Summary

United Rentals has lost some 40% of its value this year. However, a better than expected third quarter earnings report could mean the start of a significant rally.

The company is the market share leader in a fragmented industry and should benefit from several key trends over the next few years and the stock is cheap as well.

Why I see 60% upside in this name over the next 12-24 months which would bring it back to the levels it traded at in late 2014.

Based on its recent earnings report, I see no reason the stock cannot approach those highs once again in the next 12-24 months. From a current level of $74.00 a share, that would be more than a 60% gain; more than respectable in the current market environment.

Company Overview:

United Rentals, Inc is an equipment rental company. It operates in two segments; General Rentals, and Trench Safety, Power and HVAC (heating, ventilating and air conditioning), and Pump Solutions. The company offers approximately 3,300 classes of equipment for rent to construction and industrial companies, manufacturers, utilities, municipalities, homeowners, government entities, and other customers.

Its fleet of rental equipment includes general construction and industrial equipment, such as backhoes, skid-steer loaders, forklifts, earthmoving equipment, and material handling equipment; aerial work platforms consisting of boom lifts and scissor lifts; and general tools. The company has just under 900 facilities/stores in North America. United Rentals has a current market capitalization of approximately $7 billion and a stock price as noted of ~$74.00 a share.

Consolidation Play:

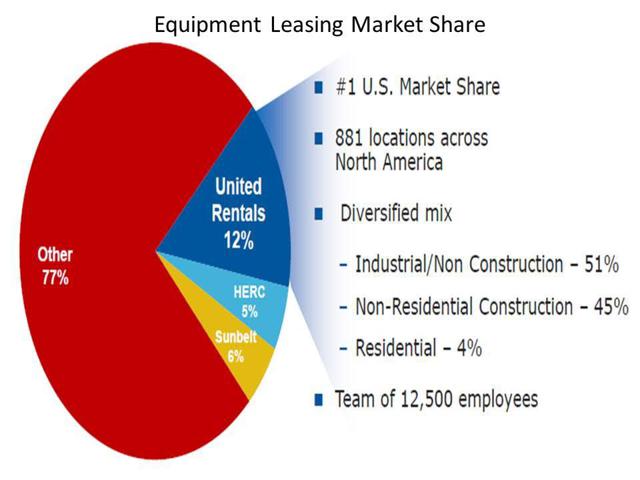

Source: Company Investor Presentation

Just over 50% of the equipment of United Rentals is utilized for industrial purposes outside commercial or residential construction. Most of the rest is utilized for construction activity. The company is by far the largest equipment rental player within the industry but still has just 12% of the overall market share. As such it should benefit by continuing to buy up less efficient competitors and growing market share.

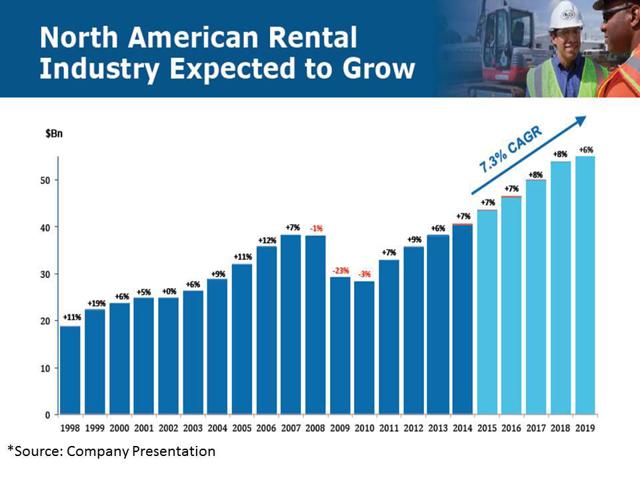

The top three players in the segment control less than one quarter of overall sales. The company should benefit from both the mid-single digit annual growth the equipment rental market is expected to experience over 2014-2018 as well as buying out these smaller competitors. In the last five years, the company has spent just over 10% of its capital budget on share buybacks, just over 30% on small acquisitions and the rest on capital equipment.

Over the next five years I would be surprised if United does not grow to capture 15% to 20% of the total market share in this segment. This would add some $1.5 billion to $4 billion in annual sales to the roughly $6 billion annual revenue figure the company is currently achieving.

Recent History:

Like most of the equipment rental companies; United Rentals had a near-death experience during the financial crisis as demand for any sort of construction and most industrial activity shriveled up. The company survived, implemented numerous operational improvements and delivered its balance sheet. Both United Rentals and its stock has done very well overall since the recession ended in June 2009.

The stock still offers plenty of capital appreciation potential as it continues to grow its market share lead in an industry that has good growth opportunities. Investors grew concerned earlier in the year by the company's possible exposure to the challenged energy sector as well as a drop in utilization levels. However, the oil & gas industry only makes up six percent of the company's overall demand, and most of that will remain intact as it is concentrated in the mid and downstream parts of the energy complex.

The company recently reported third quarter earnings of $2.57 a share, 24 cents a share above the consensus estimate. The shares rallied as it appears the company's recent weak spell is behind it. Currency impacts (Canada) cost the company five cents a share in the quarter. Adjusted EBITDA margin for the quarter came in at 50.3%, an all-time quarterly record.

Operational Improvements:

The company has initiated several key operational initiatives over the past year or so that should continue to boost earnings & margins down the road. United Rentals is about 30% through a program focused on identifying and actioning improvements to take an annual $100 million out of its operating expenses via cost reduction/productivity raising initiatives.

The company is also moving strongly into specialty rentals like trench safety, power generation and pump solutions. These areas have higher margins and also provide much greater free cash flow over the life of the equipment asset. Specialty rentals now make up just under 20% of overall revenues and are growing faster than the overall product mix.

The company has also implemented what it calls "Total Solution" where it actually manages its equipment in the field for customers even keeping a field mechanic on hand for bigger projects. It even shares equipment across projects, utilizing scheduling software to improve utilization of the equipment. This means less downtime for customers as well as lower costs per hour, and higher margins for United Rentals as well. Revenue from this effort called "Total Control" is growing approximate year-over-year and now totals north of $200 million in sales a quarter. A tiny but fast growing part of the almost $6 billion in overall sales the company should post in 2015.

The company is also concentrating on growing the amount of sales that come from Key Accounts. These customers tend to more regional or national in nature, are stronger financially than mom & pop operators and present many more opportunities to cross-sell as well as cost synergies. Almost two thirds of United's accounts now fall into this category.

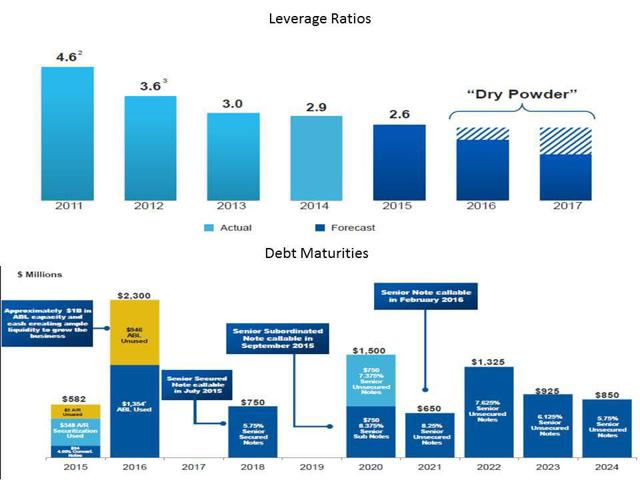

Balance Sheet:

The company has down a commendable job in reducing its leverage in recent years. Its balance sheet has staggered debt maturities and is well-managed. The company has significant high interest rate debt coming due over the next several years which would be opportunity to refinance at lower interest rates if yields continue to stay at or near current levels. The company has some $800 million in liquidity available including $170 million in cash on the balance sheet.

Source: Company Investor Presentation

Outside of acquisition and restructuring based activities the company guided during the conclusion of its third quarter earnings call to free cash flow of between $725 million to $775 million in 2015. At the mid-point of that range and considering the company's $7 billion market capitalization, that is almost an 11% free cash flow; a rare level in this market. The company expects similar or higher free cash flow returns in FY2016 & FY2017.

United Rentals does a good job of disposing of aged equipment at solid prices which not only reduces capital expenditure needs but also is resulting in a newer fleet over time. It also currently leads the industry in utilization rates.

Opportunities For Growth:

As previous stated, the equipment rental business is expected to grow in the mid-single digit levels annually over the next few years. The company will add several percent of annual growth a year just by continuing to buy up smaller competitors. Foreign expansion is another opportunity that might be a new avenue of growth that is addressed at some point down the line as well.

What is impressive about United Rental's growth since the financial crisis is that it has happened despite a tepid commercial construction market which is slowly moving towards more normalized levels. If commercial construction starts to trend higher, this would be a significant tailwind for United Rentals as would any kind of additional infrastructure spending bills coming from Congress; one of the few bipartisan efforts that can be imagined over the next year heading into the 2016 presidential election. Construction spending is expected to grow in the high single digits in 2016 which should be a nice tailwind for the company as we head into the New Year.

Summary:

Earnings per share came in at just under $7.00 a share in FY2014 and the company is tracking towards just north of $8.00 a share of profits in FY2015. United should deliver over $9.00 a share in profits during FY2016 if construction spending comes in as expected.

Housing is having its best year since 2007 with annual housing starts running at a 1.2 million annual level. However, this is significantly below the long run average of 1.5 million housing starts and not even close to the two million annual starts we saw during the housing boom. With the population 20 million higher than before the financial crisis, rising household formation, solid job growth and with mortgage rates near historical lows; pent up demand could drive many years of increasing housing and construction demand.

At the current price, the stock goes for just over eight times next year's likely earnings. This is despite the company's superior revenue and earnings growth trajectory compared to the S&P 500. At these valuation levels it is hard to see much downside from here.

A multiple of 13 times next year's profits would get us near my $120.00 a share price target and still be a 15% to 20% discount to the overall market multiple. Given the stock was priced at just under 15 times forward earnings late last year when it did sell for right under $120.00 a share at the end of 2014 this is not much of a stretch. STRONG BUY

No comments:

Post a Comment