Includes: ALK, AMZN, BA, CALM, CNI, CVGW, CXO, DOW, DPSGY, DSKE, DXCM, FCNTX,

Summary

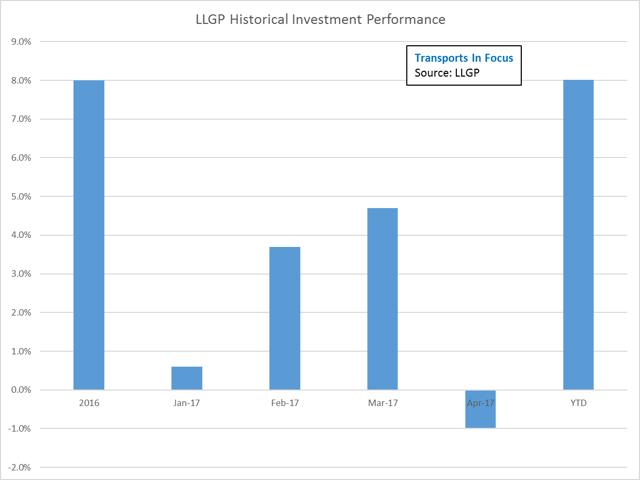

Through April 2017, the LLGP was up eight percent.

New position adds included Schneider National, Greenbrier, Prologis and Daseke.

Positions averaged during the month included Cal-Maine and Hub Group.

The portfolio now has 41 holdings under management.

Overview

The Lean Long-Term Growth Portfolio (LLGP) was created in early February 2016. The objective of this portfolio is for long-term capital appreciation and will include both companies that pay dividends and those that do not. The projected dividend yield for 2017 is around one percent. Over the long-term, yield may become a higher priority.

There are currently 41 individual stock holdings under management. For some this may seem like too many, others may think it is too little. Management strategies utilize business and industry growth drivers from a variety of source information. The biggest challenge of managing around 40 companies is maintaining enough cash to grow all holdings consistently over time. A firm structure is in place to allow for this, but the reality is that overweight positions will sporadically occur as different industry-related cycles ebb and flow.

As some of you may know, I focus intently on transports. The substantial majority of this focus is freight-related, so airlines, airports, and transit services are not strongly covered. I also focus intently on industries for holdings within the portfolio. Overall, 115 or so companies have detailed databases tracking quarterly information. Additionally, most industries also have other pricing and demand trends, which are monitored.

Currently only individual stocks are purchased. The primary objective is for long-term growth, but there are strategies in place to accumulate larger positions, which may be sold for short-term gains. Motif is used for both ROTH IRA and Traditional IRA accounts. The primary benefits of Motif over some other brokerage services include the ability to build one's own portfolio as a motif which can be invested in by any amount for only $9.95, up to 30 companies; and to be able to purchase fractional shares with a trading commission of $4.95. The $4.95 trading fee is becoming more of a standard, but buying fractional shares still is not.

As of April 28, 2017, the fund held 41 companies including:

- Alaska Air Group (NYSE:ALK)

- Amazon.com (NASDAQ:AMZN)

- Cal-Maine Foods (NASDAQ:CALM)

- Calavo Growers (NASDAQ:CVGW)

- Canadian National (NYSE:CNI)

- Concho Resources (NYSE:CXO)

- Daseke, Inc. (NASDAQ:DSKE)

- Deutsche Post DHL Group (OTCPK:DPSGY)

- DexCom (NASDAQ:DXCM)

- FedEx Corporation (NYSE:FDX)

- Grupo Aeroportuario Del Pacifico (NYSE:PAC)

- Hanesbrands (NYSE:HBI)

- Hub Group (NASDAQ:HUBG)

- JB Hunt Transport (NASDAQ:JBHT)

- JD.com (NASDAQ:JD)

- Kansas City Southern (NYSE:KSU)

- Lamb Weston Holdings (NYSE:LW)

- LINE Corporation (NASDAQ:LN)

- Lockheed Martin (NYSE:LMT)

- Matson, Inc. (NYSE:MATX)

- McCormick & Company (NYSE:MKC)

- Old Dominion Freight Lines (NASDAQ:ODFL)

- Pioneer Natural Resource (NYSE:PXD)

- Prologis, Inc. (NYSE:PLD)

