Summary

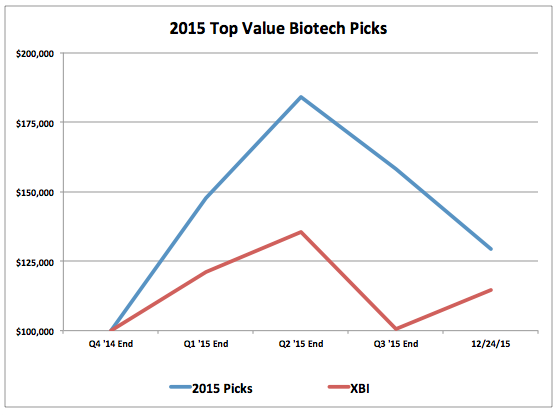

My top value biotech picks for 2015 sit at +29.4% with a few days left in 2015, approximately doubling the return of the XBI.

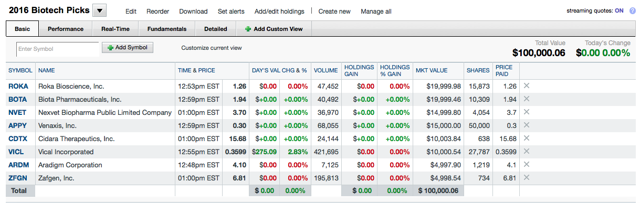

My top value biotech picks for 2016 are Roka Bioscience, Biota Pharmaceuticals, Nexvet Biopharma, Venaxis, Cidara Therapeutics, Vical, Zafgen, and Aradigm.

While top value picks for 2015 and picks starting Q2 2015 have significantly outperformed, recent picks have lagged due to Roka, Biota, and Nexvet stories taking time to play out.

Welcome to the last edition of Biotech Weekly for 2015, and thanks to all of my readers for putting up with me in 2015. This last edition of the year will cover my top value biotech picks of 2016 that will make up my portfolio for the2016 Biotech Charity Contest. While my 2015 picks have pulled back a bit from being up over 100% earlier in the year, the picks currently sit with a very solid return of 29.4%, which is approximately double the 14.8% return of the S&P Biotech ETF (NYSEARCA:XBI) that I benchmark my performance against. My return of 29.4% was good for 8th place as of market close on Thursday. While it looks like I'll come up a bit short of 1st place this year, I'm happy with my performance in my first year in the contest, and I look forward to writing a check to the winner's charity.

This thorough piece will provide a paragraph review of why I do these picks, will introduce the picks and provide a detailed explanation, and will finish with some portfolio management analytics of past picks.

I do the top value biotech picks at the start of the year as my portfolio for the Biotech Charity Contest on Silicon Investor. As most biotech investors that participate typically have more of a growth investment strategy, my picks are often held in the porfolios of zero or only a couple of participants, which makes it interesting to see how the picks compare to the other portfolios in terms of performance as the year progresses. The contest has amazingly been in existence since 2000 with BulbaMan from Silicon Investor running the contest for the past 10 years. Contestants allocate $100,000 of virtual currency to 8-10 picks at weights between 5% and 20% with performance being measured from December 31, 2015, close to December 31, 2016, close and no trading taking place. I think the contest is a great way as biotech investors to give back to charity, and I highly recommend my readers consider joining. Without further delay, my picks are as follows:

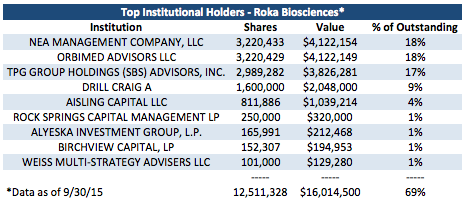

1. Dedication of Institutional Investors: The company's top 3 institutional investors own over half of the company with almost 70% of the company owned by the top 8 institutional investors.

When considering the holdings of all institutions filing 13-Fs as well as executives with stock (including CEO Paul Thomas with approximately 783k shares), approximately 80% of shares are closely held. With Jonathan Silverstein (General Partner at Orbimed), Jim Barrett (Partner Emeritus at NEA), and Fred Cohen (Partner at TPG Capital) all on the Roka Board of Directors, they wield significant power on the company's direction as three members of the board of directors that represent the owners of the majority of the company. These notable investors spend significant effort as board members and remain key players in the company. I am comfortable assuming that they are taking the company in the best direction for creating long-term value, and this provides me with a level of comfort as a long-term shareholder. I believe they would be very willing consider strategic alternatives if that were what they view as the optimal option for long-term value creation.

2. Food Safety Becoming Mainstream: Food safety continues to get more attention. You may remember when the recall related to listeria issues for major ice cream maker Blue Bell seemingly permanently tarnished the company's image. More recently, an E. coli outbreak that has been developing at Chipotle Mexican Grill (NYSE:CMG) since October has caused a new food safety hysteria to grab national attention. It was recently announced within the past week that the outbreak now consisted of two different strains of E. coli. Since the outbreak was initially announced back in mid-October, Chipotle has seen over $6 billion in market cap disappear and has seen significant declines in same-store sales.

