Banco BPI has emerged as the best capitalized bank in Portugal, relative to its publicly-traded peers.

Cost cuts and release of substantial loan reserves accumulated over the last 7 years should drive BPI performance.

Impending spin-off of international operations will further de-risk the entity and provide a catalyst for further value realization.

(Editor's Note: Investors should be mindful of the risks of transacting in securities with limited liquidity such as BBSPY. Banco BPI's listing in Lisbon, BPI.LS, offers stronger liquidity.)

Introduction

Since 2013, the bank improved its balance sheet, increased its book value per share and even produced a profit in its domestic operations. Data shows that BPI is not only one of the top performers in its home country, but also in Europe. Meanwhile, a financially incentivized management announced a spin-off of BPI's international business demonstrating its commitment to reducing risk and increasing value. The market assumes that BPI has little to show for its turnaround going forward, which is highly unlikely given the reserves accumulated over several years and the results achieved by its competitors in Europe.

1. Portugal: A brief financial history

The PSI-20 (the main Portuguese stock market index) peaked at 7734 in June 2014, before beginning a descent and reaching the current levels of 5266. The fall has been triggered by the troubles at and the subsequent collapse of Banco Espirito Santo (BES) (OTCPK:BKESY) on 3rd August 2014(3) (renamed Novo Banco), and has been exacerbated further by the Chinese economic slowdown, as well as the Portuguese national elections.

It has been argued that the recapitalization and nationalization of BES revealed a fragile banking system in Portugal. The issue was, however, idiosyncratic to BES - the Bank was characterized by large cross-shareholdings in the companies of its family shareholders, coupled with false accounting(4), ultimately leading to default on short-term debt and the arrest of its CEO. The Portuguese banking industry and the economy as a whole has done well since then.

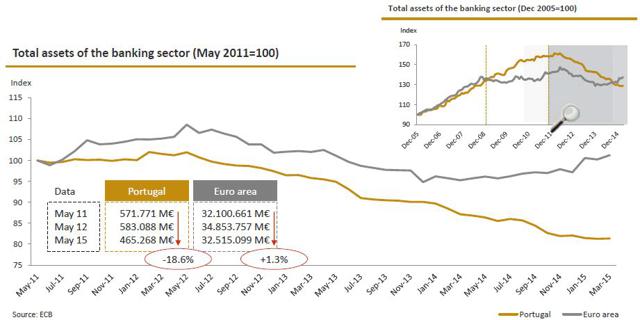

Portugal's GDP has recorded its fifth consecutive increase, unemployment has fallen from 17.5% to 11.9% and government bond yields have fallen to 2.47% from a peak of 16%, whilst consumer credit has recently recorded its first increase(5). Meanwhile, the Portuguese banking sector has undergone substantial deleveraging:

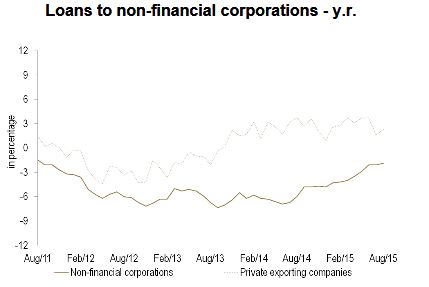

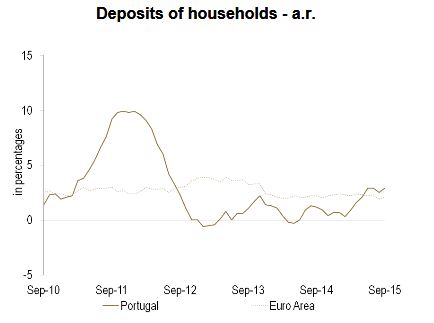

Loan to the industry and household deposits have most recently experienced an uptick - a possible indicator of renewed confidence in the financial sector:

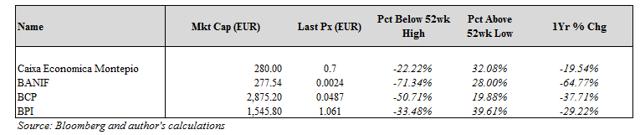

Portuguese banking stocks have nevertheless been severely punished. The following publicly listed Portuguese banks are referred to throughout the article: Banco Internacional do Funchal (BANIF), Caixa Economica Montepio and Millenium Banco Comercial Portugues (BCP).

