Summary

Farmland is declining, and what makes land such an attractive asset class is that they are not making any more of it.

Farmland is a low-risk way to participate in the global food demand story.

Farming is a near-zero vacancy business model, with mostly upfront rent, little or no maintenance capex, and supply constraints.

Farmland Partners will continue to benefit from economies of scale, and without adding more G&A the company has the systems in place to control costs, while growing like a weed.

I began researching the farming sector around a year ago as I initiated coverage of Farmland Partners (NYSE:FPI). One of the things that attracted me to the sector is the tremendous opportunity for publicly traded REITs to capitalize on the high fragmentation that exists across the United States.

Think about it like this: Most new farmland in the world is not farmable because of soil conditions or bad infrastructure (irrigation). So that simply means farmland is declining, and what makes land such an attractive asset class is that they are not making any more of it.

It really boils down to supply and demand.

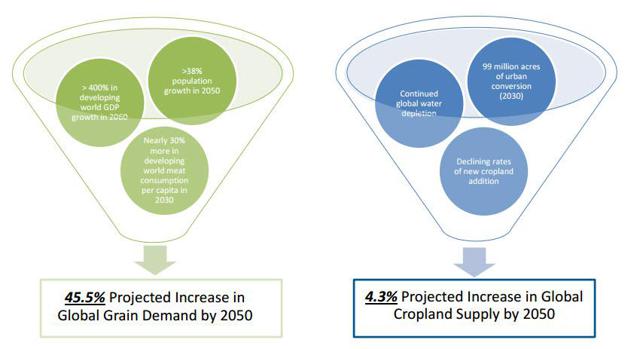

The true drivers for the asset class (farmland) is global food production, and while brick-and-mortar stores provide the necessary real estate for distribution of goods and services, farmland meets the same "brick-and-mortar" need for growing food globally. The two ingredients necessary to produce global food are simply land + water. Hence, the reason that the projected increase in global cropland supply by 2050 is just 4.3%.

So, farmland is a low-risk way to participate in the global food demand story. Farmers (particularly U.S. farmers) efficiently produce food to feed the world population - approximately 805 million people are chronically undernourished, but the percentage has declined from 20% in 1990 to 11% today.

Food production is a huge industry in the U.S., and production agriculture is underrepresented in the public markets (there are now 3 publicly traded Farm REITs). Nearly 5% of the 2013 U.S. GDP was attributable to agriculture and agriculture-related industries, and about 1% of U.S. GDP is production agriculture.

Farming is a near-zero vacancy business model, with mostly upfront rent, little or no maintenance capex, and supply constraints. The combination of these traits offers a compelling opportunity for REIT investors to capitalize on the consolidation of the very stable and predictable drivers of global food demand.

Primary Crops and Livestock Are the Main Drivers

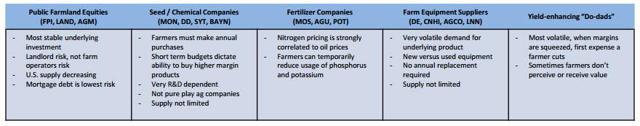

FPI is unique from the other two public peers, since the company invests primarily in row crops. Specialty crops are considered higher-risk (compared with row crops), and that's why FPI has opted to overweight exposure (75%) in row crops.

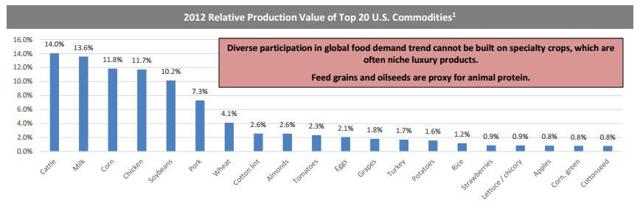

Diverse participation in global food demand trend should reflect approximately the relative contribution of primary row crop, produce and specialty crops. As illustrated below, crops and livestock are the primary drivers, and feed grains and oilseeds are proxy for animal protein.

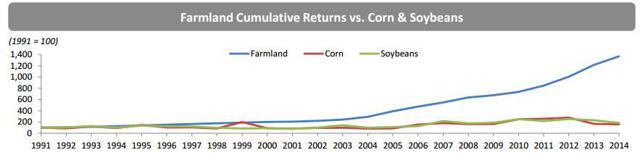

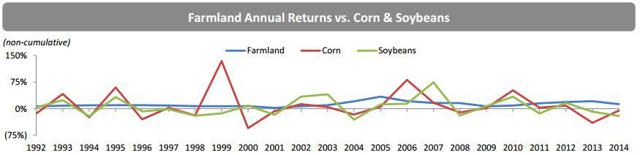

As evidenced by the chart below, yield and crop optionality differentiate farmland from individual agricultural commodity investments. Since 1991, farmland has offered consistently positive annual returns and lower volatility, leading to significant cumulative outperformance.

