Dividends And Compounding Returns

Summary

This article links together two recent academic research pieces and describes strategies that may capture the findings of these works.

Skewness in stock returns and the lower tendency of dividend payers to experience stock crashes both fit into a narrative around the types of companies that outperform long term.

The article illustrates that stable dividend payers have been among the small number of companies that have generated the bulk of shareholder wealth in the United States.

I have written two recent articles on fascinating, recently published academic research. In my article "Why Many Investors Fail", I described research that showed that the equity risk premium in the United States has been historically attributable to only a small number of stocks whose outstanding performance skewed average returns higher. In "Dividends and Stock Crashes," I described research that showed that dividend-paying stocks are less prone to large stock price corrections. Both of these papers are interesting on a standalone basis, but I believe they are even more powerful for Seeking Alpha readers when considered together.

Why Many Investors Fail

Arizona State University's Henrick Bessembinder's "Do Stocks Outperform Treasury Bills?" is a fascinating paper. We know that the simple answer to the titular question is a resounding "Yes." Over long time intervals, the equity market has, on average, paid an investor a premium for taking equity risk.

In tracking nearly 26,000 stocks, Bessembinder found that a whopping 58% of stocks failed to outperform Treasury bills over their lifetimes in the dataset. On average, stocks outperform over long time intervals, but the median stock in the U.S. equity market has actually produced negative alpha, an average return that trailed risk-free Treasury bills. That's not the type of alpha we are collectively seeking, and this stat should be of great interest to stock pickers out there.

Bessembinder's paper is essentially on skewness, and the idea behind why the stock market has generated long-run excess returns, but most stocks have not produced a better return than bonds. It makes intuitive sense. Over very long time intervals, the maximum you are going to lose is 100%, but cumulative gains can be astronomical. The right tail of the distribution is much longer. Unfortunately, the most common cumulative return over a decade-long holding period for stocks in the database is -100%. The positive excess returns for the market are a function of that long right tail.

Dividends and Stock Crashes

Over a long enough time period, companies go out of business. In "Dividend Payments and Stock Price Crash Risk," authored by Jeong-Bon Kim of University of Waterloo, Le Luo of Huazhong University of Science and Technology, and Hong Xie of the University of Kentucky, the authors demonstrated the negative correlation between dividend payments and stock price crashes. The paper suggested that a firm's commitment to dividend payments reduces agency costs and lowers the risk of large-scale stock price drops. It stands to reason that companies not experiencing large-scale price drops are more likely to make it into the hallowed right tail.

