Apple shares trade at highest prices of 2016 amid Samsung woes

Apple shares trade at highest prices of 2016 amid Samsung woes

Apple Chief Executive Tim Cook was already crowing about users switching from Android to Apple before Samsung’s Note 7 issues.

Shares of Apple Inc. hit their highest prices of 2016 on Tuesday as Samsung Electronics Co. Ltd.’s exploding-phone saga worsened and one analyst said Apple could sell millions of iPhones because of it.

Samsung 005930, -8.04% announced Monday afternoon that any Galaxy Note 7 devices that have been sold should be turned off, and said it was halting sales of the smartphone after replacements suffered a similar overheating issue to the original devices. Samsung had already decided to stop production of its Note 7 smartphone after several more phones caught fire over the weekend, telling MarketWatch that it was “temporarily adjusting the Galaxy Note 7 production schedule in order to take further steps to ensure quality and safety manners.” It took that a step further on Tuesday morning, announcing that it has decided to stop production altogether “for the benefit of consumers’ safety.”

The company issued a global recall of the phone in early September, roughly a month after introducing it, due to a number of incidents in which the phone unexpectedly exploded. Samsung replaced the first batch of phones with new ones, but the problem has seemingly persisted even in replacement models, including last week when one of the newly-issued phones caught fire on a Southwest Airlines plane.

The saga might be a boon to iPhone sales in an otherwise slower-than-normal year for Apple AAPL, +0.03% In a Monday note to clients issued before Samsung completely halted sales, CFRA Research analyst Angelo Zino said he expects the Note 7 issues to help drive some Android users over to iOS, which he estimates could help increase Apple’s share of the global smartphone market by 1%. Samsung had a 22.4% share of the market in the second quarter, double Apple’s share, which was 11.8%, according to industry tracker IDC.

Zino said a 1% share gain would help Apple sell an additional 14 million to 15 million units during the September quarter, which would mean a 7% increase from the analyst’s previous sales forecast. Analysts on average are calling for September-quarter iPhone sales of 45 million, down from 48 million a year ago, according to FactSet. Apple’s iPhone revenues are forecast to come in around $27.6 billion, compared with $32.2 billion in the year-earlier period. However, that could be higher if Zino’s prediction comes true regarding the increasing rate of switchers and share gains.

“The biggest U.S. carriers have also stopped selling Note 7 phones and will allow customers to replace with a different device,” he said. “We see a more favorable competitive landscape and higher Android switcher rates for Apple over the next 12-18 months.”

Zino also expects the Note 7 to dampen future Samsung product launches.

Customers switching to iOS from Alphabet Inc.’s GOOGL, -0.56% GOOG, -0.37% Android operating system represent an opportunity for Apple to drive top-line revenue despite iPhone saturation in developed markets, which has caused Apple’s smartphone sales to dip the past two consecutive quarters. Analysts are anticipating Apple’s first-ever year-over-year annual decline in iPhone sales this year, with the current FactSet consensus calling for 211 million iPhones sold, compared with 231 million last year.

However, switchers accounted for the highest percentage of quarterly iPhone salesin the company’s history last quarter, Apple said, helping it to narrowly surpass quarterly revenue expectations for the June quarter. The company’s next earnings report, which will include September sales of the iPhone, will be released on Oct. 25.

“Switchers and first-time smartphone buyers represented the lion’s share of our iPhone sales in the quarter,” Apple CEO Tim Cook said on a call with analysts in July.

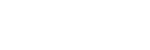

Shares of Apple rose 1.7% to close Monday at a 10-month high of $116.05, pushing them up 20% in the past three months. They have vastly outperformed the Dow Jones Industrial Average DJIA, -1.09% which includes Apple, as the blue-chip index is up less than 1% in that time period.

By Jennifer Booton

This Hot Stock Shows Why 10 Billionaires Can't All Be Wrong

If you think solar energy is only embraced by the sort of people who vote for Sen. Bernie Sanders (D., Vt.), a self-avowed socialist, consider this: Ten billionaires are investing massive sums in renewable energy technologies such as solar. Warren Buffett, George Soros, Bill Gates and their super-wealthy peers can hardly be considered as naïve and utopian.

Below, we examine a solar stock with the greatest growth potential this year. It's poised for triple-digit gains in 2016, no mean feat in a market that some analysts are saying will soon descend into a prolonged slump. If you want to "beat the bear," you should look for companies with game-changing technologies that are tapped into unstoppable trends.

But there's another misconception about solar right now. Many investors think that persistently low oil and gas prices will compel end users to abandon solar in favor of cheaper fossil fuels.

If you believe that fallacy, you'll miss one of the most exciting investment opportunities to come along in decades. Fact is, the infrastructure for the solar industry is now pervasive and entrenched, leading to a "price decoupling" of solar and fossil fuels. Solar and other renewable energies are now integral to the energy status quo and no longer need high oil and gas prices to attract users.

That's why the stock we examine below is projected to appreciate by as much as 193% this year. For further explanation as to the dynamics behind this company's stunning rise, let's turn to the Gartner Hype Cycle.

The Hype Cycle is a graphical presentation developed and used by technology research and advisory firm Gartner for representing the maturity, adoption and social application of specific technologies.

Each Hype Cycle describes five crucial phases of a technology's life cycle:

1) Technology Trigger: A technology breakthrough kicks things off; excitement builds.

2) Peak of Inflated Expectations: Early publicity spawns a flurry of success (and failure) stories. Some companies adapt; others fall by the wayside.

3) Trough of Disillusionment: Interest diminishes as reality fails to live up to the hype. A shakeout ensues, but the smartest early adopters survive and continue to invest and experiment.

4) Slope of Enlightenment: The technology becomes better understood and implemented. Second- and third-generation products emerge.

5) Plateau of Productivity: Mainstream adoption takes off.

Simply put, solar has already passed through its "hype" period and is now in the "plateau of productivity" for sustainable, long-term growth.

The solar industry has not seen its fortunes diminish in the face of cheaper fossil fuels, because solar now moves along its own supply-and-demand dynamics within its plateau of productivity. It doesn't matter if oil is dirt-cheap right now. Solar's customers are increasingly dependent on inexpensive, reliable power from the sun and see no rationale for switching.

The one stock that appears to have greatest upside potential this year is Canadian Solar (CSIQ - Get Report) .

Below, we examine a solar stock with the greatest growth potential this year. It's poised for triple-digit gains in 2016, no mean feat in a market that some analysts are saying will soon descend into a prolonged slump. If you want to "beat the bear," you should look for companies with game-changing technologies that are tapped into unstoppable trends.

But there's another misconception about solar right now. Many investors think that persistently low oil and gas prices will compel end users to abandon solar in favor of cheaper fossil fuels.

If you believe that fallacy, you'll miss one of the most exciting investment opportunities to come along in decades. Fact is, the infrastructure for the solar industry is now pervasive and entrenched, leading to a "price decoupling" of solar and fossil fuels. Solar and other renewable energies are now integral to the energy status quo and no longer need high oil and gas prices to attract users.

That's why the stock we examine below is projected to appreciate by as much as 193% this year. For further explanation as to the dynamics behind this company's stunning rise, let's turn to the Gartner Hype Cycle.

The Hype Cycle is a graphical presentation developed and used by technology research and advisory firm Gartner for representing the maturity, adoption and social application of specific technologies.

Each Hype Cycle describes five crucial phases of a technology's life cycle:

1) Technology Trigger: A technology breakthrough kicks things off; excitement builds.

2) Peak of Inflated Expectations: Early publicity spawns a flurry of success (and failure) stories. Some companies adapt; others fall by the wayside.

3) Trough of Disillusionment: Interest diminishes as reality fails to live up to the hype. A shakeout ensues, but the smartest early adopters survive and continue to invest and experiment.

4) Slope of Enlightenment: The technology becomes better understood and implemented. Second- and third-generation products emerge.

5) Plateau of Productivity: Mainstream adoption takes off.

Simply put, solar has already passed through its "hype" period and is now in the "plateau of productivity" for sustainable, long-term growth.

The solar industry has not seen its fortunes diminish in the face of cheaper fossil fuels, because solar now moves along its own supply-and-demand dynamics within its plateau of productivity. It doesn't matter if oil is dirt-cheap right now. Solar's customers are increasingly dependent on inexpensive, reliable power from the sun and see no rationale for switching.

