The Fed’s “E-Z-Credit” policy is still pushing asset prices higher… and creating a strong tailwind behind Hong Kong stocks.

Over the past year, Steve Sjuggerud has urged readers to buy stocks and real estate in Hong Kong. Hong Kong is one of the world’s major financial hubs… and one of the greatest cities in the world.

It’s technically in China. But it operates under some unique rules that make it very much “not China.”

One “not China” aspect of Hong Kong is that it has “pegged” its currency to the U.S. dollar.

When the Fed tries to goose the U.S. system with cheap credit, it also gooses the Hong Kong system.

It can cause “hot money” to flow into Hong Kong stocks and real estate.

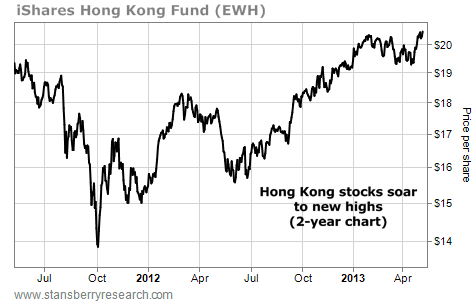

Today’s chart of the iShares Hong Kong Fund (NYSE: EWH) confirms that Steve is right on with his call.

This fund holds the biggest and best companies in Hong Kong. It saw a big run up through the end of the year. Then the fund took a “breather” and moved sideways… until last week. EWH broke out of its sideways trading range to close at a five-year high.

– Market Notes

– Market Notes

Sponsored Link: The Obama scandal. This Presidential blunder could soon change our entire nation... literally overnight.Access our full analysis, free of charge, here.

No comments:

Post a Comment