Insiders at these companies have been scooping up shares of their own stock lately.

Corporate insiders sell their own companies' stock for a number of reasons.

They might need the cash for a big personal purchase such as a new house or yacht, or they might need the cash to fund a charity. Sometimes they sell as part of a planned selling program that they have put in place for diversification purposes, which allows them to sell stock in stages instead of selling all at one price.

Other times they sell because they think their stock is overvalued and the risk/reward is no longer attractive. Some even dump their own stock because they have inside knowledge that a competitor is eating their lunch and stealing market share.

But insiders usually buy their own shares for one reason: They think the stock is a bargain and has tremendous upside.

The key word in that last statement is "think." Just because a corporate insider thinks his or her stock is going to trade higher, that doesn't mean it will play out that way. Insiders can have all the conviction in the world that their stock is a buy, but if the market doesn't agree with them, the stock could end up going nowhere. Also, I say "usually" because sometimes insiders are loaned money by the company to buy their own stock. Those loans are often sweetheart deals and shouldn't be viewed as organic insider buying.

Stocks with notable insider activity is something that I tweet about on a regular basis. These are also the exact type of stocks that I love to trade and alert in real-time.

At the end of the day, it's institutional money managers running big mutual funds and hedge funds that drive stock prices, not insiders. That said, many of these savvy stock operators will follow insider buying activity when they agree with the insider that the stock is undervalued and has upside potential. This is why it's so important to always be monitoring insider activity but twice as important to make sure the trend of the stock coincides with the insider buying.

Recently, a number of companies' corporate insiders have bought large amounts of stock. These insiders are finding some value in the market, which warrants a closer look at these stocks.

Flowers Foods

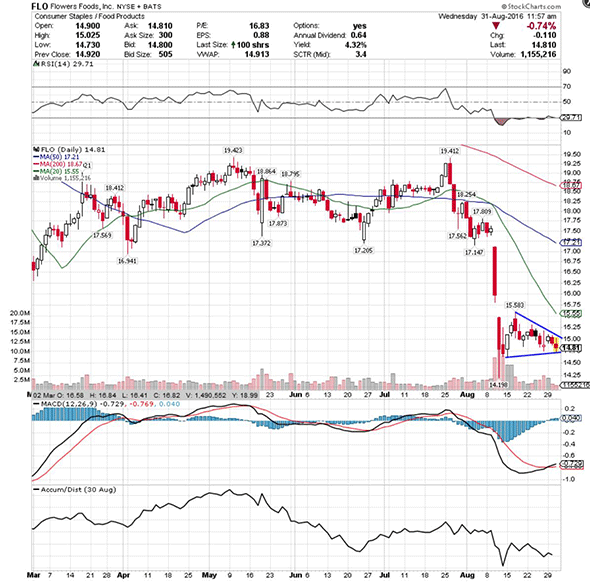

One consumer goods player that insiders are active in here is Flowers Foods (FLO) , which produces and markets bakery products in the U.S. Insiders are buying this stock into notable weakness, since shares have dropped by 20.1% over the last three months.

A director just bought 30,000 shares, or about $449,000 worth of stock at $14.99 per share. From a technical perspective, Flowers Foods is currently trending below both its 50-day and 200-day moving averages, which is bearish. This stock has been downtrending badly over the last month, with shares moving lower off its high of $19.41 a share to its recent low of $14.19 a share. During that downtrend, shares of Flowers Foods have been making mostly lower highs and lower lows, which is bearish technical price action.

If you're bullish on Flowers Foods, then I would look for long-biased trades as long as this stock is trending above its recent low of $14.19 a share and then once it breaks out above some near-term overhead resistance levels at $15.25 to its 20-day moving average of $15.55 a share and then above more resistance at $15.83 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average volume of 2.66 million shares. If that breakout materializes soon, then this stock will set up to re-test or possibly take out its next major overhead resistance levels at $17 to its 50-day moving average of $17.21 a share, or even $17.80 to $18.25 a share.

Cavium

A technology player that insiders are in love with here is Cavium (CAVM) , which designs, develops and markets semiconductor processors for intelligent and secure networks in the U.S. and internationally. Insiders are buying this stock into modest weakness, since shares have fallen by 9.2% over the last six months.

Cavium has a market cap of $3.6 billion and an enterprise value of $3.1 billion. This stock trades at a fair valuation, with a forward price-to-earnings of 20.8. Its estimated growth rate for this year -1.4%, and for next year it's pegged at 82.1%. This is a cash-rich company, since the total cash position on its balance sheet is $140.42 million and its total debt is $21.56 million.

From a technical perspective, Cavium is currently trending above both its 50-day and 200-day moving averages, which is bullish. This stock has been uptrending strong over the last two months, with shares moving higher off its new 52-week low of $35.90 a share to its recent high of $57.56 a share. During that uptrend, shares of Cavium have been consistently making higher lows and higher highs, which is bullish technical price action.