CMG Market Cap data by YCharts

In a recent overview of current food safety issues in Fortune called The Food Industry's $55.5 Billion Problem, David Acheson, a former associate commissioner for foods at the U.S. FDA, noted that the chance of a company being caught when an outbreak occurs is high and that "it can be the end of [the] company." I believe that the recent loss of billions in shareholder value with Chipotle will highlight this fact to food industry participants and may very well be what triggers the sales momentum that Roka has been lacking. This is still something that would likely take 3-6 months to play out in terms of customer wins for Roka. I would certainly think that the team at Roka is leveraging recent news flow to close customer accounts and make the food industry a safer place.

Concluding Thoughts On Roka: Guided by a successful, experienced group of institutional investors and a CEO in Paul Thomas with a $1.8 billion exit on his resume, I think Roka is set up for a sales turn around that will bring multiples in returns to shareholders from current levels. Due to the lengthy sales cycle of 6 months though, it is hard to pinpoint when this breakthrough will come. While the company does expect to have enough cash on hand for operations through midyear and expects to finish the year with over $30 million in cash, it is important to note that the company does have an ATM active with Cantor, which means it can dilute on the open market. I think this would be dumb and unadvisable at the current levels, but it's hard to predict how the company will act. The company will need money in 2016, but I believe that it can raise this money at a more attractive valuation after showing sales progress. I also want to acknowledge that the company will be losing two executives at the end of the year, though I still believe the company has a good team intact. Even with the current adversity the Company is facing, I continue to view Roka as a high upside investment due to the thesis points I have highlighted, and I think the name presents a lot of value as it sits with a market cap under $25 million.

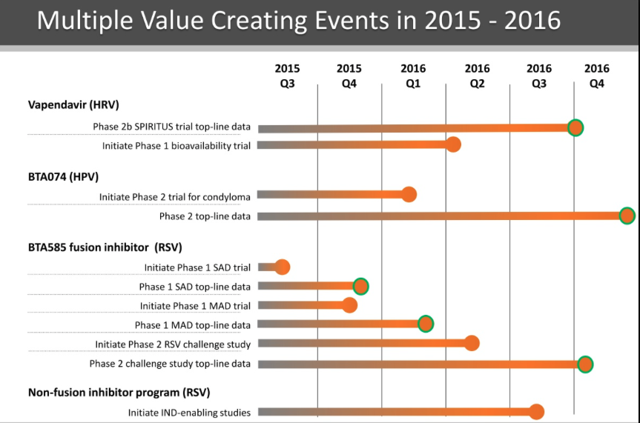

Biota Pharmaceuticals (NASDAQ:BOTA) - 20% Allocation: As I've discussed previously, Biota Pharmaceuticals is focused on developing innovative products for the prevention and treatment of serious and potentially life-threatening infectious diseases. This is a name that I have liked throughout the past year, yet it has remained stagnant due to the lack of late-stage readouts. This will change in a big way in 2016 with phase 2 readouts for three different clinical programs. Programs to watch include the following:

Source: November 2015 Stifel Conference

1. Vapendavir: Vapendavir is oral, small molecule broad spectrum inhibitor that has antiviral activity against a variety of diverse enteroviruses with its mechanism of action effectively stopping infection by interfering with early steps in the infectious cycle. The company is exploring the asset as a treatment of human rhinovirus. In my value pick analysis from last quarter, I provided a thorough analysis of Vapendavir's SPIRITUS trial design and highlighted some positive aspects I saw in the trial including a sicker patient population in which it should be easier to see a treatment effect, a higher dose that should provide a better response, an asthma control questionnaire endpoint that includes an objective reading, and a larger ITT-I population compared to past trials. This trial will read out in H2 2016.

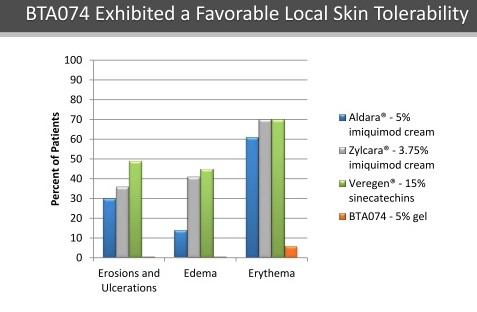

2. BTA074: BTA074 is an inhibitor of the interaction of the E1 and E2 proteins of HPV6 and HPV11 that is designed to block human papillomavirus ("HPV") replication. This is an asset Biota acquired through the acquisition of Anaconda Pharma that was closed in June 2015. The company is focused on developing this asset for the treatment of condyloma. The company chose to acquire this asset due results from an exciting phase 2 trial that displayed both efficacy through an impressive overall response rate and a substantially better percent reduction in total condyloma compared to the placebo group. On top of promising efficacy trends, the asset has displayed a much superior safety profile compared to currently used treatments.

