Summary

The turnaround story for Hologic continues unabated as they right-size their balance sheet and continue to create operational efficiencies that didn't exist two years ago.

Breast-health remains a massive opportunity as imaging providers switch from 2D to 3D technology over the next several years.

The international growth story has yet to begin but remains a new focus for management. We expect the international business to ramp considerably by 2017.

Valuation should improve as they continue to delever the balance sheet with an investment grade debt rating likely by the end of 2017 and a possible dividend initiation.

About two years ago, Hologic (NASDAQ:HOLX) was a complete mess with falling profits, increased debt load, and a revolving door of CEOs over the prior twelve months. Enter Carl Icahn and Ralph Whitworth of Relational Investors who jumped into the shares and pushed for substantial changes. Through Icahn's pushing, the company added two of his board members and appointed Steve MacMillan CEO.

About two years ago, Hologic (NASDAQ:HOLX) was a complete mess with falling profits, increased debt load, and a revolving door of CEOs over the prior twelve months. Enter Carl Icahn and Ralph Whitworth of Relational Investors who jumped into the shares and pushed for substantial changes. Through Icahn's pushing, the company added two of his board members and appointed Steve MacMillan CEO.

The shares have responded to MacMillan's complete transformation of the company culture over the last two years. The share price jump has been largely due to their breast-health business which is benefiting from a shift to 3D systems. But we think there is a significant amount of further room to run over the next three years from both continued adoption of 3D imaging and international expansion which is just starting.

3D Imaging Adoption Has Long Runway

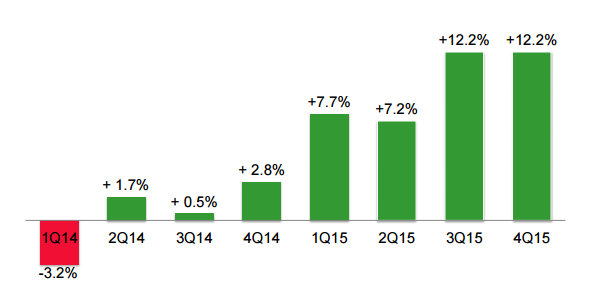

The turnaround of the business since MacMillan took over is evident in the momentum in their revenue growth. The main driver of this growth is the company's breast-health segment which accounts for 39% of revenue but two-thirds of operating profits. The driver for the business is the shift from analog 2D imaging to their Genius 3D system. The company is the market leader in the 3D imaging space with approximately 60% share due to their first-mover advantage with an FDA-approved device in 2011.

(Source: Company Presentation) (Y-Axis= % Revenue Change YoY)

The company has approximately 8,600 mammography imaging machines installed in the US out of a total of 14,500 machines in aggregate. Of that total, just 2,400 have been upgraded to 3D. The new machines cost $350K-$400K which if they replace all of their installed base over the next five years, equates to $2.2 billion of incremental revenue growth and a $3.5-$4.0 billion total US market opportunity. Management believes that they will eventually control more market share within 3D than they had in the 2D market.

The upgrade is gaining steam as the technology has become validated by recent studies. The Journal of American Medical Association released findingsthat showed 3D imaging much more accurate in detection. While some radiologists say the technology is in fact more accurate, others have noted that the advantages are not yet clear, especially given the cost and the additional radiation exposure. But the JAMA study from this past summer greatly increases the credibility as it found a 41% increase in the detection of invasive breast cancers and a 29% increase in the detection of all breast cancers. Overall, the call back rate (percentage of patients called back for a follow-up) fell by 15%.

The upgrade is gaining steam as the technology has become validated by recent studies. The Journal of American Medical Association released findingsthat showed 3D imaging much more accurate in detection. While some radiologists say the technology is in fact more accurate, others have noted that the advantages are not yet clear, especially given the cost and the additional radiation exposure. But the JAMA study from this past summer greatly increases the credibility as it found a 41% increase in the detection of invasive breast cancers and a 29% increase in the detection of all breast cancers. Overall, the call back rate (percentage of patients called back for a follow-up) fell by 15%.

Up until this year, most insurance did not cover 3D mammograms and instead charged an "upgrade fee" of $50-$75, on average to the patient. Earlier this year, Medicare began covering 3D imaging and some states are starting to mandate coverage. Given the shift by the largest payor, Medicare, and the mandate, insurance companies are now starting to cover it. We believe the recent study confirming the technology along with coverage by insurers, including Medicare, should help to increase the rate of 3D adoption by providers. In the most recent quarter, they placed 300 3D Tomo systems which we think could rise to as much as 500 per quarter over the next six to nine months.

International Expansion A Massive Opportunity

With most of their revenue coming from the US, the company has a large amount of whitespace over the next decade to continue to replace obsolete imaging systems in Europe, Latin America and Asia with both 2D and 3D systems. While the margins are likely to be lower given bulk buying discounts by sovereign entities, the top line growth and massive market opportunity will more than offset that margin pressure.

Just 23% of revenue came from outside of the US in the last quarter and we think international opportunities are one of the primary drivers for growth going forward. The top ten international markets have ~25,000 imaging machines, slightly less than double that of the US. As we noted, margins will be lower as most markets outside of the US are price sensitive and will be much slower to adopt.

Outside of breast-imaging, the surgical business (12% of total revenue), which is mostly US-driven, has strong potential to expand into high-growth markets like Latin America and Asia. They also remain underpenetrated in developed markets including Canada and Western Europe, presenting further growth potential. Management is now squarely focused on the international opportunities and starting to ramp up the infrastructure necessary to support that growth- including country-by-country product registration and reimbursement approval. We think growth internationally will start next year but pick up in earnest in 2017, ultimately driving very strong revenue growth for a sustained period of time. We do not see a reason why it couldn't get to 50% of total revenue down the road a number of years.

New Mammography Guidelines Likely To Not Be A Factor

The American Cancer Society recently issued new mammography guidelines that shifted the age recommendations higher. The group stated that women should begin getting mammograms later and have them less frequently than it had long advocated. The new guidelines suggest a woman of average risk of breast cancer should start having mammograms at age 45 and continue once a year until 54, then every second year.

Many providers and other societies like American Congress of Obstetricians and Gynecologists, and the American College of Radiology have opposed the new recommendations. Most of the opposition, which includes Hologic itself, is supporting a recently introduced bill in Congress called the PALS (Protecting Access to Lifesaving Screenings) Act, which imposes a two-year moratorium on the US Preventive Services Task Force C recommendation for mammography.

We think the new guidelines are the reason for some of the profit-taking in the shares but that little in the way of impact will be felt. Should the USPSTF implement their C recommendations, which is a high probability at this point, it could lead to additional co-pays for women who want to continue to screen under the old guidelines. But we think insurance companies are not going to revoke the coverage of the preventative care for 3D mammography given the relatively low cost and cost-savings from early detection.

Valuation

Despite the run in the shares over the last year (+42%), they trade at just 18x forward earnings and 14.1x ttm EV/EBITDA. We think the valuation is cheap given the very highly visible path towards much higher revenue and the defensive nature of the business. We believe Hologic could eventually become one of the larger diagnostics and surgical companies in the world given their technology advantages.

One of the main weights that we believe is pressuring the valuation is the leverage. In 2012, the company was levered to 5.5x with a net debt load of $4.5 billion. The company has been paying down that debt by approximately $500 million per year and finished fiscal 2015 at $3.1 billion and 3.3x. Management reiterated that they will continue to use free cash flow to pay down debt until they reach their target leverage of 2.5x by the end of fiscal 2017.

The $1.4 billion in debt reduction since 2012 was driven by prepayments to expunge high-coupon debt while entering into new secured credit agreements at LIBOR+175, decreasing the payment obligation by $650 million in 2016-2017. In July, they refinanced $1.0 billion of senior notes due 2022 lowering interest costs by 100 bps while moving out the maturity two years. We think over the next twelve to eighteen months that their debt could be upgraded to investment grade which would be a huge boon to the share price. In addition and even more importantly, at that point they may even initiate a dividend payment.

We think the shares are worth $49- $50 based on the combination of strong top line growth driven by the breast-health segment, margin expansion driven by operational improvements and G&A leverage, and debt reductions. We used a 14x multiple which we think is conservative given the growth potential, and a slight discount to their historical average.

| F2016 | F2017 | |

| EBITDA | 1150 | 1275 |

| Multiple | 14 | 14 |

| EV | 16100 | 17850 |

| Net Debt | 2100 | 1400 |

| Equity | 14000 | 16450 |

| Shares | 283 | 283 |

| Value | $ 49.47 | $ 58.13 |

| Variance | 31% | 54% |

Conclusion

The company is still in the early innings of monetizing their first-mover advantage within the 3D imaging market. Rivals GE (NYSE:GE) and Siemens (OTCPK:SIEGY) are just getting their products to market and we think Hologic will continue to gain share. They have a significant amount of runway to grow their business both domestically and internationally. Valuation is still reasonable and we think being held back by the balance sheet and the recent USPSTF recommendation guidelines. We believe it is presenting a solid entry opportunity given the lower risk and higher visibility to the growth story.

No comments:

Post a Comment