If you're bullish on Cavium then I would look for long-biased trades as long as this stock is trending above its 20-day moving average of $52.56 a share or above more near-term support at $50 a share and then once it breaks out above some near-term overhead resistance levels at $57.56 to $58.23 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average action of 1.52 million shares. If that breakout develops soon, then this stock will set up to re-test or possibly take out its next major overhead resistance levels at $62 to $64, or even $68 to $69 a share.

Western Refining

One energy player that insiders are loading up on here is Western Refining (WNR) , which operates as an independent crude oil refiner and marketer of refined products. Insiders are buying this stock into notable strength, since shares have spiked higher by 17.3% over the last three months.

Western Refining has a market cap of $2.7 billion and an enterprise value of $4.5 billion. This stock trades at a reasonable valuation, with a trailing price-to-earnings of 8.8 and a forward price-to-earnings of 14.9. Its estimated growth rate for this year -75.6%, and for next year it's pegged at 42%. This is not a cash-rich company, since the total cash position on its balance sheet is $198.28 million and its total debt is $2.07 billion. This stock currently sports a dividend yield of 6.3%.

The CEO just bought 100,000 shares, or about $2.32 million worth of stock, at $23 to $23.30 per share.

If you're in the bull camp on Western Refining, then I would look for long-biased trades as long as this stock is trending above its 20-day moving average of $23.78 a share or above some more near-term support at $22.66 a share and then once it breaks out above Wednesday's intraday high of $25.41 a share to more resistance at $26 a share with volume that hits near or above its three-month average action of 3.46 million shares. If that breakout fires off soon, then this stock will set up to re-test or possibly take out its next major overhead resistance levels at its 200-day moving average of $27.25 a share to $28.90, or even $30 a share.

Sonic Automotive

Another stock that insiders are jumping into here is Sonic Automotive (SAH) , which operates as an automotive retailer in the U.S. Insiders are buying this stock into notable weakness, since shares have fallen by 12.7% over the last six months.

Sonic Automotive has a market cap of $774 million and an enterprise value of $3.1 billion. This stock trades at a cheap valuation, with a trailing price-to-earnings of 8.6 and a forward price-to-earnings of 7.4. Its estimated growth rate for this year is 6.6%, and for next year it's pegged at 9%. This is not a cash-rich company, since the total cash position on its balance sheet is $2.42 billion and its total debt is $2.34 billion. This stock currently sports a dividend yield of 1.1%.

From a technical perspective, Sonic Automotive is currently trending below both its 50-day and 200-day moving averages, which is bearish. This stock recently formed a double bottom chart pattern, after shares found some buying interest at $16.53 to $16.64 a share over the last month. Following that potential bottom, shares of Sonic Automotive have now started to spike higher and flirt with its 20-day moving average of $17.09 a share.

If you're bullish on Sonic Automotive, then I would look for long-biased trades as long as this stock is trending above those recent double bottom support levels or above more key support at $16.06 a share and then once it breaks out above its 50-day moving average of $17.55 a share and then above some more key resistance levels at $17.60 to $17.88 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 339,117 shares. If that breakout triggers soon, then this stock will set up to re-test or possibly take out its next major overhead resistance levels at its 200-day moving average of $18.64 a share to $19.30, or even $20 a share.

Dominion Midstream Partners

My final stock with some decent insider buying is energy player Dominion Midstream Partners (DM) , which owns liquefied natural gas import, storage, regasification and transportation assets. Insiders are buying this stock into large weakness, since shares have dropped sharply by 20.6% over the last six months.

Dominion Midstream Partners a market cap of $1.9 billion and an enterprise value of $2.2 billion. This stock trades at reasonable valuation, with a trailing price-to-earnings of 21.9 and a forward price-to-earnings of 16.1. Its estimated growth rate for this year is 9.3%, and for next year it's pegged at 33.1%. This is not a cash-rich company, since the total cash position on its balance sheet is $24.20 million and its total debt is $315.70 million. This stock currently sports a dividend yield of 3.6%.

A director just bought 54,337 shares, or about $1.36 million worth of stock, at $24.85 to $25.39 per share.

If you're bullish on Dominion Midstream Partners, then I would look for long-biased trades as long as this stock is trending above its recent low of $24.20 a share and then once it breaks out above some near-term overhead resistance levels at $24.95 to $26.27 a share and then above its 50-day moving average of $26.34 a share with volume that hits near or above its three-month average action of 173,414 shares. If that breakout fires off soon, then this stock will set up to re-test or possibly take out its next major overhead resistance levels at $27.40 to $27.70, or even its 200-day moving average of $28.57 a share.

No comments:

Post a Comment