Summary

GDEN's merger with Lakes Entertainment closed in August 2015 and it reported its first quarter as a public company.

With results largely meeting the merger plan, GDEN is trading at a steep discount to its peers.

GDEN has several catalysts for growth on top of the steep discount it is currently trading at.

With the recent release of Golden Entertainment (NASDAQ:GDEN)'s first quarter after its merger with Lakes Entertainment, it is worthwhile to see where the new operating entity is at.

GDEN was born when Lakes Entertainment agreed to purchase Sartini Gaming (dba Golden Gaming) on January 23, 2015. Up until that point, Lakes Entertainment had a diverse set of assets including:

- The Rocky Gap Casino in Maryland

- Several outstanding financial debts owed to it

- Some joint ventures

- A corporate headquarters

- A fairly healthy cash balance

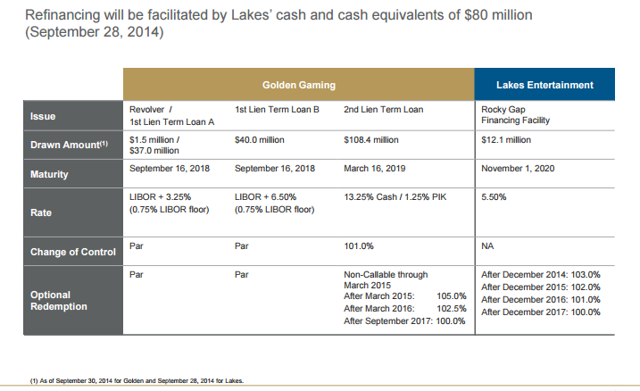

One of the key components to the deal was Lakes' cash balance that would help to re-capitalize the debt that Golden Gaming had taken on to build up its business. Prior to this recapitalization, GDEN's debt was as follows:

Source: Lakes-Golden Merger Presentation

These were fairly onerous lending conditions. As a result of its refinancing associated with its merger with Lakes, GDEN's balance sheet was significantly improved:

Source: Investor Presentation

You can see that the secure debt is now all at Libor+2.75% as compared to a Libor+3.25-6.50% pre-Lakes merger and a very high 13.25% on the largest portion of pre-GDEN debt with a Payment-in-Kind (PIK) component as well, which would increase the loan amount due over time in lieu of cash outlays. This last type of debt is very expensive so Golden took the opportunity to utilize Lakes' considerable balance of cash to reduce its overall debt level from $199m to $146.4m at the end of Q3 while still keeping $43.2m of cash on hand. This restructuring will save over $18m in annual interest costs compared to the pre-merger entities. The total facility gives them up to $160m in room (about $14m remaining) so there is some debt flexibility still remaining for future growth.

The Operations

Golden's operations are in two main components: Distributed Gaming and Casinos.

Distributed gaming incorporates two businesses, its company-owned tavern business and its gaming machine servicing business. These gaming machines, typically video poker, can be located at gas stations, restaurants, convenience stores, grocery stores and bars. They contribute 71% of the company revenues and 64% of EbITDA based on the TTM at June 30, 2015.

GDEN is the market leader in Nevada with roughly 41% market share, servicing 689 locations with a total of 7,699 machines under contract. GDEN essentially owns the machines and then either leases space from these establishments (40% of contracts) or conducts a revenue-sharing agreement with the owners (60%). Either way, it is steady money for the establishment while being a low maintenance, high margin business for GDEN. The larger the establishment, the more potential games can be placed which leverages GDEN's fixed service costs, making this a very scalable business as well. Typically, these contracts are for five to seven year terms, with a renewal rate ranging from 70% to 85%.

Currently, GDEN operates only in the Nevada area but in November 2014, it procured a license for distributed gaming in Montana which has 15,707 licensed games from its most recent disclosures. The license allows GDEN to acquire potential locations or gaming routes and to immediately service them. Management has noted this as a potential growth area but there doesn't appear to be an imminent entrance there. Several other states also have significant distributed gaming devices, notably Illinois (18,940 machines), Louisiana (13,216) and Oregon (11,951) which could be future opportunities for GDEN if they can obtain licensing.

GDEN currently has 48 owned taverns under the PT, Sierra Gold and Sean Patrick brands, with plans to open 4 more in 2016. These locations allow GDEN to leverage the distributed component business on top of the traditional food and beverage revenue streams. With only 10% market share in Clark County, NV, there is a lot of room to acquire or open new locations, which GDEN has a long history of doing.

The Casinos business involves the company ownership of three casinos in Pahrump, Nevada and the Rocky Gap Casino in Maryland. This business line contributes 29% of company revenues and 36% of company EbITDA. The three Pahrump casinos are smaller in size with less amenities than Strip-type properties, but still have decent margins. The Rocky Gap casino, however, is quite a significant property, with a Nicklaus golf course, spa, convention centre, 200 hotel rooms, 627 slot machines and 18 table games. Management has already earmarked $1m to expand its parking lot, pending approval, as well as adding three more table games. There is space to add up to 1,500 more slot machines as well, so there is definite potential to continue to grow Rocky Gap's revenue base. Currently, Rocky Gap contributes about 60% of the revenue of GDEN's casino operations with the Pahrump casinos making up the remaining 40%.

