Summary

The biotech sector has been hit hard in the last two trading sessions. The main trigger for this huge shift of sentiment is politics.

The main biotech indices have lost approximately 6.5% of their value in what has been a brutal and indiscriminate decline.

Attempting to make lemonade from lemons, here are two smaller names I would be opportunistically accumulating if one does not already have a full position in them.

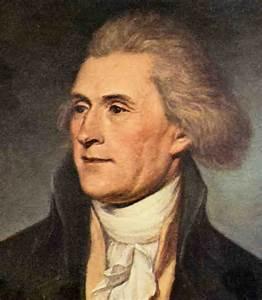

"I predict future happiness for Americans, if they can prevent the government from wasting the labors of the people under the pretense of taking care of them." - Thomas Jefferson

The biotech sector has been hit hard in the last two trading sessions. The main biotech indices have lost approximately 6.5% of their value since Tuesday in what has been a brutal and indiscriminate decline. The main trigger for this huge shift of sentiment is politics. Thanks to the recent implosion of the Republican nominee's presidential campaign, fears have grown that the Democrats could engineer a "clean sweep" this November and control all three branches of government. This could result in more regulation as well as other negative legislative actions on the Pharma & Biotech industries.

The Senate could well "flip." However, given how gerrymandered the House districts have become, the high negative ratings of both candidates and the fact two thirds of the nation thinks the country is heading in the wrong direction, a "clean sweep" is still only a 25% or 33% possibility in my view.

I have gotten a lot of questions on what smaller biotech stocks I would add to here after this week's steep decline. Here is a quick synopsis of two "Tier 3" stocks I have covered before. I would start to accumulate Thursday if you do not already have a full position. Tier 3 biotech stocks, for those that are not regular readers of my columns; are companies that have recently approved and potentially lucrative new products but have not achieved profitability as of yet.

Name: Progenics Pharmaceuticals (NASDAQ:PGNX)

Market Cap: $460 million

Stock Price: $6.26 a share

52-week high: $8.37

Median Analyst Price Target: $10.33 a share

Cash On Hand: ~$120 million

Primary Drug: Relistor. This is a gastrointestinal targeted compound that does nearly $17 million in gross sales a quarter currently. It is marketed by Valeant Pharmaceuticals (NYSE:VRX). Progenics gets a royalty rate of 15% to 19% of gross revenues depending on the volume of overall sales. The company is also eligible for another $200 million in sales milestones as well. The oral version of relistor was approved by the FDA on July 19th. This should at least triple sales as drug was only available in injectable form until approval.

Primary Drug: Relistor. This is a gastrointestinal targeted compound that does nearly $17 million in gross sales a quarter currently. It is marketed by Valeant Pharmaceuticals (NYSE:VRX). Progenics gets a royalty rate of 15% to 19% of gross revenues depending on the volume of overall sales. The company is also eligible for another $200 million in sales milestones as well. The oral version of relistor was approved by the FDA on July 19th. This should at least triple sales as drug was only available in injectable form until approval.

Other Factors: Azedra, which is a late stage drug candidate being developed for the treatment of malignant pheochromocytoma and paragangliom, looks like it is on its way to approval and could be on the market by late 2017. One analyst has estimated $300 million in annual peak sales for this compound. Valeant is also rumored to be "shopping" the rights to relistor if it can get the right price to help service its large debt load. If successful, this could remove the Valeant "overhang" on the stock.

For a more detailed analysis of Progenics click here.

Name: ACADIA Pharmaceuticals (NASDAQ:ACAD)

Market Cap: $3.05 billion

Stock Price: $25.78 a share

52-week high: $43.30 a share

Median Analyst Price Target: $45.50 a share

Cash On Hand: ~$600 million

Other Factors: ACADIA is one of the few mid-caps in the biotech sector, which is dominated by "whales" and "minnows." It is often speculated as a buyout target which I think will eventually happen but not until the first half of 2017. Biogen (NASDAQ:BIIB) is the most logical suitor. This company announced earlier this year it would be spinning off its hemophilia business that should be worth between $5 billion and $7 billion. The company has also stated it is interested in expanding its footprint in the neurology space. A hookup with ACADIA seems like a match made in heaven.

These are two actionable ideas for biotech investors that want to take advantage of lower entry points created by the substantial pullback in the sector over the past couple of trading sessions.

By Bret Jensen

No comments:

Post a Comment