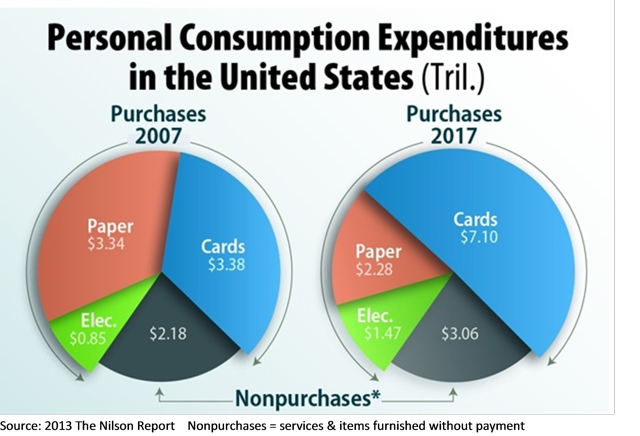

The transition from cash and checks to credit cards and electronic payments continues.

At the same time, the competitive landscape for online and mobile payment solutions is increasing.

Can investors benefit from these trends, as electronic and mobile payments displace cash on a number of transactions?

Shift to Electronic Commerce

At the same time, the competitive landscape for online and mobile payment solutions is also changing, as commerce evolves. Transactions continue to shift to online and mobile, driven by expanding access to the internet - an estimated 438 million mobile devices in the U.S. accessed the internet in 2013, and this metric is expected to reach more than 690 million devices in 2018 - and the increasing adoption of electronic payments over the last two decades since PayPal launched.

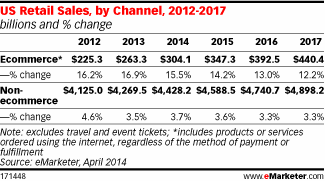

Worldwide e-commerce spending as a percentage of total retail expenditures is projected to reach 9% in 2018, up from 6% in 2013, according to the eMarketer Report. This trend is forecast to continue, reflecting rising consumption among younger, internet savvy users. eMarketer estimates that e-commerce will grow at double digit rates domestically for the next couple of years. According to electronic and POS payment solutions provider Ayden, mobile accounted for 28.7% of total online payments in 2Q15, up from 27.2% in 1Q15.

The increasing use of the internet and mobile platforms for purchases has also given rise to another factor impacting global commerce: commerce is shifting from a primarily local activity to a multinational and global one, as businesses expand across geographic borders virtually, as well as physically. Enabling online transactions expands the market for many organizations. This is one reason, we believe, why businesses encourage the use of their online e-commerce sites for transactions, often offering preferred terms and discounts for shopping online. This also implies that over time, larger organizations will rely less on purchases in their home markets and more on international consumption.

The Nilson Report projects that the percentage of global purchase transactions conducted in the U.S. and Canada will decline from 48% to 38% from 2013 to 2023. Concurrently, according to The Nilson Report, the percentage of transactions conducted in Asia and Latin America will grow from 27% to 38%. The percentage of transactions conducted in EMEA - Europe, the Middle East and Africa - is predicted to remain relatively unchanged at about 23% to 24%. These trends, combined with growing consumer preference to use cards or digital payments over cash, have had a dramatic impact on the use of cash and checks as payment mechanisms.

"The total number of checks written in the U.S. has declined for many years as a result of alternative payment methods, including credit cards, debit cards, direct deposit, wire transfers and internet-based bill paying services, as well as automated teller machines, which make cash a more readily available alternative," according to Deluxe Corp. (NYSE:DLX), a leading check manufacturer.

A December 2013 Federal Reserve study noted that in 2012, debit card, credit card and ACH payments all exceeded the roughly 21.0 billion checks that were written, with checks accounting for about 17% of all non-cash payment transactions. By comparison, only two years earlier in 2010, checks accounted for about 25% of all non-cash payment transactions, according to the Federal Reserve, which estimates that the number of checks written contracted by roughly 8.8% per annum from 2009 to 2012.

Interestingly, the number of credit card payments, after declining slightly from 2006 to 2009, resumed growth from 2009 to 2012. In fact, the number of debit card payments increased at a faster clip than any other payment format from 2009 to 2012, according to Deluxe. Intuitively, we find this logical, as consumers view debit card payments as nearly equivalent to cash and have also displayed a growing preference to use alternative forms of payment rather than cash.

