This Kenyan start-up is reinventing the family farm for the 21st century

More transparency between buyers and farmers

Hustle and connections

India Stands as Top Investment Among Emerging Market Consumer Plays

NEW YORK (TheStreet) -- The emerging market consumption story is compelling, but perhaps no market is as attractive as India's. According to Nick Smithie, chief investment strategist for Emerging Global Advisors, investors are "craving" reforms in emerging markets that will accelerate non-inflationary growth.

That's precisely the case in India, which has a falling fiscal deficit, declining current account deficit and falling inflation. Consumers in the country also have more money in their pockets, he said.

Don't forget about the sheer size of India's population, standing at more than 1.25 billion people. The consumption story is very compelling and will be a multi-year theme for the country, he explained.

As a result, Smithie likes EGShares India Consumer ETF (INCO) .

But there will be investors who don't want to buy into just India. That's why there's also EGShares Emerging Markets Consumer ETF (ECON) . With over $1 billion in assets, it's a "concentrated fund based upon the consumer staples and consumer discretionary sectors," he said.

The ETF is diversified by country and gives investors direct exposure to emerging market consumers, with 30 large cap stocks.

For those investors who want more diversity, but still want exposure to the emerging market consumer, they can consider theEGShares Emerging Markets Domestic Demand ETF (EMDD) .

While maintaining exposure to the consumer discretionary and consumer staples sectors, investors will also gain exposure to the healthcare, utilities and telecom industries, Smithie concluded.

All three ETFs are positive over the past year, with the EMDD and ECON up 12.2% and 5.35%, respectively. The INCO has performed the best, up a robust 64% in the past 12 months.

Rothschild Seeks Partners in Fast-Growing African Markets

NM Rothschild & Sons Ltd., the world’s largest family-owned financial advisory firm, is seeking partners in Africa’s largest economies to help it seize opportunities as growth accelerates.

Rothschild doesn’t intend to have African offices outside of Johannesburg, “so we either have to work from a distance and fly in and out or have partners -- we plan to do both,” Martin Kingston, its deputy executive chairman in South Africa, said in a phone interview from the city on Oct. 10.

Key markets for Rothschild include some of the continent’s fastest-growing, in Nigeria, Kenya, Angola, Tanzania, Mozambique and Ivory Coast, Kingston said. Sub-Saharan Africa’s economic expansion is forecast at 5.8 percent next year from 5.1 percent this year, according to the International Monetary Fund’s latest research. Nigeria may grow 7.3 percent in 2015 while Ivory Coast may top 7.9 percent, the IMF said Oct. 7.

“There is a huge amount of money being mobilized for Africa and there’s going to be significant opportunities to provide support and advice,” Kingston said. The industries Rothschild is focusing on include financial services -- both banks and insurers -- infrastructure, telecommunications, consumer and retail, plus natural resources.

“Where we have clients that see opportunities in Africa, we’ll work with them,” Kingston said, giving Rothschild’s work with Rio Tinto Plc (RIO) in Guinea and Vodacom Group Ltd. in the Democratic Republic of the Congo as examples. “Where we have particular expertise, like ratings advisory work, we will fly in and out.”

NEW YORK (TheStreet) -- The emerging market consumption story is compelling, but perhaps no market is as attractive as India's. According to Nick Smithie, chief investment strategist for Emerging Global Advisors, investors are "craving" reforms in emerging markets that will accelerate non-inflationary growth.

That's precisely the case in India, which has a falling fiscal deficit, declining current account deficit and falling inflation. Consumers in the country also have more money in their pockets, he said.

Don't forget about the sheer size of India's population, standing at more than 1.25 billion people. The consumption story is very compelling and will be a multi-year theme for the country, he explained.

As a result, Smithie likes EGShares India Consumer ETF (INCO) .

But there will be investors who don't want to buy into just India. That's why there's also EGShares Emerging Markets Consumer ETF (ECON) . With over $1 billion in assets, it's a "concentrated fund based upon the consumer staples and consumer discretionary sectors," he said.

The ETF is diversified by country and gives investors direct exposure to emerging market consumers, with 30 large cap stocks.

For those investors who want more diversity, but still want exposure to the emerging market consumer, they can consider theEGShares Emerging Markets Domestic Demand ETF (EMDD) .

While maintaining exposure to the consumer discretionary and consumer staples sectors, investors will also gain exposure to the healthcare, utilities and telecom industries, Smithie concluded.

All three ETFs are positive over the past year, with the EMDD and ECON up 12.2% and 5.35%, respectively. The INCO has performed the best, up a robust 64% in the past 12 months.

Rothschild Seeks Partners in Fast-Growing African Markets

African Experience

Rothschild was recently the sole financial adviser to OCP Group ofMorocco on its debut bond. It has also advised Vodacom Group Ltd. on its 7 billion rand ($630 million) acquisition of Internet provider Neotel (Pty) Ltd. in South Africa and worked with the government of Ivory Coast on its inaugural $750 million Eurobond issue.

“I think you will find that there are many more bonds coming,” Kingston said. “There is an appetite.”

Rothschild said on Sept. 30 it had hired Trevor Manuel, who was South Africa’s finance minister for 13 years, as a non-executive senior adviser globally and a non-executive deputy chairman in South Africa, to help the firm meet client needs and identify opportunities across the continent.

To contact the reporter on this story: Renee Bonorchis in Johannesburg at rbonorchis@bloomberg.net

To contact the editors responsible for this story: Dale Crofts atdcrofts@bloomberg.net John Viljoen, Cindy Roberts

MTN Group: The Emerging Market Rally Is Just Getting Started

Mar. 28, 2014 11:32 AM ET | About: MTNOY, Includes: AXTE, EEM, EMES, EZA, IST, IXP, TSLA

As we reach the end of the first quarter, Tesla Motors (TSLA) is leading the pack in the Best Stocks of 2014 contest with a massive 48% gain, followed by Emerge Energy Services LP (EMES) at 27%. Not too shabby given that the S&P 500 is barely positive on the year.

My pick for 2014 - South African mobile phone giant MTN Group(OTCPK:MTNOY) is off to a slower start, down about 2%. But with nine months left in 2014, I expect MTNOY stock to make a serious run for the top spot. And in fact, in the month of March, it has been the second-best-performing stock in the contest after EMES.

This year has been a rough one for emerging markets. First, there was the "mini-crisis" in the Argentine peso and waves of protests sweeping Venezuela. Then, there was the Ukraine political crisis that resulted in Russia effectively stealing the Crimean peninsula, and fears that China was about to have a "Lehman moment" that would see its capital markets collapse.

And finally, in the most bizarre of the lot, there is the corruption scandal engulfing Turkish Prime Minister Recep Tayyip Erdogan, in which Erdogan responded to his attackers by threatening to "eradicate" Twitter (TWTR), Facebook (FB) and YouTube (GOOG).

MTNOY's home country wasn't immune either. South Africa is in the midst of an election season that has seen President Zuma raked over the coals for using excessive public funds to upgrade his personal residence. The African National Congress is facing its most difficult election in the post-Apartheid era.

Yet an interesting thing happened. While the news stories have gone from bad to worse, most emerging markets have been quietly enjoying a rally since early February. The iShares MSCI Emerging Markets ETF (EEM) is up about 7%, and the iShares MSCI South Africa ETF (EZA) is up fully 17%.

So, what gives? Did the problems plaguing emerging markets - unsustainable current account deficits, unstable governments, weak domestic demand, etc. - spontaneously resolve themselves?

Not exactly. A more reasonable explanation is that the selling simply exhausted itself and that the bad news has already been priced in. Fund outflows from emerging markets are at their highest levels since the 2008 crisis.

As an asset class, emerging markets are cheap and under-owned and, for the most part, still completely despised by the investing public - making them a virtual textbook example of the perfect contrarian investment opportunity.

I believe that emerging markets are the single best asset class for the remainder of 2014. And as a leading mobile carrier in Africa - one of the fastest-growing regions in the world - MTN Group is in excellent position to ride that wave.

Let's review the bullish arguments for MTNOY:

As we reach the end of the first quarter, Tesla Motors (TSLA) is leading the pack in the Best Stocks of 2014 contest with a massive 48% gain, followed by Emerge Energy Services LP (EMES) at 27%. Not too shabby given that the S&P 500 is barely positive on the year.

My pick for 2014 - South African mobile phone giant MTN Group(OTCPK:MTNOY) is off to a slower start, down about 2%. But with nine months left in 2014, I expect MTNOY stock to make a serious run for the top spot. And in fact, in the month of March, it has been the second-best-performing stock in the contest after EMES.

