Early volatility last week led to a mixed response for stocks.

Interest rates increased in the face of weak economic data and dovish FedSpeak.

The FOMC meeting is unlikely to change policy, but interest rates might still move higher.

The long end of the yield curve is seeing pressure from several oft-ignored sources.

Savvy investors can rebalance portfolios to combine reasonable yield with growth.

The calendar has very little important data. The highlight is the FOMC announcement and press conference on Wednesday. Even though the Fed is not expected to change course, bonds have gotten much weaker, sending the ten-year note yield higher. This effect is gaining notice. Should we expect a further bond selloff?

There was not much news, and it was another mixed picture.

Theme Recap

In my last WTWA, I predicted a week of wondering whether we should start fearing the Fed. That was the Monday theme, but it did not last long. Governor Brainard gave a very dovish speech right at the deadline before the blackout period. Many had expected a significant tone change from her. Perceived odds of a rate increase declined after that and continued with the weaker-than-expected data reports.

The Story in One Chart

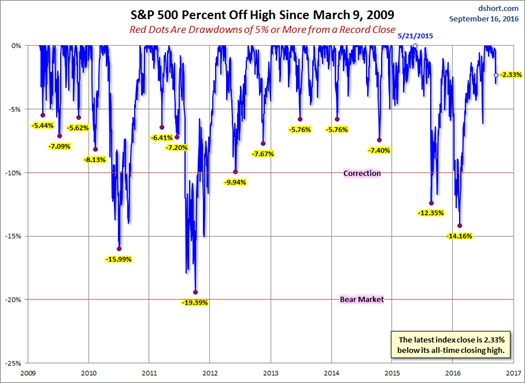

I always start my personal review of the week by looking at this great chart from Doug Short. The overall range, once again, is very narrow. Doug emphasizes the early-week volatility and generally soft data.

Doug has a special knack for pulling together all of the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis and several other charts providing long-term perspective. Here is a sample, showing the regularity of drawdowns since 2009, including 5% or more about twice a year and several over 10%. Keeping perspective is easier when you understand what is normal.

Each week I break down events into good and bad. Often there is an "ugly" and on rare occasion something really good. My working definition of "good" has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news - and you should, too!

The Good

- Initial jobless claims were 260K, continuing recent low levels.

- LA area port traffic increased in August. (Calculated Risk). This indicator may need a "reset" now that the Panama Canal is able to take more traffic. There will also be noise from the bankruptcy of a big shipping firm, leaving some cargo stranded.

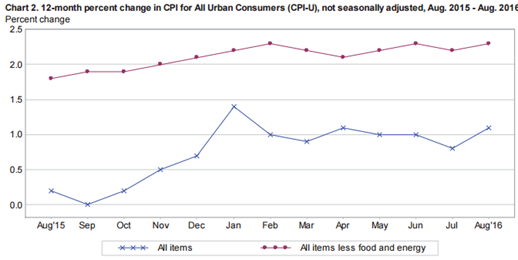

- Inflation - both PPI and CPI remains at benign levels. It is not yet at the point that will attract aggressive Fed action, but is starting to reflect improvement in wages and the economy. Doug Short and Steven Hansencollaborate on the most comprehensive analysis of these data. Check out this deep dive!

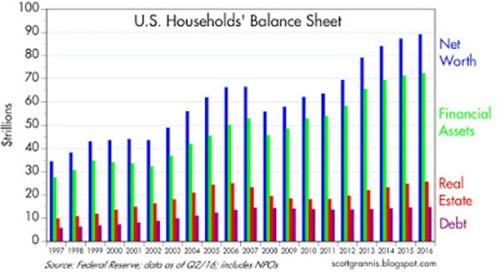

- U.S. households are richer than ever. Scott Grannis reviews the latest updates (June data). While it is 2015 data, incomes also showed a big gain.

- Frequent indicators are stronger. New Deal Democrat's update of indicators that most people miss is a regular read for me. One excellent feature is the separation of long-leading, short-leading, and concurrent indicators. This is an excellent check on the more commonly discussed economic indicators. It requires a lot of work to provide information that would be difficult to compile on your own. Here is a key quote from this week's post:Now ALL but one of the long leading indicators are positive. Interest rates for corporate bonds, treasuries, the yield curve, real money supply, real estate loans, mortgage rates, purchase and refinance mortgage applications are positive. The only negative is that mortgage rates have not made new lows for over 3 years.Short leading indicators turned a little more mixed. Stock prices, jobless claims, oil and gas prices, gas usage, and as of this week the spread between corporates and treasuries, are all positive. Both measures of the US$ are now neutral. Industrial commodities have joined the volatile regional Fed averages as a negative.The coincident indicators remain mixed. For once recently all measures of consumer spending are positive. The BDI remained barely positive. Rail, steel, the Harpex shipping index, and bank rates remain negative, with bank rates really spiking. Tax withholding was mixed. Obviously I do not like a negative YoY tax withholding reading, but I suspect this will resolve next week.