2. BPI Performance

Banco BPI has been a direct beneficiary of the macroeconomic trend and industrial strengthening. Since the Eurozone financial crisis in 2012, it has been steadily improving, first, its financial position, and second, its operations.

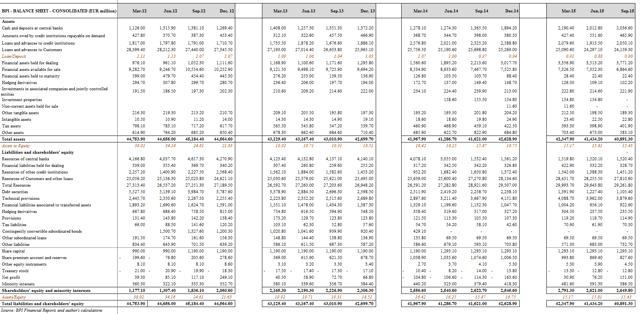

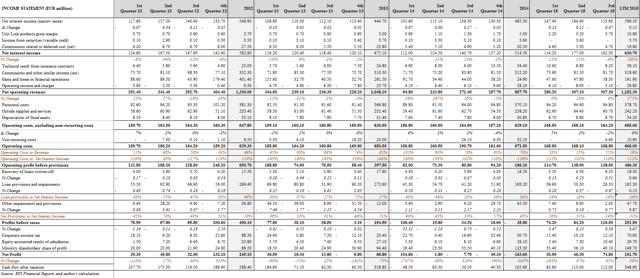

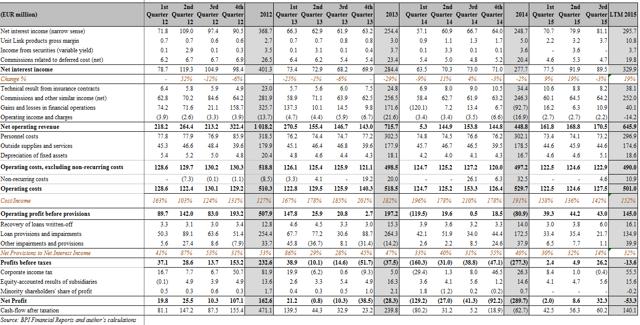

On a consolidated basis, BPI has strengthened its equity cushion and deleveraged considerably, decreasing its Assets-to-Equity multiple from 38 at the beginning of 2012 to 15 in the most recent quarter, as well as decreasing its ratio of Loans-to-Deposits from 111% to 90%. This means it utilizes (and risks) far less capital to generate profits. Meanwhile, Book Value per share has risen by 26% over the same period (see Schedule 1). Operating costs as a percentage of net interest income have fallen from a peak of 146% in 2013 to the most recent 112% (see Schedule 2).

It should be noted that the four largest banks in Portugal have large operations in Angola, a former Portuguese colony. Results are therefore comparable, but domestic results should be distinguished from any international operations. BPI International, which includes operations in Angola and Mozambique is to be examined in section 6 of this article, as it is a separate business from BPI operations in Portugal (BPI Domestic).

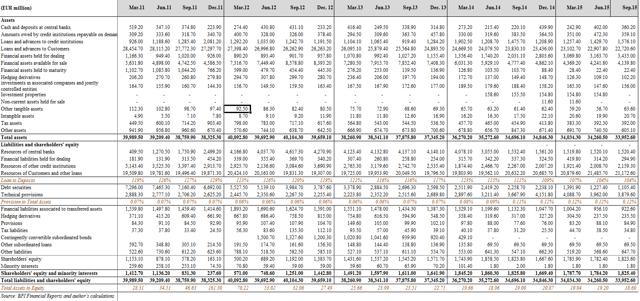

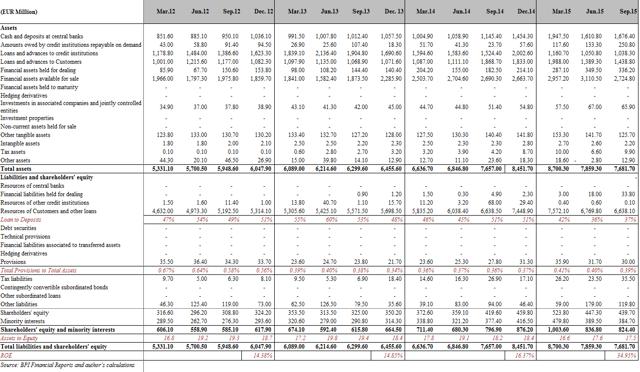

Taking a closer look at the domestic segment of BPI, the results have also been very good with a Loans-to-Deposits ratio falling from 124% during the Eurozone crisis to 104% in the most recent report (see Schedule 3). The bank has also doubled its provisions for any non-performing loans - increasing its provisions relative to total assets from 0.06% to 0.12%. Finally, BPI Domestic, whilst having a high Cost-to-Income(6) ratio of 152%, has recorded its second consecutive quarterly profit (at EUR32m), after 8 quarters of successive losses (see Schedule 4).