This year has been a rough one for emerging markets. First, there was the "mini-crisis" in the Argentine peso and waves of protests sweeping Venezuela. Then, there was the Ukraine political crisis that resulted in Russia effectively stealing the Crimean peninsula, and fears that China was about to have a "Lehman moment" that would see its capital markets collapse.

And finally, in the most bizarre of the lot, there is the corruption scandal engulfing Turkish Prime Minister Recep Tayyip Erdogan, in which Erdogan responded to his attackers by threatening to "eradicate" Twitter (TWTR), Facebook (FB) and YouTube (GOOG).

MTNOY's home country wasn't immune either. South Africa is in the midst of an election season that has seen President Zuma raked over the coals for using excessive public funds to upgrade his personal residence. The African National Congress is facing its most difficult election in the post-Apartheid era.

Yet an interesting thing happened. While the news stories have gone from bad to worse, most emerging markets have been quietly enjoying a rally since early February. The iShares MSCI Emerging Markets ETF (EEM) is up about 7%, and the iShares MSCI South Africa ETF (EZA) is up fully 17%.

So, what gives? Did the problems plaguing emerging markets - unsustainable current account deficits, unstable governments, weak domestic demand, etc. - spontaneously resolve themselves?

Not exactly. A more reasonable explanation is that the selling simply exhausted itself and that the bad news has already been priced in. Fund outflows from emerging markets are at their highest levels since the 2008 crisis.

As an asset class, emerging markets are cheap and under-owned and, for the most part, still completely despised by the investing public - making them a virtual textbook example of the perfect contrarian investment opportunity.

I believe that emerging markets are the single best asset class for the remainder of 2014. And as a leading mobile carrier in Africa - one of the fastest-growing regions in the world - MTN Group is in excellent position to ride that wave.

Let's review the bullish arguments for MTNOY:

- It's the dominant mobile provider in the last great frontier market: Africa.

- It provides a service that is essential to the lives of the new African middle classes.

- Its markets are far from saturated, and it has virtually unlimited growth potential due to the inevitable shift to smartphones and higher-margin data plans; only about a third of MTN's subscribers currently use data.

- It's very reasonably priced and pays a high and growing dividend; MTNOY stock has a dividend yield of 4.8%.

- MTNOY stock trades at a reasonable price/earnings ratio of 14.

If you haven't picked up MTNOY stock yet, it's not too late. Though it has rallied off its recent lows, I believe we are still in the early stages of a multi-year rally in emerging market stocks.

Disclaimer: This site is for informational purposes only and should not be considered specific investment advice or as a solicitation to buy or sell any securities. Sizemore Capital personnel and clients will often have an interest in the securities mentioned. There is risk in any investment in traded securities, and all Sizemore Capital investment strategies have the possibility of loss. Past performance is no guarantee of future results.

Editor's notes: With a big 2015 looming as it enters non-mobile markets, CEVA is priced for gains. Tech fund manager Edward Schneider sees a potential double over the next 18 months.

Based in Mountain View, CA with R&D in Israel, CEVA (CEVA) designs/licenses digital signal processor (DSP) cores and platforms primarily to the mobile industry. DSPs mathematically modify and improve signal quality, including the conversion of analog signals to digital, and vice-versa. CEVA mainly serves the mobile phone baseband market, but is increasing its footprint in wireless infrastructure (M2M), audio, imaging, and automotive.

Based in Mountain View, CA with R&D in Israel, CEVA (CEVA) designs/licenses digital signal processor (DSP) cores and platforms primarily to the mobile industry. DSPs mathematically modify and improve signal quality, including the conversion of analog signals to digital, and vice-versa. CEVA mainly serves the mobile phone baseband market, but is increasing its footprint in wireless infrastructure (M2M), audio, imaging, and automotive.

CEVA is the #1 licensor of DSP cores and platforms, three times larger than its closest peer. 5B CEVA-powered devices have been shipped to date, including 900M handsets in 2013. CEVA has Intel (INTC), Broadcom (BRCM), Samsung (OTC:SSNLF), Infineon (OTCQX:IFNNY), and other major semiconductor companies as licensees, with the notable exception of Qualcomm (QCOM) and MediaTek (2454.TW) for now. Several years ago, then market-leader, Texas Instruments (TXN), closed its external DSP business, creating an opening for CEVA. Since then, DSP requirements have become increasingly onerous and expensive for semiconductor manufacturers to maintain, leading most of them to outsource their DSP chip design to CEVA.

CEVA has a highly profitable and scalable business model based on royalties on every unit shipped (either fixed at $0.03 per unit on average or ~1% of chip price), and upfront license fees and support. Royalties accounted for 54% of 2013 revenues, and licensing 46%. The beauty of CEVA's ~90% GM business model is that incremental gross-margin revenue from royalties falls to the bottom line.

CEVA's high-growth trend was interrupted in 2012-2013 by 1) declines in cheap 2G mobile phone sales where CEVA had dominant market share, 2) related declines in 2G mobile royalties to $0.01 - $0.02 per unit, 3) Nokia (NOK) business decline whose mobile phones used CEVA DSP cores, and 4) the delayed launch of low-cost smart phones. In the second half of 2013, however, sub-$100 3G smart phones were introduced in China for as low as $30, which bodes well for 2014. Baseband growth in low-cost Chinese smartphones (e.g. Samsung's Galaxy models selling for $35) should be CEVA's largest growth driver in 2014. A second growth driver is the 4G LTE market which only has 2% penetration today. Samsung and Intel are now shipping multi-mode smartphones powered by CEVA. Also, the recent MediaTek acquisition of Via, a CEVA client, may help CEVA break into MediaTek for LTE chips.

CEVA is the #1 licensor of DSP cores and platforms, three times larger than its closest peer. 5B CEVA-powered devices have been shipped to date, including 900M handsets in 2013. CEVA has Intel (INTC), Broadcom (BRCM), Samsung (OTC:SSNLF), Infineon (OTCQX:IFNNY), and other major semiconductor companies as licensees, with the notable exception of Qualcomm (QCOM) and MediaTek (2454.TW) for now. Several years ago, then market-leader, Texas Instruments (TXN), closed its external DSP business, creating an opening for CEVA. Since then, DSP requirements have become increasingly onerous and expensive for semiconductor manufacturers to maintain, leading most of them to outsource their DSP chip design to CEVA.

CEVA has a highly profitable and scalable business model based on royalties on every unit shipped (either fixed at $0.03 per unit on average or ~1% of chip price), and upfront license fees and support. Royalties accounted for 54% of 2013 revenues, and licensing 46%. The beauty of CEVA's ~90% GM business model is that incremental gross-margin revenue from royalties falls to the bottom line.

CEVA's high-growth trend was interrupted in 2012-2013 by 1) declines in cheap 2G mobile phone sales where CEVA had dominant market share, 2) related declines in 2G mobile royalties to $0.01 - $0.02 per unit, 3) Nokia (NOK) business decline whose mobile phones used CEVA DSP cores, and 4) the delayed launch of low-cost smart phones. In the second half of 2013, however, sub-$100 3G smart phones were introduced in China for as low as $30, which bodes well for 2014. Baseband growth in low-cost Chinese smartphones (e.g. Samsung's Galaxy models selling for $35) should be CEVA's largest growth driver in 2014. A second growth driver is the 4G LTE market which only has 2% penetration today. Samsung and Intel are now shipping multi-mode smartphones powered by CEVA. Also, the recent MediaTek acquisition of Via, a CEVA client, may help CEVA break into MediaTek for LTE chips.

CEVA, $M

2010

2011

2012

2013

2014e§

2015e§

Licensing Revenues

18.4

20.2

19.1

22.4

25.0

26.0

Royalty Revenues

22.9

36.4

32.0

26.5

28.0

40.0

Total Revenues

44.9

60.2

53.7

48.9

53.0

66.0

Gross Profit

41.2

56.7

49.7

43.7

48.0

61.5

as % of revenues

91.7%

94.1%

92.6%

89.4%

90.6%

93.2%

EBITDA

10.4

19.1

12.9

5.4

14.0

22.0

as % of revenues

23.2%

31.7%

24.0%

11.1%

25.9%

33.3%

Non-GAAP EPS

0.56

0.97

0.79

0.54

0.84

1.10

GAAP EPS

0.51

0.77

0.59

0.30

0.60

0.86

* includes other revenues of $3.7M in 2010, $3.6M in 2011, & $2.6M in 2012; §Consensus: 2014 revs: $51.5M, 2014 GAAP EPS: 0.60, 2014 EBITDA: $14M, 2015 revs: $58M, 2015 EBITDA: $19M, 2015 GAAP EPS: 0.76

A long-awaited growth driver for CEVA has been penetrating non-mobile sectors, which diversifies its revenue base into some secular growth areas. The only problem is that these niches pale in size to the mobile baseband business. Finally, CEVA appears to be making some real progress in this area by announcing a larger-than-expected number of broad-based licensing wins in Q4 2013. Eight of the eleven 2013 Q4 licensing deals were non-baseband in fast-growing markets, and apart from two Bluetooth deals, had premium royalty potential. Also, the average dollar value of the non-baseband deals was in line with the baseband deals.