- Raytheon Company (NYSE:RTN)

- Rice Energy (NYSE:RICE)

- Rice Midstream Partners (NYSE:RMP)

- Republic Services (NYSE:RSG)

- Sanderson Farms (NASDAQ:SAFM)

- Schneider National (NYSE:SNDR)

- Sprouts Farmers Market (NASDAQ:SFM)

- The Boeing Company (NYSE:BA)

- The Dow Chemical Company (NYSE:DOW)

- The Greenbrier Companies (NYSE:GBX)

- The J.M. Smucker Company (NYSE:SJM)

- ULTA Salon, Cosmetics and Fragrance (NASDAQ:ULTA)

- Unilever (NYSE:UL)

- US Foods Holdings (NYSE:USFD)

- VF Corporation (NYSE:VFC)

- Visa, Inc. (NYSE:V)

- XPO Logistics (NYSEMKT:XPO)

Current Holdings Performance - Update

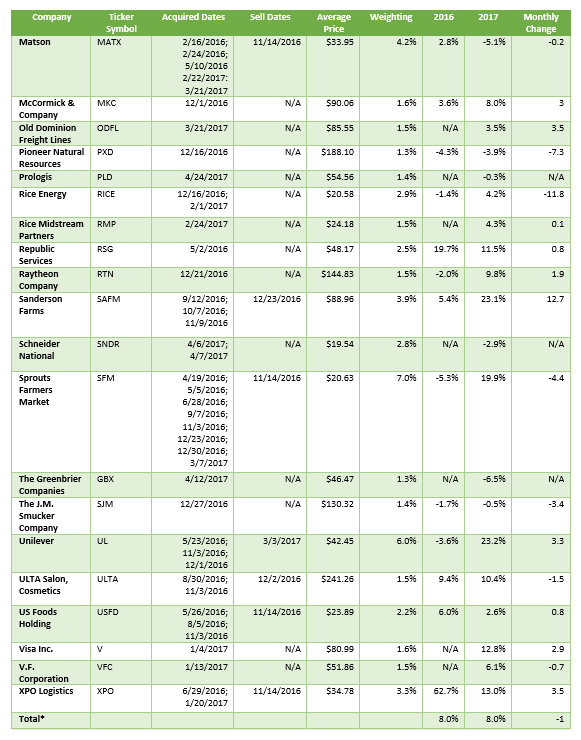

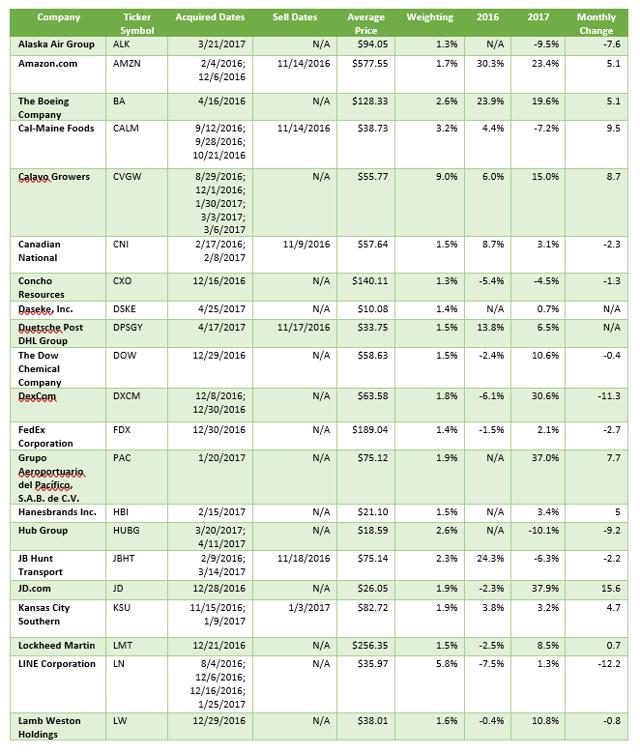

As of April 28, 2017, the table below provides the stock acquired and sell dates, average price, weighting, performance by year and monthly change. All dividend payouts are included in the performance to illustrate total returns.

Source: Personal Database

As transports have been weaker when compared to broader indices thus far, I assumed that the LLGP's first monthly decline was driven by transport holdings. However, under closer review, it appears that some over-weighted positions outside of transports had significant impacts for the lower performance.