3. Domestic comparison

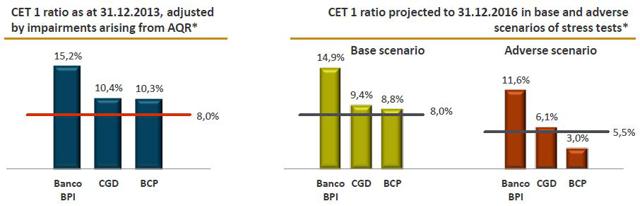

On a comparative level, Banco BPI, for the first time in at least 15 years, is up against very weak competition. Whilst, BPI, BCP and BES had many years of 20% ROE(7) leading up to the 2008 financial crisis, this has been rapidly changing over the last three years. BES was not only technically insolvent, but its reborn and re-branded entity, Novo Banco, was told earlier this month that it has a capital shortfall of EUR1.4b(8). Privatization of the bank has not yet been successful. Equally, BCP did not meet the Tier One Capital Ratio requirements and had a shortfall of EUR1.15b(9) in 2014 under the European Central Bank Asset Quality Review programme.

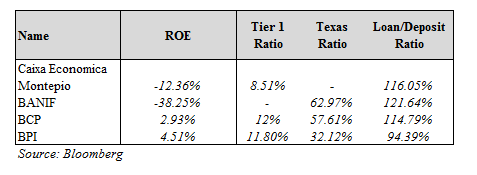

BANIF and Caixa (see table below) are not close to being profitable and have significant amounts of Non-Performing Assets (NPAs)(10). This in fact presents great opportunities for BPI - whilst most of its competitors are struggling (or likely to struggle) and have been closing branches and selling businesses, BPIhas gradually positioned themselves to be the best in Portugal for the long term. The data below is calculated on a FY2014 basis:

Whilst BCP was the first to achieve profitability in its domestic operations and has the lowest cost to income ratio, BPI has acted as the most prudent out of the four publicly listed Portuguese lenders. It has significant loan loss reserves, accounting for the provisions made over the last 7 years, and which it will be able to release going forward and boost earnings. Furthermore, it has managed to deleverage substantially, resulting in a Loan/Deposit Ratio of 94%, compared to the 114% reached by BCP - the second best.

Whilst BPI does not have the highest Tier 1 Ratio (it is 20 basis points off BCP's), it easily beat its rival on an adverse scenario, according to ECB's Asset Quality Review. This is most likely as a result of the significant loan loss reserves accumulated, and admittedly also as a result of the share issues completed since the start of the economic decline.

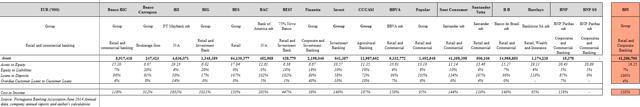

The comparison of BPI to its domestic competitors (unfortunately, for the lazy reader) does not stop there. The Portuguese Banking Association releases financial reports of every Portuguese banking entity operating in the country on an annual basis, with the results dated June. Even though the latest data is from June 2014, it still gives strong insight into the profitability and capitalization of BPI relative to its local peers, allowing us to approve or disprove the BPI thesis.

In this analysis, the banks previously analyzed are excluded, and key ratios are summarized (see Schedule 7). The results are varied and therefore some research was done in order to determine what type of banking was provided by that particular entity. Often the website of the company provided good enough evidence of their commercial activities (and some even provide annual reports to their customers).

Prepare for the most exciting information in your Portuguese banking analysis experience as the results in Schedule 7 reveal the following: Out of the 18 banks examined, only up to 11 perform retail and commercial banking activities akin to BPI (depending on how flexible you are with the definition and assuming that PT Maybank and Bank of America (NYSE:BAC) subsidiaries perform very similar functions to those normally performed by their sister companies abroad). Out of those 13 banks, BPI ranks a joint 2nd in relation to how much equity it has against its liabilities but 6th on an assets-to-equity ratio (admittedly a more relevant metric).

