Includes: C, LNC, MET, STX, VLO

Summary

C, LNC, MET, STX, and VLO are all rated as suitable for the Defensive Investor or the Enterprising Investor following the ModernGraham approach.

All five are found to be significantly undervalued according to the ModernGraham valuation model.

The five companies have the highest beta out of undervalued companies for the Intelligent Investor.

There are a number of great companies in the market today. By using the ModernGraham Valuation Model, I've selected the five undervalued companies for value investors reviewed by ModernGraham with the highest beta.

A company's beta indicates the correlation at which its price moves in relation to the market. A beta greater than 1 indicates a company is more volatile than the market.

Each company has been determined to be suitable for either the Defensive Investor or the Enterprising Investor according to the ModernGraham approach. Defensive Investors are defined as investors who are not able or willing to do substantial research into individual investments, and therefore need to select only the companies that present the least amount of risk. Enterprising Investors, on the other hand, are able to do substantial research and can select companies that present a moderate (though still low) amount of risk.

With a high beta, Mr. Market may turn these companies around very quickly, so be sure to check them out in depth!

Seagate Technology PLC (NASDAQ:STX)

As for a valuation, the company appears to be undervalued after growing its EPSmg (normalized earnings) from $2.39 in 2012 to an estimated $4.63 for 2015. This level of demonstrated earnings growth outpaces the market's implied estimate of 1.11% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham's formula, returns an estimate of intrinsic value above the price.

Lincoln National Corporation (NYSE:LNC)

As for a valuation, the company appears to be undervalued after growing its EPSmg (normalized earnings) from $0.80 in 2011 to an estimated $4.65 for 2015. This level of demonstrated earnings growth outpaces the market's implied estimate of 1.59% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham's formula, returns an estimate of intrinsic value above the price.

Valero Energy Corporation (NYSE:VLO)

Valero Energy Corporation qualifies for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, and the insufficient earnings growth or stability over the last ten years. The Enterprising Investor has no initial concerns. As a result, all Enterprising Investors following the ModernGraham approach based on Benjamin Graham's methods should feel comfortable proceeding with further research into the company.

As for a valuation, the company appears to be undervalued after growing its EPSmg (normalized earnings) from $0.95 in 2011 to an estimated $6.06 for 2015. This level of demonstrated earnings growth outpaces the market's implied estimate of 0.71% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham's formula, returns an estimate of intrinsic value above the price.

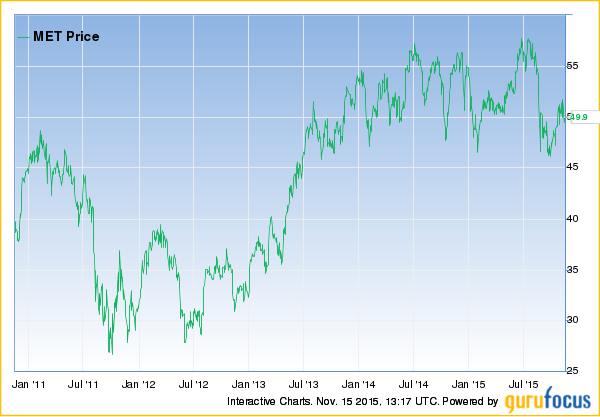

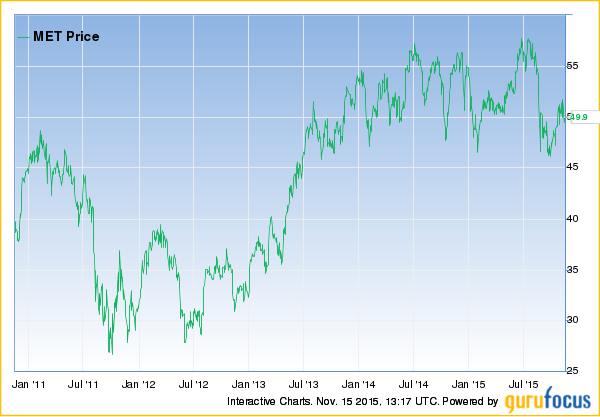

Metlife Inc (NYSE:MET)

As for a valuation, the company appears to be undervalued after growing its EPSmg (normalized earnings) from $3.02 in 2011 to an estimated $4.20 for 2015. This level of demonstrated earnings growth outpaces the market's implied estimate of 1.45% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham's formula, returns an estimate of intrinsic value above the price.

Citigroup Inc (NYSE:C)

As for a valuation, the company appears to be undervalued after growing its EPSmg (normalized earnings) from a loss of $6.47 in 2011 to an estimated gain of $3.80 for 2015. This level of demonstrated earnings growth outpaces the market's implied estimate of 2.43% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham's formula, returns an estimate of intrinsic value above the price.

Source: http://seekingalpha.com/article/3695266-5-undervalued-companies-for-value-investors-with-a-high-beta-november-2015

No comments:

Post a Comment