LINE Corporation was the biggest laggard and reflected the second largest weighted position at the end of March. As such, the 12.2 percentage point decline was a big impact on the LLGP. Both Rice Energy and DexCom also witnessed percentage point declines greater than 11 percent. Rice Energy's weighting was above average, while DexCom's was not. Clearly, though, the weakest performers were not in the transports area.

Other weaker non-transports holdings included Pioneer Natural Resources, Sprouts and The JM Smucker Company. For transports, Hub Group and Alaska Air Group were the weakest performers. Other negative transports included Canadian National and FedEx. April witnessed a substantial increase in transports as five of the seven moves occurred in this area.

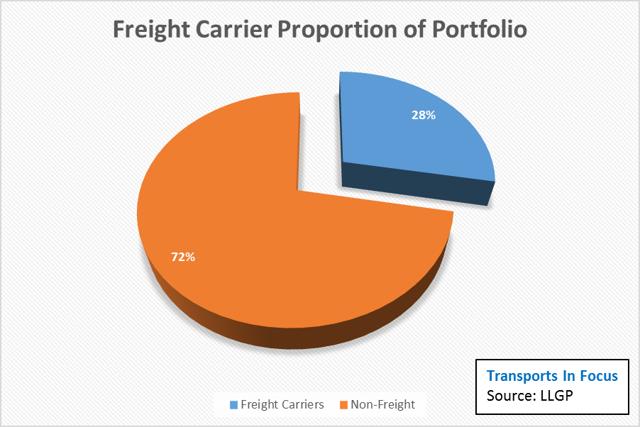

Freight holdings, as a percent of the total, increased by six percentage points to 28 percent. During April, as stated above, the majority of activity was related to transports. Contrarily, the most impactful declines were form non-transport companies. Collectively, this led to a stronger mix with freight-based companies as a proportion of the portfolio. I remain focused on incorporating the top freight companies in the LLGP.

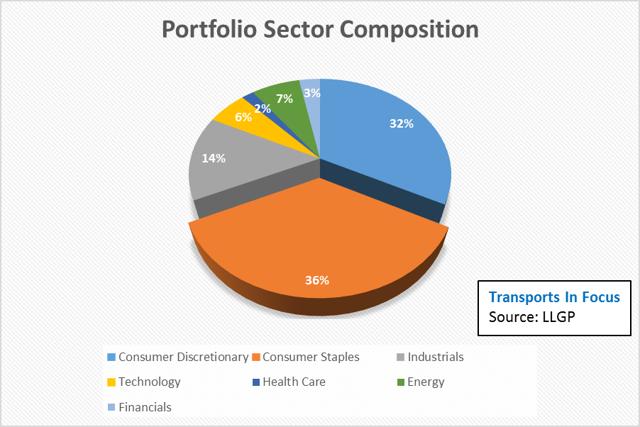

Most transports in the LLGP are categorized within the consumer discretionary sector. As a result of April's moves, this sector increased by three percentage points from the previous month. Sectors witnessing declines included consumer staples, technology, and energy.

Moving forward, the technology sector will be a focus over the next few weeks and may see multiple companies added. The NASDAQ (^IXIC) has continued to be one of the top performing indices through 2017.

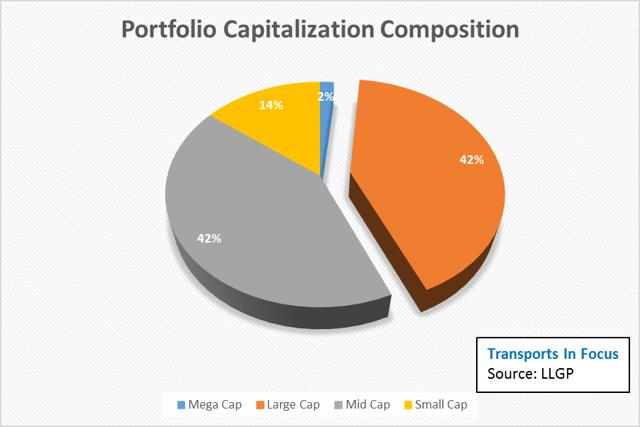

Large cap holdings decreased by two percentage points to 42 percent of the LLGP's total. This reflected the second consecutive month of declines. Mid cap holdings witnessed an increase to 42 percent as many companies added were within this category. Currently, 56 percent of the LLGP's portfolio capitalization is mid or small-cap.