However, BPI is still one of the most prudent - for example, it ranks 2nd on the basis of overdue customer loans in proportion to the total amounts lent to its customers (this excludes Barclays - primarily engaged in wealth operations). Excluding any retail banks with Cost-to-Income ratios below 95%, BPI still comes third behind the almighty Santander with 120% and, somehow (but unlikely after the most recent collapse), BES with 133%.

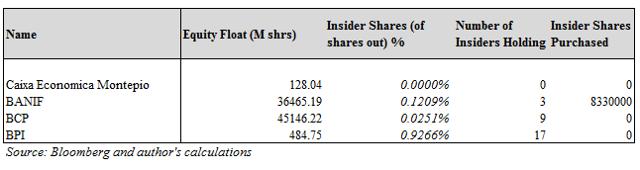

Finally, BPI is highly appealing because, relative to its publicly listed competitors, it has the largest insider ownership. The board of directors of BPI own an equivalent of EUR14m worth of the company's shares. As a percentage of shares outstanding, this makes BPI once again stand out from its competitors, giving the management a very strong incentive to drive the bank's performance and close the gap between price and value.

4. European comparison

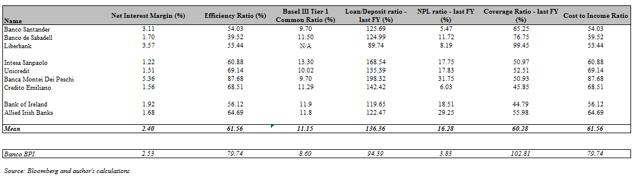

BPI's performance is not just impressive in its home country, but also in Europe. The comparison is made in relation to other states requiring significant help in 2012, the PIIGS (Portugal, Italy, Ireland, Greece and Spain) and to banks carrying out its retail and commercial banking operations primarily in those countries. Greek banks, currently undergoing a significant recapitalization, are excluded.

On a FY2014 basis, BPI beats the averages on almost every metric - except on a Cost-to-Income Ratio(11) basis, where it has room for significant improvement.

The table above also demonstrates what BPI could realistically achieve if it were to continue with its strategy. Models would be Banco de Sabadell (OTC:BNDSF) with a cost ratio of 39% and Bank of Ireland with 56%. These also happen to be banks with the largest returns on their equity as seen below. If management has been so successful in navigating the Eurozone crisis and achieving superior results relative to its competitors, it is a highly realistic scenario to see a Cost-to-Income Ratio of at least the average of 62% as amongst the Eurozone banks. A note of caution is warranted - Sabadell operates in an economy, which boasted a 3.5% year-on-year increase, whilst Bank of Ireland's turnaround coincided with Ireland's GDP growth of 6%. BPI's progress may be at the mercy of Portugal as a whole.

5. Valuation/Pricing

On 29th September, during the announcement of its 9-month performance for 2015, BPI announced that it will be spinning-off its international subsidiaries (BPI International) - and shares are up more than 25% since then (results, however, also improved). The demerger is done primarily to quarantine the risks of an economically vulnerable Angola, but also in order to realize the full value of BPI, which according to a comparable survey and the valuation attached to the bank by its two main shareholders, is much higher than the current EUR1.061.

i. Domestic operations

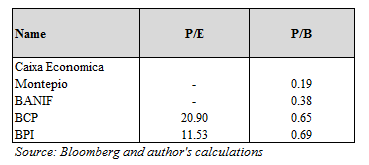

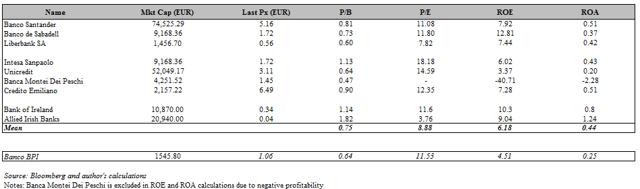

Domestically, BPI is the most expensive banking stock. Quality is not cheap.

Examining the valuations attached to banks operating in the PIIG economies, it is apparent that the market rewards these enterprises for their performance on a Price-to-Book (P/B) and Price-to-Earnings (P/E) basis. It only makes sense that the intrinsic value of BPI should increase if it improves the returns it produces on the capital it employs. However, very little of that potential is priced into BPI's current share price.