Source: November 2015 Stifel Conference

The company will be initiating a phase 2 study in early Q1 2016 with the results expected near the end of 2016.

3. BTA585: BTA585 prevents the fusion of the RSV virus to the cell and is being developed to treat RSV infections in highly susceptible patient populations including children, elderly, and immunocompromised patients. The belief is that BTA585 can be used within the first 48-72 hours to stop a viral infection before peak viral load. The company announced successful results and no major safety concerns for the P1 single ascending dose portion of the trial on December 18. The company has already initiated the multiple ascending dose portion of the P1 trial with the expectation to report out on this in Q1 2016. This puts the company on track to initiate a P2 trial for this asset in the RSV indication in Q2 2016 with a readout projected for Q4 2016.

Concluding Thoughts On Biota: With phase 2 readouts from three exciting programs in 2016 and $66.3 million in cash/equivalents at Q3 end, Biota presents a unique value proposition to investors. The company is led by a CEO in Joe Patti that help take a company in Inhibitex from founding to a multi-billion dollar sale to Bristol-Myers Squibb (NYSE:BMY). The company additionally has royalty streams from Relenza and Inavir that help to lessen cash burn. This is an under-the-radar name that will get increased attention from institutional investors as the phase 2 readouts approach.

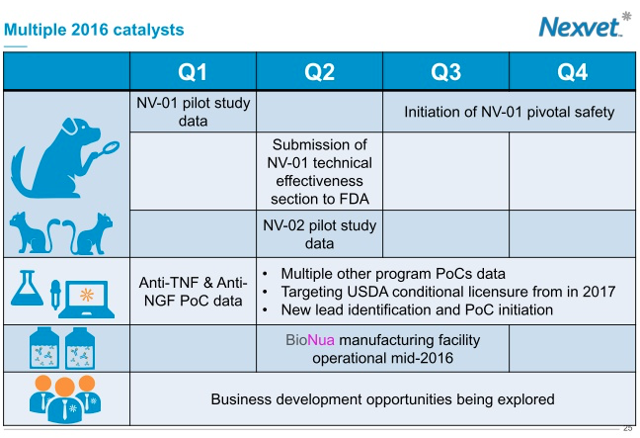

Nexvet Biopharma (NASDAQ:NVET) - 15% Allocation: As I've highlighted previously, Nexvet Biopharma is a clinical-stage biopharmaceutical company focused on the therapeutic market for companion animals by developing and commercializing novel biologic therapies, including species specific products derived from its PETization technology. Two points I want to highlight on the name are as follows:

1. Robust Pipeline: The company's deep pipeline is led by NV-01, the company's anti-nerve growth factor (NGF) monoclonal antibody (mAb) in development for the control of pain associated with osteoarthritis in dogs. While the company announced in the spring that a positive result in its pivotal NV-01 study was unlikely, the company surprised the market by announcing that it actually ended up achieving the primary endpoint. I view this as an enormous accomplishment that should significantly increase investor confidence in the company as a whole. I believe that the positive NV-01 results provide a positive read through for NV-02 (aimed at the control of pain in cats associated with osteoarthritis), which, like NV-01, is an anti-NGF mAb that inhibits the activity of nerve growth factor. I also view this positive readout as a positive read through for the company's PETization platform as a whole, a platform that harnesses proprietary cDNA library data to rapidly translate monoclonal antibodies between species. This allows the company's mAbs to be recognized as "native" by the relevant type of animal. Upcoming major catalysts are displayed in the below slide:

Source: BAML Investor Presentation

With the recent success of the NV-01 trial, I feel very optimistic about the upcoming NV-01 and NV-02 readouts that will be upcoming in H1. With over 15 active programs, I expect news flow to remain heavy as the company looks to move compounds toward approval.

2. Impressive Corporate Structure: For a microcap biotechnology company, the company has an extremely impressive corporate structure that will provide significant opportunities for scaling as the company grows. The company has its global headquarters in Ireland where the tax rate is less than 1/3rd of what it is in the U.S. Additionally, with the 2015 purchase of a manufacturing facility in Ireland, the company is receiving grants and incentives from the government. Furthermore, the company completes the main portion of its R&D in Australia, where it receives substantial R&D incentives.

Concluding Thoughts On Nexvet: With a robust pipeline backed by an impressive platform and an expertly designed corporate structure, I think it is ridiculous for the company to be trading with a market cap five million dollars under its book value of $48 million based on September 30 financials. Even when considering projected cash burn, the market is essentially placing absolutely no value on the company's pipeline or corporate structure that it has developed in anticipation of substantial scaling as assets make it through the pipeline. With a partnership already established with a leading animal health company in Virbac that has a presence in more the 100 countries, the company is on the right path to maximizing the value of its assets. I expect a steady flow of both pipeline progress and business development announcements throughout 2016 that will continue to move the company forward and increase value for shareholders.