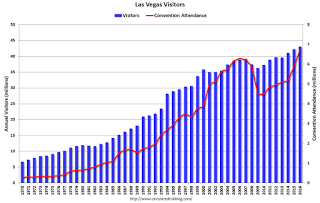

- Las Vegas visitor traffic has reached a new record high. Bill McBride has the story. And this is even before the new direct flights from Beijing have begun.

The Bad

- Rail traffic had another bad week. Steven Hansen notes that it is still down 4.9% y-o-y if you remove coal and grain traffic.

- Industrial production dropped 0.4% missing expectations for a decline of 0.3%.

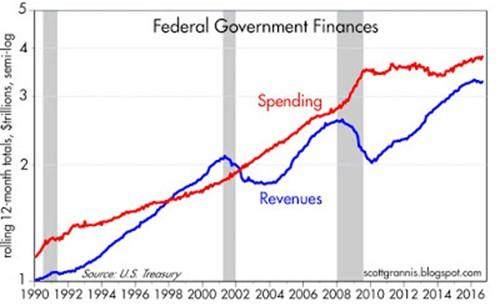

- The federal budget deficit is increasing as revenues falter. Scott Grannis has a good discussion. Various sources this week, including Barron's, noted that the election debate does not pay enough attention to this issue.

- Election uncertainty is holding back business investment, and it will not stop when the election ends. Duke's regular survey of CFO's reports that 1/3 will hold back on investment until there is information about how the new president will govern. Election expert Prof. Larry J. Sabato alsoexpresses concern about the "strange race." This is a growing concern.

- Michigan sentiment missed expectations (89.8 v 91.5), but matched last month's final result.

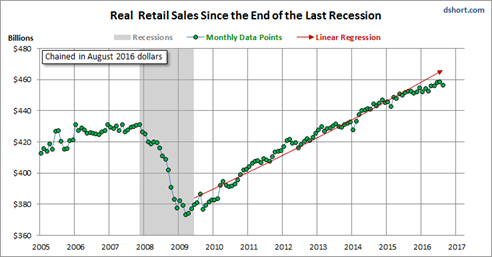

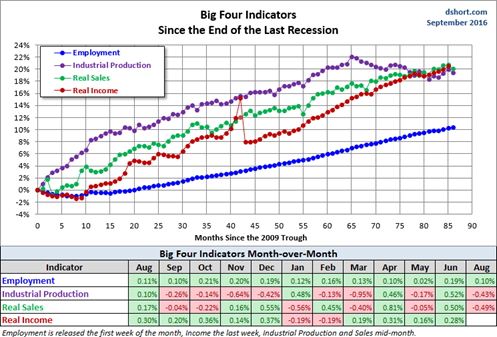

- Retail sales declined 0.1% missing expectations of a 0.3% gain. Jill Mislinski covers this thoroughly. The effect on Doug Short's Big Four indicators is described in the quant section.

The Ugly

Corporate misconduct. Deutsche Bank via Bloomberg. "Aside from the U.S. probe into residential mortgage-backed securities, the lender also faces inquiries into matters including currency manipulation, precious metals trading and billions of dollars in transfers out of Russia". Wells Fargo creating two million phony accounts. (CNN). Exxon accounting issues. (Reuters). Bosch under investigation for possible help to VW in "Dieselgate." (Bloomberg).

Wells Fargo's CEO John Stumpf will be before the Senate Banking Committee on Tuesday. The fines and other penalties for corporate offenses sound large, but do not really force accountability. Eddy Elfenbein ponders what a Wells Fargo investor should do. (We also hold stock versus short calls).

Following up on last week's North Korea story - the Council on Foreign Relations has a collection of papers covering the key issues.

