Vuzix's pilot program with General Electric is expected to convert into a commercial rollout over the next 12-month per Tech Crunch and APX Labs (Vuzix partner).

VUZI is engaged in over 100 pilot programs that are in various stages within the pilot program process.

Management expects these pilot programs to bear fruit over the coming quarters, which will result in strong growth in 2016 as sales increases quarter over quarter throughout 2016.

I'm continuing to model 2016 revenue of $15m with upside up to $20m and downside to $12m or up 3 to 5 times over 2015 revenue.

Vuzix remains relatively unknown amongst institutional and retail investors and is well positioned to be the top wearable device investment play in 2016.

Vuzix (NASDAQ:VUZI) held its Q3 conference call on Friday, November 13th, but the message delivered from management was far from a Nightmare on Elm Street. Patient and deep value investors understand that Vuzix's management is steadfast and focused that the augmented reality (AR) and virtual reality (VR) will continue to develop over time.

The issue with new technology is similar to the chicken or egg debate. Vuzix's M100 smart glasses could be the best product on the market; however, until applications are developed, tested and catered for each commercial pilot program, sales will remain tepid at best. As I have witnessed in other industries, pilot programs for new technology can take months to even years before pilot programs bear fruit and convert into commercial orders.

The good news for VUZI investors is that the company is engaged in over 100 pilot programs that are in various stages within the pilot program process. Management expects these pilot programs to bear fruit over the coming quarters, which will result in strong growth in 2016 as sales increases quarter over quarter throughout 2016.

One Vuzix pilot program that will be converted to revenue over the next 12 months is for General Electric (NYSE:GE). APX Labs (a Vuzix partner)acknowledged in a recent TechCrunch article that GE was doing a smartglass rollout over the next 12 months. Paul Travers confirmed (see transcript below) during the Q3 CC that GE is an active pilot program for Vuzix. The number of units and specific timing of commercial order with GE is still unknown, but investors should expect this opportunity to convert into meaningful revenue in 2016.

GE, HP, large pharma companies, post acute care facilities, hospitals and others are leveraging Vuzix to deliver ROIs and improved client experiences, with other examples like public go-live such as Bechtle via SAP rolling out complex warehouse picking applications just recently. (Paul Travers, VUZI CEO Q3 Transcript)

Management played the outlook for the coming year very well on the Q3 conference call without giving out concrete revenue growth estimates, which may allow actual results to exceed expectations as numbers get reported over the coming quarters throughout 2016.

Vuzix iWear Video Headphones Image Source (click to enlarge)

The iWear Video Headphone production and consumer rollout was impacted by a parts delay from suppliers. In addition to component delays, VUZI experienced quality issues with certain components that forced the company to delay shipping the iWear to consumers until the issues were rectified. Vuzix announced on December 11th that it had begun shipping out orders for the iWear Video Headphones for consumers.

Vuzix ended Q3 with $16.1m of cash and cash equivalents versus $15.0m at the end of Q2. The company's cash balance remains ample with 18 to 24 months of runway remaining, which is enough of a runway to sustain VUZI until the company becomes cash flow positive in 2017.

In terms of current assets, Vuzix increased inventory and prepaid expenses in Q3 to prepare for increased shipment volume to customers in the coming months. Prepaid expenses increased from $1.4m to $1.65m and inventory jumped from $1.1m to $1.8m. (Source Vuzix 10-Q)

It's often hard to understand the ebbs and flows associated with the price of a stock, but investors have been buying up VUZI in droves since the Q3 conference call when the share price was hovering. The stock recently touched $7.00 and remains in striking distance of its 52-week high of $7.60 set in June.

Chardan Capital recently raised the firm's price target for Vuzix from $7 to $10. The price target increase came despite the firm lowering 2015 revenue expectations from $3.9m to $3.5m as well as dropping 2016 revenue expectations from $10m to $7.8m. Chardan's $10 price target is based on a EV/Sales target of 10-12x the firm's Q4 2017 annual revenue run rate of $19m or $4.75m for the quarter.

A firm that increases a price target for a company that it covers despite lowering revenue expectations for 2015 and 2016 might sound a bit odd. Despite Chardan's reduction of revenue expectations in 2015 and 2016, the Vuzix story is well intact and the company is making meaningful strides to capture a fair share of the developing wearable display market.

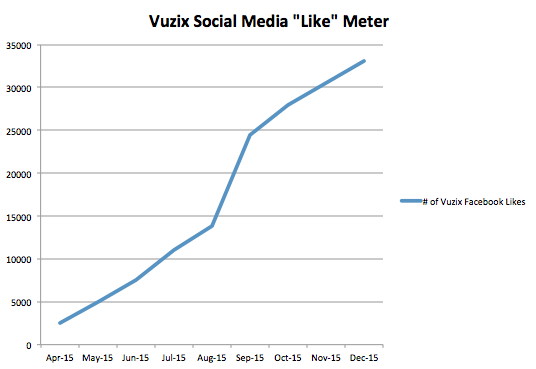

The 2016 CES will start in just three weeks in Las Vegas, NV on January 6th and will continue through January 9th. Vuzix will have an opportunity to showcase the company's VR and AR offerings to over 150,000 attendees and potential consumers. Keep an eye on Vuzix's Facebook page, which has seen "likes" rise from under 3,000 in April to over 33,000 as of December 16th.

Image Source Wall Street Forensics

In conclusion, I remain a bit more bullish than Chardan Capital on Vuzix's growth prospects. I'm continuing to model 2016 revenue of $15m with upside up to $20m and downside to $12m or up 3x to 5x 2015 revenue levels. My expectation is that quarterly run rates will continue to increase as we move through 2016 driven by increased order flow associated with new product launches (iWear video headphones) and continuous M100 pilot program to commercial order conversions over the course of 2016.

I'm maintaining my $15 price target intact for Vuzix, which implies nearly a 150% upside over the next 12 months. My $15 price target assumes an EV/Sales target of 10.5x-15.8x my 2017 revenue estimate of between $20m and $30m.

Vuzix remains relatively unknown amongst institutional and retail investors and is well positioned to be the top wearable device investment play in 2016.

By Matt Margolis

No comments:

Post a Comment