Venaxis (NASDAQ:APPY) - 15% Allocation: Venaxis is a new name to my Top Value Biotechs list. Venaxis is an in vitro diagnostic company developing and commercializing its unique multi-biomarker diagnostic test, the APPY1 test. While the name popped 50% within a few days after I initially discussed it in a spotlight piece back in April, the name has lagged since. When I wrote about the name in late July, I expected the company to would likely follow up with a Q3 business update on the path forward with APPY1, but the company has been extremely quiet. Two main points I would like to highlight are as follows:

1. Sale of Headquarters: The only piece of news that has come out since the last business update in late June is the fact that the company sold its corporate headquarters in Castle Rock, Colorado. The company announced through the 8-K filed on October 21st that it sold its headquarters to Niebur Golf Development, LLC for $4,053,000 with closing expected to take place in December. The company expects to generate $1.7 million in net cash from this sale after expenses and mortgage payoffs. Post-closing the company will just pay a lease payment of $22,000 per month. Why would a company sell its headquarters? The sale cleans up the balance sheet in that the company will get $990,500 in cash at close and will receive a note receivable for the remainder of money owed. The company can pay off debt and is now only committed to a lease that can be ended with 60 days' notice with the ability to provide notice starting January 31.

2. What is Going on at Venaxis?: Other than the sale of the headquarters, news has been nonexistent. Let's think critically about the one piece of news we have gotten. Cleaning up the balance sheet by taking care of selling the company's main property and equipment is something I view as preparing the company for a strategic action. Additionally supporting this line of thinking is the fact that the company has not had a business update call for six months, which is unheard of and signals to me that they are in the process of a substantial strategic action. Even when considering cash burn of $1.35 million per quarter (the level of cash burn management has guided previously) or even cash burn up to $2.00 million given that we are generally unsure what exactly the company is doing, cash at year end would still likely be between $16.9 and $17.6 million based on the Q3 end cash balance. Adding the $990,500 in upfront cash from the real estate deal would bring this cash estimate up to between $17.9 and $18.6 million. The company may use some of the cash to pay off the mortgage note, but this would not affect shareholder equity. Shareholder equity was $18.9 million as of Q3 end. Based on a market cap of only $9.6 million, the stock currently trades at only 0.5x-0.6x based on book value and cash value. Way back in the June 2015 business update, the company had noted it was reviewing a variety of business opportunities. While I had initially thought the company would just be doing an asset buy in the in-vitro diagnostics space, the company's more or less silence over the past 6 months makes me think they could be reviewing a more substantial strategic action like a reverse merger. If the company were just looking at a more minor strategic action, I would expect them to keep investors much more updated on what was going on with other parts of the business like APPY1 and APPY2.

Concluding Thoughts On Venaxis: Ultimately, given the lack of communication with shareholders, it's hard to predict exactly what is happening at Venaxis. While I think the sale of the headquarters combined with the company dropping off the radar in terms of updates for six months means that the company may be completing a more substantial strategic alternative (such as a reverse merger) that was identified through the business development review, I want to acknowledge that this is merely conjecture as there are a wide variety of things that could be going on at Venaxis. While I do think we may very well see a strategic alternative, it's also possible that the next update brings disappointment in terms of lack of progress with APPY1 and APPY2. With the stock trading at 0.5x-0.6x book and roughly the same ratio based on cash, I think downside is muted though given the balance sheet even if the company provides a disappointing, lackluster update.

Cidara Therapeutics (NASDAQ:CDTX) - 10% Allocation: Cidara Therapeutics is a name that was new to my top value biotech picks last quarter. Cidara is a clinical stage biotechnology company developing novel anti-infectives to address serious infections. The company is well capitalized with over $114 million in cash of Q4 end and an enterprise value just above $100 million. Two points on the name I would like to cover are as follows:

1. Recent Progress and 2016 Outlook: The major announcement of the fourth quarter was the company announcing on November 16 that the company's anti-fungal drug candidate, CD101 IV, demonstrated excellent safety and tolerability in a P1 SAD trial in healthy volunteers. Additionally important was that the results support once-weekly IV dosing as being able to achieve approval for a long acting anti-fungal with once-weekly dosing would be a huge win for patients. The drug was well tolerated with no serious or severe adverse events and pharmacokinetics in line with what has been seen previously. The company has moved quickly into the multiple ascending dose portion of the trial with the company guiding for investors to expect an early 2016 readout. As per clinicaltrials.gov, enrollment of 24 was completed as of early December with an estimated primary readout of January 2015 most recently verified in the last review of the study in the database in mid-December. The company confirmed in a late December press release that it expects to initiate a phase 2 trial in H1 2016]. This release also noted new clinical guidelines from the Infectious Diseases Society of America that provide a positive read through for the company's anti-fungal candidate, CD101 IV. The company additionally expects to have the topical version of CD101 into phase 2 by mid-2016.