The Silver Bullet

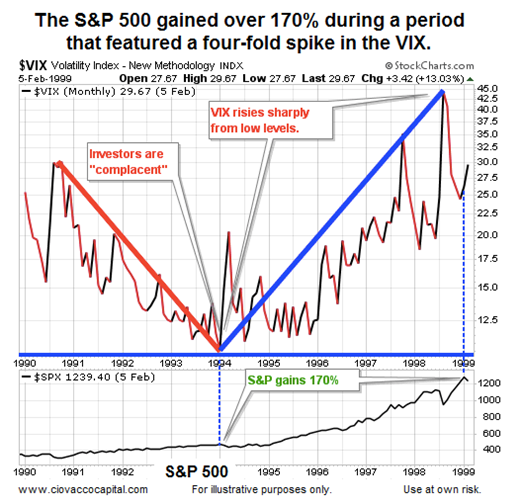

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. This week's award goes to Chris Ciovacco (See It Market) for his great explanation of the VIX. Featuring a prior piece by Jeff Macke, he emphasizes that the VIX is not really about fear, but expected volatility.

The misunderstanding of this concept is costly for investors who see it is a leading "fear" indicator, as well as traders who misuse it for hedging. The entire post is worth a careful reading, but keep this chart in mind:

See also runner-up Adam H. Grimes with similar conclusions on the same topic.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a very light week for economic data, featuring the FOMC decision and Yellen press conference. While personally I watch everything on the calendar, you do not need to! I highlight only the most important items in WTWA. Focus is essential.

The "A" List

- FOMC decision (W). No policy change is expected. Will the statement and press conference clarify anything?

- Housing starts and building permits (T). Crucial element for stronger growth.

- Initial claims (Th). The best concurrent indicator for employment trends.

The "B" List

- Existing home sales (F). Not as important for the economy as new homes, but still a good read on the market.

- Crude inventories . Often has a significant impact on oil markets, a focal point for traders of everything.

FedSpeak will resume after the meeting with several participants on the calendar.

Next Week's Theme

Last week began with revisionist Fed thinking on Monday and a poorly-explained sell-off on Tuesday. I parsed the explanations which were basically inconsistent. Many relied on the lame "delayed reaction" argument. It is amazing how imagination can be used to make facts fit your favorite scenario. I tweeted a good CNBC sequence where the stock pundits (once again) said that markets were taking a cue from oil. The oil expert then opined that commodity traders were watching stocks!

True enough. Everything declined together on Tuesday, including the interest-rate sensitive names. Pundits were mystified by bond selling even though the FedSpeak was more dovish. Could it be? Regardless (but including) what the Fed does, I expect that everyone will be asking: Is the long-awaited bond correction at hand?

There is a key mistake in most commentary - the idea that the Fed controls all interest rates. "Davidson" (via Todd Sullivan) pursues a theme that I hope will be familiar to my readers.

When I began my career ~35yrs ago everyone talked about "The Credit Spread". Today, everyone talks about rates as if it is the rate, the short-term rate, and importantly the rate the Fed sets, the Fed Funds Rate. Today's discussion is universally about the next Fed Funds Rate hike as if the Federal Reserve controls the economy. The extensive economic data we have available has never supported the wide-spread belief repeated ad nauseam in every media that the Federal Reserve controls US economic activity. Actual control lies in the Free Market.

I have not been a fan of Jeff Gundlach on most of his predictions about stocks, but when a "bond guy" gets worried about bonds, we should probably pay attention. Robert Huebscher covers this in an article that has been extremely popular with investment advisors. Here is a key quote:

"This is a big, big moment," Gundlach said¸ and it won't pay to "be cute" by trying to benefit from short-term price movements, since the dominant trend will be higher rates.

"It pays not to squeeze the last bit of juice out of the orange," Gundlach said.

Brett Arends (who also has been no fan of stocks) is sounding a warning about the so-called safe investments.

JP Morgan seems to be on the same page.

As always, I'll have a few ideas of my own in the conclusion.

Quant Corner

We follow some regular great sources and also the best insights from each week.

Risk Analysis

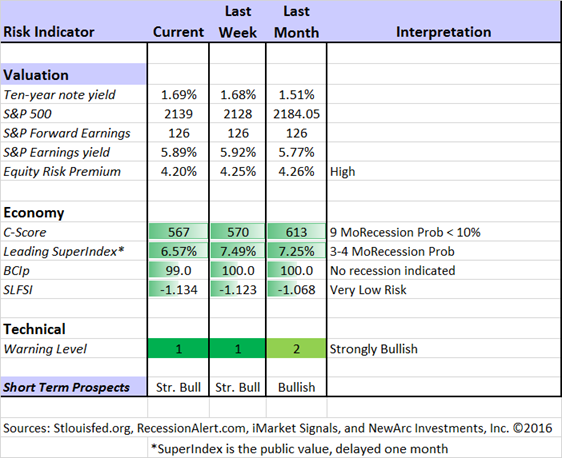

Whether you are a trader or an investor, you need to understand risk. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

The Indicator Snapshot

The Featured Sources:

Bob Dieli: The "C Score" which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). His subscribers get Monthly reports including both an economic overview of the economy and employment.

The recession odds (in nine months) have nudged closer to 10%.

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature his recession analysis, Dwaine also has a number of interesting approaches to asset allocation.

Georg Vrba: The Business Cycle Indicator, and much more. Check out his sitefor an array of interesting methods. Georg regularly analyzes Bob Dieli's enhanced aggregate spread, considering when it might first give a recession signal. Georg thinks it is still a year away. It is interesting to watch this approach along with our weekly monitoring of the C-Score.

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies.

Doug Short: The Big Four Update, the World Markets Weekend Update (and much more).

The ECRI has been dropped from our weekly update. It was not so much because of the bad call in 2011, but the stubborn adherence to this position despite plenty of evidence to the contrary. Those interested can still follow them via Doug Short and Jill Mislinski. The ECRI commentary remains relentlessly bearish despite the upturn in their own index.

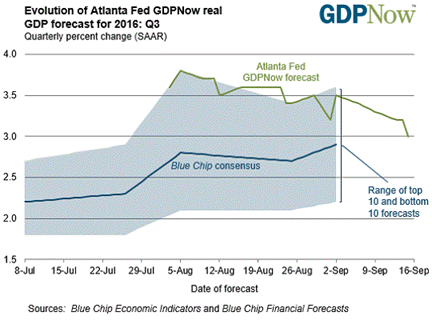

Quant work on GDP was a key topic this week. The Atlanta Fed's GDP Now project shows a current forecast of 3%, a lot better than most expect.

Lipper explains why things might be stronger than they feel on the earnings front. This is a theme from Brian Gilmartin that we have been monitoring for months.

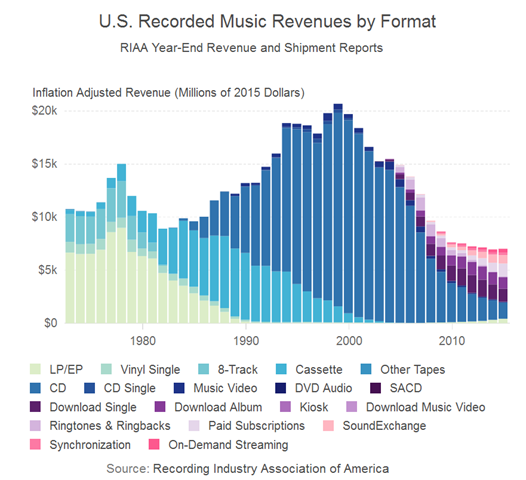

Mark Perry has a good idea about GDP measurement. Let's start by asking whether you think the world's "music well-being" has ever been better than it is now. Mark explains why it is currently awesome. Next take a look at how it is measured by GDP. Everyone will enjoy this chart, which makes obvious the error in using dollar sales as the main indicator.

How to Use WTWA

In this series I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. Most readers can just "listen in." If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide a number of free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!) Free reports include the following:

- Understanding Risk - what we all should know.

- Income investing - better yield than the standard dividend portfolio, and also less risk.

- Holmes - the top artificial intelligence techniques in action.

- Why it is a great time to own for Value Stocks - finding cheap stocks based on long-term earnings.

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions. What scares you?)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and also the best advice from sources we follow.

Felix and Holmes

We continue with a strongly bullish market forecast. Felix is fully invested. Oscar holds several aggressive sectors. The more cautious Holmes also remains fully invested. They now have a regular Thursday night discussion, which they call the "Stock Exchange." You are welcome to join in with questions or ideas.

Top Trading Advice

Brett Steenbarger is posting great ideas day after day. Traders should read his posts frequently. I sense another book coming! My favorite this week is about what you should do if you are in a drawdown.

Are other people, trading similar strategies, also losing money?That will tell you quite a bit. If you were making money and suddenly go cold and others in the same markets, with similar strategies are doing the same, then you know that it isn't simply a psychological issue. Everyone did not suddenly lose discipline or become an idiot at the same time. Rather, the strategy is not working under current market conditions, or it has stopped working altogether.

Simple, but wise and often overlooked by traders who start second-guessing themselves.