The one stock that appears to have greatest upside potential this year is Canadian Solar (CSIQ - Get Report) .

With a market cap of $917.27 billion, Canadian Solar produces solar ingots, wafers, cells, modules and integrated power systems. Canadian Solar is a "small-cap rocket stock" that is poised to explode this year. As a small-cap with current market capitalization of about $1.07 billion, Canadian Solar confers greater risk than peers First Solar (FSLR - Get Report) (market cap: $6.3 billion) and SunPower (SPWR - Get Report) (market cap: $3.3 billion), but it also enjoys the greatest upside potential.

With a market cap of $917.27 billion, Canadian Solar produces solar ingots, wafers, cells, modules and integrated power systems. Canadian Solar is a "small-cap rocket stock" that is poised to explode this year. As a small-cap with current market capitalization of about $1.07 billion, Canadian Solar confers greater risk than peers First Solar (FSLR - Get Report) (market cap: $6.3 billion) and SunPower (SPWR - Get Report) (market cap: $3.3 billion), but it also enjoys the greatest upside potential.

By John Persinos

Below, we examine a solar stock with the greatest growth potential this year. It's poised for triple-digit gains in 2016, no mean feat in a market that some analysts are saying will soon descend into a prolonged slump. If you want to "beat the bear," you should look for companies with game-changing technologies that are tapped into unstoppable trends.

Below, we examine a solar stock with the greatest growth potential this year. It's poised for triple-digit gains in 2016, no mean feat in a market that some analysts are saying will soon descend into a prolonged slump. If you want to "beat the bear," you should look for companies with game-changing technologies that are tapped into unstoppable trends.The 5 Most Important 2016 IPOs to Watch

It's going to be a volatile year for the market, as the Dow Jones has had its worst start to the year in history. The index fell 8.3% in the first 10 trading days.

Market volatility means less demand for newly issued stocks – which will hurt2016 IPOs. That's what hurt the IPO market in 2015. The Dow's 6.6% plunge in August scared off private companies planning to go public and caused 17 IPO withdrawals during the third quarter – the most for that quarter since 2012.

Compared to 2014's blockbuster year, the overall 2015 IPO market was a huge disappointment for investors. Only 169 companies went public last year and raised a combined $30 billion in proceeds. That's the lowest amount of annual IPO proceeds since 2009.

The tech sector, which was the crown jewel of the 2014 IPO market, underperformed in 2015. Tech IPOs only raised a combined $4.2 billion in 2015. Tech deals raised $32.3 billion in 2014; the Alibaba Group Holding Ltd. (NYSE: BABA) IPO from September 2014 raised $21.8 billion alone.

While about 58% of 2015's IPOs trade below their offer price, a number of new stocks profited through the volatility. Popular companies like GoDaddy Inc. (NYSE: GDDY) and Shake Shack Inc. (NYSE: SHAK) are up 46% and 52.7% from their respective IPO prices last year.

Just like last year, not all of 2016's new issues will flop. That's why we're tracking these five major 2016 IPOs. Even if the markets are volatile, these new issues all have the chance to reward investors and outperform the markets in 2016…

Compared to 2014's blockbuster year, the overall 2015 IPO market was a huge disappointment for investors. Only 169 companies went public last year and raised a combined $30 billion in proceeds. That's the lowest amount of annual IPO proceeds since 2009.

The tech sector, which was the crown jewel of the 2014 IPO market, underperformed in 2015. Tech IPOs only raised a combined $4.2 billion in 2015. Tech deals raised $32.3 billion in 2014; the Alibaba Group Holding Ltd. (NYSE: BABA) IPO from September 2014 raised $21.8 billion alone.

While about 58% of 2015's IPOs trade below their offer price, a number of new stocks profited through the volatility. Popular companies like GoDaddy Inc. (NYSE: GDDY) and Shake Shack Inc. (NYSE: SHAK) are up 46% and 52.7% from their respective IPO prices last year.

Just like last year, not all of 2016's new issues will flop. That's why we're tracking these five major 2016 IPOs. Even if the markets are volatile, these new issues all have the chance to reward investors and outperform the markets in 2016…

It's going to be a volatile year for the market, as the Dow Jones has had its worst start to the year in history. The index fell 8.3% in the first 10 trading days.

Market volatility means less demand for newly issued stocks – which will hurt2016 IPOs. That's what hurt the IPO market in 2015. The Dow's 6.6% plunge in August scared off private companies planning to go public and caused 17 IPO withdrawals during the third quarter – the most for that quarter since 2012.

Compared to 2014's blockbuster year, the overall 2015 IPO market was a huge disappointment for investors. Only 169 companies went public last year and raised a combined $30 billion in proceeds. That's the lowest amount of annual IPO proceeds since 2009.

Compared to 2014's blockbuster year, the overall 2015 IPO market was a huge disappointment for investors. Only 169 companies went public last year and raised a combined $30 billion in proceeds. That's the lowest amount of annual IPO proceeds since 2009.

The tech sector, which was the crown jewel of the 2014 IPO market, underperformed in 2015. Tech IPOs only raised a combined $4.2 billion in 2015. Tech deals raised $32.3 billion in 2014; the Alibaba Group Holding Ltd. (NYSE: BABA) IPO from September 2014 raised $21.8 billion alone.

While about 58% of 2015's IPOs trade below their offer price, a number of new stocks profited through the volatility. Popular companies like GoDaddy Inc. (NYSE: GDDY) and Shake Shack Inc. (NYSE: SHAK) are up 46% and 52.7% from their respective IPO prices last year.

Just like last year, not all of 2016's new issues will flop. That's why we're tracking these five major 2016 IPOs. Even if the markets are volatile, these new issues all have the chance to reward investors and outperform the markets in 2016…

2016 IPOs to Watch No. 1: Uber Technologies Inc.

Although no date has been announced yet, the Uber IPO will be the most anticipated deal of 2016. That's because the company's sky-high valuation is unprecedented when it comes to startups.

At $51 billion, Uber is the highest-valued private company in the world. The mobile taxi service has raised $7.4 billion over 13 rounds of funding. It's currently seeking $2.1 billion in its latest round, which would value the company at $62.5 billion.

Uber's major appeal to investors is it's disruption of an untouched market. The taxi industry has operated for years with relatively few changes and competitors. Now, Uber offers an easily available third option between hailing a cab and paying exorbitant prices for a private car service.

While the company doesn't release financials, it's expected to hit an annual revenue of $10 billion by the end of 2015. According to a 2014 report by The New York Times, Uber could potentially bring in $1 billion in annual revenue if it successfully takes over 50% of the U.S. taxi industry.

Because it has raised a whopping $7.4 billion in private funding, company officials have been able to put off the Uber IPO until 2016. It's currently in the process of raising $2.1 billion in its 13th financing round.

Although no date has been announced yet, the Uber IPO will be the most anticipated deal of 2016. That's because the company's sky-high valuation is unprecedented when it comes to startups.

At $51 billion, Uber is the highest-valued private company in the world. The mobile taxi service has raised $7.4 billion over 13 rounds of funding. It's currently seeking $2.1 billion in its latest round, which would value the company at $62.5 billion.

Uber's major appeal to investors is it's disruption of an untouched market. The taxi industry has operated for years with relatively few changes and competitors. Now, Uber offers an easily available third option between hailing a cab and paying exorbitant prices for a private car service.

While the company doesn't release financials, it's expected to hit an annual revenue of $10 billion by the end of 2015. According to a 2014 report by The New York Times, Uber could potentially bring in $1 billion in annual revenue if it successfully takes over 50% of the U.S. taxi industry.

Because it has raised a whopping $7.4 billion in private funding, company officials have been able to put off the Uber IPO until 2016. It's currently in the process of raising $2.1 billion in its 13th financing round.

Although no date has been announced yet, the Uber IPO will be the most anticipated deal of 2016. That's because the company's sky-high valuation is unprecedented when it comes to startups.

Although no date has been announced yet, the Uber IPO will be the most anticipated deal of 2016. That's because the company's sky-high valuation is unprecedented when it comes to startups.

At $51 billion, Uber is the highest-valued private company in the world. The mobile taxi service has raised $7.4 billion over 13 rounds of funding. It's currently seeking $2.1 billion in its latest round, which would value the company at $62.5 billion.

