Summary

All rhetoric aside, the post election economy will be driven by traditional policy factors; taxes, monetary, and regulatory.

Trump will need Congressional agreement to enact any significant policies. For economic stimulus, he already has bipartisan supporters and should enact massive economic change in his first 100 days.

Tax, Trade, The Fed; these 3 Ts are the policy areas which will drive the economy under Trump.

Subscribers to Income From Covered Option Writing receive an advance look at this material.

DOW futures are swooning at a Trump Presidency. Let's look at reality to see if we can expect a good or bad economic outlook.

Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and 10 other companies can expect to be among the largest beneficiaries of the First 100 Days. Why and how are discussed below.

Reality Review: The Job

Donald Trump has been elected President of the United States. He has not been crowned king and has very few dictatorial powers. His, is an executive job, leading and managing what the Congress enacts as law and funds spending for. The courts also add significant further legal restraint on the ability to rule by fiat.

Election rhetoric that can't be done without the (nonexistent) support of the Congress and the Courts includes:

- Ban immigration or new visas based on religion or creed (unconstitutional and would require an amendment).

- Round up and deport millions of illegal (undocumented and visa overstay) aliens. (An impossible task, far underfunded and courts would drag out beyond 4-year term and likely ban ultimately).

- Renounce existing ratified trade treaties. (Most all would require congressional approval to renounce. Most will have bi-partisan support to significantly modify to attempt to achieve the original results of *balanced trade and net job creation for all sides).

- Modify tax code. (This is complex but there probably is bi-partisan support in a give and take tradeoff for both tax policy issues and quid quo pro spending deals).

- Trade War With China. (Trump never claimed he wanted a trade war, only that he wants China to stop cheating on existing agreements. Critics claim China will reject his attempts. This ignores that China is the largest trade partner of the US and needs US trade. China also owns a huge part of US debt and weakening the US dollar would harm China and devalue the debt it holds. It would also harm China's currency which is partially linked directly to the US Dollar).

- Heat up the Global War on Terror. (We have had hot and cold wars on terror and communism since the end of World War II. These are not grand economic determiners. Each alternative policy has both plus and minus effects on both short and long range economic outcomes. Overall, it can be considered neutral or indeterminant).

The 3 Ts, Policies likely to achieve bi-partisan support and be enacted in the first 100 days:

Tax, Trade, and The Fed (via interest rates) are the 3 primary policies that have always traditionally driven the economy and will continue to do so.

Trump has proposed 2 significant tax policies. One, a reduction to 10% tax rate for repatriated foreign earnings. This proposal is highly likely to bring bi-partisan support because it benefits everyone and harms no special interest. The resulting immediate infusion of over $2.5 trillion into the US economy in 2017 (and perhaps 2018). This would mean a $250 billion windfall to the tax treasury along with additional taxes from the economic activity generated by the remaining $2.250 trillion as it is spent on special dividends, mergers and acquisitions, and corporate expansion.

Add in the re-cycling of the 2nd cycle as the new jobs and orders create more economic growth and jobs as newly enriched consumers spend their money on deferred necessities and increased discretionary spending. It is estimated that every trillion dollars of economic activity results in 10.5 million jobs. Thus, the repatriation and investment of $2.5 trillion can stimulate creation of over 26 million new jobs.

Which are the companies that will most benefit from this change in tax policy?

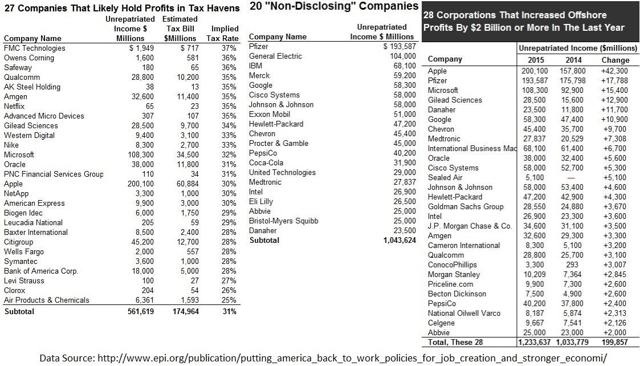

It is clear from the chart below that Apple, Pfizer (NYSE:PFE), Microsoft, and General Electric (NYSE:GE) will be at the top of the winners pile. Together, they represent $660 Billion (about 25% of the $2.5 trillion) in un-repatriated profits currently held in tax havens.

Changes in individual and corporate tax rates will take long and hard negotiations on policy components and specific tax targets. These are likely to result in a cut in tax rates, an increase in tax revenues, and overall economic growth. This has always been the case for such negotiated tax rate cuts in the past.

As the newly repatriated cash is put to work, the next immediate segments to benefit will likely be investment banking and employment services. This includes M&A giants like Goldman Sachs (NYSE:GS), JPMorgan Chase (NYSE:JPM), and Barclays (NYSE:BCS). Employment services will also benefit from a growing economy and job creation. Consider U.S. leaders such as the top four public companies: Adecco (OTCPK:AHEXY), Randstad Holding (OTCPK:RANJY), ManpowerGroup Inc. (NYSE:MAN), and Kelly Services (NASDAQ:KELYA).

It is of course difficult to pick individual winners at this early date. You may want to consider an ETF or mutual fund for each of these sectors so as to benefit from the basket as a whole. A rising tide will indeed float all boats. Some to consider are the iShares Edge MSCI USA Momentum Factor ETF (NYSEARCA:MTUM), the PowerShares DWA Momentum Portfolio (NYSEARCA:PDP), and the Index IQ Merger Arbitrage ETF (NYSEARCA:MNA).

Trade and The Fed Interest rate policies will lag implementation due to the complexity of negotiations both with the outside parties and the Congress, coupled with a time lag for results to flow into the broader economy. For these reasons, I will wrap up this "Winners of First 100 Days," part 1 for now. I will revisit the subject in latter series additions as appropriate.

Closing Thoughts:

I welcome comments and insights (but not political discussion please).

If you find this article thought-provoking, please consider becoming a follower by scrolling back to the top and clicking the "Follow" link next to my name. This ensures you are notified of all my work as it is published and gives me feedback to know what readers find of interest. You will find a full index to all published "Engineered Income" articles here in my instablog. Thanks for taking the time to read. Join the comments section below to continue this discussion and share your thoughts and experiences.

Income-oriented investors are invited to consider my exclusive premium research by subscription, offered in Income From Covered Option Writing through Seeking Alpha's MarketPlace.

Disclaimer: I am not a licensed securities dealer or advisor. The views here are solely my own and should not be considered or used for investment advice. As always, individuals should determine the suitability for their own situation and perform their own due diligence before making any investment.

Disclosure: I am/we are long AAPL, MSFT.

By Richard Berger

No comments:

Post a Comment