CEVA's 2013 Q4 could be a turning point. Total revenues of $14M rose 40% sequentially, and 8% y-o-y. Royalties advanced 11% sequentially from a Q3 trough to $6.7M, after a long downtrend that started in 2012 Q1. Licensing revenues in Q4 were a record $7.3M, up 84% sequentially and 52% y-o-y. Licensing revenue momentum continued into the month of January. Licensing revenue eventually turns into royalty income. Thus, medium-term visibility to rebounding revenues and profits improved dramatically.

CEVA is by no means out of the woods. Management guided down consensus estimates for a seasonally soft 2014 Q1. CEVA's 2013 Q4 handset exposure was 60% feature phones and 40% smartphones. While feature phone exposure decreased from over 70% at the beginning of the year, CEVA is still sensitive in the short term to feature phone market erosion, as well as smartphone launch delays. But by the time this short-term volatility issues disappear, CEVA stock should be much higher than today. Not surprisingly, CEVA shares jumped 10% in the first two trading days after CEVA reported before the open on January 30, and have roughly maintained those gains since then. This is the first-leg in what could be a larger rebound after the Street gets on board.

The tipping point is still a ways off, but visibility is improving. Aided by non-mobile phone baseband applications and low-cost smartphones, the number of CEVA-powered devices will move from 3B in 2012 to 7B in 2016 according to management. 4B incremental devices x $0.03 average royalty rate = $120M in revenues that drop to the bottom line. This would have a major impact on CEVA with just $49M in 2013 revenues.

How much upside does CEVA shares have from here? I see 2015 as a break-out year for CEVA, well above the consensus forecasts. I am less certain about 2014 as there are still some handset transition issues that can weigh on CEVA's 2014 results. Viewed another way, CEVA stock was trading above $30 in January 2012 when revenues and EPS peaked at $60M and 0.77, respectively. I am forecasting a strong rebound in 2015, with revenues of $66M and EPS of $0.86. CEVA shares are at $17.22 today, they would double over the next 18 months using the same multiples and growth rates that the market applied to CEVA two years ago.

The risk that management can control is execution. CEVA needs to continue licensing momentum to build a diversified yet robust base for sustainable long-term growth. The uncontrollable variable is the mobile phone market - will Samsung (CEVA's customer) continue to gain market share at the expense of Apple (AAPL)? In any case, if management fails or the market disappoints, CEVA will be penalized by its stock-based compensation program that takes a big chunk out of years with weak profits like 2013. In other words, CEVA's prospects today have to be that much stronger to compensate for an aggressive ESOP relative to its current small net profit base.

The risk that management can control is execution. CEVA needs to continue licensing momentum to build a diversified yet robust base for sustainable long-term growth. The uncontrollable variable is the mobile phone market - will Samsung (CEVA's customer) continue to gain market share at the expense of Apple (AAPL)? In any case, if management fails or the market disappoints, CEVA will be penalized by its stock-based compensation program that takes a big chunk out of years with weak profits like 2013. In other words, CEVA's prospects today have to be that much stronger to compensate for an aggressive ESOP relative to its current small net profit base.

Company Ticker

Price

2/19/14

MktVal

EV/LTM

Revs

EV/LTM

EBITDA

Price/

LTM EPS

GM

EBITDAMargin

EBITDA % chg '14 ARM ARMH $46.07 $22.2B 17.8x 45.7x 127.9x 94.5% 39.6% +51% Immersion IMMR $11.36

$325M

5.9x 37.0x 82.6x 94.9% 15.9% +78% Imagination IMG.L £1.83 $808M 3.0x 28.3x Loss 87.2% 10.8% +70% Peer Avg. 8.9x 37.0x 105.3x 92.2% 22.1% +66% CEVA CEVA $17.22 $379M 5.0x 45.0x 57.4x 89.4% 11.1% +158%

Currently priced at $17.22, CEVA shares have a market cap of $379M, and after deducting net cash and equivalents of $134M, have an enterprise value of $244M. CEVA shares rose 13% year to date, after declining 3% in 2013 and dropping 48% in 2012. CEVA shares are fully valued on an absolute basis using 2013 figures, trading at EV/revenues of 5.0x, EV/EBITDA of 45.0x, and a P/E of 57.4x. Based on 2015 figures, the numbers are more attractive with EV/revenues of 3.7x, EV/EBITDA of 11.1X, and a P/E of 20.0x. CEVA is attractively valued versus its direct peers. The premium valuations of CEVA and its few public peers are merited in light of their well protected, scalable and profitable royalty/licensing business model. ARM Holdings and Immersion are the most direct comparisons, while Imagination Technologies had major operational shortfalls in 2013 and has a more levered balance sheet.

CEVA's unique, protected and profitable business model was coveted by Wall Street in 2010-2011, and will be attracting similar interest again as positive trends initiated in Q4 2013 become more prevalent. What is not in the price today, are watershed results starting next year. The Street will need further confirmations of positive 2013 trends that became more pronounced in Q4. Some investors are looking at current subpar royalty revenues (which actually reflect customer sales from the previous quarter). But by the time that analysts tweak their models/price targets and royalties rise, CEVA shares should be much higher. While it is not a lock, recent positive operating trends should continue as 1) positive licensing momentum continues into the current quarter, and 2) today's licensing revenue strength turns into future royalty streams. Thus, CEVA has an attractive risk-reward tradeoff.

By Edward Schneider

Source:http://seekingalpha.com/article/2038623-ceva-a-good-time-to-buy

My pick for 2014 - South African mobile phone giant MTN Group(OTCPK:MTNOY) is off to a slower start, down about 2%. But with nine months left in 2014, I expect MTNOY stock to make a serious run for the top spot. And in fact, in the month of March, it has been the second-best-performing stock in the contest after EMES.

This year has been a rough one for emerging markets. First, there was the "mini-crisis" in the Argentine peso and waves of protests sweeping Venezuela. Then, there was the Ukraine political crisis that resulted in Russia effectively stealing the Crimean peninsula, and fears that China was about to have a "Lehman moment" that would see its capital markets collapse.

And finally, in the most bizarre of the lot, there is the corruption scandal engulfing Turkish Prime Minister Recep Tayyip Erdogan, in which Erdogan responded to his attackers by threatening to "eradicate" Twitter (TWTR), Facebook (FB) and YouTube (GOOG).

MTNOY's home country wasn't immune either. South Africa is in the midst of an election season that has seen President Zuma raked over the coals for using excessive public funds to upgrade his personal residence. The African National Congress is facing its most difficult election in the post-Apartheid era.

Yet an interesting thing happened. While the news stories have gone from bad to worse, most emerging markets have been quietly enjoying a rally since early February. The iShares MSCI Emerging Markets ETF (EEM) is up about 7%, and the iShares MSCI South Africa ETF (EZA) is up fully 17%.

So, what gives? Did the problems plaguing emerging markets - unsustainable current account deficits, unstable governments, weak domestic demand, etc. - spontaneously resolve themselves?

Not exactly. A more reasonable explanation is that the selling simply exhausted itself and that the bad news has already been priced in. Fund outflows from emerging markets are at their highest levels since the 2008 crisis.

As an asset class, emerging markets are cheap and under-owned and, for the most part, still completely despised by the investing public - making them a virtual textbook example of the perfect contrarian investment opportunity.

I believe that emerging markets are the single best asset class for the remainder of 2014. And as a leading mobile carrier in Africa - one of the fastest-growing regions in the world - MTN Group is in excellent position to ride that wave.

Let's review the bullish arguments for MTNOY:

- It's the dominant mobile provider in the last great frontier market: Africa.

- It provides a service that is essential to the lives of the new African middle classes.

- Its markets are far from saturated, and it has virtually unlimited growth potential due to the inevitable shift to smartphones and higher-margin data plans; only about a third of MTN's subscribers currently use data.

- It's very reasonably priced and pays a high and growing dividend; MTNOY stock has a dividend yield of 4.8%.