Consultancy group Capgemini writes that:

"In developed countries, "card transaction volume is very high, as consumers prefer to use cards even for low-value transactions. However, the developed countries have not been able to match up to the growth showcased by the emerging world. The growth in transaction volume of cards in Europe was in single digits at 8.6% in 2011 and in the U.S. it was 11.7%. This growth is hardly comparable to growth rates exhibited by Latin America, which saw a growth rate of 21.0% and Asia-Pacific, with a growth rate of 20% in 2011. Both Latin America and Asia Pacific have been showcasing enormous growth for the past few years."

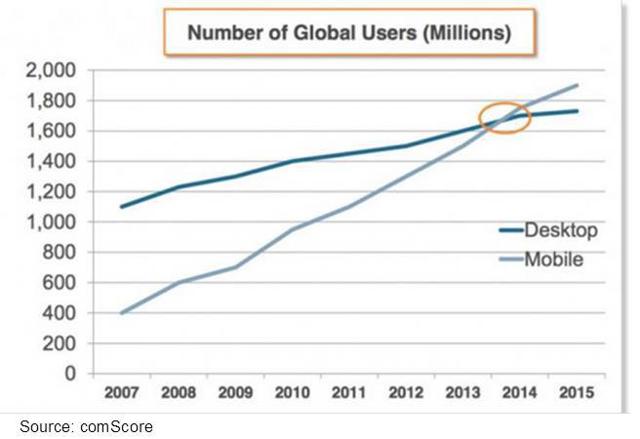

The industry now appears to be experiencing a similar trend with electronic payments, which are also displacing cash for many transactions. Partially, this reflects the rise of mobile payment options that enable many small businesses to complete transactions they could not accept before because they were not equipped to take credit card payments. In addition, mobile contactless payments are generally faster and more convenient for many types of transactions, as they enable consumers to pay for purchases by passing their phone near a point of sale terminal. Growing mobile penetration, illustrated below, is expected to further fuel increased spending via mobile devices.

There are roughly 1.3 billion active credit and debit accounts globally compared to about 5.3 billion active mobile phone accounts. This implies that in some developing nations where credit card and bank account penetration are low, the use of mobile phone payments presents one viable option. Recent data indicates that mobile payment is growing globally at approximately 50%each year.

For some small businesses that have found traditional payments solutions prohibitively expensive and difficult to use, mobile fills a void. Moreover, some small sellers are often denied service by traditional providers. An estimated approximately 20 million domestic vendors do not accept card payments today, according to Square. However, enabling mobile contactless payments means that businesses generally need to install new technology. Thus, many retailers are responding by enabling mobile payment solutions. According to aHospitality Technology study, 38% of restaurant businesses surveyed plan to develop or deploy a mobile POS solution.

Widespread adoption of mobile payments has lagged in the U.S., according to First Data, "primarily due to the greater complexity of its financial and communications ecosystems," including a "diverse array of handset manufacturers, mobile network operators, financial institutions, and payment networks," which have had difficulty reaching agreement on m-commerce standards and economics along the value chain. The mobile percentage of total e-commerce transactions in the U.S. is slightly lower than the worldwide average, at 29% compared to 34% globally. Over time, we would expect the U.S. to narrow this gap.

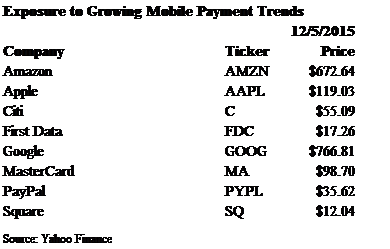

There are ways, we believe, for investors to gain exposure to these trends. For example, there is PayPal, which was launched in 1998 as a digital wallet, acquired by eBay (NASDAQ:EBAY) and then spun off earlier this year. The landscape is much more fragmented now than it was in the early days of PayPal.

Although PayPal is well known and generally accepted by consumers, there are other payment brands that are increasingly gaining recognition, according to Market Strategies International. For example, there are Amazon (NASDAQ:AMZN) Payments, Apple (NASDAQ:AAPL) Pay, Android Pay, Samsung Pay and Google (NASDAQ:GOOG) (NASDAQ:GOOGL) Wallet, to name a few. Google Wallet launched in October 2011 as a mobile commerce and payment application for Android phones, with partners including First Data, Citi (NYSE:C) and MasterCard (NYSE:MA). Square is a leading mobile credit card processor for small businesses. Square completed its IPO last month at $9 per share, which was about 25% below the original price range of $11 to $13 price range.

Many of these larger companies offer some investment exposure to the trends discussed in this article, in our view. However, we would think that PayPal, First Data and Square, which all became public this year, offer more direct exposure and could warrant some due diligence.

No comments:

Post a Comment