Interestingly, in June, BPI's largest shareholder, Caixabank SA, dropped its bid for BPI shares it does not already own. The bid stood at EUR1.329. It was rejected by BPI's second largest shareholder, Isabel dos Santos: In her opinion, the shares of BPI are worth at least EUR2.04. Almost nothing has changed since the summer for BPI. In fact, its Q3 2015 results further reinforced the thesis for the stability and profitability of the bank. If BPI continues cutting its costs and proceeds with a spin-off of its international subsidiary (as we will see below), such a valuation may not be far from the truth.

ii. International operations

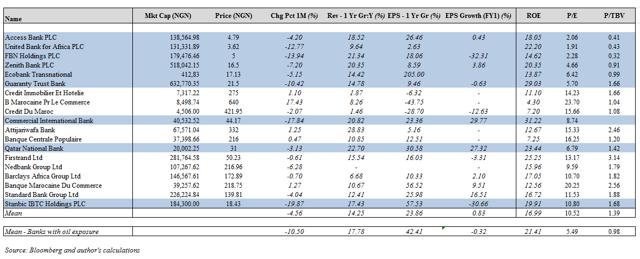

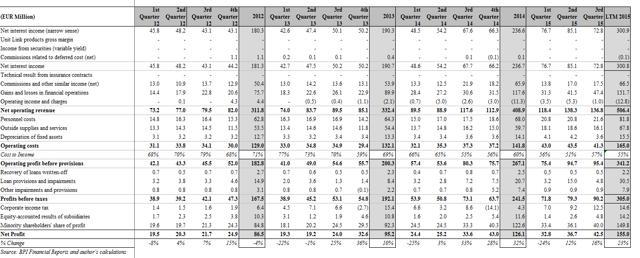

The performance of BPI's international subsidiary has been very good, producing an ROE of 34% - primarily as a result of BPI's 50% stake in Banco de Fomento Angola (BFA). Such growth will almost definitely not continue: Angola is primarily an oil-exporting nation and its GDP has decreased from 7% to 5% over the last year and is projected to decrease further to 3.5% this year.

Unfortunately, there are no direct Angolan comparables listed on the public markets. There are, however, African and Middle Eastern banks with significant oil exposures. These are highlighted in blue and the averages are calculated in the table below (on a FY2014 basis).

Several questions were asked about BAF and its possible exposure to the falling local currency, the kwanza, and the possible valuation that will be attached to the International subsidiary upon its listing on the stock exchange. The process will involve an independent third party determining the value of BPI International. Reassuringly, BPI's CEO, Fernando Ulrich, has expressly stated that he cannot see how BAF could be valued at less than book.This stood at EUR412m. This is reasonable - after BPI International recorded a ROE of 35% in its most recent quarter (see Schedule 6) and has increased its net interest income by almost 50% (see Schedule 6) whilst maintaining the same level of assets relative to its net worth.

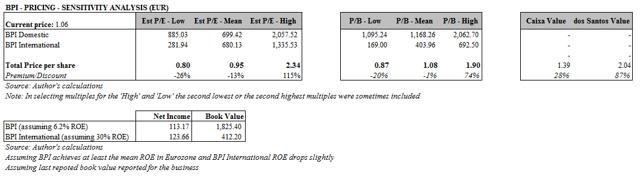

The sensitivity analysis above indicates that BPI is currently priced only slightly above its lowest possible value. The above table is conservatively presented: It assumes that the domestic operations of BPI will achieve only as much as the average possible ROE in the Eurozone of 6.2% and that the ROE in BPI International falls by 4%. The mean market pricing of P/B in the table above appears to indicate that the market has no faith in the performance of BPI International, BPI Domestic or both. As discussed above, the prospects of at least one of the businesses are positive.

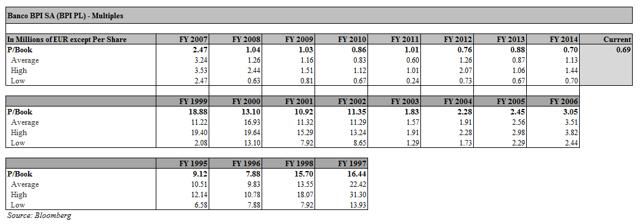

Finally, historical examination of BPI's P/B reveals that the current 0.69 multiple is the lowest it has ever been in a twenty-year period. BPI (and Portugal) have seen worse times.

Readers may have noticed the writer's overwhelming reference to - and use - of Bloomberg. What a great (but expensive) tool! A big thank you to the person who left the login details over the weekend in the library.

6. Risks

a. Spin-off collapse

Whilst the spin-off is due to be completed "very soon" (according to the Q3 2015 conference call), it may take considerably longer than suggested. Between now and the time that BPI divests itself of BPI International, the Angolan economy may experience further deterioration. The cushion here is that the prudence of BPI management, who have improved BPI International's performance, lowering its Loans-to-Deposits ratio from a peak of 60% in June 2013 to 37% most recently and achieving the highest ROE in its history of 35%. If this is the risk that no one is prepared to take, hedging against Angola may also be an option (I am personally unable to find my ISDA membership details). Finally, it should be remembered that the new worth of BPI International represents only 1/6 of BPI's net worth.

Nevertheless, several parties need to agree to the demerger. The announcement of each of the following or all at the same time will no doubt offer a catalytic effect:

- Agreement to the listing by BFA's other major shareholder, Unitel,

- prior approval from the Bank of Portugal, the National Bank of Angola and the Bank of Mozambique, and

- confirmation by the Portuguese Tax and Customs Authority that the regime of tax neutrality envisaged in articles 73 to 78 of the Corporate Income Tax Code is applicable to the demerger.

b. Lack of operational improvement and competition

The cost and reserve releases may never occur as management is unable to locate branches to close and decided that further provisioning is required. This is a point worth thinking over, especially considering the competitive nature of Portuguese banking (see Schedule 7) and Portugal's realistic macroeconomic problems.

c. Portuguese debt

The other side to the Portuguese economic recovery is the horror story of its disproportionate debt increase. Debt to GDP currently stands at 130%, eclipsed only by Greece at 170%. Studies have shown that a nation with such large debt obligations will likely struggle to achieve consistent growth(12). Indeed, Portuguese GDP growth of 1.2% looks less glamorous when compared to growth of Spain or Ireland (at 3.5% and 6% respectively). Any slowdown in the Portuguese economy will most likely have an adverse impact on economic and financial confidence of the nation, and most likely, Banco BPI.

d. Portuguese policy

Closely linked to the above risk, is the issue of Portuguese government policy. The newly elected socialist Portuguese government stated that it wants to increase welfare spending and improve output, as their previous (very successful) predecessors but within a longer time range(13). The dislike for Portugal's governments is not new(14). A commitment of the new government to Eurozone fiscal policies and financial measures provides some scope for optimism(15).

e. Life

A small section to remind the readers and the author that there are risks that cannot be currently imagined, nor recognized. The Eurozone is far from finding the financial stability it seeks.

Conclusion

BPI presents an interesting opportunity for the patient investor. Whilst relative to its domestic competition, BPI is the most expensive banking stock, and it appears to be worth it. BPI has demonstrated superior performance on almost every metric. The bank is yet to achieve its optimum performance and is patiently marching forward. Meanwhile, a management incentivized to achieve a positive return for its shareholders has taken steps to both reduce risks further and close the gap between price and value in the form of a spinoff of its international unit.

SCHEDULE 1 - CONSOLIDATED BALANCE SHEET

SCHEDULE 2 - CONSOLIDATED INCOME STATEMENT

SCHEDULE 3 - DOMESTIC BALANCE SHEET

SCHEDULE 4 - DOMESTIC INCOME STATEMENT

SCHEDULE 5 - INTERNATIONAL BALANCE SHEET

SCHEDULE 6 - INTERNATIONAL INCOME STATEMENT

SCHEDULE 7 - PORTUGUESE BANKS - JUNE 2014

3 Portugal in 4.9 billion euro rescue of Banco Espirito Santo - Reuters

4 Behind the Collapse of Portugal's Espírito Santo Empire - WSJ

6 Calculated as Operating Costs/Net Interest Income

7 Calculated as Net Income/Average of Equity Value of FY and previous years' results

8 Portugal’s Novo Banco told to fill €1.4bn capital shortfall - FT

9 AGGREGATE REPORT ON THE COMPREHENSIVE ASSESSMENT - pdf

10 Montepio H2 2015 Financial Statements; BANIF 9M 2015 Financial Statements

11 Calculated here as Operating Costs/(Net Interest Income + Fees earned + Other operating income + Gains from trading - Fees Paid)

12 Next Up On Europe’s Default Block - Why Portugal’s Debts Are Unsustainable - David Stockman's Contra Corner

13 Portugal's ousted PM says Socialist government proposal unstable - Reuters

14 Portugal’s political turmoil risks debt restructure - FT

15 Silva Meets Banks as Portugal Awaits Next Premier - Bloomberg

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment