. Moving away from regular gasoline helps China in two ways: reducing oil consumption and, thereby, the dependence on other nations, and reducing pollution - in one fell swoop.

That's exactly why China is aggressively backing any initiative that will take it closer to that end goal.

Of note, Beijing recently issued its first red alert for pollution. Last year, the Chinese Premier Li Keqiang vowed to declare war on pollution, but smog continues to blight cities across the country. To put a number to it, scientists blame air pollution for about 4,000 deaths a day.

So What's China Doing About It? Plenty, Apparently!

Look at how aggressively the nation is reacting to the situation. When industry is fully behind the government, this is the effect:

"According to the statistics made by CAAM, the production and sales of new energy vehicles in China in October reached 36,494 units and 34,316 units respectively, increasing 4.2 times and 5.0 times year on year. To be specific, the production and sales of BEV reached 27,639 units and 26,193 units, increasing 6.5 times and 9.2 times year on year; and such figures for PHEV were 8,855 units and 8,123 units, increasing 1.7 times and 1.6 times year on year.As for the first ten months, the production and sales of new energy vehicles reached 181,225 units and 171,145 units respectively, increasing 2.7 times and 2.9 times year on year. To be specific, the production and sales of BEV reached 121,099 units and 113,810 units, increasing 3.3 times and 3.9 times year on year; and such figures for PHEV were 60,126 units and 57,335 units, increasing 1.9 times and 1.8 times year on year." - Source: CAAM

Consulting firm PWC estimates sales of new energy vehicles a.k.a. electric vehicles in China to reach 1.4 million by 2020 and 3.75 million units by 2015. So the industry is definitely poised to grow at a very healthy rate. It's not without a reason Elon Musk is doing his best to crack the China code and wants to start building his cars in China and which is expected to cut the price by a third.

In several other industries, we've seen that the Chinese government looks after its own. Whether it's a leading restaurant group or a world-famous car manufacturer, China will always put the interests of local companies ahead of foreign entities. That's not about to change. Ask Range Rover (NYSE:TTM), which, despite vociferous complaints to Chinese authorities to try and stop its dirt-cheap clone Land Wind, had to sit by powerlessly to see its protests brushed aside.

The country is also moving fast to build its charging network and, by 2025, it is expected to have the largest charging network in the world. Apart from this, the government also offers purchase and tax subsidies for electric vehicles. The generous incentives have obviously helped in increasing EV sales in the country.

For Kandi Technologies, such an environment is a blatantly undisguised blessing - and that's exactly why the Teslas (NASDAQ:TSLA) and Nissans (OTCPK:NSANY) of the EV world are never going to be able to penetrate China as deeply and thoroughly as Kandi intends to.

Who Is Kandi Competing With?

Data Table Source: Wikipedia

BYD Qin, which debuted in December 2013, is a plug-in hybrid sedan and the top seller, closely followed be all electric vehicles. Of course, with a plug-in-hybrid, there are several advantages: low fuel consumption, extra space, and, of course, the fact that you don't have to worry about running out of charge when driving long distance.

However, batteries are getting more efficient and charging networks are ever widening; so, in the not-too-distant future, I certainly hope you'll be able to plan your cross-country trip in an EV the same way you can today with a petrol or diesel car.

For Kandi, the range of its cars is definitely a huge limiter, but the feisty company is taking a different approach to market penetration using the country's ire against pollution as its springboard to success. One very important point to remember here is that, as a small electric car manufacturer, KNDI is not at all a competitor to a company like Tesla. The customer Kandi seeks is not the one Tesla seeks.

To make a point, let's take a look at just one of the things that the company is able to do that none of the so-called "leaders" of the electric automotive technology are unable to accomplish.

Kandi's Micro Public Transport Success

On November 24, 2015, Kandi announced that its JV had penned an agreement to sell 3,000 units of the Global Hawk K17 model. Though it may not look like a huge number, let's not forget that it was the sale of a mere 7,000 units that got it into the top spot for EV sales in China.

Moreover, this is just one in a series of deals KNDI is signing across the country. Since then, it has already signed agreements for 1,000 K10 units for Tianjin and 2,000 units of pure EVs to Haikou in the Hainan province.

Can you even imagine Nissan Leaf landing a deal like this despite being the most bought electric car in history?

Investor Takeaways

That kind of local penetration is what I'm saying is practically impossible for larger, global players to duplicate...and if they can't do it in the fastest growing EV market in the world, then doing it elsewhere will have little impact on their overall penetration across the globe.

With Kandi's aggressive municipal-level propaganda set against a backdrop of a hugely supportive government that will go out of its way to reduce pollution and dependence on the "West", the company is only going to get stronger with each year. I could give you a hundred reasons why you should not invest in KNDI, but giving you just one solid reason why you should is what gives me immense satisfaction.

So let the naysayers have their "two cents" while you calmly walk away with the dollar.

No comments:

Post a Comment