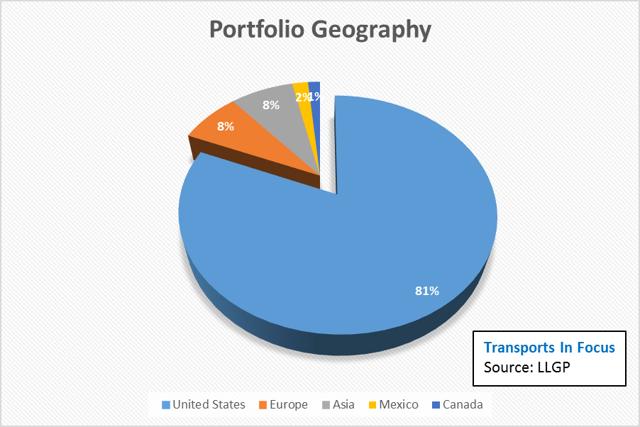

The percentage of U.S.-based holdings increased by one percentage point during April. This came at the expense of Europe and Asia. Despite the addition of DHL Group, the greater amount of U.S.-based companies continued to keep U.S. holdings as a percent of the total, around the 80 percent level. The current focus on near-term moves will likely maintain and/or increase this level.

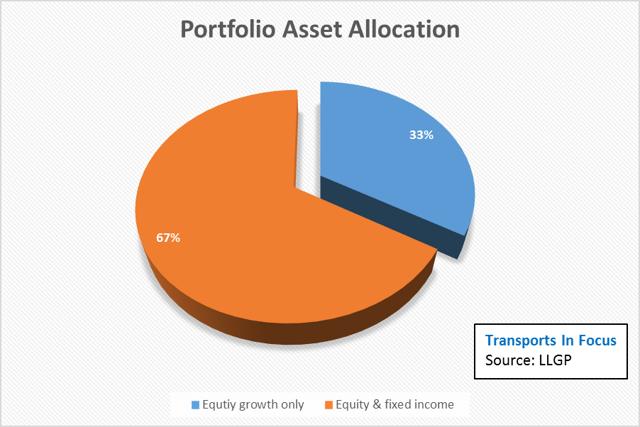

The combination of added companies, as well as the particular companies which witnessed the greatest declines, led to a three percentage-point increase in equity and fixed income holdings. As the portfolio will be considering the addition of multiple technology companies in the near-term, this increase may witness a degree of reversal.

