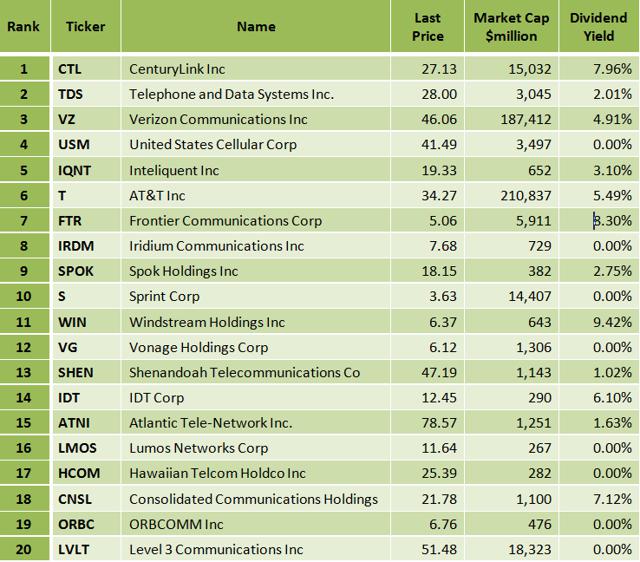

In my view, income-seeking investors should consider CTL's stock.

CenturyLink is generating strong free cash flow and returning substantial cash to shareholders via share repurchases, and by a very attractive dividend, currently yielding 7.96%.

CenturyLink's valuation is very good; the price to free cash flow is very low at 14.53, and the Enterprise Value/EBITDA ratio is also very low at 5.21.

However, demand for high-bandwidth data services remained strong in the last quarter, and network sales increased driven by enterprise and global customers. Year to date, CTL's stock is down 31.5% while the S&P 500 index has increased 0.9% and the NasdaqQ Composite Index has gained 7.7%. Nevertheless, the stock is already up 12.5% from its 52-week low of $24.11 from October 02, and in my opinion, the shares have much room to grow. After all, the forward P/E is very low at 11.40, and the price to free cash flow is also very low at 14.53.

CTL Daily Chart

CTL Weekly Chart

Charts: TradeStation Group, Inc.

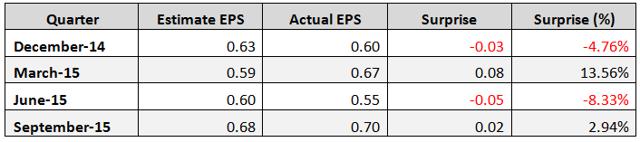

On November 04, CenturyLink reported its third quarter 2015 financial results, which beat EPS expectations by $0.02 (3%). The company posted revenue of $4.55 billion in the period, which matched Street forecasts. CenturyLink showed earnings per share surprise in the last quarter after missing estimates in the previous quarter, as shown in the table below.

Data: Yahoo Finance

In the report, Glen F. Post III, Chief Executive Officer and President, said:

CenturyLink achieved solid third quarter revenues from its Consumer and Business retail network customers, while Business wholesale and hosting revenues declined. Demand for high-bandwidth data services remained strong as our business network sales increased sequentially and year-over-year, primarily driven by enterprise and global customers. We exited the quarter with a very strong business sales funnel, including an increased number of large deal opportunities. This funnel has continued to strengthen during the fourth quarter and October sales results were the highest of the year. We are also on track to achieve our targeted reduction of approximately $125 million in planned second half 2015 operating expenses, with the majority of the reduction expected to occur in the fourth quarter.

In my view, CenturyLink can achieve solid growth from its strategic businesses. Key growth drivers are increasing business customer demand for high-bandwidth data services and hosting solutions, along with growth in high-speed Internet and Prism TV subscribers.

Along with the third-quarter results, CenturyLink announced that it was pursuing strategic alternatives for its data center and colocation businesses. The review of strategic alternatives will involve a full range of options including, but not limited to, a partnership or joint venture, a sale of all or a portion of the data centers, as well as keeping some or all of these assets and operations as part of CenturyLink's portfolio. In my opinion, CenturyLink's decision to seek strategic alternatives for its data center makes sense since the data center, and colocation business has become much more competitive, driving down revenue and profits.

CenturyLink is paying a very generous dividend; the forward annual dividend yield is very high at 7.96%. Although the payout ratio is high at 166%, in my opinion, the high dividend is sustainable due to the company's strong free cash flow. In the last quarter, out of a free cash flow of $747 million, CenturyLink used only $296 million on dividends.

CTL Dividend data by YCharts

CenturyLink repurchased nearly 9.8 million shares for $263 million during the third quarter. Through November 3, 2015, the company repurchased 27.5 million shares for $867 million leaving approximately $133 million outstanding under the current $1 billion repurchase program.

Valuation

CenturyLink's valuation is very good. The forward P/E is very low at 11.40, and the price to free cash flow is also very low at 14.53. Furthermore, the price to sales ratio is very low at 0.83, and the Enterprise Value/EBITDA ratio is also very low at 5.21. According to James P. O'Shaughnessy, the Enterprise Value/EBITDA ratio is the best-performing single value factor. In his impressive book "What Works on Wall Street," Mr. O'Shaughnessy demonstrates that 46 years back-testing, from 1963 to 2009, have shown that companies with the lowest EV/EBITDA ratio have given the best return.

Ranking

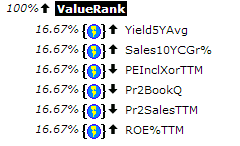

According to Portfolio123's "ValueRank" ranking system, CTL's stock is ranked first among all 35 Russell 3000 Telecommunication Services companies.

The "ValueRank" ranking system is quite complex, and it is taking into account many factors like 5-years average yield, sales growth, trailing P/E, price to book, price to sales and return on equity, as shown in Portfolio123's chart below.

Back-testing over 16 years has proved that this ranking system is very useful. The reader can find the back-testing results of this ranking system in thisarticle.

Summary

In my view, income-seeking investors should consider CTL's stock. The company is generating strong free cash flow and returning substantial cash to shareholders via share repurchases, and by very attractive dividend, currently yielding 7.96%. CenturyLink can achieve solid growth from its strategic businesses. Key growth drivers are increasing business customer demand for high-bandwidth data services and hosting solutions, along with growth in high-speed Internet and Prism TV subscribers.

CenturyLink's valuation is very good; the price to free cash flow is very low at 14.53, and the Enterprise Value/EBITDA ratio is also very low at 5.21. Year to date, CTL's stock is down 31.5%. However, the stock is already up 12.5% from its 52-week low of $24.11 from October 02, and in my opinion, the shares have much room to grow.

No comments:

Post a Comment