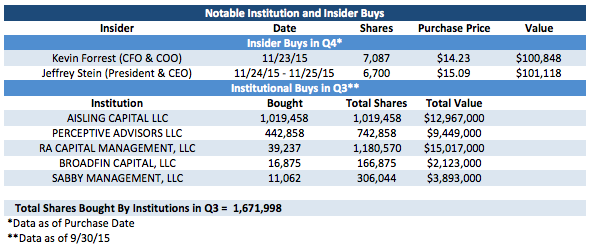

2. Institutions and Insiders are Buying: Both institutions and insiders have been active buyers of the stock on the open market.

While you may often see insiders with stocks less than five dollars buy a few hundred or even a few thousand shares, you often have to take these buys with a grain of salt as an insider spending less than $10,000 isn't exactly very material. In this case though, the company's top two executives decided to each spend over $100,000 on company stock, which are certainly very material amounts. As the saying goes, there are many reasons for an insider to sell a stock, but there is only one main reason for an insider to buy it. I definitely view this form of management confidence as providing a positive read though. I also like that a number of very successful biotech funds were busy buying in Q3, and I look forward to seeing if more buying by these institutions in Q4 is something that fueled the 23% stock price rise this quarter.

Concluding Thoughts On Cidara: Cidara provides you with a way to invest alongside a multitude of smart institutions and a management team with a $1.6 billion exit on its resume. The company is making quick progress in a therapeutic area that has lacked innovation, and the company has identified an expedited path to market. On top of all this, the company has significant cash reserves to fund operations and has a compelling technology in the Cloudbreak immunotherapy platform that will drive value for shareholders in future years. What else could you want? This name is well worthy of an investment, and it's amazing that it still sits on my cheap biotech screen.

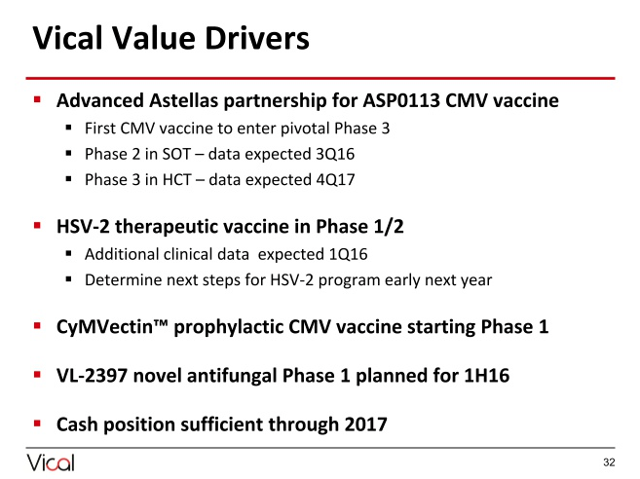

Vical Incorporated (NASDAQ:VICL) - 10% Allocation: Vical Incorporated is a new name I ran into while reviewing my cheap biotech screen. Vicaldevelops biopharmaceutical products for the prevention and treatment of chronic or life-threatening infectious diseases. When you see me highlighting this name, you may be saying the following:

"Dan, what are you thinking? Did you see the phase 1/2 failure for its therapeutic genital herpes vaccine in June 2015 or the phase 3 failure for intratumoral cancer immunotherapy Allovectin back in August 2013?"

Yes, yes I definitely am aware of its history of futility. Even given this, take a look at the following thesis points highlighting why I believe this stock presents a compelling opportunity.