The original Lakes Entertainment was a disparate group of gaming operations, joint ventures and financing arrangements. Now re-born as Golden Entertainment, GDEN is a more focused operation with a clear path forward.

Insider Ownership

An additional benefit to the Golden takeover is a very vested owner. Blake Sartini, CEO of GDEN, is a 33.2% owner of the company, based on his recent 13D filing. Filling out his leadership team is CFO Matt Flandermeyer and COO Steve Arcana. Mr. Flandermeyer has been with Sartini since 2007 and Arcana since 2003 so they have a long history of operating together including through the financial crisis of 2008-9.

Former Lakes CEO Lyle Berman and his management team have stayed on with the Board of Directors to continue to support the business for the next few years, as well as to deal with the Jamul tribe loan (more on this later). Mr. Berman continues to own roughly 15% of the company.

Having a vested CEO with a stable management team bodes well for the future as they continue to look to grow the business, this time as a public entity.

Catalysts

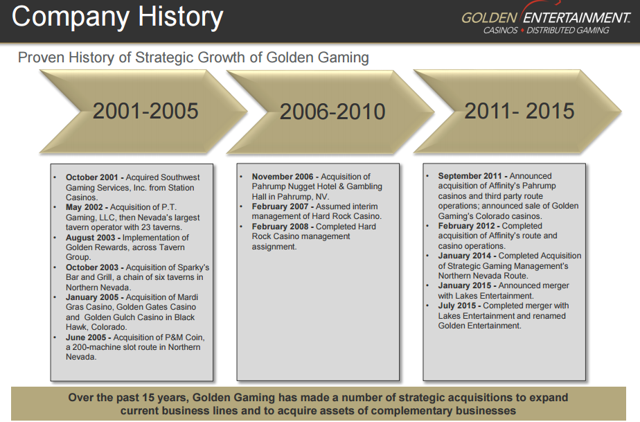

Acquisitions. The GDEN management team has had a long history of growing its business through acquisition as you can see below:

Source: Company Presentation

What is notable is the lull in acquisitions between 2008 and 2010, during the heart of the business downturn. It appears management decided to hunker down during this period in order to conserve its funds and make sure it got through it; this was only the second year of the CFO's tenure which is a good sign for them managing going forward. In its recent conference call, management seemed somewhat lukewarm on any big acquisitions in the near term; they have had enough on their hands with the merger and taking over operations at Rocky Gap. However, they are opening 4 new taverns in 2015/6to augment the distributed gaming business, as well as the potential Rocky Gap enhancements I noted above. The average tavern is generating $1.2m in revenue and $0.2m EbITDA per location with an additional $0.15m in EbITDA driven by distributed gaming. The average payback period is roughly 2.5 to 3 years, depending if a property is acquired or is a new build (acquired is traditionally at a discount to new builds due to rising construction costs). These 4 Locations will add approximately $0.07/share to their EbITDA per year so it is not an inconsequential increase.

I suspect when they have their current business lines stabilized, they will resume some targeted acquisitions, potentially taking advantage of their license in Montana or continuing to grow its Nevada footprint.

Jamul Note. Leftover from the Lakes Entertainment era, this is a $60m note that GDEN holds with the Jamul Indian band in San Diego. Entered in to in 1999, this was part of a financing arrangement that Lakes had extended to the band to help develop a casino. However, this eventually fell through with Lakes terminating its relationship with the band in 2012 after failing to get a casino off the ground. At this point, the note was essentially written off.

However, the Jamul band has now partnered with Penn National Gaming (NASDAQ:PENN) on developing a $390m casino on its lands. PENN is essentially developing the casino for the Jamul band, who will own it after construction. However, PENN will operate the business with a management and licensing fee, to be paid out of the casino's profits (estimated at roughly 30% margins on a $200m revenue base to start). There was hope that 50% of the project would be financed through outside parties but if not, PENN is prepared to move ahead as financier as well. The casino is slated to open in mid-2016 and, despite a few legal issues, appears on track to do so.

Lakes has negotiated a 4.25% interest amount to be paid on its note once the casino opens until such time that it is repaid. Its note is also a claim on the property, though subordinate to any other financing attached to the casino that must be settled first. However, with revenue coming from a professionally operated casino as soon as next year, valuing this note at $0 probably isn't fair either.

Investor Relations. Since Lakes was essentially a holding company of assets, it worked to keep its costs down and as such was not active in interacting with its shareholders. GDEN has already developed a more professional investor section to its website, while reaching out to several analysts to generate coverage of the company as well. This isn't something to rely on for share price appreciation, but it will certainly help to improve the share volume going forward and improve the chance for price discovery.