Uber's major appeal to investors is it's disruption of an untouched market. The taxi industry has operated for years with relatively few changes and competitors. Now, Uber offers an easily available third option between hailing a cab and paying exorbitant prices for a private car service.

While the company doesn't release financials, it's expected to hit an annual revenue of $10 billion by the end of 2015. According to a 2014 report by The New York Times, Uber could potentially bring in $1 billion in annual revenue if it successfully takes over 50% of the U.S. taxi industry.

Because it has raised a whopping $7.4 billion in private funding, company officials have been able to put off the Uber IPO until 2016. It's currently in the process of raising $2.1 billion in its 13th financing round.

2016 IPOs to Watch No. 2: Pinterest Inc.

The hype behind Pinterest Inc. is simple – it will become the latest major social media website to IPO after Facebook Inc. (Nasdaq: FB) and Twitter Inc. (NYSE:TWTR).

Pinterest is a scrapbooking site where users can manage topical "pins" through collections called "pinboards." Most pinboards focus on fashion, cooking, and child-related activities. The site commands a strong female demographic, with comScore reporting nearly 70% of Pinterest's 100 million monthly users are women.

The company has seen incredibly strong funding growth. Over the company's seven disclosed rounds, its funding has seen an average growth rate of 138% each round. It has raised $1.3 billion in total equity funding and is valued at $11 billion.

But Pinterest is one of many tech companies with an unrealistically high valuation. The only way these firms can keep their valuations from getting slashed is by never actually filing for an IPO.

A recent example is Square Inc. (NYSE: SQ). After the company filed back in October, its valuation became $4.2 billion. That's a significant drop from the $6 billion valuation it received during its last round of funding.

Pinterest is even more susceptible to a valuation cut due to its small revenue stream. The Wall Street Journal reported the company brought in less than $25 million in 2014. The company's valuation is 44 times that amount.

The success of the Pinterest IPO will depend on whether or not investors and issuers are willing to lower their expectations.

The hype behind Pinterest Inc. is simple – it will become the latest major social media website to IPO after Facebook Inc. (Nasdaq: FB) and Twitter Inc. (NYSE:TWTR).

Pinterest is a scrapbooking site where users can manage topical "pins" through collections called "pinboards." Most pinboards focus on fashion, cooking, and child-related activities. The site commands a strong female demographic, with comScore reporting nearly 70% of Pinterest's 100 million monthly users are women.

The company has seen incredibly strong funding growth. Over the company's seven disclosed rounds, its funding has seen an average growth rate of 138% each round. It has raised $1.3 billion in total equity funding and is valued at $11 billion.

But Pinterest is one of many tech companies with an unrealistically high valuation. The only way these firms can keep their valuations from getting slashed is by never actually filing for an IPO.

A recent example is Square Inc. (NYSE: SQ). After the company filed back in October, its valuation became $4.2 billion. That's a significant drop from the $6 billion valuation it received during its last round of funding.

Pinterest is even more susceptible to a valuation cut due to its small revenue stream. The Wall Street Journal reported the company brought in less than $25 million in 2014. The company's valuation is 44 times that amount.

The success of the Pinterest IPO will depend on whether or not investors and issuers are willing to lower their expectations.

2016 IPOs to Watch No. 3: Snapchat Inc.

In May 2015, Snapchat Inc. CEO Evan Spiegel announced he intends to take his company public. Although he didn't offer many specifics for theSnapchat IPO date, it was the first time any company official mentioned going public.

First launched in 2011, Snapchat has since become one of the fastest-growing social media platforms ever. It currently has more than 200 million monthly active users (MAUs). That's 43% more than Facebook's MAUs four years after its launch.

Although Snapchat hasn't turned a profit yet, the company just launched in October a new advertising format that will put it on track for $100 million a year. Called "Sponsored Lenses," it allows users to add different animated filters to pictures or videos of themselves.

These filters give companies an outlet for advertising. For example, 20th Century Fox allowed animated selfie features with characters from the studio's upcoming "The Peanuts Movie." Users could add animated characters like Woodstock and Snoopy to their picture messages.

Snapchat's challenge moving forward will be building these new sources of advertising revenue. Investors will also be looking for it to turn a profit sometime soon, which is the biggest challenge for social media companies before going public.

In May 2015, Snapchat Inc. CEO Evan Spiegel announced he intends to take his company public. Although he didn't offer many specifics for theSnapchat IPO date, it was the first time any company official mentioned going public.

First launched in 2011, Snapchat has since become one of the fastest-growing social media platforms ever. It currently has more than 200 million monthly active users (MAUs). That's 43% more than Facebook's MAUs four years after its launch.

Although Snapchat hasn't turned a profit yet, the company just launched in October a new advertising format that will put it on track for $100 million a year. Called "Sponsored Lenses," it allows users to add different animated filters to pictures or videos of themselves.

These filters give companies an outlet for advertising. For example, 20th Century Fox allowed animated selfie features with characters from the studio's upcoming "The Peanuts Movie." Users could add animated characters like Woodstock and Snoopy to their picture messages.

Snapchat's challenge moving forward will be building these new sources of advertising revenue. Investors will also be looking for it to turn a profit sometime soon, which is the biggest challenge for social media companies before going public.

In May 2015, Snapchat Inc. CEO Evan Spiegel announced he intends to take his company public. Although he didn't offer many specifics for theSnapchat IPO date, it was the first time any company official mentioned going public.

In May 2015, Snapchat Inc. CEO Evan Spiegel announced he intends to take his company public. Although he didn't offer many specifics for theSnapchat IPO date, it was the first time any company official mentioned going public.

First launched in 2011, Snapchat has since become one of the fastest-growing social media platforms ever. It currently has more than 200 million monthly active users (MAUs). That's 43% more than Facebook's MAUs four years after its launch.

Although Snapchat hasn't turned a profit yet, the company just launched in October a new advertising format that will put it on track for $100 million a year. Called "Sponsored Lenses," it allows users to add different animated filters to pictures or videos of themselves.

These filters give companies an outlet for advertising. For example, 20th Century Fox allowed animated selfie features with characters from the studio's upcoming "The Peanuts Movie." Users could add animated characters like Woodstock and Snoopy to their picture messages.

Snapchat's challenge moving forward will be building these new sources of advertising revenue. Investors will also be looking for it to turn a profit sometime soon, which is the biggest challenge for social media companies before going public.

2016 IPOs to Watch No. 4: Saudi Aramco

Saudi Aramco – the most valuable and secretive company in the world – is considering going public in 2016.

According to a Jan. 6 report by The Economist, a Saudi Aramco IPO is being considered by the kingdom of Saudi Arabia. Formally known as the Saudi Arabian Oil Co., the state-owned oil behemoth known for keeping its revenue and other financials under wraps announced it's going over plans to sell a stake in the company.

Saudi Aramco has dominated the global oil industry for over 70 years. It produces more than 10% of the world's total oil supply every day. In 2014, the company stated it owns 261 billion barrels of crude oil reserves. That dwarfs the 14 billion barrels owned by Exxon Mobil Corp. (NYSE: XOM) – the largest non-state-owned oil company in the world.

A Saudi Aramco IPO of even a small slice of the company could raise billions of dollars in proceeds. It could also possibly become the largest IPO of all time. After all, analysts from RBS Research and Bloomberg estimate Saudi Aramco would command a $2 trillion market cap after going public. That's about 535% more than Exxon's market cap.

The massive proceeds from the IPO will be used to pay off the Saudi government's mounting budget deficit. Since oil accounts for nearly 80% of the country's total exports, Saudi Arabia reported a fiscal deficit of $98 billion last year due to the 44% drop in oil prices.

With a current budget deficit of roughly $87 billion, the Saudi government is desperate to climb out of its hole of debt. Selling a stake of its crown jewel to the public is an easy way to infuse money into the country's struggling economy.

A Saudi Aramco IPO of even a small slice of the company could raise billions of dollars in proceeds. It could also possibly become the largest IPO of all time. After all, analysts from RBS Research and Bloomberg estimate Saudi Aramco would command a $2 trillion market cap after going public. That's about 535% more than Exxon's market cap.