- MTNOY stock trades at a reasonable price/earnings ratio of 14.

If you haven't picked up MTNOY stock yet, it's not too late. Though it has rallied off its recent lows, I believe we are still in the early stages of a multi-year rally in emerging market stocks.

Disclaimer: This site is for informational purposes only and should not be considered specific investment advice or as a solicitation to buy or sell any securities. Sizemore Capital personnel and clients will often have an interest in the securities mentioned. There is risk in any investment in traded securities, and all Sizemore Capital investment strategies have the possibility of loss. Past performance is no guarantee of future results.

Editor's notes: With a big 2015 looming as it enters non-mobile markets, CEVA is priced for gains. Tech fund manager Edward Schneider sees a potential double over the next 18 months.

Based in Mountain View, CA with R&D in Israel, CEVA (CEVA) designs/licenses digital signal processor (DSP) cores and platforms primarily to the mobile industry. DSPs mathematically modify and improve signal quality, including the conversion of analog signals to digital, and vice-versa. CEVA mainly serves the mobile phone baseband market, but is increasing its footprint in wireless infrastructure (M2M), audio, imaging, and automotive.

CEVA is the #1 licensor of DSP cores and platforms, three times larger than its closest peer. 5B CEVA-powered devices have been shipped to date, including 900M handsets in 2013. CEVA has Intel (INTC), Broadcom (BRCM), Samsung (OTC:SSNLF), Infineon (OTCQX:IFNNY), and other major semiconductor companies as licensees, with the notable exception of Qualcomm (QCOM) and MediaTek (2454.TW) for now. Several years ago, then market-leader, Texas Instruments (TXN), closed its external DSP business, creating an opening for CEVA. Since then, DSP requirements have become increasingly onerous and expensive for semiconductor manufacturers to maintain, leading most of them to outsource their DSP chip design to CEVA.

CEVA is the #1 licensor of DSP cores and platforms, three times larger than its closest peer. 5B CEVA-powered devices have been shipped to date, including 900M handsets in 2013. CEVA has Intel (INTC), Broadcom (BRCM), Samsung (OTC:SSNLF), Infineon (OTCQX:IFNNY), and other major semiconductor companies as licensees, with the notable exception of Qualcomm (QCOM) and MediaTek (2454.TW) for now. Several years ago, then market-leader, Texas Instruments (TXN), closed its external DSP business, creating an opening for CEVA. Since then, DSP requirements have become increasingly onerous and expensive for semiconductor manufacturers to maintain, leading most of them to outsource their DSP chip design to CEVA.

CEVA has a highly profitable and scalable business model based on royalties on every unit shipped (either fixed at $0.03 per unit on average or ~1% of chip price), and upfront license fees and support. Royalties accounted for 54% of 2013 revenues, and licensing 46%. The beauty of CEVA's ~90% GM business model is that incremental gross-margin revenue from royalties falls to the bottom line.

CEVA's high-growth trend was interrupted in 2012-2013 by 1) declines in cheap 2G mobile phone sales where CEVA had dominant market share, 2) related declines in 2G mobile royalties to $0.01 - $0.02 per unit, 3) Nokia (NOK) business decline whose mobile phones used CEVA DSP cores, and 4) the delayed launch of low-cost smart phones. In the second half of 2013, however, sub-$100 3G smart phones were introduced in China for as low as $30, which bodes well for 2014. Baseband growth in low-cost Chinese smartphones (e.g. Samsung's Galaxy models selling for $35) should be CEVA's largest growth driver in 2014. A second growth driver is the 4G LTE market which only has 2% penetration today. Samsung and Intel are now shipping multi-mode smartphones powered by CEVA. Also, the recent MediaTek acquisition of Via, a CEVA client, may help CEVA break into MediaTek for LTE chips.

CEVA, $M

|

2010

|

2011

|

2012

|

2013

|

2014e§

|

2015e§

|

Licensing Revenues

|

18.4

|

20.2

|

19.1

|

22.4

|

25.0

|

26.0

|

Royalty Revenues

|

22.9

|

36.4

|

32.0

|

26.5

|

28.0

|

40.0

|

Total Revenues

|

44.9

|

60.2

|

53.7

|

48.9

|

53.0

|

66.0

|

Gross Profit

|

41.2

|

56.7

|

49.7

|

43.7

|

48.0

|

61.5

|

as % of revenues

|

91.7%

|

94.1%

|

92.6%

|

89.4%

|

90.6%

|

93.2%

|

EBITDA

|

10.4

|

19.1

|

12.9

|

5.4

|

14.0

|

22.0

|

as % of revenues

|

23.2%

|

31.7%

|

24.0%

|

11.1%

|

25.9%

|

33.3%

|

Non-GAAP EPS

|

0.56

|

0.97

|

0.79

|

0.54

|

0.84

|

1.10

|

GAAP EPS

|

0.51

|

0.77

|

0.59

|

0.30

|

0.60

|

0.86

|

* includes other revenues of $3.7M in 2010, $3.6M in 2011, & $2.6M in 2012; §Consensus: 2014 revs: $51.5M, 2014 GAAP EPS: 0.60, 2014 EBITDA: $14M, 2015 revs: $58M, 2015 EBITDA: $19M, 2015 GAAP EPS: 0.76

A long-awaited growth driver for CEVA has been penetrating non-mobile sectors, which diversifies its revenue base into some secular growth areas. The only problem is that these niches pale in size to the mobile baseband business. Finally, CEVA appears to be making some real progress in this area by announcing a larger-than-expected number of broad-based licensing wins in Q4 2013. Eight of the eleven 2013 Q4 licensing deals were non-baseband in fast-growing markets, and apart from two Bluetooth deals, had premium royalty potential. Also, the average dollar value of the non-baseband deals was in line with the baseband deals.

CEVA's 2013 Q4 could be a turning point. Total revenues of $14M rose 40% sequentially, and 8% y-o-y. Royalties advanced 11% sequentially from a Q3 trough to $6.7M, after a long downtrend that started in 2012 Q1. Licensing revenues in Q4 were a record $7.3M, up 84% sequentially and 52% y-o-y. Licensing revenue momentum continued into the month of January. Licensing revenue eventually turns into royalty income. Thus, medium-term visibility to rebounding revenues and profits improved dramatically.

CEVA is by no means out of the woods. Management guided down consensus estimates for a seasonally soft 2014 Q1. CEVA's 2013 Q4 handset exposure was 60% feature phones and 40% smartphones. While feature phone exposure decreased from over 70% at the beginning of the year, CEVA is still sensitive in the short term to feature phone market erosion, as well as smartphone launch delays. But by the time this short-term volatility issues disappear, CEVA stock should be much higher than today. Not surprisingly, CEVA shares jumped 10% in the first two trading days after CEVA reported before the open on January 30, and have roughly maintained those gains since then. This is the first-leg in what could be a larger rebound after the Street gets on board.

The tipping point is still a ways off, but visibility is improving. Aided by non-mobile phone baseband applications and low-cost smartphones, the number of CEVA-powered devices will move from 3B in 2012 to 7B in 2016 according to management. 4B incremental devices x $0.03 average royalty rate = $120M in revenues that drop to the bottom line. This would have a major impact on CEVA with just $49M in 2013 revenues.

How much upside does CEVA shares have from here? I see 2015 as a break-out year for CEVA, well above the consensus forecasts. I am less certain about 2014 as there are still some handset transition issues that can weigh on CEVA's 2014 results. Viewed another way, CEVA stock was trading above $30 in January 2012 when revenues and EPS peaked at $60M and 0.77, respectively. I am forecasting a strong rebound in 2015, with revenues of $66M and EPS of $0.86. CEVA shares are at $17.22 today, they would double over the next 18 months using the same multiples and growth rates that the market applied to CEVA two years ago.