The media headlines often associate corn prices with farmland prices. However, that could not be further from the truth. The true drivers for farmland valuation is global food demand, and when you combine the strong demand attributes with the limited supply characteristics, you get a sound business model that provides reliable and predictable income.

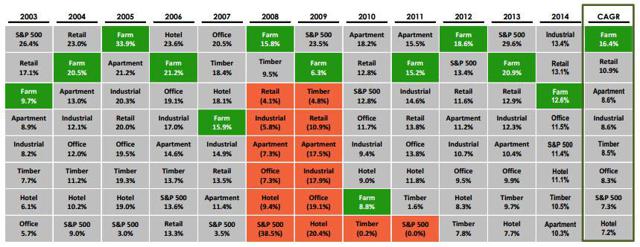

As referenced above, there are three farming REITs, and while the business model is fairly new to the REIT sector, farmland properties have regularly outperformed other real estate asset classes. Since NCREIF began tracking farmland values in 1992, there has not been a year with negative total returns. Between 2003 and 2014, farmland has yielded annual returns of 16.4%.

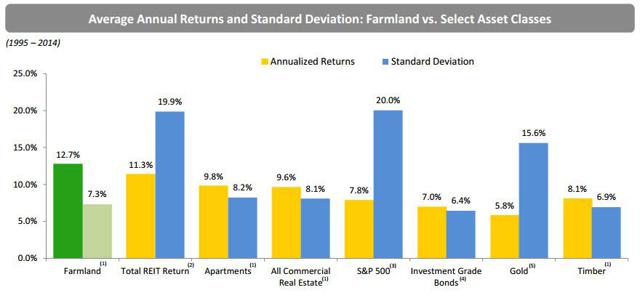

The farmland sector offers a compelling opportunity to invest in an asset class where land values appreciate consistently. As the chart below suggests, Price Appreciation + Current Yields = Powerful Total Returns Story. According to the Illinois Farm Index, from 1972 to 2012, Illinois farmland had returned 10.6% annually, with roughly 6.6% coming from appreciation.

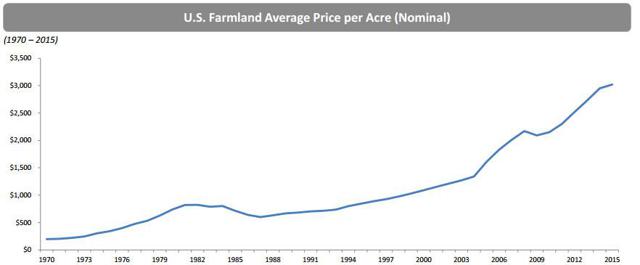

Value growth in U.S. farmland may slow temporarily, but over the long term, the trend is strongly positive. As reported by the USDA, the overall U.S. farm real estate value increased 2.4% from the 2014 values.

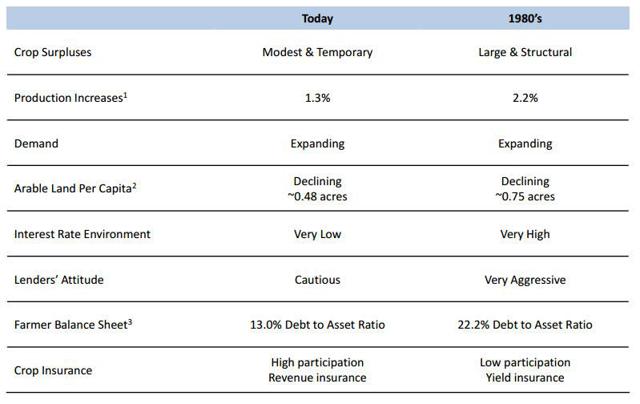

Also, the factors today are different from those of the 1980s agricultural recession. Today, the fundamentals are better - more demand and reduced supply - so there's not as much risk today as there was in the 1980s.

Don't Bet the Farm on American Farmland

Around a month ago, American Farmland (NYSEMKT:AFCO) hit the Street with an IPO that was expected to generate at least $114 million, with pre-market pricing in the range of $8.50-10.50 per share. However, the market makers (led by Deutsche Bank and Citi) fell short of their expectations, settling for just around $48 million, which included around $8 million in fees paid to some of the well-heeled owners.

At opening, AFCO priced 6 million shares at $8.00, and by the end of the day, the stock plunged to $6.90.

AFCO is an internally managed REIT that owns a diversified portfolio of farmland, consisting of mature permanent, specialty/vegetable row and commodity row crop farms, as well as farmland development projects, and is located in select major agricultural regions in the United States.