The massive proceeds from the IPO will be used to pay off the Saudi government's mounting budget deficit. Since oil accounts for nearly 80% of the country's total exports, Saudi Arabia reported a fiscal deficit of $98 billion last year due to the 44% drop in oil prices.

With a current budget deficit of roughly $87 billion, the Saudi government is desperate to climb out of its hole of debt. Selling a stake of its crown jewel to the public is an easy way to infuse money into the country's struggling economy.

Saudi Aramco – the most valuable and secretive company in the world – is considering going public in 2016.

According to a Jan. 6 report by The Economist, a Saudi Aramco IPO is being considered by the kingdom of Saudi Arabia. Formally known as the Saudi Arabian Oil Co., the state-owned oil behemoth known for keeping its revenue and other financials under wraps announced it's going over plans to sell a stake in the company.

Saudi Aramco has dominated the global oil industry for over 70 years. It produces more than 10% of the world's total oil supply every day. In 2014, the company stated it owns 261 billion barrels of crude oil reserves. That dwarfs the 14 billion barrels owned by Exxon Mobil Corp. (NYSE: XOM) – the largest non-state-owned oil company in the world.

A Saudi Aramco IPO of even a small slice of the company could raise billions of dollars in proceeds. It could also possibly become the largest IPO of all time. After all, analysts from RBS Research and Bloomberg estimate Saudi Aramco would command a $2 trillion market cap after going public. That's about 535% more than Exxon's market cap.

A Saudi Aramco IPO of even a small slice of the company could raise billions of dollars in proceeds. It could also possibly become the largest IPO of all time. After all, analysts from RBS Research and Bloomberg estimate Saudi Aramco would command a $2 trillion market cap after going public. That's about 535% more than Exxon's market cap.

The massive proceeds from the IPO will be used to pay off the Saudi government's mounting budget deficit. Since oil accounts for nearly 80% of the country's total exports, Saudi Arabia reported a fiscal deficit of $98 billion last year due to the 44% drop in oil prices.

With a current budget deficit of roughly $87 billion, the Saudi government is desperate to climb out of its hole of debt. Selling a stake of its crown jewel to the public is an easy way to infuse money into the country's struggling economy.

2016 IPOs to Watch No. 5: Xiaomi Inc.

Its name may not resonate in the United States, but Xiaomi Inc. is known around the world as the "Apple of China." That's because it's the third-largest provider of smartphones in the world behind Apple Inc. (Nasdaq: AAPL) and Samsung.

But the Chinese smartphone giant has had a rough year as it struggles to meet sales expectations.

After selling 60 million phones in 2014, Xiaomi vowed to sell 100 million phones last year. In March, CEO Lei Jun lowered that projection to 80 million. The company reported in July that it had only sold 34.7 million phones in the first half of 2015. According to research firm Trendforce, the company was on track to sell only 70 million phones in 2015.

There's also a question about Xiaomi's profitability. The company sells many of its devices near their break-even point, or cost of production. The average device sold by Xiaomi retails at about $150. Apple's iPhones retail for as much as $600 each in the United States.

The company plans to go public sometime in 2016, but no official Xiaomi IPO date has been set yet. While the size of the deal is unknown, the company is valued at $46 billion.

Although few Americans know about Xiaomi, a U.S. IPO would be a big story due to the recent performance of Chinese stocks. Alibaba and Baidu Inc. (Nasdaq ADR: BIDU) – China's largest Internet search company – have gained 22.7% and 32.4% in the last three months, respectively.

A debut of Xiaomi stock in 2016 would be welcomed by investors looking to play the growing Chinese market. It's unclear whether Xiaomi will debut in the United States or China, but the recent success of Chinese companies on U.S. markets could influence that decision.

By Alex Mcguire

Its name may not resonate in the United States, but Xiaomi Inc. is known around the world as the "Apple of China." That's because it's the third-largest provider of smartphones in the world behind Apple Inc. (Nasdaq: AAPL) and Samsung.

But the Chinese smartphone giant has had a rough year as it struggles to meet sales expectations.

After selling 60 million phones in 2014, Xiaomi vowed to sell 100 million phones last year. In March, CEO Lei Jun lowered that projection to 80 million. The company reported in July that it had only sold 34.7 million phones in the first half of 2015. According to research firm Trendforce, the company was on track to sell only 70 million phones in 2015.

There's also a question about Xiaomi's profitability. The company sells many of its devices near their break-even point, or cost of production. The average device sold by Xiaomi retails at about $150. Apple's iPhones retail for as much as $600 each in the United States.

The company plans to go public sometime in 2016, but no official Xiaomi IPO date has been set yet. While the size of the deal is unknown, the company is valued at $46 billion.

Although few Americans know about Xiaomi, a U.S. IPO would be a big story due to the recent performance of Chinese stocks. Alibaba and Baidu Inc. (Nasdaq ADR: BIDU) – China's largest Internet search company – have gained 22.7% and 32.4% in the last three months, respectively.

A debut of Xiaomi stock in 2016 would be welcomed by investors looking to play the growing Chinese market. It's unclear whether Xiaomi will debut in the United States or China, but the recent success of Chinese companies on U.S. markets could influence that decision.

By Alex Mcguire

HOT PENNY STOCK

Los Angeles, May 20, 2015 (GLOBE NEWSWIRE) -- Giggles N' Hugs, Inc. (GIGL), owner and operator of family-friendly restaurants that bring together high-end, organic food with active, cutting-edge play and entertainment for children, announces its financial results for the thirteen weeks ended March 29, 2015.

First Quarter Highlights:

.

Revenue increased 11.7% year-over-year to $0.9 million

.

Total costs and operating expenses decreased 6.9% year-over-year

.

Total long-term liabilities were $1.7 million at quarter end, down 3.8% from year-end 2014

"This is the first quarter we're seeing true year-over-year comparisons for our three current locations, and to report double-digit revenue growth in the period bodes very well for our long-term success," commented Joey Parsi, founder and CEO of Giggles N' Hugs. "We also took important steps to prepare for our expansion by further strengthening our management team with the addition of Philip Gay as chief business development officer and John Kaufman as interim-president. Having worked together previously in their roles as CFO and COO respectively at California Pizza Kitchen, where they helped grow the chain from two locations to more than 70 locations, Gay and Kaufman are incredible additions to our team and provide a strong endorsement of our concept as we move into the next phase of our expansion."

Parsi continued, "With the help of Todd Star, the former head of west coast leasing at Westfield USA, who is now spearheading our negotiations with all the major mall owners in the country, we're moving forward on our goal of expanding to 12 company-owned locations by the end of 2017. We're also very excited about the potential of further growth fueled by franchise locations. Since opening our first Giggles N' Hugs in 2009, we've seen a steady stream of interest from franchisees looking to take our concept to markets here in the U.S. and around the world. We look forward to reporting on our progress on these and other fronts in the coming quarters as we work diligently to generate continued shareholder value improvements."

The net sales for the thirteen weeks ended March 29, 2015 and March 30, 2014 were $918,228 and $822,050, respectively. The increase of $96,178, or 11.7%, was due primarily to a continuing trend for higher party rentals. The net sales consist of revenues from food and beverages, private party rentals, fees for access to the children's play area, sales from membership cards (of varying terms), sales from Giggles N' Hugs-branded merchandise, and net of allowances, returns and discounts. Sales were up for private party rentals and other sales, offsetting the decrease in allowances, returns and discounts. The Century City location showed the highest increase of 19.0% over the comparable period from last year.

Costs related to food purchases, supplies and general restaurant operations totaled $214,316 during the thirteen weeks ended March 29, 2015 which showed virtually no change in costs from the comparable period last year. Food costs fluctuate regularly and are difficult to offset or minimize, as any increase in costs of certain commodities could adversely impact the Company's operations unless it passes any such price increases to its guests.

Labor expenses for the thirteen weeks ended March 29, 2015 and March 30, 2014 were $332,071, and $319,518, respectively. The increase of 3.9% was largely due to wage increases. As a customer service company our primary variable cost is related to providing such services. With constant pressure for increased wages, the Company was successfully in keeping labor costs at 39% of revenue versus 38% for a comparable period in 2014. Labor costs are constantly fluctuating and any changes to minimum wages payable could adversely impact the Company's operations.