The risk that management can control is execution. CEVA needs to continue licensing momentum to build a diversified yet robust base for sustainable long-term growth. The uncontrollable variable is the mobile phone market - will Samsung (CEVA's customer) continue to gain market share at the expense of Apple (AAPL)? In any case, if management fails or the market disappoints, CEVA will be penalized by its stock-based compensation program that takes a big chunk out of years with weak profits like 2013. In other words, CEVA's prospects today have to be that much stronger to compensate for an aggressive ESOP relative to its current small net profit base.

| Company | Ticker |

Price

2/19/14 |

MktVal

|

EV/LTM

Revs |

EV/LTM

EBITDA |

Price/

LTM EPS | GM |

EBITDAMargin

| EBITDA % chg '14 |

| ARM | ARMH | $46.07 | $22.2B | 17.8x | 45.7x | 127.9x | 94.5% | 39.6% | +51% |

| Immersion | IMMR | $11.36 |

$325M

| 5.9x | 37.0x | 82.6x | 94.9% | 15.9% | +78% |

| Imagination | IMG.L | £1.83 | $808M | 3.0x | 28.3x | Loss | 87.2% | 10.8% | +70% |

| Peer Avg. | 8.9x | 37.0x | 105.3x | 92.2% | 22.1% | +66% | |||

| CEVA | CEVA | $17.22 | $379M | 5.0x | 45.0x | 57.4x | 89.4% | 11.1% | +158% |

Currently priced at $17.22, CEVA shares have a market cap of $379M, and after deducting net cash and equivalents of $134M, have an enterprise value of $244M. CEVA shares rose 13% year to date, after declining 3% in 2013 and dropping 48% in 2012. CEVA shares are fully valued on an absolute basis using 2013 figures, trading at EV/revenues of 5.0x, EV/EBITDA of 45.0x, and a P/E of 57.4x. Based on 2015 figures, the numbers are more attractive with EV/revenues of 3.7x, EV/EBITDA of 11.1X, and a P/E of 20.0x. CEVA is attractively valued versus its direct peers. The premium valuations of CEVA and its few public peers are merited in light of their well protected, scalable and profitable royalty/licensing business model. ARM Holdings and Immersion are the most direct comparisons, while Imagination Technologies had major operational shortfalls in 2013 and has a more levered balance sheet.

CEVA's unique, protected and profitable business model was coveted by Wall Street in 2010-2011, and will be attracting similar interest again as positive trends initiated in Q4 2013 become more prevalent. What is not in the price today, are watershed results starting next year. The Street will need further confirmations of positive 2013 trends that became more pronounced in Q4. Some investors are looking at current subpar royalty revenues (which actually reflect customer sales from the previous quarter). But by the time that analysts tweak their models/price targets and royalties rise, CEVA shares should be much higher. While it is not a lock, recent positive operating trends should continue as 1) positive licensing momentum continues into the current quarter, and 2) today's licensing revenue strength turns into future royalty streams. Thus, CEVA has an attractive risk-reward tradeoff.

By Edward Schneider

Source:http://seekingalpha.com/article/2038623-ceva-a-good-time-to-buy

Bitcoin Spawns China Virtual IPOs as U.S. Scrutiny Grows

By - Aug 21, 2013

The Bitcoin craze is reaching new heights in China.

Sun Minjie is a 28-year-old Internet worker who lives in Beijing. Eager to profit from growing demand for the digital currency, Sun has invested more than $3,000 in a company called 796 Xchange Ltd., an online exchange for trading stocks and other financial instruments related to Bitcoin, where initial public offerings are also being held.

He’s part of a small but growing group of investors in China who have put the country into contention with the U.S. as the biggest downloader of the virtual money that’s being used to buy a growing range of goods and services online. While intensified scrutiny by U.S. regulators casts doubt on the currency’s future there, China’s Bitcoin industry is expanding.

“What’s worrisome is that a lot of people could be just treating it as a speculative investment,” said Peter Pak, head of trading of BOCI Securities Ltd. in Hong Kong. “In China, the stock market, property and bond market are all not so good, so people get really excited when they hear of a new investment that generates high returns.”

Sun’s outlay of about 28 Bitcoins -- or $3,108 -- for more than 400 shares in 796 Xchange has returned about 46 percent since the stock’s Aug. 1 debut on the company’s own website. The benchmark Shanghai Composite Index (SHCOMP) has only gained about 2 percent during the same period.

The Bitcoin craze is reaching new heights in China.

Sun Minjie is a 28-year-old Internet worker who lives in Beijing. Eager to profit from growing demand for the digital currency, Sun has invested more than $3,000 in a company called 796 Xchange Ltd., an online exchange for trading stocks and other financial instruments related to Bitcoin, where initial public offerings are also being held.

He’s part of a small but growing group of investors in China who have put the country into contention with the U.S. as the biggest downloader of the virtual money that’s being used to buy a growing range of goods and services online. While intensified scrutiny by U.S. regulators casts doubt on the currency’s future there, China’s Bitcoin industry is expanding.

“What’s worrisome is that a lot of people could be just treating it as a speculative investment,” said Peter Pak, head of trading of BOCI Securities Ltd. in Hong Kong. “In China, the stock market, property and bond market are all not so good, so people get really excited when they hear of a new investment that generates high returns.”

Sun’s outlay of about 28 Bitcoins -- or $3,108 -- for more than 400 shares in 796 Xchange has returned about 46 percent since the stock’s Aug. 1 debut on the company’s own website. The benchmark Shanghai Composite Index (SHCOMP) has only gained about 2 percent during the same period.

‘Expensive to Crack’

Bitcoin is similar to other currencies -- say, the Mexican peso -- except it’s not controlled by any government and the total number is capped at about 21 million coins. Computer users can “mine” them by solving mathematical puzzles -- uncovering the hidden series of letters and numbers that matches up with security keys specified by the computer programmers who invented Bitcoin in 2009. As more are mined, the puzzles get harder, and therefore more expensive to crack.

Sun turned to shares of Bitcoin companies after initially trying to mine the currency crunching algorithms on souped-up PCs at his office and home. He gave up after a month, concluding that his computers weren’t up to the task.

“Simple desktops can no longer dig them up,” he said.

There are about 11.5 million Bitcoins in circulation, according to Blockchain.info, which tracks the virtual currency. At today’s price of about $121, there’s still $1.15 billion to unearth. The inherent scarcity of Bitcoin that was intended to help secure its value has also attracted early investors -- Cameron and Tyler Winklevoss, the twins known for their claim to have co-founded Facebook Inc. (FB), own about 1 percent of the currency in issue.

Bitcoin is similar to other currencies -- say, the Mexican peso -- except it’s not controlled by any government and the total number is capped at about 21 million coins. Computer users can “mine” them by solving mathematical puzzles -- uncovering the hidden series of letters and numbers that matches up with security keys specified by the computer programmers who invented Bitcoin in 2009. As more are mined, the puzzles get harder, and therefore more expensive to crack.

Sun turned to shares of Bitcoin companies after initially trying to mine the currency crunching algorithms on souped-up PCs at his office and home. He gave up after a month, concluding that his computers weren’t up to the task.

“Simple desktops can no longer dig them up,” he said.

There are about 11.5 million Bitcoins in circulation, according to Blockchain.info, which tracks the virtual currency. At today’s price of about $121, there’s still $1.15 billion to unearth. The inherent scarcity of Bitcoin that was intended to help secure its value has also attracted early investors -- Cameron and Tyler Winklevoss, the twins known for their claim to have co-founded Facebook Inc. (FB), own about 1 percent of the currency in issue.

Bigger Drills

Prices have been volatile, with the value of one Bitcoin varying from $84 to $266 in the span of one week in April, according to Tokyo-basedMt. Gox, the largest exchange that allows Bitcoin to be traded for dollars, euros and other currencies.

More advanced miners use specially designed gadgets that cost as much as 86 Bitcoins, about $10,407, in order to mine the digital currency.

Labcoin, managed by Hong Kong-based ITec-Pro Ltd., also began trading its shares this month in a virtual market. The seller of virtual-mining equipment had a market value of 20,000 Bitcoins, or about $2.4 million. Another company that sold shares is Myminer, which operates “mining farms” in China, where it says the low cost of power to run computers gives it an edge. BTC Garden, a Shenzhen-based Bitcoin miner, withdrew its IPO this month, citing a dispute with an investor.

Hong Kong-incorporated 796 Xchange offers an online stock market for Bitcoin companies, as well as futures, financing and IPO services, all priced in Bitcoins, according to its website.

Prices have been volatile, with the value of one Bitcoin varying from $84 to $266 in the span of one week in April, according to Tokyo-basedMt. Gox, the largest exchange that allows Bitcoin to be traded for dollars, euros and other currencies.

More advanced miners use specially designed gadgets that cost as much as 86 Bitcoins, about $10,407, in order to mine the digital currency.

Labcoin, managed by Hong Kong-based ITec-Pro Ltd., also began trading its shares this month in a virtual market. The seller of virtual-mining equipment had a market value of 20,000 Bitcoins, or about $2.4 million. Another company that sold shares is Myminer, which operates “mining farms” in China, where it says the low cost of power to run computers gives it an edge. BTC Garden, a Shenzhen-based Bitcoin miner, withdrew its IPO this month, citing a dispute with an investor.

