About: Pfizer Inc. (PFE), Includes: AGU, APO, AQUNF, AUPH, AVG, AVS

Summary

Aurinia hits endpoints; could draw suitors.

Bidders circle Cabela’s.

Lexmark clears CFIUS.

Welcome to the Beaten Down issue of M&A Daily

Aurinia

Aurinia's (NASDAQ:AUPH) stock was significantly undervalued coming into this month. Thank you, Steven Goldman for sharing your thesis on Aurinia first onSifting the World. Many members have benefitted from this idea already.

Now that its Lupus drug hit all primary and secondary endpoints, there is likely to be further upside. Ultimately, with success in trials, Aurinia will probably be acquired by a major pharmaceutical company such as Pfizer (NYSE:PFE). What is the right takeout price? Within $3 of $12 by this time next year. For details,please join the conversation at Sifting the World Live Chat.

Cabela's

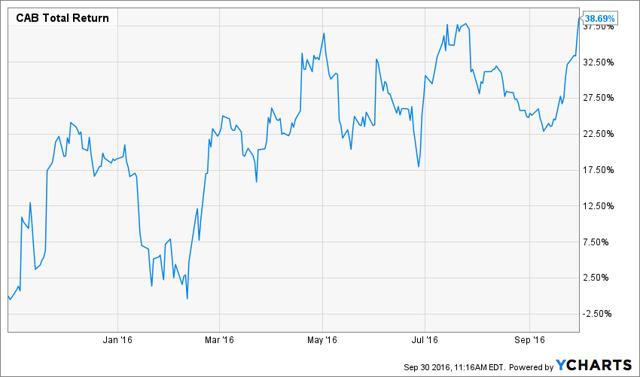

I am more enthusiastic about Cabela's (NYSE:CAB) as a customer than as an investor, but the company is likely to change hands shortly. Two bidding groups are circling, following pressure from activist Elliott. Bass Pro Shops is working with Goldman (NYSE:GS) on a bid. Capital One (NYSE:COF) wants to buy the Cabela's credit card unit. Another bid is being made by Sycamore andSynchrony (NYSE:SYF).

This takeover target is up over 30% since it was first disclosed in M&A Daily, but it remains modestly attractive at its market price today.

EverBank

The definitive proxy was filed for the Teachers Insurance & Annuity acquisition of EverBank (NYSE:EVER). EverBank shareholders vote November 9.

G&K

Rackspace

The definitive proxy was filed for the Rackspace (NYSE:RAX) acquisition by Apollo (NYSE:APO). Rackspace shareholders vote November 2.

Potash

Infoblox

Today is the HSR filing deadline and expiration of the go-shop period for the Vista acquisition of Infoblox (NYSE:BLOX).

Empire

The Arkansas Public Service Commission cleared the Algonquin (OTCPK:AQUNF) acquisition of Empire (NYSE:EDE).

Lexmark

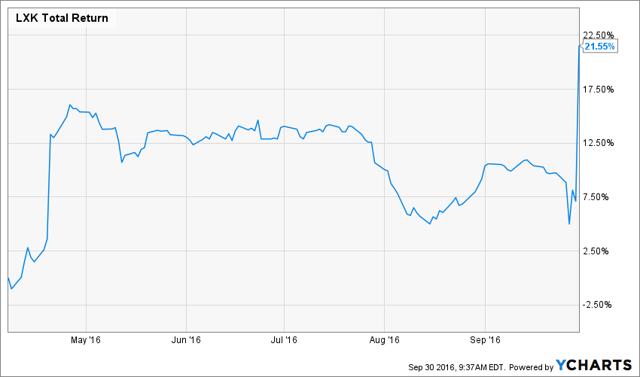

Lexmark (NYSE:LXK) received CFIUS approval for its acquisition by Apex. The deal target has returned over 20% since their talks were first discussed on M&A Daily.

More to come in future editions of M&A Daily…

Done deal.

- Avast (Private:AVST) closed its AVG (NYSE:AVG) acquisition.

- SemGroup (NYSE:SEMG) completed its Rose Rock (NYSE:RRMS) deal.

- The acquisition of Skullcandy (NASDAQ:SKUL) was completed.

Thank you, Ravi Mulani, for your great research on this opportunity.

Elsewhere on Seeking Alpha

- Harvesting Citi's 10% Dividend (NYSE:C)

Beyond Seeking Alpha

Sifting the World

Disclosure: I am/we are long AUPH, CAB, LXK, SKUL.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Chris DeMuth Jr and Andrew Walker are portfolio managers at Rangeley Capital. We invest with a margin of safety by buying securities at discounts to their intrinsic value and unlocking that value through corporate events.

By Chris DeMuth Jr.

No comments:

Post a Comment