Adjusted net loss (non-GAAP) for the thirteen weeks ended March 29, 2015 was $120,000. The net loss for the thirteen weeks ended March 29, 2015 was $318,680, compared to a net loss of $506,272 for the thirteen weeks ended March 30, 2014. The decrease of $187,592, or 37%, was a function of stabilizing operating costs and a drop in overall general and administrative costs 37%. Management believe losses will continue to be reduced and profitability will be attained in future quarters as the popularity of its restaurants increases.

About Giggles N' Hugs

Giggles N' Hugs is the first and only restaurant that brings together high-end, organic food with active, cutting-edge play and entertainment for children. Every Giggles N' Hugs location offers an upscale, family-friendly atmosphere with a dedicated play area that children 10 and younger absolutely love. We feature high-quality menus made from fresh and local foods, nightly entertainment such as magic shows, concerts, puppet shows and face painting, and hugely popular party packages for families that want to do something special.

Forward Looking Statements:

Certain statements in this press release constitute "forward-looking statements" within the meaning of the federal securities laws. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward looking statements are based upon current estimates and assumptions and are subject to various risks and uncertainties, including without limitation those set forth in the Company's filings with the Securities and Exchange Commission (the "SEC"). Thus, actual results could be materially different. The Company expressly disclaims any obligation to update or alter statements whether as a result of new information, future events or otherwise, except as required by law.

"This is the first quarter we're seeing true year-over-year comparisons for our three current locations, and to report double-digit revenue growth in the period bodes very well for our long-term success," commented Joey Parsi, founder and CEO of Giggles N' Hugs. "We also took important steps to prepare for our expansion by further strengthening our management team with the addition of Philip Gay as chief business development officer and John Kaufman as interim-president. Having worked together previously in their roles as CFO and COO respectively at California Pizza Kitchen, where they helped grow the chain from two locations to more than 70 locations, Gay and Kaufman are incredible additions to our team and provide a strong endorsement of our concept as we move into the next phase of our expansion."

Parsi continued, "With the help of Todd Star, the former head of west coast leasing at Westfield USA, who is now spearheading our negotiations with all the major mall owners in the country, we're moving forward on our goal of expanding to 12 company-owned locations by the end of 2017. We're also very excited about the potential of further growth fueled by franchise locations. Since opening our first Giggles N' Hugs in 2009, we've seen a steady stream of interest from franchisees looking to take our concept to markets here in the U.S. and around the world. We look forward to reporting on our progress on these and other fronts in the coming quarters as we work diligently to generate continued shareholder value improvements."

The net sales for the thirteen weeks ended March 29, 2015 and March 30, 2014 were $918,228 and $822,050, respectively. The increase of $96,178, or 11.7%, was due primarily to a continuing trend for higher party rentals. The net sales consist of revenues from food and beverages, private party rentals, fees for access to the children's play area, sales from membership cards (of varying terms), sales from Giggles N' Hugs-branded merchandise, and net of allowances, returns and discounts. Sales were up for private party rentals and other sales, offsetting the decrease in allowances, returns and discounts. The Century City location showed the highest increase of 19.0% over the comparable period from last year.

Costs related to food purchases, supplies and general restaurant operations totaled $214,316 during the thirteen weeks ended March 29, 2015 which showed virtually no change in costs from the comparable period last year. Food costs fluctuate regularly and are difficult to offset or minimize, as any increase in costs of certain commodities could adversely impact the Company's operations unless it passes any such price increases to its guests.

Labor expenses for the thirteen weeks ended March 29, 2015 and March 30, 2014 were $332,071, and $319,518, respectively. The increase of 3.9% was largely due to wage increases. As a customer service company our primary variable cost is related to providing such services. With constant pressure for increased wages, the Company was successfully in keeping labor costs at 39% of revenue versus 38% for a comparable period in 2014. Labor costs are constantly fluctuating and any changes to minimum wages payable could adversely impact the Company's operations.

Adjusted net loss (non-GAAP) for the thirteen weeks ended March 29, 2015 was $120,000. The net loss for the thirteen weeks ended March 29, 2015 was $318,680, compared to a net loss of $506,272 for the thirteen weeks ended March 30, 2014. The decrease of $187,592, or 37%, was a function of stabilizing operating costs and a drop in overall general and administrative costs 37%. Management believe losses will continue to be reduced and profitability will be attained in future quarters as the popularity of its restaurants increases.

About Giggles N' Hugs

Giggles N' Hugs is the first and only restaurant that brings together high-end, organic food with active, cutting-edge play and entertainment for children. Every Giggles N' Hugs location offers an upscale, family-friendly atmosphere with a dedicated play area that children 10 and younger absolutely love. We feature high-quality menus made from fresh and local foods, nightly entertainment such as magic shows, concerts, puppet shows and face painting, and hugely popular party packages for families that want to do something special.

Forward Looking Statements:

Certain statements in this press release constitute "forward-looking statements" within the meaning of the federal securities laws. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward looking statements are based upon current estimates and assumptions and are subject to various risks and uncertainties, including without limitation those set forth in the Company's filings with the Securities and Exchange Commission (the "SEC"). Thus, actual results could be materially different. The Company expressly disclaims any obligation to update or alter statements whether as a result of new information, future events or otherwise, except as required by law.

HOT PENNY STOCK

Los Angeles, May 20, 2015 (GLOBE NEWSWIRE) -- Giggles N' Hugs, Inc. (GIGL), owner and operator of family-friendly restaurants that bring together high-end, organic food with active, cutting-edge play and entertainment for children, announces its financial results for the thirteen weeks ended March 29, 2015.

| Adjusted Net Loss (non-GAAP) Reconciliation (in millions) | |||

| 1Q15 | |||

| Net Loss, as reported | ($0.32) | ||

| add back non-cash and non-recurring items: | |||

| Loss on settlement | $0.02 | ||

| Depreciation and amortization | $0.09 | ||

| Share based comp | $0.07 | ||

| Litigation expense, non-recurring | $ | ||

| Finance and interest expense, related to warrant exercise | $0.02 | ||

| Adjusted net loss | ($0.12) | ||

INVESTORS RELATIONS CONTACT: Bruce Haase? RedChip Companies, Inc.? 800.733.2447, ext. 131? bruce@redchip.com Joey Parsi Founder/CEO Giggles N Hugs Joey@gigglesnhugs.com

Xpel Technologies: Wrapping Up A Sticky Model And Hyper Growth Worth Multiples Of Today's Price

Summary

- Xpel's growth over the past 4 years is on-par with growth of Wal-Mart post IPO and both have many traits in common.

- Xpel is building its stickiness through an ecosystem of direct distribution, training and DAP cutting software which should give it an edge to maintain high growth.

- Company-owned install shops should provide upside and a method to exploit its direct distribution model internationally.

- Xpel trades at a significant discount due to its obscurity, stock listing and illiquidity and potentially worth multiples of today's price.

- Continued performance, a potential stock uplisting next year and a potential takeover in the mid-term provide catalysts to value creation.

(Note: Shares are also traded on the Canadian TSX Venture exchange in $USD under the ticker DAP.U-V.)

Few companies come around during an investors' lifetime that have a probable chance of changing one's life if enough capital is allocated to it. These companies have a rare combination of extremely high economics, are run by high quality, incentivized owner-operators, have defensible characteristics, high consistent growth with potential to continue high growth, and are trading at a fair price. Charlie Munger even said that if you can find these companies early in their business development, then it would be a mistake to not invest in them. To illustrate that point, Munger and Buffett have admitted to mistakes of omission especially their omission of not investing in Wal-Mart in the early days. For investors like ourselves, when investing in compounders for the long term it is best to learn from others who have already made big mistakes of omission, since by the time we notice our omission mistakes the opportunity costs are likely to be huge. In Buffett and Munger's case Wal-Mart cost them somewhere around $10 billion.