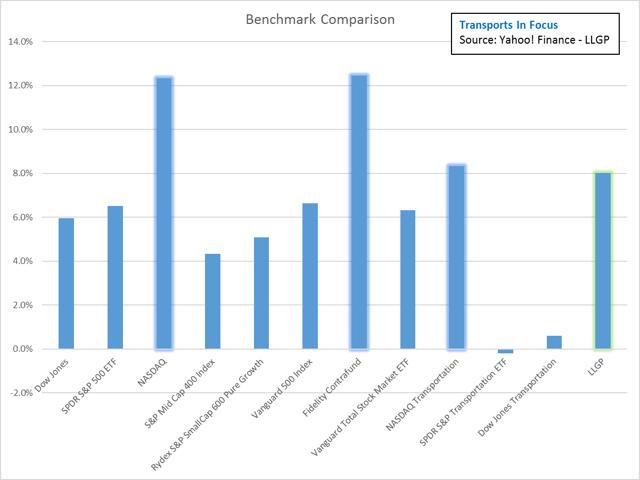

Benchmark Comparison and LLGP Historical Performance

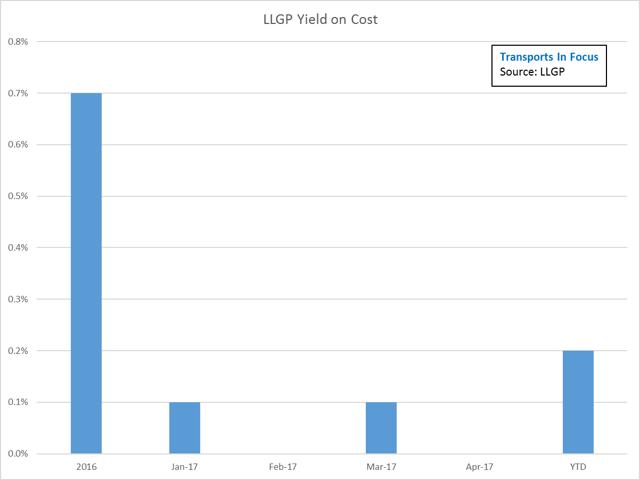

Through April, the LLGP has returned eight percent. A handful of companies have paid dividends, but the current yield is only at 0.2 percent. Through April, the NASDAQ, the Fidelity Contrafund (MUTF:FCNTX) and NASDAQ Transportation index (^TRAN) have been performance leaders, up 12.3, 12.5 and 8.3 percent. The Dow Jones (^DJI), SPY and Vanguard indices all have performed close to six percent.

Many of the LLGP's holdings witnessed a weak day as gross domestic product (OTC:GDP) results underwhelmed. Personally, I thought that the results were good, as the Atlanta Federal Reserve's GDPNow had an estimate at 0.2 percent. Moving forward, I expect to see improvement for transports, which now reflect a larger percentage of the portfolio. Additionally, some management strategies may lead to cashing out a couple positions, which may in-turn provide more cash to support laggards.

The month of April witnessed the first negative performance for the year, with a decline of one percent. This performance was much lower than the one percent positive results for some other indices. Results for the NASDAQ, Fidelity and NASDAQ Transportation were substantially higher. The portfolio is still performing well against index funds, over the near-term, more peers will be included to continue to enhance the LLGP's benchmark.

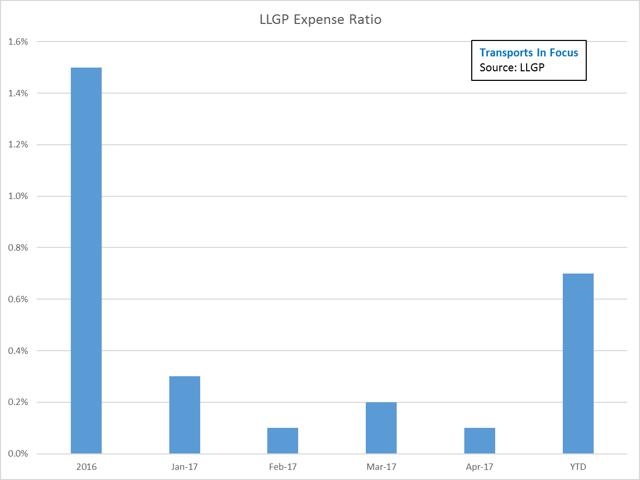

All expense ratio information is computed by a weighted average basis (NYSE:WAB). The WAB is simply the transaction fees incurred, divided by the average the LLGP's closing-day value. The original objective was to maintain the expense ratio near 0.5 percent.

The expense ratio for 2016 came in at 1.5 percent, through April 2017, it was at 0.7 percent, as April witnessed a 10-basis point increase. At the current pace, it looks as if the portfolio may repeat last year's expense performance. This metric will continue to be monitored in order to review the cost for performance.

As mentioned, despite dividends being paid, the aggregate amount has been minimal, so there is not a very impactful YOC. There has been better visibility regarding the timing of when holdings were initially acquired and when dividends are expected to be paid. The next couple of months should begin to see stronger improvement as the second quarter will likely be the first normalized quarter for the majority of holdings paying dividends.

Conclusion

The eight percent performance to date remains as an excellent start. Performance peaked in April at 9.4 percent, but fell hard this past Friday. The LLGP continues to perform well against its benchmark and based upon the strong performance for the technology sector, technology companies will be considered for further diversification.

With earnings season still in full swing, and first quarter GDP out of the way, it is not clear as to the direction the market will take. I continue to believe that the pace of consolidation for all sectors will remain, especially in the case of transports. The LLGP's stance remains focused on defending existing positions, as volatility is expected to continue.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I am/we are long ALL LISTED LLGP HOLDINGS.

By James Sands

Source: https://goo.gl/MXlO5z

No comments:

Post a Comment