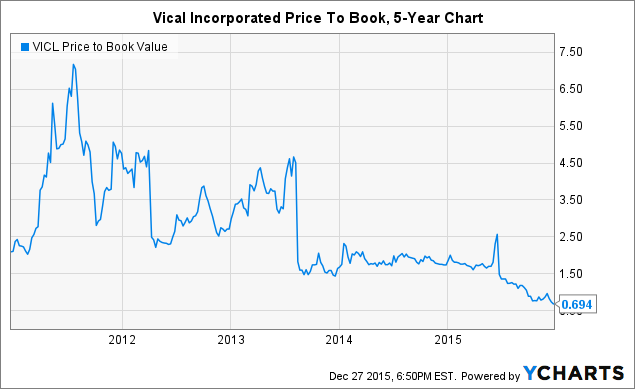

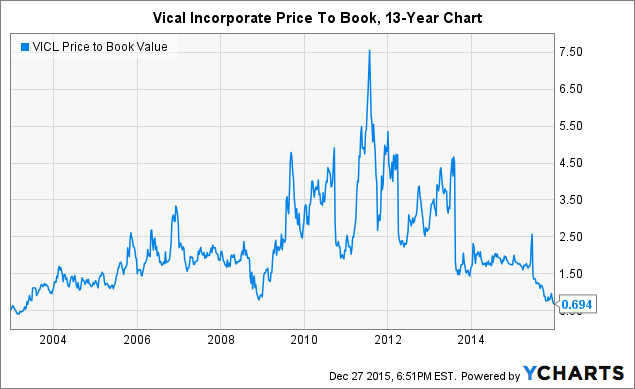

1. Clean Capital Structure and Rock-Bottom Valuation: Typically biotechs with a history of futility at what appear to be low valuations will have poor capital structures (think Aeterna Zentaris (NASDAQ:AEZS) ), which spells doom for shareholders. Utilizing control+F through a few SEC filings will show you that Vical refreshingly has no outstanding warrants or preferred stock. So, exactly how cheap is it? Well, at a price to book ratio of 0.694x, the stock is the cheapest it's been in the past five years.

VICL Price to Book Value data by YCharts

As a matter of fact, you'd have to go back more than a dozen years to find when the stock was this cheap.

VICL Price to Book Value data by YCharts

Coincidentally, twelve or so years ago is roughly when notable value investor John Rogers and Ariel Investments initially took a stake in the name. You can read about Ariel's history with the name in a piece by ValueWalk here. While Ariel has managed its position by selling the rips and buying the dips as it kept weightings in line, the company still currently owns approximately 8.1% of the company. Given the company's value investing strategy of exhibiting discipline and capitalizing on mispricings, I believe that the company will consider increasing its stake at current levels. While a clean capital structure and trading well under book value provide are both quality characteristics for a value investment, the company's partnership with Astellas is what clinches the company's spot in my value investment portfolio. My reason for being very positive on this partnership with Astellas is that Astellas is currently funding the ASP0113 program, which includes multiple late-stage trials with a phase 2 solid organ transplant (SOT) trial and a phase 3 hematopoietic cell transplantation (HCT) trial. With Astellas funding multiple late-stage trials, the company is projected to only burn $7-9 million in 2015, and I expect the company to be able to continue to manage cash burn in 2016 thanks to Astellas.

2. Variety of Upcoming Catalysts: While I admittedly do not have a specific catalyst to point to that will rescue shares from a valuation not seen since the early 2000s, there are a nice set of catalysts to note, and it will only take one piece of notable positive news to provide investors with a solid return from current levels. Catalysts on deck include the following:

Source: November 2015 Stifel Conference

ASP0113 Program: From this program partnered with Astellas, we'll receive phase 2 data in SOT in Q3 2016. In this phase 2 study, the company is looking at the highest risk patients where an organ is being transferred from a cyatomegalovirus (CMV) positive donor to a CMV negative recipient. We're also expected to receive an enrollment completion milestone for the phase 3 HCT trial in Q3 2016.

HSV-2 Therapeutic Vaccine: As I previously mentioned, the company failed a top-line efficacy readout for the phase 1/2 trial in June 2015. While herpes vaccine development is difficult and the data was very poor, the company will be reporting additional clinical data in the first quarter of 2016 that will include the change in lesion rate and recurrence data. While I have low hopes for value creation from this asset, there was biological activity data that was a bit interesting in the initial readout, and it should not take much to get the name moving upward from this depressed valuation.

CyMVectin CMV Vaccine: The company is exploring this asset in the treatment of women of childbearing age as a way to prevent CMV infection in this at-risk group of women and their children. The company has a phase 1 trial design and has an IND that has been allowed by the FDA. It is reviewing options to move forward individually or with a partnership with a partnership providing an interesting catalyst and a method for cash-burn control.

VL-2397: VL-2397 is an anti-fungal compound the company in-licensed from Astellas with Vical completing this deal with stock and $250,000 in cash. The company will be initiating a phase 1 trial in H1 2016 for treatment of invasive aspergillosis. Lack of research in anti-fungals makes this an area of research with a number of financial incentives with the company eligible for certain incentives through the GAIN Act of 2012.

Concluding Thoughts On Vical: While I acknowledge the lack of success on the part of Vical in past years, this is a company with a clean capital structure, a partner in Astellas funding substantial R&D, and minimal cash burn that currently trades well under book value. I believe that there are ample catalysts on deck to drive value creation for shareholders over the next year.

Zafgen (NASDAQ:ZFGN) - 5% Allocation: Zafgen is another new name to my top value biotechs, and it is a name that has struggled recently, declining over 80% in the past 3 months. Zafgen is a biopharmaceutical company dedicated to significantly improving the health and well-being of patients affected by obesity and complex metabolic disorders. With a market cap of $186 million, the company trades at an enterprise value of essentially $0 given guidance for a greater than $180 million year-end cash guidance. Institutional ownership as of Q3 end was high with Atlas Ventures, Deerfield, Franklin Resources, Janus, Jennison, Wellington, State Street, and BlackRock all owning significant stakes.