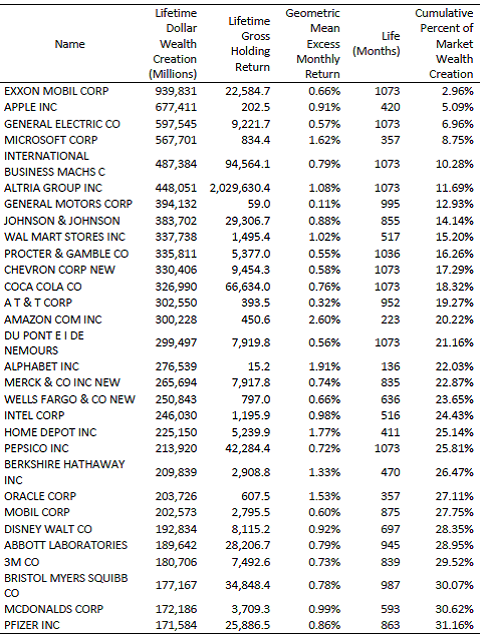

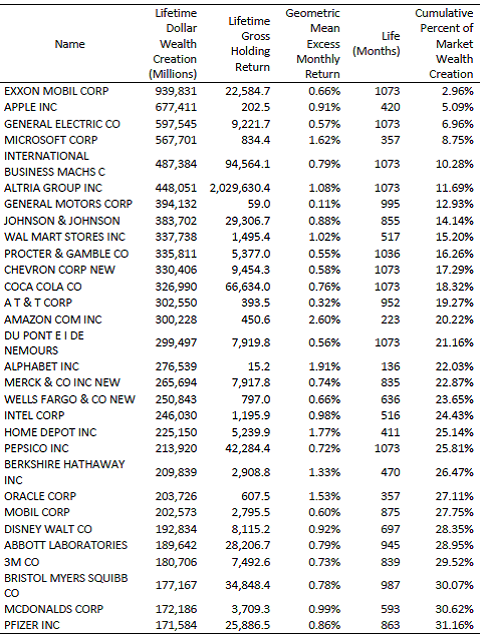

While this data in this article was based on weekly returns, I believe there are still long-run implications. In Bessembinder's article, he listed in the exhibits the 30 best-performing stocks in the dataset stretching from 1926-2015 as excerpted below:

These 30 stocks have cumulatively generated nearly one-third of the total wealth creation from U.S. stocks over a period pre-dating the Great Depression.

It should come as no surprise that this list is populated by royal blue-chips. A company would need to have grown into a market leader to rank highly on this list. Another interesting observation from this table is the commonality in the other lists that these companies populate.

From this list of 30 companies, 3M (NYSE:MMM), Abbott Labs (NYSE:ABT), AT&T (NYSE:T), Chevron (NYSE:CVX), Coca-Cola (NYSE:KO), Exxon Mobil (NYSE:XOM), Johnson & Johnson (NYSE:JNJ), McDonald's (NYSE:MCD), PepsiCo (NYSE:PEP), Proctor & Gamble (NYSE:PG), and Wal-Mart (NYSE:WMT) are all members of the Dividend Aristocrats (NOBL, SDY). Counting both Exxon and Mobil, 40% of this list is populated by companies that have at least a 25-year history of increasing dividend payments to shareholders. This type of consistent dividend growth has been one of my 5 Ways to Beat the Market. Companies with the discipline and financial wherewithal to return increasing amounts of cash to shareholders over multiple business cycles are likely to be in the right tail of the distribution, where you can bet on seeing compounding returns over long-time intervals.

Another one of my preferred dividend strategies is to focus on low-volatility, high-dividend companies (NYSEARCA:SPHD). Abbott spin-off AbbVie (NYSE:ABBV), AT&T, Chevron, Coca-Cola, Exxon Mobil, General Electric (NYSE:GE), General Motors (NYSE:GM), International Business Machines (NYSE:IBM), Merck (NYSE:MRK), Pfizer (NYSE:PFE), and Proctor & Gamble are each part of the 50-member S&P 500 Low Volatility High Dividend Index, which tracks the 50 lowest-volatility members of the 75 highest-dividend paying S&P 500 constituents. Companies that pay sustainable levels of dividends and have lower realized volatility are less likely to experience stock crashes and more likely to experience compounding returns.

There are some notable exceptions in this table. Berkshire Hathaway (BRK.A, BRK.B) has never paid a dividend, choosing to reinvest the cash flow its operating businesses and investments generate. Alphabet (NASDAQ:GOOGL) also does not pay a dividend. Both companies have the balance sheet and capacity to pay steadily increasing dividends, but have chosen not to follow this path. They are, however, exceptions and not the rule.

The takeaways from these two research pieces are that an outsized portion of the equity risk premium is a function of very high long-run returns from a small number of stocks. Those stocks tend to be high-quality dividend payers which are less prone to stock crashes. Both of the dividend strategies I described in this article have handsomely outperformed the S&P 500 over time with lower variability of returns. These strategies are populated by long-run stable dividend payers that typically avoid crashes and compound successfully over time.

Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon.

Disclosure: I am/we are long SDY, SPHD, NOBL.

These 30 stocks have cumulatively generated nearly one-third of the total wealth creation from U.S. stocks over a period pre-dating the Great Depression.

It should come as no surprise that this list is populated by royal blue-chips. A company would need to have grown into a market leader to rank highly on this list. Another interesting observation from this table is the commonality in the other lists that these companies populate.