Approximately 45.6% of the company's 2014 contractual rent and 50.1% of contractual rent through the second quarter of 2015 is comprised of fixed and base rent, some of which has annual escalators. In addition, AFCO has participating leases that require professional farmer tenants to obtain crop insurance.

As of the date of AFCO's prospectus, the portfolio is comprised of 18 farms with an appraised value of $207.7 million, and approximately 16,136 gross acres with more than 21 crop varieties, some of which are planted in rotation, in Alabama, Arkansas, California, Florida, Georgia and Illinois.

Several risks are noted in the company's portfolio: (1) AFCO has around 20% of its portfolio in development, and (2) It has too much concentration with specialty crops. Remember, specialty crops are a niche/luxury business model as compared to key food commodities). In a previous article, I pointed out these differences when comparing FPI, predominantly row crop model, and Gladstone Land (NASDAQ:LAND), predominantly specialty crops.

Another risk is that AFCO is highly concentrated with exposure in California. In addition to the specialty crop concentration, AFCO is also exposed to water risks in that state.

In AFCO's prospectus, the company has valued the farms at around $207 million; however, I value the properties closer to their purchase price, or around $175 million - that translates to a price of around $8.50 per share. Keep in mind that AFCO has around $52 million in debt, so the company was not even able to pay off its debt with the IPO yesterday.

If the large investment banks could not pull off the IPO, why did it happen in the first place?

Obviously, there was no support for the offering, except perhaps it was the $8 million paid to pad the pockets of several board members. This is from the prospectus:

As consideration in the Internalization, our operating partnership will issue Common Units with an aggregate value of $12 million to AFTRS and each of the holders of equity ownership interests in AFA.On December 15, 2014, we received the requisite consent from a majority of our disinterested stockholders approving the Internalization.

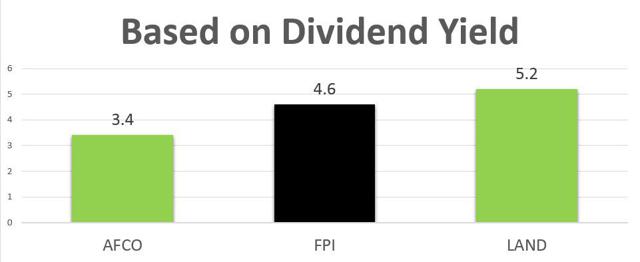

AFCO intends to pay a quarterly dividend of $.0625 per share, or $.25 per share annually. Based on the current share price ($7.30), that translates to a dividend yield of 3.4%. I have no clue as to whether or not AFCO can cover its dividend, but I am certain that the company is not going to generate the growth without access to capital.

I would have never taken AFCO public, and given the higher risk attributes, I believe that the shares will continue to trade well-below their NAV. LAND is a perfect comp, and I believe that the AFCO shares should trade closer to a 5% dividend yield, or a price of around $6.00. That's still a risky bet though, and my advice is don't bet the farm on American Farmland.

Farmland Partners Growing Like A Weed

Just over a year ago, I wrote my first article on FPI, and I initiated a BUY price at $10.25. Since that time, the shares are up around 3%.

Since going public on April 16, 2014, FPI shares have declined by 19.9%.

FPI and the other peers are small-cap REITs, so I would not "bet the farm" on any of these companies.

Based on Total Assets, FPI is the largest farm REIT:

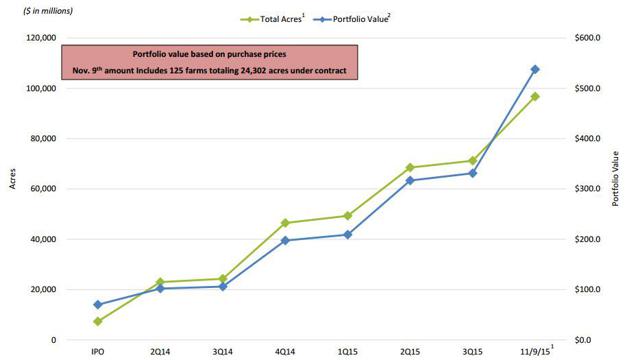

At the time of the IPO (April 2014), FPI owned 7,323 acres, and it now owns or has under contract a total of 253 farms totaling approximately 104,742 acres, including 130 farms totaling approximately 32,319 acres under contract, located in the following regions:

- Corn Belt: 32,920 acres

- Plains: 23,163 acres

- Delta: 24,091 acres

- Southeast: 24,568 acres

Additionally, the REIT offers loans to farmers secured by farm real estate. Currently, FPI has over $570.0 million of real estate assets, including farms under contract:

On November 30th, FPI said it intends to buy a 7,400-acre farm in Louisiana from an unnamed seller for $31.8 million in cash. The company expects the acquisition to close in the first quarter of 2016, subject to customary closing conditions.

The company has entered into a three-year lease agreement for the farm, which includes rent based on a percentage of gross farm proceeds, for an expected cap rate of 5.0%. This represents FPI's third largest acquisition to-date in terms of price.

The farm is irrigated, precision-leveled, and also has significant acreage dedicated to rice, increasing some of the diversification of FPI's portfolio.

Also, earlier in November, FPI announced the acquisition of 120 farms (22,300 acres) in Illinois for a total of $197 million. The transaction represents the company's largest acquisition since its IPO, both in terms of purchase price and acreage. The seller had accumulated the farms over decades. FPI will be the largest private owner of farmland in the Midwest, with some of the most desirable land in the region.

The Illinois acquisition will increase the total acreage by 30.0%, and the recently announced acquisition will increase total acreage by another 7.6% to 104,742 acres owned/under contract.

Where's The Value?

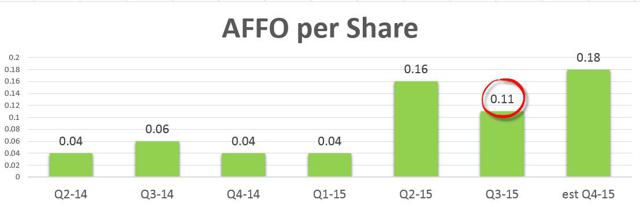

Once FPI closes the two above-named deals, the company should have debt of around $240 million, $117 in preferred, and most of its cash should be invested. In Q3-15, it generated AFFO per share of $.11 per share, lower that projected due to the timing of the announced acquisitions.

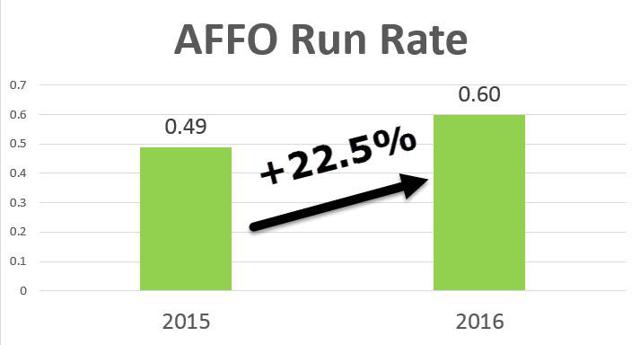

Taking into account the recent deals, I have revised my 2016 AFFO run rate estimate to $.60 per share (maintaining my 2015 estimate of $.49 per share).

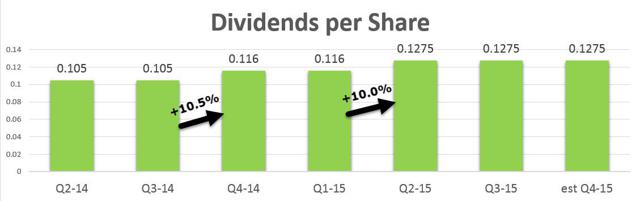

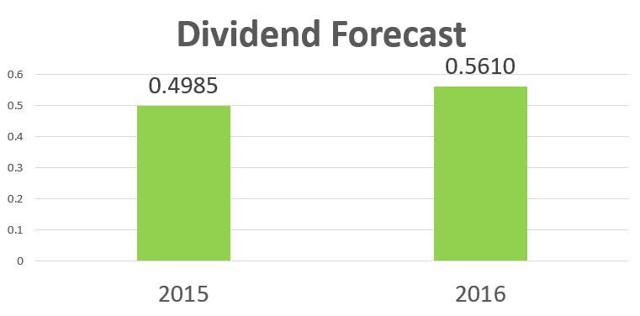

FPI's robust growth is also reflected in its dividend history. As illustrated below, the company has increased its dividend twice since going public.

Here's a snapshot of my AFFO per share run rate:

Given the robust acquisition activity, I expect to see FPI increase its dividend again in Q1 or Q2 of 2016. Using the AFFO estimates (above), I'm forecasting a payout of $.56 per share in 2016:

Summing up the story, as I said earlier, this opportunity is related the global food demand. FPI represents the most compelling farmland REIT, based on the following: (1) a portfolio highly weighted towards row crops; (2) an experienced management team; (3) a steady and robust acquisition pipeline; and (4) strong dividend growth. Here's how the company is valued, based on its current dividend yield:

The Bottom Line

FPI is a growth story, and the investment thesis is to capitalize on highly fragmented farms where the majority are family-owned, with an increasing average age of the owner/operator. FPI will continue to benefit from economies of scale, and without adding more G&A the company has the systems in place to control costs, while growing like a weed. For more information:

Source: SNL Financial and FPI Investor Presentations.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

No comments:

Post a Comment