5 comments | About: Ferrari N.V. (RACE)

Summary

Vintage Ferraris are exceptionally good investments.

Ferrari stock is a more nuanced story, though. In recent years, cash flow was rather weak compared to the profitability, and could hardly justify current market valuation.

The stock is attractive if the interim 2015 figures prove to be a new cash flow standard.

According to Priceonomics, the most expensive car ever sold at auction was a Ferrari (NYSE:RACE) 250 GTO (it was sold for USD 38.15 million in August of 2014). Moreover, of the 50 most expensive cars ever sold at auction, 30 are Ferraris. According to the Hagerty Collector Car Index, the prices of German [BMW (OTCPK:BAMXY), Porsche (OTCPK:POAHY), Mercedes-Benz (OTCPK:DDAIY)], British [Bentley, Rolls Royce (OTCPK:RYCEY)], and American [Ford (NYSE:F) GT] cars have stagnated in 2010 - 2015 period. Nevertheless, the prices of Ferrari cars went through a sharp rally (see this for the details and some interesting charts).

Based on the above it seems Ferraris are not only exceptional cars, they could be an exceptional investment. Is the same true for the Ferrari stock?

Cash flow lags significantly behind profits...

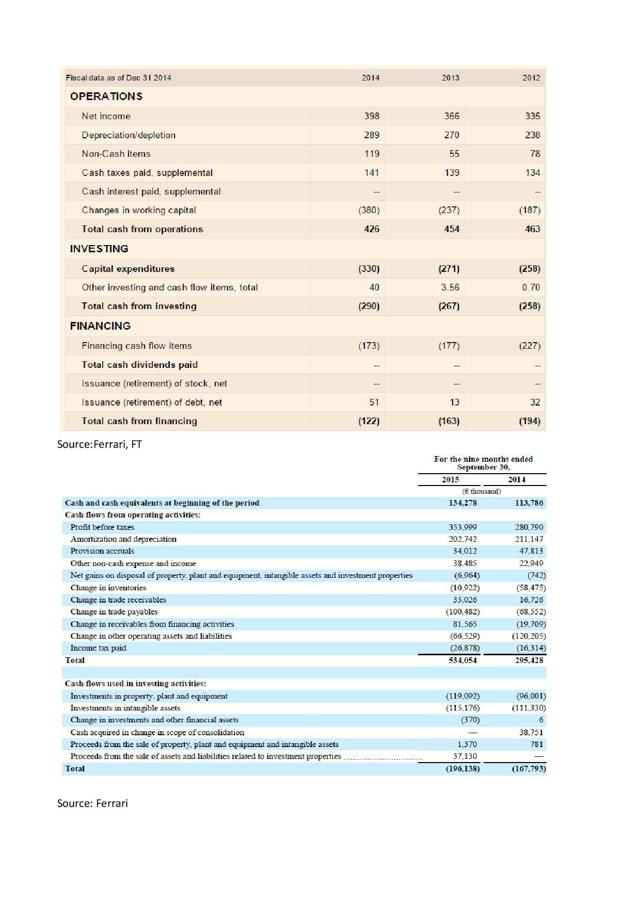

Ferrari was able to increase its profitability in the last four years, nevertheless its cash flow paints a different picture: Cash from operations declined from EUR 463 million in 2012 to EUR 426 in 2014 (this development is mostly a reflection of the changes in working capital). Moreover, CapEx is gradually rising, which means cash flow after CapEx is declining even more sharply than cash flow from operations.

The company has only minimal other investments, and we can therefore perceive cash flow after CapEx as free cash flow. It reached EUR 200 million in 2012, but only EUR 96 million in 2014. The trend is therefore not very encouraging. Moreover, there are quite high „financial cash flow items", which should also be considered when estimating the cash flow, which is available for the shareholders. Therefore, the profit and loss statement and the profitability of Ferrari provides quite an incomplete (and too rosy) picture of its fundamental strength and ability to generate money for the shareholders.

... but not all is lost

I must say I was quite disappointed when I looked at the above presented full year cash flow figures. Market cap of the company is now around USD 9.71 billion (EUR 9.1 billion). It is hard to see how could this market cap be justified for a company, which is in the short term able to generate less than EUR 100 million of free cash flow to equity and is not able (or willing) to grow this cash flow quite rapidly in the longer term. However, not all is lost. Hope could be based on the interim figures, which are summarized in the second table above.

The company has significantly increased its profitability in 9M 2015, and has reduced its working capital investments (especially the inventories). Therefore, the cash flow from operations reached EUR 534 million (EUR 295 million in 9M 2014). CapEx and total investments grew significantly too, but 9M 2015 cash flow after CapEx is still remarkably higher in y-o-y comparison - it reached EUR 300 million in 9M 2015, but only EUR 88 million in 9M 2014. If we assume the cash flow in Q4 2015 will be the same as in the same period last year, thecompany will generate full year 2015 cash flow of approximately EUR 260 million.

The valuation and long term outlook

As indicated above, current market cap is close to EUR 9.1 billion. Carmakers like Peugeot (OTCPK:PUGOY) or Renault (OTCPK:RNLSY) have beta close to 1.8, BMW has beta of 1.26. This suggest luxury does not mean higher sensitivity to a cycle, on the contrary. I therefore assume Ferrari could have beta close to 1, and its required rate of return could be around 7.9 % (based on standard CAPM model).

If the 2015 free cash flow to equity really reaches EUR 260 (see above), and is stable in the long term, its present value is close to EUR 3.31. This is approximately one third of the current market cap - the market is clearly more optimistic, and expects the cash flow to grow and not to stagnate. To get its present value at the same level as the market cap, it must concretely grow by 5.2 % a year. Is it a challenge, or is the market too pessimistic?

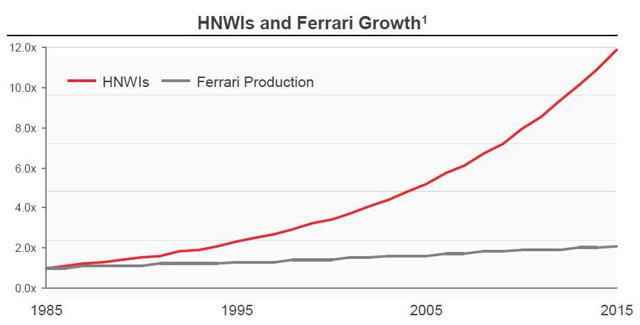

There are more ways how to try to answer the question, but for the sake of simplicity we can look at the following chart from ADW Capital Management:

According to Capgemini/RBC's World Wealth Report, the number of High-Net Worth Individuals (HNWIs) grew at an average annual rate of approximately 8.6 % over the last three decades. And Ferrari has increased its production by approximately 2.5 % per year over the same period. Therefore, the hurdle rate of 5.2 % long term nominal (!) growth does not seem to represent a huge challenge. Not to mention a possibility of increasing the rate of production at least slightly to keep more in touch with the growth of HNWI.

In summary, if the interim 2015 results are indicative of the short term cash flow generation, and the long term growth is at least 5.2 (e.g, 2.5 % growth of the number of the cars sold, 2.7 % average price growth, and stable cash flow margins), the stock is attractive. Still, buying a vintage Ferrari may be a better investment (at least for HNWI).

Disclaimer: I encourage you to do your own research and analysis. I use information obtained from sources I believe to be reliable, but its accuracy and completeness are not guaranteed. Any examples shown here are for demonstrational purposes only. My articles are in no way a recommendation to buy or sell any asset. They are my personal opinion, I am happy if they can help you make your own.

No comments:

Post a Comment