From this list of 30 companies, 3M (NYSE:MMM), Abbott Labs (NYSE:ABT), AT&T (NYSE:T), Chevron (NYSE:CVX), Coca-Cola (NYSE:KO), Exxon Mobil (NYSE:XOM), Johnson & Johnson (NYSE:JNJ), McDonald's (NYSE:MCD), PepsiCo (NYSE:PEP), Proctor & Gamble (NYSE:PG), and Wal-Mart (NYSE:WMT) are all members of the Dividend Aristocrats (NOBL, SDY). Counting both Exxon and Mobil, 40% of this list is populated by companies that have at least a 25-year history of increasing dividend payments to shareholders. This type of consistent dividend growth has been one of my 5 Ways to Beat the Market. Companies with the discipline and financial wherewithal to return increasing amounts of cash to shareholders over multiple business cycles are likely to be in the right tail of the distribution, where you can bet on seeing compounding returns over long-time intervals.

Another one of my preferred dividend strategies is to focus on low-volatility, high-dividend companies (NYSEARCA:SPHD). Abbott spin-off AbbVie (NYSE:ABBV), AT&T, Chevron, Coca-Cola, Exxon Mobil, General Electric (NYSE:GE), General Motors (NYSE:GM), International Business Machines (NYSE:IBM), Merck (NYSE:MRK), Pfizer (NYSE:PFE), and Proctor & Gamble are each part of the 50-member S&P 500 Low Volatility High Dividend Index, which tracks the 50 lowest-volatility members of the 75 highest-dividend paying S&P 500 constituents. Companies that pay sustainable levels of dividends and have lower realized volatility are less likely to experience stock crashes and more likely to experience compounding returns.

There are some notable exceptions in this table. Berkshire Hathaway (BRK.A, BRK.B) has never paid a dividend, choosing to reinvest the cash flow its operating businesses and investments generate. Alphabet (NASDAQ:GOOGL) also does not pay a dividend. Both companies have the balance sheet and capacity to pay steadily increasing dividends, but have chosen not to follow this path. They are, however, exceptions and not the rule.

The takeaways from these two research pieces are that an outsized portion of the equity risk premium is a function of very high long-run returns from a small number of stocks. Those stocks tend to be high-quality dividend payers which are less prone to stock crashes. Both of the dividend strategies I described in this article have handsomely outperformed the S&P 500 over time with lower variability of returns. These strategies are populated by long-run stable dividend payers that typically avoid crashes and compound successfully over time.

Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon.

Disclosure: I am/we are long SDY, SPHD, NOBL.

This article links together two recent academic research pieces and describes strategies that may capture the findings of these works.

Skewness in stock returns and the lower tendency of dividend payers to experience stock crashes both fit into a narrative around the types of companies that outperform long term.

The article illustrates that stable dividend payers have been among the small number of companies that have generated the bulk of shareholder wealth in the United States.

I have written two recent articles on fascinating, recently published academic research. In my article "Why Many Investors Fail", I described research that showed that the equity risk premium in the United States has been historically attributable to only a small number of stocks whose outstanding performance skewed average returns higher. In "Dividends and Stock Crashes," I described research that showed that dividend-paying stocks are less prone to large stock price corrections. Both of these papers are interesting on a standalone basis, but I believe they are even more powerful for Seeking Alpha readers when considered together.

Why Many Investors Fail

Arizona State University's Henrick Bessembinder's "Do Stocks Outperform Treasury Bills?" is a fascinating paper. We know that the simple answer to the titular question is a resounding "Yes." Over long time intervals, the equity market has, on average, paid an investor a premium for taking equity risk.

In tracking nearly 26,000 stocks, Bessembinder found that a whopping 58% of stocks failed to outperform Treasury bills over their lifetimes in the dataset. On average, stocks outperform over long time intervals, but the median stock in the U.S. equity market has actually produced negative alpha, an average return that trailed risk-free Treasury bills. That's not the type of alpha we are collectively seeking, and this stat should be of great interest to stock pickers out there.

Bessembinder's paper is essentially on skewness, and the idea behind why the stock market has generated long-run excess returns, but most stocks have not produced a better return than bonds. It makes intuitive sense. Over very long time intervals, the maximum you are going to lose is 100%, but cumulative gains can be astronomical. The right tail of the distribution is much longer. Unfortunately, the most common cumulative return over a decade-long holding period for stocks in the database is -100%. The positive excess returns for the market are a function of that long right tail.

Dividends and Stock Crashes

Over a long enough time period, companies go out of business. In "Dividend Payments and Stock Price Crash Risk," authored by Jeong-Bon Kim of University of Waterloo, Le Luo of Huazhong University of Science and Technology, and Hong Xie of the University of Kentucky, the authors demonstrated the negative correlation between dividend payments and stock price crashes. The paper suggested that a firm's commitment to dividend payments reduces agency costs and lowers the risk of large-scale stock price drops. It stands to reason that companies not experiencing large-scale price drops are more likely to make it into the hallowed right tail.

While this data in this article was based on weekly returns, I believe there are still long-run implications. In Bessembinder's article, he listed in the exhibits the 30 best-performing stocks in the dataset stretching from 1926-2015 as excerpted below:

These 30 stocks have cumulatively generated nearly one-third of the total wealth creation from U.S. stocks over a period pre-dating the Great Depression.

It should come as no surprise that this list is populated by royal blue-chips. A company would need to have grown into a market leader to rank highly on this list. Another interesting observation from this table is the commonality in the other lists that these companies populate.

From this list of 30 companies, 3M (NYSE:MMM), Abbott Labs (NYSE:ABT), AT&T (NYSE:T), Chevron (NYSE:CVX), Coca-Cola (NYSE:KO), Exxon Mobil (NYSE:XOM), Johnson & Johnson (NYSE:JNJ), McDonald's (NYSE:MCD), PepsiCo (NYSE:PEP), Proctor & Gamble (NYSE:PG), and Wal-Mart (NYSE:WMT) are all members of the Dividend Aristocrats (NOBL, SDY). Counting both Exxon and Mobil, 40% of this list is populated by companies that have at least a 25-year history of increasing dividend payments to shareholders. This type of consistent dividend growth has been one of my 5 Ways to Beat the Market. Companies with the discipline and financial wherewithal to return increasing amounts of cash to shareholders over multiple business cycles are likely to be in the right tail of the distribution, where you can bet on seeing compounding returns over long-time intervals.

Another one of my preferred dividend strategies is to focus on low-volatility, high-dividend companies (NYSEARCA:SPHD). Abbott spin-off AbbVie (NYSE:ABBV), AT&T, Chevron, Coca-Cola, Exxon Mobil, General Electric (NYSE:GE), General Motors (NYSE:GM), International Business Machines (NYSE:IBM), Merck (NYSE:MRK), Pfizer (NYSE:PFE), and Proctor & Gamble are each part of the 50-member S&P 500 Low Volatility High Dividend Index, which tracks the 50 lowest-volatility members of the 75 highest-dividend paying S&P 500 constituents. Companies that pay sustainable levels of dividends and have lower realized volatility are less likely to experience stock crashes and more likely to experience compounding returns.

There are some notable exceptions in this table. Berkshire Hathaway (BRK.A, BRK.B) has never paid a dividend, choosing to reinvest the cash flow its operating businesses and investments generate. Alphabet (NASDAQ:GOOGL) also does not pay a dividend. Both companies have the balance sheet and capacity to pay steadily increasing dividends, but have chosen not to follow this path. They are, however, exceptions and not the rule.

The takeaways from these two research pieces are that an outsized portion of the equity risk premium is a function of very high long-run returns from a small number of stocks. Those stocks tend to be high-quality dividend payers which are less prone to stock crashes. Both of the dividend strategies I described in this article have handsomely outperformed the S&P 500 over time with lower variability of returns. These strategies are populated by long-run stable dividend payers that typically avoid crashes and compound successfully over time.

Disclaimer: My articles may contain statements and projections that are forward-looking in nature, and therefore inherently subject to numerous risks, uncertainties and assumptions. While my articles focus on generating long-term risk-adjusted returns, investment decisions necessarily involve the risk of loss of principal. Individual investor circumstances vary significantly, and information gleaned from my articles should be applied to your own unique investment situation, objectives, risk tolerance, and investment horizon.

Disclosure: I am/we are long SDY, SPHD, NOBL.

3 Dividend Stocks to Buy Now for High Yields

CLDT, LMT, MO average a 3.8% dividend yield

by Louis Navellier | February 27, 2015 6:00 am

3 Dividend Stocks to Buy Now for High Yields

Everyone knows that dividend stocks pack a one-two punch of security and profit opportunity. As a holder of dividend stocks, you receive a steady stream of income from your investment.

But there is much more to a quality dividend stock than just this income. If you haven’t taken a look at these five dividend stocks that should be sold right away yet, I recommend you do so because they’re all big names on Wall Street.

But there is much more to a quality dividend stock than just this income. If you haven’t taken a look at these five dividend stocks that should be sold right away yet, I recommend you do so because they’re all big names on Wall Street.

Some examples of dividend stocks to sell include Caterpillar Inc. (NYSE:CAT[1]), Mattel, Inc. (NASDAQ:MAT[2]) and Wynn Resorts, Limited (NASDAQ:WYNN[3]).

The fact is that the constantly changing market has made things more complicated for yield-seekers. In a different market environment, I’d usually have no problem unearthing dividend stocks that are ripe for the picking.

However, right now I’m being especially picky with my high-yield recommendations due to the uncertainty surrounding interest rates. You can’t be too careful in this market.

So, to get you started, I’ve crunched the numbers and have uncovered the top three dividend stocks fresh out of Portfolio Grader.

Here are my criteria for selecting today’s top three dividend stocks:

- A dividend yield over 3% — after all, this is a profit maximizing exercise!

- A dividend yield that isn’t substantially higher than competitors’ — remember, that’s a red flag for fundamental problems.

- At least a B rating — there’s no point in looking into it if it’s a C-rated stock, which makes it an automatic hold.

- A significant increase in dividend payments over the years.

Keeping these criteria in mind, I have a list of three superb dividend stocks that have an average dividend yield of 3.8%:

- Chatham Lodging Trust (NYSE:CLDT[4]) — 4.1% Dividend

- Lockheed Martin Corporation (NYSE:LMT[5]) — 3% Dividend

- Altria Group Inc (NYSE:MO[6]) — 3.7% Dividend

Despite some of the macro forces weighing on dividend stocks right now, there still are a handful of premium income plays on the market right now. All I recommend is that you continue using Portfolio Grader to help you separate the wheat from the chaff (and if you subscribe to any of my newsletters, continue to follow the recommendations I post there because those will truly be the best of the best).

Louis Navellier is a renowned growth investor. He is the editor of five investing newsletters: Blue Chip Growth, Emerging Growth, Ultimate Growth, Family Trust and Platinum Growth. His most popular service, Blue Chip Growth, has a track record of beating the market 3:1 over the last 14 years. He uses a combination of quantitative and fundamental analysis to identify market-beating stocks. Mr. Navellier has made his proven formula accessible to investors via his free, online stock rating tool, PortfolioGrader.com. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.

Some examples of dividend stocks to sell include Caterpillar Inc. (NYSE:CAT[1]), Mattel, Inc. (NASDAQ:MAT[2]) and Wynn Resorts, Limited (NASDAQ:WYNN[3]).

The fact is that the constantly changing market has made things more complicated for yield-seekers. In a different market environment, I’d usually have no problem unearthing dividend stocks that are ripe for the picking.

However, right now I’m being especially picky with my high-yield recommendations due to the uncertainty surrounding interest rates. You can’t be too careful in this market.

So, to get you started, I’ve crunched the numbers and have uncovered the top three dividend stocks fresh out of Portfolio Grader.

Here are my criteria for selecting today’s top three dividend stocks:

- A dividend yield over 3% — after all, this is a profit maximizing exercise!

- A dividend yield that isn’t substantially higher than competitors’ — remember, that’s a red flag for fundamental problems.

- At least a B rating — there’s no point in looking into it if it’s a C-rated stock, which makes it an automatic hold.

- A significant increase in dividend payments over the years.

- Chatham Lodging Trust (NYSE:CLDT[4]) — 4.1% Dividend

- Lockheed Martin Corporation (NYSE:LMT[5]) — 3% Dividend

- Altria Group Inc (NYSE:MO[6]) — 3.7% Dividend

Louis Navellier is a renowned growth investor. He is the editor of five investing newsletters: Blue Chip Growth, Emerging Growth, Ultimate Growth, Family Trust and Platinum Growth. His most popular service, Blue Chip Growth, has a track record of beating the market 3:1 over the last 14 years. He uses a combination of quantitative and fundamental analysis to identify market-beating stocks. Mr. Navellier has made his proven formula accessible to investors via his free, online stock rating tool, PortfolioGrader.com. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.

These 16 Dividend Champions Could Soon Boost Payouts

(Note that all references to Champions mean companies that have paid higher dividends for at least 25 straight years; Contenders have streaks of 10-24 years; Challengers have streaks of 5-9 years. “CCC” refers to the universe of Champions, Contenders, and Challengers.)

Recent dividend increases have come from Champions like Archer Daniels Midland (ADM), Black Hills Corp. (BKH), andConsolidated Edison (ED).

The only thing better than reporting such increases is knowing ahead of time which companies are going to boost their dividends soon.

Fortunately, the vast majority of CCC companies have a habit of announcing dividend hikes about the same time each year.

So it’s no stretch of the imagination to suggest that most of these companies can be expected to repeat this annual phenomenon.

The announcements can come anywhere from two days to more than two months before the Ex-Dividend Date, so I try to look ahead by about 11 weeks to provide adequate “warning” of the good news to come. Currently, that means companies with Ex-Dividend anniversaries through April 23. Here is the next group of companies that should boost their payouts, based on last year’s dates:

( Click to enlarge )

( Click to enlarge )

Past as Prologue

Typically, the repeatability factor for these dividend increases is about 90%, which is worthy of some confidence. The percentage increases (dividend growth rates) may vary, but these companies have established a solid dividend “culture” and generally pass along the fruits of their labor, which means a portion of their growing profitability.

– David Fish

This Cheap 7% Yielder Is Up 35% This Year

Thursday, September 19, 2013 02:30 PM

In 2008, Apollo Global Management (NYSE: APO) co-founder Joshua Harris was on a losing streak.

The firm's $430 million investment in big-box retailer Linens N' Things went south when the company filed for bankruptcy.

Investments in Claire's retail stores, Realogy Holdings (NYSE: RLGY), and Harrah's Entertainment all came under pressure as the global credit crisis hit. Apollo was forced to shut off cash interest payments to investors and to issue more debt.But Harris didn't let a little bad luck stop him. He and his partners kept making deals.

In a classic contrarian move, he purchased moreshares of troubled plastics-makerLyondellBasell Industries (NYSE: LYB), even as the company was sliding toward bankruptcy.

The result? By 2013, the firm's initial $2 billion investment had turned a $9.6 billion profit, the largest gain ever on a private equity investment.

Apollo Management was a private equity firm until its IPO in 2011. And even though Apollo is an excellent company, it's the idea of private equity I would like to talk about today.

If you're a regular StreetAuthority reader, you may have heard of business development companies (BDCs). BDCs allow you to invest in private equity firms on the open market. And their structure gives stockholders several unique advantages.

Because business development companies target underserved firms, they typically can charge higher interest rates on loans, helping to compensate for any additional risk. In addition, BDCs will often take anequity stake in the companies they finance -- if these small private firms go public, the BDC scores a windfall.

Even better, they offer tremendous tax advantages. The federal government wants to encourage investment in small businesses -- according to the U.S. Small Business Administration (SBA), small companies hire more than half the U.S. private-sector workforce and have accounted for 60% to 80% of all new U.S. jobs over the past decade. Therefore, BDCs are a special type of organization exempt from federal taxation.

To qualify, a company must meet certain specific criteria. First, it must pay out 90% of its income to shareholders as dividends. Not all of this cash must be paid out immediately -- some can be carried forward to smooth out dividends over time, but the cash must be paid or the BDC faces taxes on part of its earnings. This is why most BDCs offer high dividend yields, approaching 20% in some cases.

And because the companies they invest in are considered riskier, the government also requires BDCs retain relatively low leverage.

Business development companies must have $1 in equity for every $1 borrowed -- their debt-to-equity ratio cannot exceed 1.0. Thus, your average BDC has far less debt than an average bank of equal size.

But thanks to the law, even if some of a BDC's investments go south because of a weak economic environment, it doesn't have huge fixed charges in the form of debt repayments to worry about.

Even the worst markets can offer great opportunities for BDCs. When credit markets dry up and banks are unwilling to take on risky lending, BDCs are one of the few sources of financing for many small companies. This gives them the opportunity to extract particularly favorable terms for their investments.

StreetAuthority expert analyst Amy Calistri has had incredible success with BDCs in her Daily Paycheckportfolio. When she recommended Hercules Technology (NYSE: HTGC) in February 2010, the stockwas trading for a little more than $10 a share.

Today, HTGC is trading near $15 a share. A 50% gain in three years isn't too shabby -- but let's not forget the rich 7% yield that Hercules has been paying out over that same time. By reinvesting her dividends, Amy (and the subscribers who took her advice) is enjoying a total gain of 104% on her position.

And here's the thing: At today's prices, Hercules is still a bargain.

Hercules makes money by providing finance to tech companies at all stages of development -- from startups to mature companies looking for growth.

These companies are major players across the tech spectrum. From Achronix Semiconductors to Zoom Media Group, Hercules' investments include companies that operate in communications and telecom infrastructure, computing and storage infrastructure, digital media and consumer Internet, e-commerce, security and cloud computing.

Over the past two years, HGTC has been on a remarkable run:

But despite a 35% rise in share price this year, the stock still trades at a forward price-to-earnings (P/E) ratio of 11 and a price-to-book (P/B) ratio of 1.5.

As mentioned, HGTC's dividend yield is 7%. And that's on the low end for Hercules: Thanks to the dividend-friendly BDC structure, the company has paid annual yields ranging from 7% to 16% over the past five years.

For context on Hercules' attractive share price compared with its yield, consider this: The average company in the S&P 500 currently yields 2% and trades at a P/E of 19 and a P/B of 2.5.

Amy made a smart move when she added Hercules to her portfolio in 2010, and she's been smart to keep the company in her portfolio. If you haven't already, you might be smart to add Hercules to your portfolio today.

Risks to Consider: BDC dividends are taxed as ordinary income rather than the lower 15% dividend rate. So it is preferable to hold BDCs in a tax-advantaged account. BDCs are sensitive to interest rates, and a sharp rise could make dividends and share prices volatile.

Action to Take --> HTGC is a strong buy for income-oriented investors at today's prices.

P.S. Current yields averaging 7.2%... gains of more than 127%... and 43% safer returns than traditional investing. Amy Calistri's Daily Paycheck advisory is delivering all of these things and more. Right now, 91% of her picks are winners, and she's collecting more than $1,400 per month in dividend checks. Click here to see how she's doing it -- and how you can join her today.

- Chad Tracy

5 Best Performing Dividend Aristocrats In 2012

By Serkan Unal :Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

By Serkan Unal

In 2012, the S&P 500 Dividend Aristocrats, a group of stocks that have raised dividends for at least 25 consecutive years, outperformed the overall S&P 500 Index by a whole percentage point. Consisting of 51 companies, the S&P 500 Dividend Aristocrats had an average total return of 15.3% for the year as a whole, versus 14.3% for the blue-chip benchmark, the S&P 500. While the S&P 500 Dividends Aristocrats as a group realized a remarkable average total return over the past year, some members fared better than others. In fact, more than 40% of theS&P 500 Dividends Aristocrats had above-average total returns in 2012. Here is a list of last year's five best performing S&P 500 Dividend Aristocrats with dividend yields above 2%.

Cincinnati Financial Corp. (CINF) was the fourth best performing Dividend Aristocrat in 2012, with a total return of almost 34%. Raising dividends for 51 consecutive years, the company is currently yielding 4.2% on a payout ratio of 73%. On average, this property and casualty insurance provider increased dividends by 2.7% annually over the past five years. With the company's long-term EPS growth projected at a modest 5.0% per year and an elevated payout ratio, dividend hikes in low single digits are expected in the future. In a year of remarkable performance for insurance stocks, Cincinnati Financial has rallied substantially despite its heavy exposures to catastrophe-prone Midwest and Southeast. The company has a number of strengths including adequate risk-adjusted capitalization, strong balance sheet with substantial free cash flow and low leverage, strong operational performance, and a solid business model. The stock is not cheap by any means, as it trades above industry with 18.2x trailing and 22.5x forward earnings. The stock is popular with Jean-Marie Eveillard's First Eagle Investment Management.

Illinois Tool Works (ITW) was the fifth best performing Dividend Aristocrat last year, with a total return of 30%. This industrial products and equipment manufacturer has raised dividends for the past 49 consecutive years. Currently, the stock is yielding 2.5% on a payout ratio of 31%. Its dividend growth averaged 8.6% over the past five years. The company has performed well in line with the expectations of a rebound in industrial production. It raised its guidance for the fourth quarter and the full year 2012. ITW expects revenue growth between 1% and 3% in 2013 and forecasts growth rates some 200 basis points above the rate of growth in industrial production by 2017. Moreover, the company sees 100% free cash flow conversion. Its five-year EPS CAGR is forecasted at 10.6% annually, while the company sees an accelerated EPS CAGR of 12.3% per year beyond 2017. The stock is attractive based on valuation. Its forward P/E of 14.4x is below industry's 27.7x. The company has a PEG of 1.5. ITW is popular with fund manager Ralph Whitworth (Relational Investors).

McCormick & Co. (MKC) was the sixth best performing Dividend Aristocrat in 2012, with a total return of 29%. This spice and seasonings maker has boosted dividends for 26 consecutive years. Its current dividend is yielding 2.2% on a payout ratio of 47%. The company's dividend growth averaged 9.1% annually over the past half decade. MKC has been growing through accretive overseas acquisitions. The company is planning additional acquisitions in fast-growing China. While it delivered weak revenue and above consensus EPS in the previous quarter, MKC is expected to see its five-year EPS CAGR at 8.5% annually. The company has strong brand recognition and has recession-resilient earnings, as evidenced by its earnings expansion during the last recession. Its beta is only 0.45. In terms of valuation, the stock is pricey with a forward P/E of 19.2x versus its industry's 16.2x. Insiders have also been accumulating this stock. Fund managers John W. Rogers (Ariel Investments) and Cliff Asness are buyers of MKC.

Leggett & Platt (LEG) was last year's ninth best performer among Dividend Aristocrats, with a total return of nearly 24%. The maker of components for residential furniture and automobile seats, Leggett & Platt has raised dividends for the past 41 consecutive years. Its dividend is yielding 4.4% on a payout ratio of 93% of trailing earnings and 57% of trailing free cash flow. The company has seen a rebound due to recoveries in the housing market and the auto industry. LEG's 5-year EPS CAGR is forecasted at 15%, which should bode well for the stock's continued appreciation and dividend growth. The company accelerated the payment of its dividend from January 2013 to December 2012 so as to assure its shareholders benefit from a lower dividend tax rate. Based on its forward multiple of 17.3x, LEG is trading on par with the furnishings industry and below its own five-year valuation average. Fund manager Michael Lowenstein (Kensico Capital) holds a stake in the company.

Aflac Inc. (AFL) was the 11th best performing Dividend Aristocrat in 2012, with a nearly 22% total return. This life and supplemental insurance provider has raised its dividend for 30 years in a row. Its current dividend is yielding 2.7% on a payout ratio of only 23%. The insurance provider's dividend growth averaged 10.9% per year over the past half decade. The company has a rock-solid balance sheet with low leverage. It has benefited from a robust demand for insurance products in Japan, its core market. AFL has also seen stronger stock performance following the easing of concerns about the company's possible exposure to bad European financial sector debt. While it remains highly exposed to Japanese government bonds, AFL is diversifying by increasing its exposure to U.S. government debt. Analysts see AFL's EPS expanding at a robust long-term CAGR of 10.2%. Despite the recent run-up in prices, with a forward P/E of 7.8x, the stock is still undervalued relative to its historical multiples. Citadel Investment's Ken Griffin is particularly bullish about this stock.

Source: seekingalpha.com

No comments:

Post a Comment