I also recommend this post on The Psychology of Dealing with Choppy Markets.

Most aspiring traders would save a lot of time and money if they asked Sam Seiden's question, Are You a Good Fit for Trading? (This was GEI's Investing Trading Academy's article of the week).

Adam H. Grimes has another take on psychology, considering how it is linked with experience and methodology.

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility!

Best of the Week

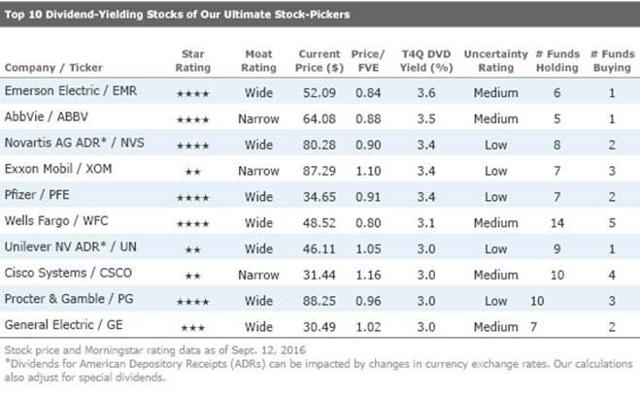

If I had to pick a single most important source for investors to read this week it would be Chuck Carnevale's lesson about how to pick dividend stocks. I almost always suggest that readers take a look at his ideas, but this week's post is extra special. He provides a wonderful opportunity to test the tools at his wonderful time-saving and profit-building site. Anyone who is a do-it-yourself individual investor should set aside an hour or so to read the article and try out the method.

His example convincingly shows why entry price is important. A given budget permits purchase of more shares. Better value at the time of purchase gives you both extra upside on stock gains and also larger dividends. Take Chuck's challenge to try it for yourself.

Stock Ideas

Eddy Elfenbein's latest CNBC appearance explains the relationships underlying the gold trade, where someone bought $1 million worth of put options on a single gold stock. The discussion emphasizes the short run, reaching adifferent conclusion than Felix, who thinks long-term.

Our newest trading model, Holmes, has been contributing an idea each week, a stock we bought for clients a few days ago. I will mention it here, but you can see it a little sooner if you read my new weekly column, the Stock Exchange. I'll have a "conversation" each week with all three of our models. Since each has a different personality and style, there are often disagreements - especially with me! While we cannot verify the suitability of specific stocks for everyone who is a reader, the ideas may be a starting point for your own research. Holmes may exit a position at any time, and I am not going to do a special post on each occasion. If you want more information about Holmes and exits, just sign up via holmes at newarc dot com and you will get email updates. This week's Holmes added several stocks, including Solar City (NASDAQ:SCTY).

Technology stocks are now favored by value funds. That is no surprise to me or to my readers! Barron's has the story. A subscription is required, but you can probably get it by putting the title or key phrase into Google.

Barron's also highlights homebuilder CalAtlantic (NYSE:CAA). The company has been digesting a merger which helped to place it in some of the fastest growing areas.

The top 10 dividend stocks from Morningstar's Ultimate Stock pickers.