We think Xpel Technologies (OTC:XPLT) is one of those rare businesses that is early in its growth that fits almost all of the qualities that could make this a long-term compounder:

- Return on assets >20% since 2010

- Return on equity >30% since 2010

- Business needs little capital to grow and has maintained ROIC above 20% since 2009

- Insiders own ~50% of shares with the CEO owning ~6%

- Zero dilution from stock options

- Recurring like revenues, marketing advantage and plenty of operating leverage

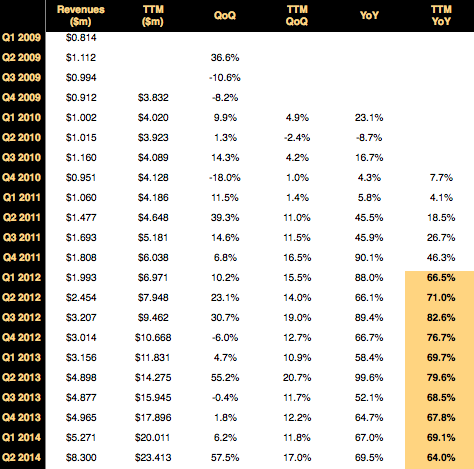

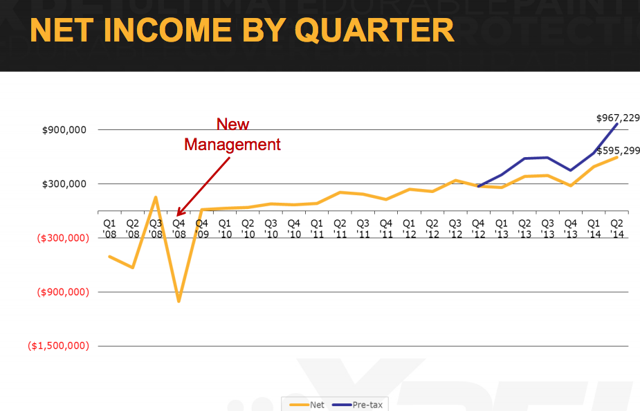

- Consistent trailing-twelve-month growth over 60% the past 10 quarters since CEO Ryan Pape has been at the helm

- Paint Protection Film has only 2% adoption rate in the US and much less internationally meaning plenty of growth potential

You might expect a company with the above credentials to be trading for ridiculously high multiples, but it actually does not. Since there is already aquality write-up done on Xpel explaining what the company does, the industry which it competes in and growth opportunities we think there is no need to rehash them here in this article.

We will focus on why this company is rare by comparisons with another high compounder of the past, highlighting the company's structural advantages, detailing the value dislocation and why it is occurring as well as outlining the several catalysts that could help push the share price closer to intrinsic value.

You might expect a company with the above credentials to be trading for ridiculously high multiples, but it actually does not. Since there is already aquality write-up done on Xpel explaining what the company does, the industry which it competes in and growth opportunities we think there is no need to rehash them here in this article.

We will focus on why this company is rare by comparisons with another high compounder of the past, highlighting the company's structural advantages, detailing the value dislocation and why it is occurring as well as outlining the several catalysts that could help push the share price closer to intrinsic value.

- Xpel's growth over the past 4 years is on-par with growth of Wal-Mart post IPO and both have many traits in common.

- Xpel is building its stickiness through an ecosystem of direct distribution, training and DAP cutting software which should give it an edge to maintain high growth.

- Company-owned install shops should provide upside and a method to exploit its direct distribution model internationally.

- Xpel trades at a significant discount due to its obscurity, stock listing and illiquidity and potentially worth multiples of today's price.

- Continued performance, a potential stock uplisting next year and a potential takeover in the mid-term provide catalysts to value creation.

Second to None Growth

"One method is what I'd call the method of finding them small get 'em when they're little. For example, buy Wal-Mart when Sam Walton first goes public and so forth. And a lot of people try to do just that. And it's a very beguiling idea. If I were a young man, I might actually go into it." - Charlie Munger

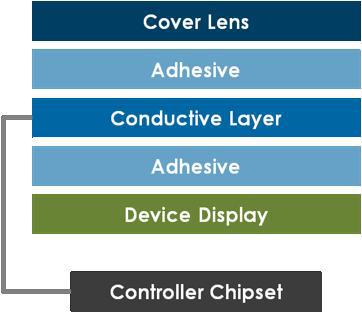

Few companies in the recent past and even far past have had the consistent high growth Xpel has achieved over the last 10 quarters as shown below. Shareholders tend to focus on the trailing-twelve-month year-over-year numbers since quarter-over-quarter and year-over-year numbers tend to be distorted by shifting seasonal orders.

(Source: 2009-2014 MD&As)

(Source: Xpel Presentation)

It was Xpel's focus on its marketing and distribution model, as well as the introduction of its Ultimate paint protection film line that first led to the large consistent increase in sales. The further bump in growth the past year has been a result of the company's increased marketing, expanding domestically through company-owned installation facilities and expansion abroad.

Looking through history books we can only find a few companies that have sustained growth on Xpel's scale for a number of years. Following Charlie Munger's suggestion of going after Wal-Mart (NYSE:WMT) when Sam Walton goes public is a good starting point. Let's take a look at Wal-Mart's revenue growth post IPO and compare it with Xpel after its marketing focus on paint protection film - PPF:

(Source: 2009-2014 MD&As)

(Source: Xpel Presentation)

It was Xpel's focus on its marketing and distribution model, as well as the introduction of its Ultimate paint protection film line that first led to the large consistent increase in sales. The further bump in growth the past year has been a result of the company's increased marketing, expanding domestically through company-owned installation facilities and expansion abroad.

Looking through history books we can only find a few companies that have sustained growth on Xpel's scale for a number of years. Following Charlie Munger's suggestion of going after Wal-Mart (NYSE:WMT) when Sam Walton goes public is a good starting point. Let's take a look at Wal-Mart's revenue growth post IPO and compare it with Xpel after its marketing focus on paint protection film - PPF:

"One method is what I'd call the method of finding them small get 'em when they're little. For example, buy Wal-Mart when Sam Walton first goes public and so forth. And a lot of people try to do just that. And it's a very beguiling idea. If I were a young man, I might actually go into it." - Charlie Munger

Wal-Mart

- 1970-1971 - 43.5%

- 1971-1972 - 76%

- 1972-1973 - 60.1%

- 1973-1974 - 34%

Xpel

- 2010-2011 - 46.28%

- 2011-2012 - 76.6%

- 2012-2013 - 67.8%

- 2013-2014 - est. >60%

The results are eerily similar. We do not have Wal-Mart data pre IPO, however, we guess that Wal-Mart grew at a higher pace before the IPO than after the IPO since by 1970 Wal-Mart had 32 stores making growth rates in the first few stores would have been higher. In comparison, we can clearly see from the chart above that Xpel's growth before 2010 was actually lower as it focused on its previous business model of selling its DAP film cutting software with a much lower emphasis on marketing and distributing its films. The current business model is actually 180 degrees different by focusing on selling Xpel's PPF products and de-emphasizing DAP software sales outside Xpel sellers. Xpel's revenue growth is actually picking up steam since it refocused the business model and looks to be sustainable at much higher rates than Wal-Mart's which fell down to the 20% annually after 1974.

We doubt that Xpel will be able to sustain 25% annual growth for thirty years like Wal-Mart did (essentially reaching $20 billion in annual revenues by 2044), but Xpel does have some traits in common with the young Wal-Mart that gives it a fighting chance to continue to dominate the Paint Protection Film industry as it grows and potential to achieve above average market returns.

Clean Share Structure and Aligned Owner-Operators

At around Wal-Mart's IPO we estimate there to have been a total of approximately 1.6 million shares outstanding (Wal-Mart has undergone 11, 2:1 splits). The 300,000 shares that were issued during the IPO meant that there was a very small trading float and the share structure looks to have been clean of any stock dilution. While the micro-cap universe today could be seen as the wild west of investable assets, Xpel's share structure is one of the few public companies, regardless of size, that has a relatively small share count, low trading float with ~50% owned by insiders and zero dilution from stock options. Insider ownership is not concentrated all in one shareholder but spread out amongst executives and directors. CEO Ryan Pape owns close to 6% of the company and such a share structure conveys that management is trying to align themselves fully with creating value over the long term.

(Source: Xpel Presentation)

Above shows Xpel since Ryan Pape became CEO. Clearly the results of the management and the change in business model speaks for itself.

Competitive Advantages

For Xpel to continue growing at high rates it has to be able to fend off competition and sustain/grow its market share as the PPF market continues to grow globally. Paint protection films have reached a point where different paint films are somewhat hard to differentiate which is not too different than retail. Sam Walton showed that he was able to differentiate retail by controlling costs and creating a different distribution model. Xpel's CEO has made it clear that he is trying to build stickiness through an ecosystem of distribution, training and DAP cutting software.

First let us look at the PPF distribution model. Common amongst competitors and 3M has been for them to sell to distributors who then would sell to each installer. Customer concentration is higher under this model and more importantly the distribution model provides little support to installers after the sale. Xpel has cut out the distributor by marketing and selling directly to installers. By cutting out the distributor Xpel can provide better service to installers through installer education/support, marketing of paint protection film and ability to use its DAP cutting software. Creating an ecosystem where installers can flourish is likely to be the system that sustains majority market share. Xpel has been able to master this direct distribution model in the US, however, still relies on the distributor model internationally. This is changing, which we will highlight in the company-owned install shop section.

Many independent installers provide other services than PPF resulting in a range of installer abilities. For PPF to reach an adoption rate on par with window tint (35-40% new cars), independent installers have to be proficient in applying PPF. Keep in mind that window tinting could be considered on a level of difficulty lower than PPF since PPF is applied to larger areas of the automobile that are of different shapes. The installer pool skill set is a bottleneck in the adoption growth of PPF. Xpel goes the extra mile by providing education to installers treating them more like associates (think Wal-Mart here) and providing the skills to complete better installations. The result is an installer who performs better installs, has a better chance of satisfying customers and achieving higher business performance. At the end of the day the direct to installer model is a win-win for everyone in comparison with the distribution model.

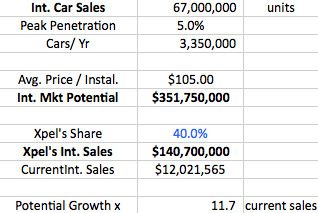

Xpel's ecosystem does not stop at education. To apply PPF an installer must have precisely cut film to install on each part of many different car models. Xpel has the DAP cutting software that has a very large database of 70,000 vehicle applications to cut precise film patterns which lowers install time and increases install precision. Xpel previously marketed this software to any installer, but now is phasing out the DAP software to non-Xpel installers. This software then becomes a sticky point for installers since having access to the largest up-to-date database would be extremely valuable. Xpel understands this edge and has a dedicated team that specifically works on designing patterns for new car models and models not in its database.

Xpel's ecosystem so far has proven to be effective in both creating sticky relationships with installers and increasing the adoption rate of PPF which currently stands at approximately 2% domestically and much less internationally. We think the company is mindfully trying to expand the ecosystem to differentiate its service over other competitors allowing it to maintain high market share many years into the future.

Company-Owned Install Shops

Over the past year Xpel has taken ownership of the vertical even further by acquiring and running a few of its own install shops in the US. These owned install shops provide the company with experience of running an install shop operation but also provides operating leverage as Xpel normally receives about $35-$120 gross margin per domestic car install. Owned install shops greatly enhance earnings potential per install and at roughly $1 million in revenue per install shop/year plus high margins, each install shop is a material addition to the company's earnings currently.

One might think that these install shops could compete with the current base of installers, however, Xpel is being opportunistic and highly selective on each location to make sure there is not any competition between its current installer base. Xpel-owned install shops have shown Xpel company installers are likely to be of higher skill set with installing as its only focus is installing paint protection film and especially Xpel's products. Even if there was a non-company-owned install shop near an Xpel-owned shop it is likely that they would not be even competing for the same customers. Dealerships want to work with the highest quality installers and since Xpel install shops would only focus on applying PPF, Xpel shops would likely be better suited to Dealer clients. Independent clients would likely be selling other services and potentially have a lower PPF installation skill set and would be targeting after market installs by enthusiasts and other consumers.

What we believe Xpel's main reason in opening these operations in the US was to test its ability to run its own operations to be replicated abroad. Xpel has been operating under the distribution model internationally so operating install shops in different markets abroad allow it to utilize the direct distribution model that it has perfected in North America. As of October 2nd, Xpelannounced that it has opened a company-owned operation in the UK. This install shop now gives the company a presence in Europe to educate installers, distribute film and market to both consumers and to installers in the area. As the company once had a distributor who sold to numerous installers in the UK, Xpel is likely to convert those installers into direct customers. Why wouldn't they as they would have Xpel's direct support instead of working with a salesman distributor. Xpel is likely to be a force to reckon with if this model proves to successfully transfer in other markets outside North America and the UK.

Valuation

Xpel is a quality company with a highly probable chance of continuing high growth, so it is a huge mistake to value this company utilizing traditional value criteria. One might look at the high trailing P/E and be turned off, however, the current price looks extremely attractive.

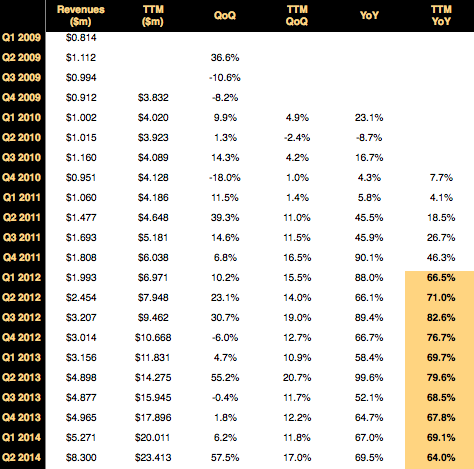

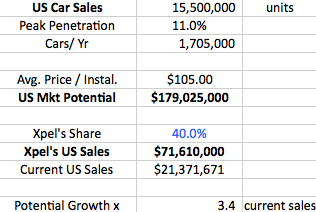

When we look at valuation we look at where the company could be trading in 5 to 10 years. Xpel management believes that PPF should be able to reach about 10-12% penetration rate or ~$180 million domestically (@11% of 15.5 million new cars sold and $105 per install for PPF). With 40% market share, which management has alluded to, Xpel could grow revenues to $71 million a year just in the domestic market. This number could be a bit conservative since window tinting has somewhere around a 35-40% penetration rate and car sales could increase over the years.

(Source: Our Calculations)

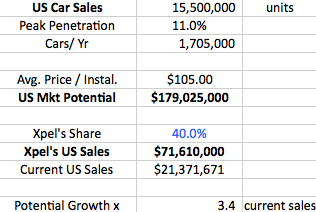

Internationally we estimate roughly 5% peak penetration rate as international market sales have a higher proportion of sales from less wealthy nations. On67 million new cars sold a year that would equal a total market for PPF at 3.3 million cars a year. Average revenue per car internationally is likely to be much higher than the domestic $105/car since pollution and sand is likely to drive full car wrap installations. To stay conservative we continue to use the same $105/car. Again, if Xpel were to maintain a 40% market share international sales would equal approximately $140 million for Xpel.

(Source: Our Calculations)

Internationally we estimate roughly 5% peak penetration rate as international market sales have a higher proportion of sales from less wealthy nations. On67 million new cars sold a year that would equal a total market for PPF at 3.3 million cars a year. Average revenue per car internationally is likely to be much higher than the domestic $105/car since pollution and sand is likely to drive full car wrap installations. To stay conservative we continue to use the same $105/car. Again, if Xpel were to maintain a 40% market share international sales would equal approximately $140 million for Xpel.

(Source: Our Calculations)

On a conservative basis domestic and international sales would then equal approximately $210 million in revenues to Xpel. At relatively moderate growth rates (23% CAGR domestic and 42% CAGR international) it would take the company approximately 6-7 years to grow to this size in revenues. Keep in mind our assumptions are based off of 2013-2014 car sales, do not take into account the overall growth in car sales over the 6-7 years' time frame and do not include revenues from owned install shops.

Xpel currently produces 12% EBIT and is likely to expand with a higher mix of owned retail stores and other operating leverage. We think a 15% EBIT would be highly conservative and 18%-20% as a possibility by year 6-7. With revenue at $210 million EBIT could be $37.8 million at 18%. Since Xpel has such high returns, 10x EBIT would be achievable so Xpel's valuation would then reach $400 in market cap by year 7. Of course there is substantial upside with higher number of cars sold in emerging markets, Xpel achieving >40% market share internationally, higher revenues per car sold internationally and higher revenues from company-owned install shops.

A quality company growing at such a high rate could fetch a 15x EBIT multiple and still not be too optimistic, so that would be ~$600 million market cap by year 7. If our opportunity cost is 25% annual returns and the FV is $600 million, the PV would be $125 million or $5 a share. The market is currently pricing Xpel at $3 a share, so with our highly conservative estimates the market is under appreciating Xpel's growth potential and quality economics by a long shot even at a very high hurdle rate of 25%.

Keep in mind this is a $77MM company and has relatively low liquidity in the US-listed shares and Canadian Venture-listed shares. These two factors of size and illiquidity alone are enough to deter institutional funds who have both too much money to invest in such a small company and look for companies with significantly higher liquidity to initiate a substantial position and potentially exit. For smaller investors and institutional investors with the structural advantage of small size and no aversion to illiquidity can essentially purchase Xpel before larger institutional investors and other investors.

Usually the market does not keep companies with these growth characteristics and earnings potential this cheap for long, so for the market to anticipate 10% annualized returns until year 7, and $600 million in future value, Xpel would have to be currently trading for $300 million or $12 a share. That is 3 times today's price and if our conservative estimate is achieved over the next 7 years an investor should theoretically be able to still achieve a 10% annualized return, potentially achieving a market beating return.

When value investors talk about margin of safety they tend to want a margin of safety in terms of value below tangible assets. In Xpel's case there are few tangible assets so it trades at a premium to tangible assets. The margin of safety is in the qualitative aspects such as business model, with an emphasis on building a sticky ecosystem, high quality incentivized management and a large growth potential. Quantitatively we estimate there is a ~40% discount to achieving a 25% compounded annual rate for another seven years with potential for additional upside.

Our estimates are not precise and not intended to be. Our estimate of $600 million in revenues by 2021 is likely to be precisely wrong. But with the margin of safety both in the qualitative and quantitative aspects, our estimates could be roughly right or wildly low. It is hard to imagine that Xpel would have fewer than $200 million in revenue in 7 years and trading at a low EBIT multiple. With the share price currently at $3 a share, with little institutional ownership, small share structure and little market following, Xpel looks to have a large margin of safety even after increasing 1,893% in the last two years.

(Source: Our Calculations)

On a conservative basis domestic and international sales would then equal approximately $210 million in revenues to Xpel. At relatively moderate growth rates (23% CAGR domestic and 42% CAGR international) it would take the company approximately 6-7 years to grow to this size in revenues. Keep in mind our assumptions are based off of 2013-2014 car sales, do not take into account the overall growth in car sales over the 6-7 years' time frame and do not include revenues from owned install shops.

Xpel currently produces 12% EBIT and is likely to expand with a higher mix of owned retail stores and other operating leverage. We think a 15% EBIT would be highly conservative and 18%-20% as a possibility by year 6-7. With revenue at $210 million EBIT could be $37.8 million at 18%. Since Xpel has such high returns, 10x EBIT would be achievable so Xpel's valuation would then reach $400 in market cap by year 7. Of course there is substantial upside with higher number of cars sold in emerging markets, Xpel achieving >40% market share internationally, higher revenues per car sold internationally and higher revenues from company-owned install shops.

A quality company growing at such a high rate could fetch a 15x EBIT multiple and still not be too optimistic, so that would be ~$600 million market cap by year 7. If our opportunity cost is 25% annual returns and the FV is $600 million, the PV would be $125 million or $5 a share. The market is currently pricing Xpel at $3 a share, so with our highly conservative estimates the market is under appreciating Xpel's growth potential and quality economics by a long shot even at a very high hurdle rate of 25%.

Keep in mind this is a $77MM company and has relatively low liquidity in the US-listed shares and Canadian Venture-listed shares. These two factors of size and illiquidity alone are enough to deter institutional funds who have both too much money to invest in such a small company and look for companies with significantly higher liquidity to initiate a substantial position and potentially exit. For smaller investors and institutional investors with the structural advantage of small size and no aversion to illiquidity can essentially purchase Xpel before larger institutional investors and other investors.

Usually the market does not keep companies with these growth characteristics and earnings potential this cheap for long, so for the market to anticipate 10% annualized returns until year 7, and $600 million in future value, Xpel would have to be currently trading for $300 million or $12 a share. That is 3 times today's price and if our conservative estimate is achieved over the next 7 years an investor should theoretically be able to still achieve a 10% annualized return, potentially achieving a market beating return.

When value investors talk about margin of safety they tend to want a margin of safety in terms of value below tangible assets. In Xpel's case there are few tangible assets so it trades at a premium to tangible assets. The margin of safety is in the qualitative aspects such as business model, with an emphasis on building a sticky ecosystem, high quality incentivized management and a large growth potential. Quantitatively we estimate there is a ~40% discount to achieving a 25% compounded annual rate for another seven years with potential for additional upside.

Our estimates are not precise and not intended to be. Our estimate of $600 million in revenues by 2021 is likely to be precisely wrong. But with the margin of safety both in the qualitative and quantitative aspects, our estimates could be roughly right or wildly low. It is hard to imagine that Xpel would have fewer than $200 million in revenue in 7 years and trading at a low EBIT multiple. With the share price currently at $3 a share, with little institutional ownership, small share structure and little market following, Xpel looks to have a large margin of safety even after increasing 1,893% in the last two years.

Acquisition Target

The Paint Protection Film industry looks highly attractive and there are a few companies with significant resources with a need for high growth verticals (MMM, Saint Gobain). While the larger paint protection film competitors have a place in the market Xpel is showing that it has the entrepreneurial spirit and skill to run circles around a competitor with billions more dollars in resources. The larger competitors likely do not see the market opportunity yet. We are fairly comfortable in guessing that Ryan Pape and other insiders have a very good grasp of what the company is worth and with their high inside ownership would only sell for the right price, in this case price much higher than today.

It is hard to gauge probabilities of timing and price of a takeover, however, we can estimate a few possibilities. For a larger company to move the needle in terms of revenues and earnings they need to purchase somewhat sizable amounts of revenue and earnings. 3M has ~$30 billion in annual revenue so a $25 million revenue stream growing at a fast rate is still only 0.08% of total revenues. The larger companies might wait until Xpel is of a larger size and its direct distribution model and the industry as a whole is clearly attractive, so it may take a few years for any possible takeover of Xpel.

A company with $100 million in revenues that is growing at high rates could be large enough to make a small material contribution to a large company. If this were to be the case with Xpel, based on our conservative estimate the company would reach $100 million in revenues by approximately year 3. Again utilizing our estimates above of 18% EBIT margin and 15x EBIT multiple the purchase price could be in the neighborhood of $300 million. A 25% hurdle rate would necessitate the company to have a present value of ~$150 million market cap or $6 a share. If institutions and market participants were highly optimistic, essentially baking in the prospects of high growth or a sale, a 10% rate would be a likely rate of return the market would expect necessitating a present value of $225 million or $9 a share.

Risks

A global recession could impact new cars sales and ultimately mute the growth of the paint protection film industry. During the Great Recession in 2009 car sales dropped to 10.4 million units sold. A recession of that magnitude could possibly send new car sales that low or lower domestically and impact international sales. Domestic PPF sales would be impacted, while international sales would likely be minimally affected since international PPF adoption is still in its infancy. Overall, we could still see Xpel growing in a recession, but at a slower pace than current rates.

Competition in the paint protection industry could increase, however, we feel that Xpel's business model will make it much harder for competitors as installers enter its growing ecosystem. On top of that Xpel is leading the way in terms of marketing to installers and consumers.

Currently paint protection film is being in large part installed on exotic cars and cars owned by enthusiasts. The adoption rate of other new car owners is growing but will be important to the company's growth in the future. If Xpel is not able to capture this large market, then growth rates will be lower than we anticipate. We think that the benefits of paint protection film are highly valuable to all car owners in the ability to retain a car's resale value and saving individuals money, preventing paint damage from many sources, while maintaining a car's appearance.

Catalysts

- Q3 could possibly be another high growth quarter, it is likely since higher marketing in the past is starting to pay off as shown in Q2, and new company owned install shops should contribute materially.

- An uplisting to a reputable stock exchange would increase investor awareness especially institutional small cap funds. Management has stated that this is not high on their priority list but could be in the next year.

- A potential takeover by a larger competitor in the paint protection film space or one who wants to enter the industry in the next few years is a possibility.

Conclusion