Problems started at Zafgen with the stock starting to tank on October 12 asthe company cancelled an investor roadshow with investment bank RBC Capital. As the stock continued to lose over half its value, the company finally announced on October 14 that a patient on beloranib died in the P3 bestPWS study of beloranib in Prader-Willi Syndrome (PWS). While the stock showed some signs of recovery over the next month, the company saw its stock tank to a negative enterprise value in early December on news of a second patient on beloranib dying in the P3 bestPWS study.

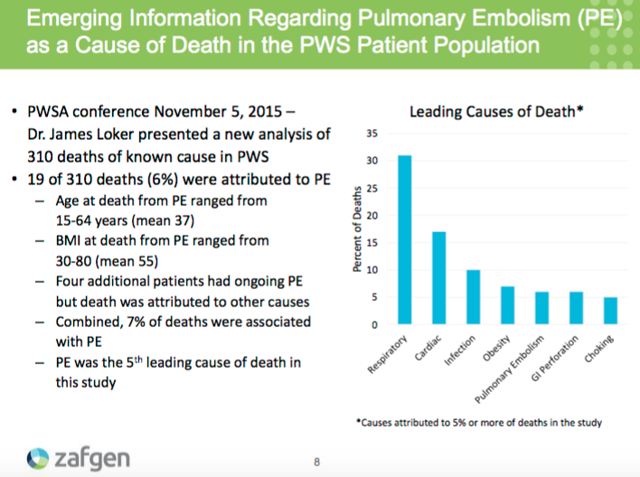

I won't get too detailed on explaining the rationale behind this holding as I think there are a number of detailed biotech investors that have done a solid job highlighting the upside scenario with Scientist on Stocks Chirag Shah putting together a helpful analysis through Seeking Alpha that is linked here. I'd also recommend taking a look at the comments section as there is helpful commentary there. Explained succinctly, the bull thesis as I view it centers on the belief that patient deaths due to blood clots (as occurred in the deaths that caused the stock to tank) can be mitigated through therapeutic anticoagulation with heparin as is discussed here on Medscape. It's also important to note that pulmonary embolism (a blood clot that occurs in the lungs) appears to be one of the most common causes of death in patients with PWS.

The past data for beloranib in patients with PWS has been promising with the results of a P2a trial announced in 2014 displaying beloranib reducing body fat content 8.1% versus placebo in four weeks of treatment at the 1.8mg dose even with a 50% increase in caloric allowance. Should the company see positive results from the phase 3 bestPWS trial readout on track for Q1 2016 as past clinical data suggests it will, finding a path forward leveraging the inclusion of a treatment with anticoagulants such as heparin to mitigate the adverse side effects would provide significant upside to shareholders. Investors will also receive a top-line readout from the ZAF-203 trial, which is a phase 2b trial evaluating beloranib in patients with severe obesity and type 2 diabetes.

Concluding Thoughts On Zafgen: I think upside in the form multiples from current levels is possible given that PWS is a condition with a highly unmet need and patients actively looking for solution with other indications also possible. Along with this upside, I acknowledge that there is probably more downside in the next few quarters than some longs will admit. Should news flow continue to be negative, the company's substantial cash burn that has resulted in over $50 million of operating losses in the first three quarters of 2015 will make it possible for the stock to fall to a market cap of $100 million within a few quarters as it certainly could trade at a negative enterprise value with additional negative news. Given the enormous upside should the scenario I describe play out along with the pretty substantial downside that is still possible, I believe it's prudent to place the minimum 5% allocation in this name.

Aradigm Corporation (NASDAQ:ARDM) - 5% Allocation: Aradigm Corporation is a biotechnology company developing drugs to improve the quality of life of patients with pulmonary disease. This is also a new name for my top value biotech picks and likely is another name that might have people scratching their heads. I can already hear people saying the following:

"You realize they've increase their share count by almost 4000% in less than 10 years with a stock that has declined 99.96% in the past 20 years, according to Google Finance?"

Yes, yes I do. I'm well aware of its past history of futility that includes the failure of inhaled insulin system AERx that was in development with Novo Nordisk (NYSE:NVO). Yes, they probably should spend the $15,000 to give their website a face lift so that it looks like it's from this decade. Regardless, I think this investment presents a value thesis that makes it worthwhile to take a flyer with a 5% weighting in 2016.