Hong Kong-incorporated 796 Xchange offers an online stock market for Bitcoin companies, as well as futures, financing and IPO services, all priced in Bitcoins, according to its website.

Regulatory Probe

BTCChina.com, China’s most popular Bitcoin exchange, lets traders to use the payment systems of more established companies. That includesTencent Holdings Ltd. (700), the nation’s biggest Internet company, and Alipay, an affiliate of Alibaba Group Holding Ltd., the No. 1 e-commerce company. Other Bitcoin trading platforms popular in China include FXBTC.com and Btctrade.com.

China briefly overtook the U.S. in monthly downloads of Bitcoins in May, and now ranks second, according to SourceForge.

In the U.S., the Securities and Exchange Commission sued a Texas man over claims he operated a Bitcoin Ponzi scheme. New York’s Department of Financial Services this month sent subpoenas to 22 digital-currency companies to determine whether new regulations should be adopted, according to a person familiar with the matter.

The lack of regulation, which has drawn scrutiny from U.S. regulators, is why Bitcoins are taking off in China, where the government controls the flow of money overseas and keeps a tight rein on what it views as undesirable behavior.

BTCChina.com, China’s most popular Bitcoin exchange, lets traders to use the payment systems of more established companies. That includesTencent Holdings Ltd. (700), the nation’s biggest Internet company, and Alipay, an affiliate of Alibaba Group Holding Ltd., the No. 1 e-commerce company. Other Bitcoin trading platforms popular in China include FXBTC.com and Btctrade.com.

China briefly overtook the U.S. in monthly downloads of Bitcoins in May, and now ranks second, according to SourceForge.

In the U.S., the Securities and Exchange Commission sued a Texas man over claims he operated a Bitcoin Ponzi scheme. New York’s Department of Financial Services this month sent subpoenas to 22 digital-currency companies to determine whether new regulations should be adopted, according to a person familiar with the matter.

The lack of regulation, which has drawn scrutiny from U.S. regulators, is why Bitcoins are taking off in China, where the government controls the flow of money overseas and keeps a tight rein on what it views as undesirable behavior.

‘Bitcoin is Freedom’

“The advantage for Chinese users to use Bitcoin is freedom, people can do something without any official authority,” said Patrick Lin, system administrator of Erights.net and owner of about 1,500 Bitcoins. Lin said he’s sticking to the currency itself, rather than IPOs, in part because of weak regulation. “The Bitcoin world is just like the Wild West -- no law, but opportunity and risk,” he said.

The China Securities Regulatory Commission didn’t respond to a faxed query on whether it’s looking at new rules regarding Bitcoin. So long as it remains small, the industry may continue to fly below the radar screen of a Chinese government more preoccupied with a faltering economy and social stability.

“If the circulation of Bitcoins is still confined to a small circle of people, it won’t be something on the Chinese authority’s priority list,” said Edward Au, co-head of Deloitte China’s public-offering group. “They already have too much to cope with.”

To contact the reporter on this story: Lulu Yilun Chen in Hong Kong at ychen447@bloomberg.net

To contact the editor responsible for this story: Michael Tighe at mtighe4@bloomberg.net

“The advantage for Chinese users to use Bitcoin is freedom, people can do something without any official authority,” said Patrick Lin, system administrator of Erights.net and owner of about 1,500 Bitcoins. Lin said he’s sticking to the currency itself, rather than IPOs, in part because of weak regulation. “The Bitcoin world is just like the Wild West -- no law, but opportunity and risk,” he said.

The China Securities Regulatory Commission didn’t respond to a faxed query on whether it’s looking at new rules regarding Bitcoin. So long as it remains small, the industry may continue to fly below the radar screen of a Chinese government more preoccupied with a faltering economy and social stability.

“If the circulation of Bitcoins is still confined to a small circle of people, it won’t be something on the Chinese authority’s priority list,” said Edward Au, co-head of Deloitte China’s public-offering group. “They already have too much to cope with.”

To contact the reporter on this story: Lulu Yilun Chen in Hong Kong at ychen447@bloomberg.net

To contact the editor responsible for this story: Michael Tighe at mtighe4@bloomberg.net

China Unicom's 3G Growth Delivers Big Time As Budget Smartphones Flourish

China Unicom (CHU) announced a solid set of results for the first half of 2013, as 3G growth continued to impress amid robust sales of low-cost smartphones, which helped mitigate subsidy concerns as well. The second largest Chinese wireless carrier benefited tremendously from its 100 million plus 3G subscriber base as strong data demand boosted overall revenues. Half yearly revenues grew by 18.6% from last year, bolstered by a 52.1% increase in the operator’s 3G service revenues over the same period.

China Unicom (CHU) announced a solid set of results for the first half of 2013, as 3G growth continued to impress amid robust sales of low-cost smartphones, which helped mitigate subsidy concerns as well. The second largest Chinese wireless carrier benefited tremendously from its 100 million plus 3G subscriber base as strong data demand boosted overall revenues. Half yearly revenues grew by 18.6% from last year, bolstered by a 52.1% increase in the operator’s 3G service revenues over the same period.

China Unicom’s 3G business continues to be its mainstay as 3G subscribers increase every month while a low 3G penetration rate of 38% offers large room for growth. However, considering the capital intensive nature of the telecommunication industry and the fast changing technological landscape for mobile telephony, China Unicom will have to carefully devise its 4G strategy in light of the steps being taken by its mighty competitor -- China Mobile (CHL) (see China Mobile Readies For A Massive 4G Launch). Heavy CapEx for 3G has so far thwarted China Unicom’s efforts in generating free cash flows. However, the company managed to generate free cash flows in H1 2013 by scaling back its CapEx spend, in preparation for a potential 4G LTE launch in the coming months.

In our previous analysis (see China Unicom’s Earnings: 3G Push Driven By Data Demand And Low Cost Smartphones), we had raised concern over China Unicom’s declining 3G ARPU. However, as per the latest interim results, the 3G ARPU seems to have stabilized at RMB 77.6, which is a good sign for the long-term growth of the company. Another positive development is that the impact of handset subsidies has largely been mitigated as low cost smartphones now represent a bulk of Chinese smartphones sales.

We reiterate our price estimate of $18 for China Unicom’s stock. Buoyed by strong results, the stock price rose more than 6% post earnings on August 8th.

3G Revenue Growth Is Here To Stay

China Unicom’s 3G business represents more than 50% of the mobile division’s revenues. More importantly, China Unicom’s 3G ARPU is more than twice that of 2G. Therefore, increase in 3G subscribers with simultaneous higher 3G penetration translates into higher revenue and earnings growth for China Unicom.

China Unicom’s strong half yearly performance can be attributed to the growth of its 3G subscribers from last year. For the six months ending June 2013, China Unicom added 24 million 3G subscribers, a 40% improvement over the same period last year. As a result, the company’s 3G service revenue grew 52.1% to RMB 40.91 billion in the first half of 2013. Consequently, overall revenues grew 18.6% to RMB 144.31 billion. Going forward, we expect the 3G business to continue its strong performance as China Unicom adds 3G subscribers at a brisk pace of 4 million per month.

Focus On Free Cash Flows

China Unicom has invested huge sums on its HSPA+ 3G network. As a consequence, it has not been able to generate positive free cash flow (operating cash flow – CapEx) in the last couple of years. However, the recent results show a change in this trend.

In the first half of 2013, China Unicom generated a positive free cash flow of RMB 19.6 billion as CapEx declined by almost 50% from the same period last year. The decline in CapEx is as per the company’s guidance as it seeks to conserve cash for its 4G foray. The onset of 4G would require large capital investments from China Unicom. Thus, the upcoming transition in the Chinese telecommunication space is likely to curtail free cash flow generation for China Unicom.

It will be interesting to see how China Unicom adapts to 4G as licenses are expected to be issued later this year. China Mobile, the largest of the three Chinese telcos, has been the front-runner in 4G as it plans to build more than 200,000 4G base stations in 2013. If 4G services were to trickle down quickly to China’s mobile subscribers, China Mobile will certainly get an edge considering its large scale preparation for a 4G launch.

Low Cost Smartphones Have a Neutralizing Effect

In the last couple of years, low cost smartphones have become increasingly popular in the Chinese market. This has impacted China Unicom in two ways. On one hand, it has led to lower 3G ARPU while on the other it has helped in controlling the subsidy impact, which has enabled the company to arrest the fall in margins. China Unicom’s 3G ARPU has declined from RMB 91 in H1 2012 to RMB 77.6 in H1 2013. But the fall hasn’t impacted China Unicom much as the company has expanded its 3G subscriber base rapidly. Moreover, the decline in the 3G ARPU seems to have stabilized at the current level and we expect it to rise over the long term, considering the explosive demand for data consumption.

On the margins front, the onset of 3G proved to be tough for China Unicom as the mobile division’s margins declined from about 45% in 2008 to around 21% in 2012, as per our analysis. Handsets subsidies on premium smartphones like the iPhone have been responsible for the large contraction in margins. However, low cost smartphones have helped China Unicom control the subsidy impact and the subsequent fall in margins.

Recent data confirms this trend. For the first half of 2013, 3G terminal subsidy cost as a percentage of 3G service revenue declined to 10.3% from 13.1% in the previous year. EBITDA margins for the mobile division have also stabilized at around 21% in the last 2 years. Therefore, on a broader perspective, low cost smartphones have certainly helped China Unicom emerge as a healthier company.

Disclosure: No positions.

The Most Undervalued Emerging Market In The World

By David Sterman

Published 07/09/2013 - 14:30

Forget the old adage "When the U.S. sneezes, the world catches a cold."

Friday's solid employment report shows the U.S. economy -- the world's largest by a considerable margin -- to be faring reasonably well.

The new adage: "When China sneezes, the world catches a cold."

China's economy, which recently overtook Japan's as the world's second largest, has been slowing throughout the first half of 2013. That slowdown is wreaking havoc on many emerging economies.#-ad_banner-#

The sharp pullback in places like Brazil, Australia, Turkey and elsewhere should be seen as opening for investors that have been awaiting better valuations in these markets. Indeed, the forward earnings multiple for many of these countries' stock markets has been drifting ever lower, creating a valuation gap with U.S. stock markets that, in some instances, approaches 40%.

Still, investors need to know that these markets can surely fall lower, so it's crucial to take the long view with investments in Latin America, Asia, Eastern Europe and Africa. If the Chinese economy weakens further, its huge role in global trade means that some emerging-market economies might actually slip into a recession in coming quarters.

It may be too soon to draw such a dire conclusion, and some these markets may have already hit bottom. However, the International Monetary Fund (IMF) this week pared back its growth forecast for this year to 3.1%, down from the 3.3% it projected in April. This underscores the need to monitor the global economy closely if you plan to wade into these markets.

A Lone Bright Spot?

Yet throughout the downturn in emerging markets, one country appears poised to feel only a minor impact from a slowing China. It's home to 250 million people (the fourth-largest population in the world), has been posting robust growth rates thanks to a rapidly expanding middle class, and now has sufficient domestic consumption to insulate itself from the global trading headwinds that are emerging.

That country: Indonesia, which has been moving up in global rankings and now has the 17th-largest economy in the world, just ahead of Turkey and right behind South Korea, according to the IMF.

This economy is growing at such a robust pace that one can cite a variety of impressive statistics. For example, auto sales rose 17.8% in the first quarter of this year from the same period last year. Here's another: Foreign direct investment surged 27% in the first quarter to around $7 billion. That's the fastest growth rate of any of the world's 50 largest economies. Notably, much of that recent foreign direct investment is targeted at the Indonesian consumer -- not at the traditional mining industries that were once the backbone of the economy.

Indonesia's economy has grown in excess of 6% for each of the past three years, according to the IMF. Can that growth rate last? Probably not. The troubles in China will likely shave a percentage point or two off of Indonesia's growth rate. The IMF's latest forecast suggests 6.3% GDP growth this year and 6.4% growth in 2014. Look for that forecast to move closer to 5% as the year progresses

.

Indonesia's biggest headwind isn't China -- it's corruption and red tape. The country is "growing by 6% but should be growing by 10%," a U.S. Chamber of Commerce official recently told [1] The New York Times.

Indonesia's biggest headwind isn't China -- it's corruption and red tape. The country is "growing by 6% but should be growing by 10%," a U.S. Chamber of Commerce official recently told [1] The New York Times.

The good news: The Indonesian government is aggressively revamping the process for new business applications, and anti-corruption efforts, which were launched five years ago, are starting to finally take root in the form of heavy fines and jail time for bribery. (As theHuffington Post notes [2], however, more work still needs to be done.)

Time To Invest?Indonesian stocks have surged more than 300% since the end of the 2008 economic crisis, and investors waiting for an entry point have been frustrated as the Indonesia market moved ever higher. In recent weeks, that opening may have arrived.

There are three exchange-traded funds (ETFs) that focus on Indonesia, all of which have been sucked into the emerging-markets downdraft of the past few weeks:

There are three exchange-traded funds (ETFs) that focus on Indonesia, all of which have been sucked into the emerging-markets downdraft of the past few weeks:

Action to Take --> Investors who were wise enough to invest in Japan in the 1960s, South Korea in the 1980s or China in the past decade scored huge gains for one basic reason. Those economies put the foundation in place to build a thriving middle class, which established a self-sustaining pattern of rising domestic consumption. Indonesia appears to be working off of the same playbook. It's unclear where Indonesian stocks will trade three or six months from now, but long-term investors could reap significant gains.

-- David Sterman

http://www.streetauthority.com/international-investing/most-undervalued-emerging-market-world-475780

Friday's solid employment report shows the U.S. economy -- the world's largest by a considerable margin -- to be faring reasonably well.

The new adage: "When China sneezes, the world catches a cold."

China's economy, which recently overtook Japan's as the world's second largest, has been slowing throughout the first half of 2013. That slowdown is wreaking havoc on many emerging economies.#-ad_banner-#

The sharp pullback in places like Brazil, Australia, Turkey and elsewhere should be seen as opening for investors that have been awaiting better valuations in these markets. Indeed, the forward earnings multiple for many of these countries' stock markets has been drifting ever lower, creating a valuation gap with U.S. stock markets that, in some instances, approaches 40%.

Still, investors need to know that these markets can surely fall lower, so it's crucial to take the long view with investments in Latin America, Asia, Eastern Europe and Africa. If the Chinese economy weakens further, its huge role in global trade means that some emerging-market economies might actually slip into a recession in coming quarters.

It may be too soon to draw such a dire conclusion, and some these markets may have already hit bottom. However, the International Monetary Fund (IMF) this week pared back its growth forecast for this year to 3.1%, down from the 3.3% it projected in April. This underscores the need to monitor the global economy closely if you plan to wade into these markets.

A Lone Bright Spot?

Yet throughout the downturn in emerging markets, one country appears poised to feel only a minor impact from a slowing China. It's home to 250 million people (the fourth-largest population in the world), has been posting robust growth rates thanks to a rapidly expanding middle class, and now has sufficient domestic consumption to insulate itself from the global trading headwinds that are emerging.

That country: Indonesia, which has been moving up in global rankings and now has the 17th-largest economy in the world, just ahead of Turkey and right behind South Korea, according to the IMF.

This economy is growing at such a robust pace that one can cite a variety of impressive statistics. For example, auto sales rose 17.8% in the first quarter of this year from the same period last year. Here's another: Foreign direct investment surged 27% in the first quarter to around $7 billion. That's the fastest growth rate of any of the world's 50 largest economies. Notably, much of that recent foreign direct investment is targeted at the Indonesian consumer -- not at the traditional mining industries that were once the backbone of the economy.

Indonesia's economy has grown in excess of 6% for each of the past three years, according to the IMF. Can that growth rate last? Probably not. The troubles in China will likely shave a percentage point or two off of Indonesia's growth rate. The IMF's latest forecast suggests 6.3% GDP growth this year and 6.4% growth in 2014. Look for that forecast to move closer to 5% as the year progresses

.

The good news: The Indonesian government is aggressively revamping the process for new business applications, and anti-corruption efforts, which were launched five years ago, are starting to finally take root in the form of heavy fines and jail time for bribery. (As theHuffington Post notes [2], however, more work still needs to be done.)

Time To Invest?Indonesian stocks have surged more than 300% since the end of the 2008 economic crisis, and investors waiting for an entry point have been frustrated as the Indonesia market moved ever higher. In recent weeks, that opening may have arrived.

- iShares MSCI Indonesia Investable Market Index (NYSE: EIDO [3]). This fund has $475 million in assets and a 0.61% expense ratio.

- Market Vectors Indonesia Index ETF (NYSE: IDX [4]), which has $325 million in assets and a 0.59% expense ratio.

- Market Vectors Indonesia Small Cap ETF (NYSE: IDXJ [5]), which has just $7 million in assets and a 0.61% expense ratio.

Action to Take --> Investors who were wise enough to invest in Japan in the 1960s, South Korea in the 1980s or China in the past decade scored huge gains for one basic reason. Those economies put the foundation in place to build a thriving middle class, which established a self-sustaining pattern of rising domestic consumption. Indonesia appears to be working off of the same playbook. It's unclear where Indonesian stocks will trade three or six months from now, but long-term investors could reap significant gains.

-- David Sterman

http://www.streetauthority.com/international-investing/most-undervalued-emerging-market-world-475780

Peru's Credicorp Continues To Perform Strongly And Offers Some Upside For Investors

JPMorgan Likes Latin American Beverage Stocks

By Ben Levisohn

JPMorgan released a note on Latin American staples on Dec. 10– and the company is particularly bullish on beverage stocks.

- Lynn Bo Bo/European Pressphoto Agency

Beverage stocks should continue growing earnings at a double-digit clip, analysts Alan Alanis and Sambuddha Ray say, and their high valuations can be sustained if the good news continues.

They’re particularly bullish on Companhia de Bebidas Das Americas (ABV) , known as AMBEV. Not only do they see earnings growing, they also believe there’s a good chance the company will raise its dividend. The analysts set a 2013 price target of 97 reais on the stock, up 11% from today’s 87.28, and rate the stock and overweight.

Compania Cervecerias Unidas S.A. (CCU), meanwhile, should benefit from easy comparisons–so operating performance should “improve significantly in 2013.” JPMorgan set a 2013 price target of $36 on the stock, up 14K% from today’s $31.58.

Fomento Económico Mexican (FMX), or FEMSA, will benefit from its exposure to Mexican retailer Oxx0, which is trading at a discount to other Mexican–despite having stronger growth and better margins. JPMorgan set a 2013 price target of $110 on the stock, up 3.9% from today’s $105.86.

Hedge Funds Are Buying These 4 BRIC Stocks

By Kapitall :Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Interested in emerging markets? If so, here are some ideas to get you started.

We ran a screen on US-traded stocks from the BRIC countries (Brazil, Russia, India and China) for those seeing the most significant net institutional purchases over the current quarter. Institutional investors, such as hedge fund managers and mutual fund managers, are generally considered "smart money" investors because of their experience and access to sophisticated research.

We screened for those with bullish sentiment from institutional investors, with significant net institutional purchases over the last quarter representing at least 5% of share float. This indicates that institutional investors such as hedge fund managers and mutual fund managers expect these names to outperform into the future.

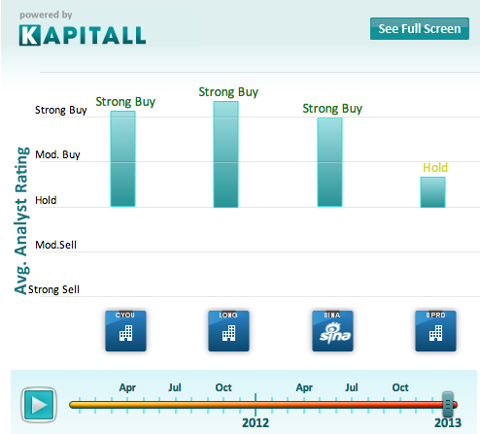

Interactive Chart: Press Play to compare changes in analyst ratings over the last two years for the stocks mentioned below. Analyst ratings sourced from Zacks Investment Research.

Do you think these stocks will outperform like hedge funds expect? Use this list as a starting point for your own analysis.

1. Changyou.com Limited (CYOU): Develops and operates online games in the People's Republic of China. Market cap at $1.54B, most recent closing price at $29.12. Net institutional purchases in the current quarter at 877.6K shares, which represents about 8.87% of the company's float of 9.89M shares. The top 2 holders of the stock are Wellington Management, and FMR, LLC.

2. eLong, Inc. (LONG): Operates as an online travel service provider in the People's Republic of China. Market cap at $526.81M, most recent closing price at $15.35. Net institutional purchases in the current quarter at 186.9K shares, which represents about 5.34% of the company's float of 3.50M shares. The top 2 holders of the stock are Capital World Investors, and Inegre Advisors.

3. Sina Corp. (SINA): Provides online media and mobile value-added services (MVAS) in the People's Republic of China. Market cap at $3.52B, most recent closing price at $52.76. Net institutional purchases in the current quarter at 4.2M shares, which represents about 6.68% of the company's float of 62.86M shares. The top 2 holders of the stock are FIl Ltd., and Capital Research Global Advisors.

4. Spreadtrum Communications Inc. (SPRD): Operates as a fabless semiconductor company that designs, develops, and markets baseband processor and RF transceiver solutions for wireless communications and mobile television markets. Market cap at $788.1M, most recent closing price at $17.17. Net institutional purchases in the current quarter at 5.5M shares, which represents about 16.67% of the company's float of 33.00M shares. The top 2 holders of the stock are FMR, LLC, and Waddell & Reed Financial Inc.

*Institutional data sourced from Fidelity, all other data sourced from Finviz.

Are These 4 Small Cap Growth Stocks Tomorrow's Industry Leaders?

By David Sterman

Published 12/27/2012 - 08:30

It's hard to remember, but today's leading large-cap stocks were once just fast-growing small businesses. Years of double-digit annual sales growth turned these acorns into mighty oak trees.

And if you glance across the 600 stocks comprising the S&P's SmallCap 600 Index, then you'll come across tomorrow's stars as well. Several dozen firms are in the midst of a long-term growth spurt that will likely have them characterized as mid-cap stocks before long. And well down the road, these stocks could be solid citizens in the S&P 500 Large Cap Index. Here are four to keep your eye on...

Risks to Consider: Strong growth begets rising expectations, so these stocks would be punished if there are any growth stumbles along the way.

Action to Take --> When identifying companies capable of sustained growth, you need to focus on those firms that are able to expand sales simply through an expansion of their current efforts. Of this group, only 3D Systems is pursuing acquisitions, but in this instance, these deals only help to expand a robust pipeline of organic growth opportunities.

-- David Sterman

And if you glance across the 600 stocks comprising the S&P's SmallCap 600 Index, then you'll come across tomorrow's stars as well. Several dozen firms are in the midst of a long-term growth spurt that will likely have them characterized as mid-cap stocks before long. And well down the road, these stocks could be solid citizens in the S&P 500 Large Cap Index. Here are four to keep your eye on...

| 1. 3D Systems |

[1]3D Systems (NYSE: DDD [2]), along with Stratasys (Nasdaq: SSYS [3]), was one of the early pioneers of "rapid prototyping," which allows designers to make a three-dimensional model of virtually any small item. NASA even used a machine to create spare parts in mid-flight if necessary. For many years, this industry was more about hype than reality: 3D Systems' sales hit $126 million in 2004 and by 2009, had actually shrank to $113 million. Since then, you can see this company hitting its stride as sales rose at least 40% in 2010 and 2011. Thanks to acquisitions that augment organic growth, sales likely rose more than 50% this year (to around $350 million) and could approach $450 million by next year.There's a counterintuitive way to trade a stock like this. You want to buy high-growth stocks when they hit a temporary rough patch. And this stock has risen from $15 to $50 in the past year, thanks to scorching growth, but we've repeatedly seen fast-moving stocks like this take a huge hit when a bad quarter arrives (Netflix (Nasdaq: NFLX [4]) and Chipotle Mexican Grill (NYSE: CMG [5]) being two recent notable examples.) 3D Systems' long-term growth prospects are so robust, you need to track this stock and be ready to pounce when the inevitable quarterly stumble happens. [1]3D Systems (NYSE: DDD [2]), along with Stratasys (Nasdaq: SSYS [3]), was one of the early pioneers of "rapid prototyping," which allows designers to make a three-dimensional model of virtually any small item. NASA even used a machine to create spare parts in mid-flight if necessary. For many years, this industry was more about hype than reality: 3D Systems' sales hit $126 million in 2004 and by 2009, had actually shrank to $113 million. Since then, you can see this company hitting its stride as sales rose at least 40% in 2010 and 2011. Thanks to acquisitions that augment organic growth, sales likely rose more than 50% this year (to around $350 million) and could approach $450 million by next year.There's a counterintuitive way to trade a stock like this. You want to buy high-growth stocks when they hit a temporary rough patch. And this stock has risen from $15 to $50 in the past year, thanks to scorching growth, but we've repeatedly seen fast-moving stocks like this take a huge hit when a bad quarter arrives (Netflix (Nasdaq: NFLX [4]) and Chipotle Mexican Grill (NYSE: CMG [5]) being two recent notable examples.) 3D Systems' long-term growth prospects are so robust, you need to track this stock and be ready to pounce when the inevitable quarterly stumble happens. |

| 2. Akorn Inc. |