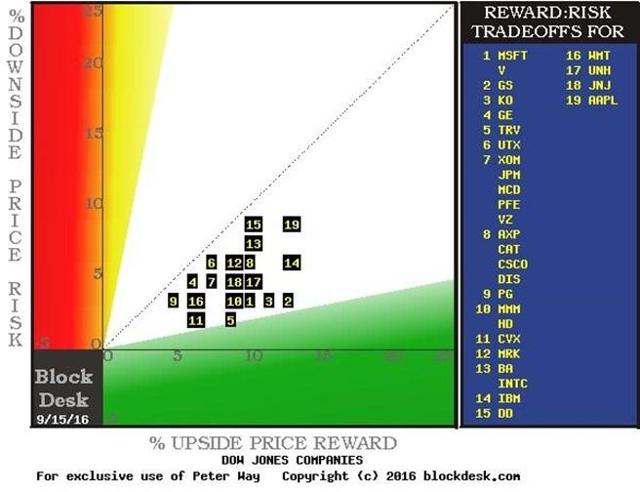

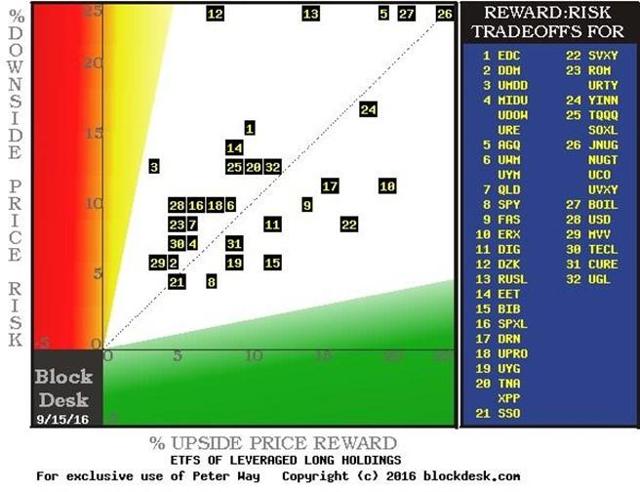

Peter F. Way uses his unique methodology to highlight Dow stocks with the best risk/reward profile. Here is one of several interesting charts:

OK, here is another….

You can get some great ideas from this approach.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read AR every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. This was a really great post. There are several great choices worth reading, including my pick for best advice of the week. My personal favorite is the Harvard Business Review study of the cost of your inconsistent decisions. Unless you are a regular HBR reader (I listen to a lot of their podcasts) you would never see this story. Tadas does the heavy lifting for you.

Many readers would also enjoy his Saturday post with interesting lifestyle features. Mrs. OldProf liked the item on wine.

Market Outlook

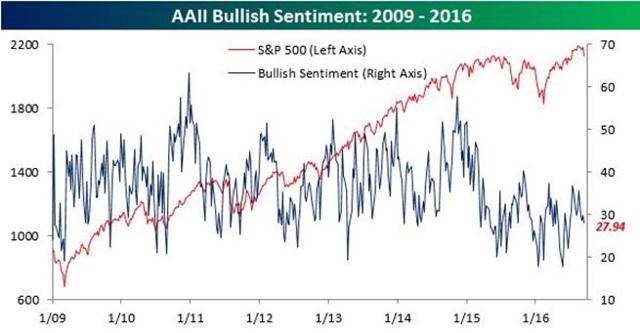

Many people have described current markets as "complacent." That is not what I see. The fact that the trading range is tight can occur when there are intense feelings in a rough balance. There is plenty of negative market sentiment. Here is a typical popular column listing six worries.

This week I was struck by two excellent posts.

Brian Gilmartin summarized the "Delivering Alpha" conference, where nearly everyone was downbeat. For contrast, here are some notes from Market Folly. It will be interesting to review how well these ideas play out over the next year.

Joe Fahmy explains why the market will not correct when that is what everyone is expecting. His perception of the trading community squares with what I hear.

Watch out for…

Junk bonds. Marc Gerstein has a warning for "yield hogs."

Final Thoughts

Fueled by ill-informed reports from financial media, most investors think only of a single interest rate, controlled by the Fed. This is a costly mistake. It is important to monitor the entire yield curve.

The short end responds mostly to the Fed policy announcements. Most recently the Fed is unsure that their decisions can have the desired impact, so the resulting rate is imprecise.

The long end reflects (at least) five factors:

- Expected future rate increases - the term premium;

- Inflation, current and expected;

- Economic growth;

- The Fed balance sheet - estimates are that the current holdings have an effect of 1 - 1.5% on the ten-year note; and

- Global interest rates, including policies from other central banks.

Those who attribute the long rate or the slope of the yield curve to a single factor are making a costly mistake. This is especially true for those whose favorite game is to make it all about the Fed.

Investment Implications

The dominant perception holds that the Fed is about to raise interest rates despite economic weakness, probably creating a recession. This is backwards. If rate increases are consistent with economic growth, it would be the "bear steepener" that I have been describing for some weeks. We should embrace short-term rate increases when growth is strengthening and the long rates are also moving higher.

Holdings to reduce or avoid include:

- Bonds and bond mutual funds. Alliance Bernstein warns that the one statistic you must know is duration of your bond holdings. Do you? That helps you see how much is at risk.

- Utility stocks and bond proxies.

- REITs and MLPs that are interest sensitive and without a tie to economic growth. Look for sectors benefiting from demographic changes - health care, senior living.

Holdings to emphasize include:

- Technology

- Banks

- Homebuilders

The consensus, even among the traditional bond advocates, is that the crowded bond trade (bubble?) has reached its end. As investors following the traditional 60-40 formula see absolute losses on their brokerage statements, where do we expect the money to flow?

Disclosure: I am/we are long CAA, WFC.

By Jeff Miller

No comments:

Post a Comment