Risks

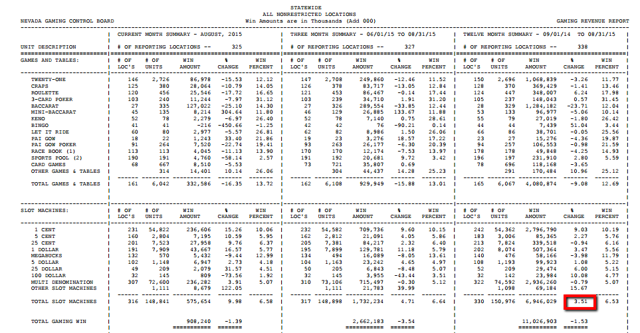

Nevada Dependency. GDEN's business is currently heavily skewed to the Nevada economy, with roughly 82% of its revenues driven by Nevada-based business lines. As a result, any potential downturn in the Nevada economy, exclusive to the broader economy, will have a more significant effect on GDEN than more geographically diverse companies. Based on recent data, it appears that there continues to be growth in machine-based revenue:

Source: Nevada Gaming Commission August 2015 Report

From the above, winnings from slot-based games (i.e. Video poker) have increased 3.51% from last year. With more people playing slots, they become more attractive for establishments to take on these types of machines as potential additional Revenue.

When we look at broader gaming revenue, there is still an uptrend in place in visitors coming to Nevada which will drive revenues as well.

Source: UNLV

However, should a broader economic slowdown occur, Nevada is still a travel-based destination. These types of vacations could very easily be one of the first thing households reduce when they need to tighten their belt. The trend looks on track for growth right now but this will always be a risk until they expand their geographic base. Even then, they will be levered to the U.S. economy as a whole since international expansion is not a likely (or relevant) area of expansion for GDEN.

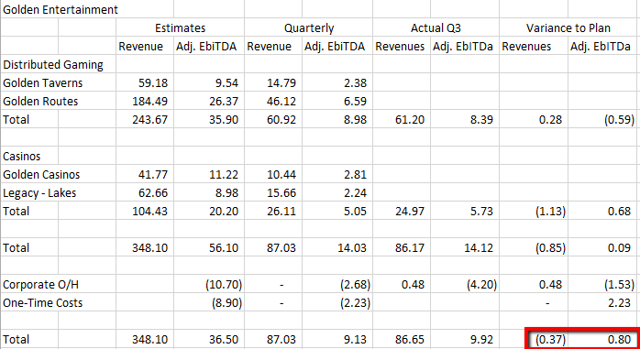

Integration. GDEN is continuing to integrate its operations with the historical Lakes organization so there will continue to be the risks associated with making this occur. So far, based on Q3's results, they are roughly on track to meet the merger targets:

Source: Investor Presentation, Q3 Results

In the first and second columns, we have the anticipated organizational results that management proposed during the original Lakes-Golden merger, which I then broke down to a quarterly basis to compare them to their actual results from their first quarter of operations. Essentially, they are almost bang on to their projections.

Management still has some cost synergies to achieve but because this integration was essentially a takeover by GDEN of the Lakes public entity, these risks are not significant.

Valuation

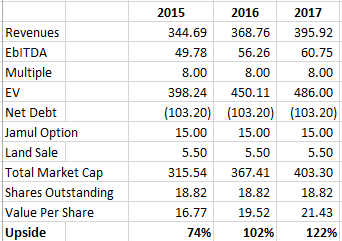

In order to come up with a valuation metric, I made the following assumptions:

- The Taverns business grew at its same-store sales level of 5.5% + trending out a 10% increase in establishment to give a 7% growth rate

- The Routes business grew at 6% (5% same store sales + a 1% increase in games served so far in 2016 from plan)

- The Casinos business increased at 10% due to the significant expansion opportunities at Rocky Gap

- Consistent EbITDA margins on each business line

- An addition $3.0m in overhead synergies

- An EV/EbITDA multiple of 8.0 based on the following comparatives: EV/EbITDA Multiples

| Company | Multiple | Source |

| BYD | 9.6x | YCharts 2015 Forward Guidance |

| PENN | 7.6x | YCharts 2015 Forward Guidance |

| ISLE | 8.2x | YCharts 2015 Forward Guidance |

| ERI | 8.2x | Estimate |

| Average | 8.4x |

Note: ERI Forward guidance per Vince Martin article

- Realization of $5.5m on the land sale to PENN

- A 25% chance of recovery on the Jamul loan; with interest payments of over $2m slated to begin next year and with a casino backing it, GDEN has a legitimate cash flow stream coming on-line with a potential recovery still at hand

There is some pretty compelling upside here. I believe this is largely due to the very unoriginal thesis of just lack of awareness. Lakes Entertainment was basically an asset play with no real catalyst for many years and as a result had lost investor interest completely. With a real operating business behind it with a strong, vested management team, it will only be a matter of time before GDEN begins to be noticed along with its peers.

No comments:

Post a Comment