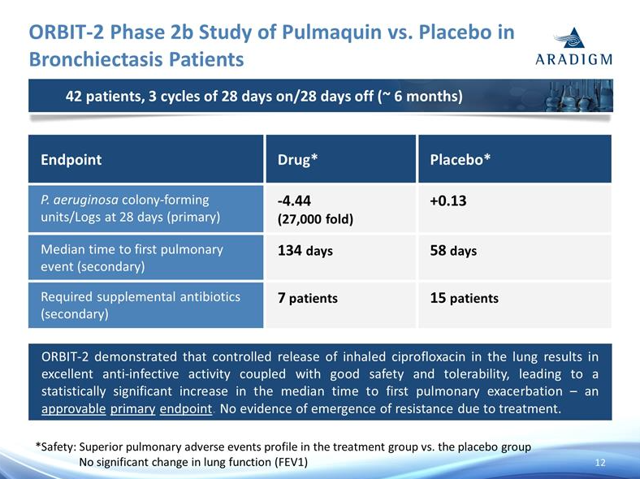

The investment thesis centers on the company's propriety inhaled antibiotic called Pulmaquin that is in development for the treatment of non-cystic fibrosis bronchiectasis. The company has two ongoing phase 3 trials with enrollment completion for the first phase 3 trial called ORBIT-4 announced on September 22 and enrollment completion for the second phase 3 trial called ORBIT-3 announced on October 13. The company is developing Pulmaquin in collaboration with Grifols, which has funded $65 million of development expenses as part of the agreement and owns approximately 35% of the company. Aradigm additionally has $20 million more (it has already earned $5 million) in precommercial milestones to achieve through its agreement with Grifols. Part of the reason I like this company as an investment is the promising data from the phase 2 ORBIT-2 trial.

The important data point here is the median time to first pulmonary event (a secondary in this P2 trial) where Pulmaquin outperformed with 134 days versus 58 days for the placebo. Cycle length will remain constant between the P2 trial and the P3 trials. As per the company's last presentation, the expectation is that top line data from at least one of the P3 trials will be presented in Q4 2016.

Concluding Thoughts On Aradigm: With $40 million of cash as of Q3 end, a major partner in Grifols, and compelling phase 2 data, I view Aradigm as well worth a flyer at the current valuation. While the company may very well raise some cash before the results, I think the name will come into investor focus with the upcoming phase three readouts, which will allow them to do a raise if they so choose at relatively attractive terms. While I do acknowledge the past history of futility, I think the market is undervaluing this opportunity as we move in to 2016.

Portfolio Management Analytics of Past Portfolios

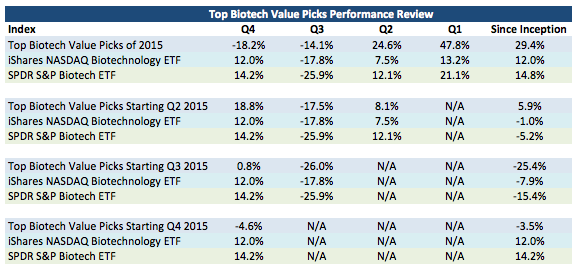

Given that I've presented my top value biotech picks for the next twelve months every quarter since the start of 2015, I wanted to provide some performance analysis.

Top Value Biotech Picks For 2015

With 2015 almost over, the top value biotech picks for 2015 have performed well, providing a 29.4% return that has approximately doubled the return of the S&P Biotech ETF.

Quarterly Performance of Each Portfolio

A return overview of the all picks has been as follows:

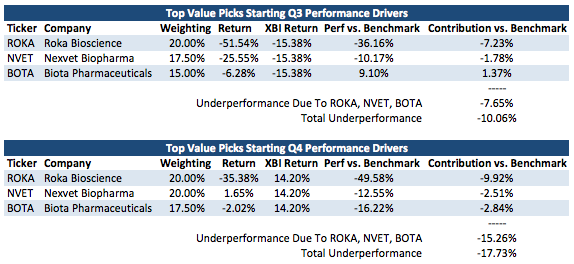

As you can see while the picks starting Q1 2015 have provided +1459 basis points in terms of outperformance versus the XBI with a few days left and the picks starting Q2 2015 have provided +1107 basis points of outperformance versus the XBI so far, underperformance for the picks starting in Q3 2015 and Q4 2015 has provided a hole to dig out of over the next few quarters. What are the main issues causing this underperformance for the recent picks? See the below analysis:

Contribution vs. Benchmark displays the underperformance versus the XBI caused by the individual holding. ROKA, NVET, and BOTA have caused 76% of the underperformance versus the XBI for my Q3 picks and 86% of the underperformance versus the XBI for my Q4 picks. With multiple quarters left for performance measurement for these picks and given my continued confidence in ROKA, NVET, and BOTA as I have discussed, I believe that these portfolios can turn their performance around through the full year measurement period.

Conclusion

With 2015 coming to a close and the time to make 2016 picks arriving, I will look improve upon the 29.4% that my 2015 picks have generated with a few days left in 2015. My picks for 2015 include Roka Bioscience (20% allocation), Biota Pharmaceuticals (20% allocation), Nexvet Biopharma (15% allocation), Venaxis (15% allocation), Cidara Therapeutics (10% allocation), Vical Incorporated (10% allocation), Zafgen Inc. (5% allocation), and Aradigm Corporation (5% allocation). Best of luck to everyone in 2016!

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment