Integration costs associated with the CLP Towne acquisition early last year have been fully immersed within Forward Air's business.

Fourth-quarter results are an indication that the company is prepared to get its earnings growth back on track.

The fourth quarter provided a complete perspective for the new baseline from which investors should consider a valuation for Forward Air.

Forward Air's recent selloff offers investors a great entry point with potential for a nearly 30 percent return for the year.

Overview

FASI provides pool distribution services, including managing high-frequency, last mile handling and distribution and distribution of time-sensitive product to numerous destinations in specific geographic regions. TQI provides security and temperature-controlled logistics services, primarily truckload services to the life sciences sector (pharmaceutical and biotechnology products).

During 2015, nearly 83 percent of the company's revenue was generated from the Forward Air segment; nearly 14 percent was generated from FASI and the remaining 3 percent from TQI. Additionally, the Forward Air segment grew nearly 30 percent during 2015, while FASI was up nearly 4 percent and TQI was down 13 percent. This was primarily driven by the CLP Towne Inc., or Towne, acquisition.

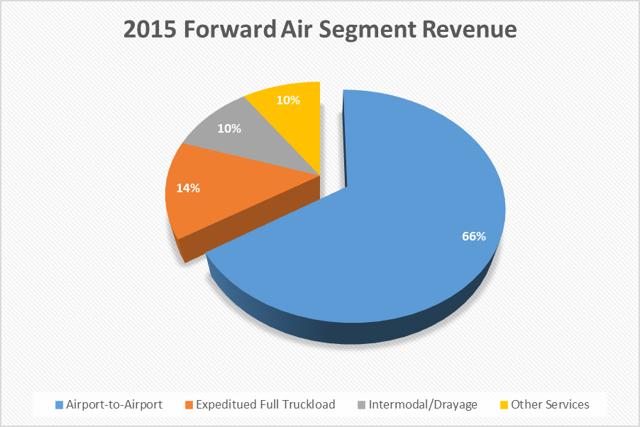

The Forward Air segment is clearly the core driver for the company, and within this segment are multiple customer services, including airport-to-airport expedited ground freight services; and logistics and other services, including expedited full truckload, intermodal/drayage and other services.

Source: Forward Air financial filings.

As depicted in the chart above, the airport-to-airport portion of the business represented a substantial majority of the Forward Air segment revenue. On an absolute basis, airport-to-airport revenue reflected 55 percent of the company's total revenue during 2015.

This is important to highlight because the Towne acquisition was anticipated to add value to Forward Air's Complete product as well as other synergies within the Forward Air segment. To this point, the company witnessed a substantial increase in Forward Air revenue growth, but also witnessed a decrease in diluted EPS of nearly 10 percent during 2015. This was mostly from the result of integration and deal costs related to the Towne acquisition, and to a lesser extent, the CST deal.

As of December 2015, the company has completed the integration of the Towne deal, and based upon the results from the fourth quarter earnings last week, it appears that the synergies from the deal are going to begin to pay off. Despite income from operations being down nearly 12 percent for the year, during the fourth quarter, performance was up nearly 21 percent when compared to December 2014. Revenue growth substantially accelerated due to the deal throughout 2015, and bottom-line growth has followed suit; the company is poised to get back to diluted EPS growth during 2016 and beyond.

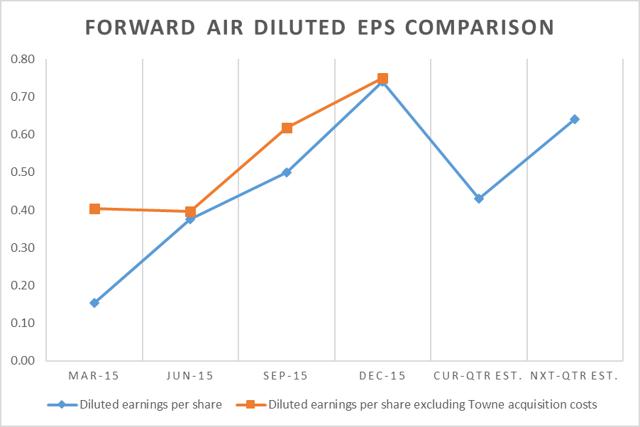

The key focal point for investors to pay attention to is the fact that the baseline for 2015 will be adjusted now that management will include the Towne acquisition for the full year. This was highlighted during the fourth-quarter call when guidance was provided for diluted EPS. The range for the first quarter 2016 diluted EPS was $0.41 to $0.45 per share and this was compared to the 2015 first-quarter amount of $0.40/share. This amount on a diluted EPS basis as announced last year was actually $0.15/share which means that integration and deal costs are no longer part of the equation from this point on.

Excluding integration and deal costs from the second, third and fourth quarters will be necessary to get a solid baseline of comparable performance for 2016 and beyond. When considering these factors, Forward Air's recent selloff last week, putting the current stock price at $37.50/share, offers a great entry point with the potential for 30 percent upside by 2016 year-end.

A Well-Defined Opportunity

Each of the first four quarters during 2015 all involved Towne acquisition integration and deal costs which reduced diluted EPS substantially for the year. Based upon the information provided for the first quarter 2016 guidance, we know that these acquisition-based costs for the first quarter 2015 were roughly $0.25/share or nearly $8 million. This was validated based upon the 2015 first-quarter earnings report where management iterated the $0.40/share amount, excluding the Towne acquisition and remaining CST deal costs.

By reviewing past transcripts, we can see that during the second quarter 2015, only $0.02/share or roughly $0.7 million in integration costs were accounted for; during the third quarter 2015, roughly $0.12/share or nearly $4 million was accounted for; and during the fourth quarter 2015, roughly $0.01/share or nearly $0.3 million was accounted for.

After assuming these integration and deal costs throughout 2015, we get a revised total diluted EPS of $2.17/share for the year versus the actual $1.78/share amount reported last week. This revised amount is what investors should be basing their valuation assessment on for the projected 2016 and 2017 diluted EPS estimates.

Source: Forward Air financial filings.

For the first half of 2016, analyst estimates project diluted EPS to grow by 34 percent; for the entire year, estimates project diluted EPS growth of nearly 17 percent. Estimates project diluted EPS growth during 2017 at nearly 10 percent. Today, the stock price trades at a P/E level of less than 15 times 2016 diluted EPS representing a great opportunity for investors.

Fourth Quarter Indicates Strong Growth Potential for 2016

Forward Air witnessed substantial double-digit growth for revenue during the past few years, driven by acquisitions. The next few years will witness the company's opportunities to grow organically in the mid to high single digits for revenue and double-digit levels for diluted EPS.

For 2016, the majority of the company's growth will occur in the first half of the year. This growth should be led by the Forward Air segment, which is anticipated to be the core driver. A key component of this driver is the fact that the company decided to change its dimensional weight pricing from a factor of 250 to 200. This move is expected to increase the average weekly weight that the company ships and substantially contribute to top-line growth.

This move is not in response to compensate any loss of business, but rather a further indication in the shift in product mix by weight which is being seen across other industries. As an example, less-than-truckload, or LTL, industry has witnessed average weight per shipment declines, with some peers near 3 to 5 percent declines during 2015. This has been evident across the board whether considering stronger players such as FedEx Corporation (NYSE:FDX) and Old Dominion Freight (NASDAQ:ODFL) or others such as YRC Worldwide (NASDAQ:YRCW) and Saia, Inc. (NASDAQ:SAIA).

Another important factor for investors to consider is the fact that the company's operating ratio improved substantially during the fourth quarter. Without integration and deal costs, the primary impact will continue to be fuel surcharges. This should provide for the opportunity for the company to get this metric back down to the 85 percent level to provide support for strong diluted EPS growth.

Both the FASI and TQI segments did not witness as robust performance for the year. The FASI segment is exposed to higher retail business and as such concerns relative to higher retail inventory builds versus retail sales are valid as possible headwinds; marginal growth is to be expected. The TQI segment has been struggling for a while now and management's course of action has been to gut and reorganize leadership to get things moving, but the first quarter for 2016 still should expect some pain.

Regardless, the Forward Air segment is going to be the driving force for 2016 to the benefit of investors who are willing to take the risk at today's level.

2016 Guidance and Valuation

Forward Air's competitive market is more targeted towards LTL companies rather than other package and delivery companies such as FedEx. This is important for investors to understand because it speaks to the premium valuation with which investors should consider for Forward Air.

Many LTL companies are structured similarly as Forward Air in that business operations consist of tractor and trailer revenue equipment deployed in combination of terminal assets serving their customer needs. Many LTL companies also provide capacity for truckload services as well as other logistics services. However, the customer base for Forward Air is where the company distinguishes itself from most LTL competitors. Forward Air provides a large amount of its services to freight forwarders and integrated air cargo carriers and passenger and cargo airlines. This insulates the company from competing against air delivery, package delivery and traditional LTL companies.

This is due to the fact that the company focuses on deferred air freight shipments which can be transported in an expedited fashion by ground transportation; that the company provides complimentary services with major package and delivery companies like FedEx and UPS (NYSE:UPS); and that this niche market requires extensive capital investments for other LTL companies to develop a similar competitive scale against.

The fact that Forward Air operates closely to the LTL industry also provides us with a peer group to compare the company against to help generate transparency for valuation considerations. Valuation multiples for the LTL industry have witnessed negative pressure stemming from declining tonnage, shipment and average weight per shipment trends during 2015. Despite broad industry negative trends, Old Dominion Freight and FedEx have been bright spots. Old Dominion Freight currently trades with a P/E ratio of 17 times earnings, while companies like ArcBest Corporation (NASDAQ:ARCB) and Saia trade with P/E ratios near 12 times earnings.

The differentiator between Old Dominion Freight and other peers is growth in tonnage, shipments and revenue and earnings. As such, Forward Air currently trades at a slight premium to Old Dominion Freight on a historical basis at 21 times earnings, but assuming the adjusted 2015 baseline, the P/E ratio is at 17 times earnings. Based upon 2016 diluted EPS estimates, Forward Air trades below 15 times earnings while Old Dominion Freight trades at nearly 16 times earnings.

Old Dominion Freight is a good benchmark for Forward Air because both companies have a historical trend of trading slightly below 20 times earnings and near 25 times earnings fairly consistently over the recent few years. Old Dominion Freight has been able to buck the LTL industry trend by outperforming its peers substantially through its service platform. Forward Air has continued to provide strong service to its customers through its specialty product offerings and expects this to continue leading to strong tonnage growth during 2016. Both companies are leading peers.

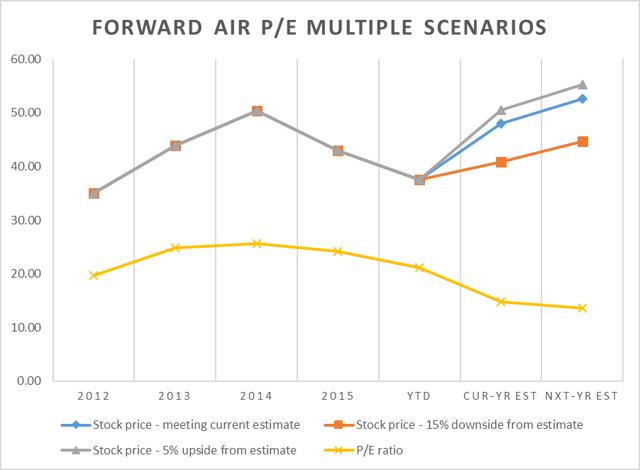

Based upon guidance from the company, analysts have estimated the company to earn $2.53/share during 2016 and $2.77/share during 2017. During 2015, Forward Air was forced to revise guidance downward and the company fell well short of earlier estimates. This is likely what triggered the selloff last week as the company missed revised full-year earnings estimates.

Given the fact that company missed earlier 2015 targets by roughly 20 percent, this is cause for concern going into 2016. Since we know that $0.40/share or nearly 75 percent was due to integration and deal costs, we should have some assurance that any miss based on current estimates for the 2016 should not deviate as much.

Taking a conservative stance and assuming variability of negative 15 percent and positive 5 percent will provide us with a decent comparison for valuation considerations. Forward Air has provided enough performance to grant that the company should trade at a premium valuation based upon its customers served and comprehensive network within its market. There is no fundamental change impacting the business at the moment, but rather growth prospects are looking up. With growth returning, a P/E multiple of 19 times earnings is well justified based on recent historical year-end comparisons.

Source: Yahoo Finance! and Forward Air financial filings.

Based upon the three scenarios for the current year estimate, or 2016, the lowest return based on a P/E ratio of 19 times earnings would be 9 percent in the event the company missed current estimates by 15 percent. In the event the company met or exceeded current estimates, the return based upon a P/E of 19 times earnings would be between 28 to 35 percent.

It could be argued that if the company missed current estimates by 15 percent that this would mean flat growth from the 2015 adjusted diluted EPS baseline. With solid fundamentals in place, a P/E ratio of 18 times earnings would still provide a 3 percent stock price gain. The main point here is that the market will eventually recognize the mispricing of Forward Air's P/E multiple and that the multiple will rise at a pace based upon each quarter's performance.

In the event oil prices remain at or slightly below $30/ barrel, management's assumptions for fuel surcharge impacts should remain consistent and the reward should outweigh the risk. If the price of oil were to drop to the $20/barrel level or lower, we could expect that this would lead towards the 15 percent lower scenario and risk could keep the P/E multiple from rising either marginally or to normal levels.

Aside from this, the fact that the business fundamentals are solid, should give investors some confidence that a return near 30 percent from today's stock price levels is probable. In the event macroeconomic circumstances change due to unforeseen events, it should be assumed that this information would no longer hold the same weight.

Investor Perspectives

Forward Air has completed its three-year integration process for the deals undertaken, most notably the completion of the Towne acquisition. From this point, the company will refocus on growing its core Forward Air service and fine-tuning the FASI and TQI segments.

Investors looking to add a company with good prospects for strong returns during 2016 should consider a position in Forward Air. Based upon the business fundamentals and moderate premium afforded to the company from the current level, investors could expect returns up to 30 percent by year-end.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

James Sands

No comments:

Post a Comment