Summary

- The company is targeting 17-20% EPS CAGR through 2017.

- SLB has excess free cash flow, which it can use to increase dividends, buyback shares, and acquisitions.

- SLB’s introduction of new technologies and self-help initiatives are leading to strong incremental margins.

- Acquisitions are also adding to growth.

For the 11th straight quarter Schlumberger (NYSE:SLB), the largest oilfield services company in the world, reported better-than-expected results. Schlumberger's 2Q14 operating EPS of $1.37 came in better than Wall Street estimates of $1.36. Year-over-year (Y/Y) revenues grew 8%, EBITDA 12%, EBIT 13% and EPS an impressive 19%.

On the revenue side, Latin America was the biggest surprise, helped by robust activity in Colombia and Venezuela while Eastern Hemisphere posted the highest sequential growth of 13% as activity levels rebounded in Russia and Norway.

High-Teens EPS CAGR

If you want to invest in a large-cap growth stock and want to earn long term above market returns, Schlumberger is the stock for you. Schlumberger's execution is best in class. The company is on track to generate high-teens EPS CAGR, as it proceeds towards its stated EPS target of $9 to $10 by 2017 (this implies EPS CAGR of 18%-20%). For a company with a market cap of 145 billion, this is very impressive. Schlumberger also expects revenue to grow at 7%-8%. Again, for a company of SLB's size this top- and bottom-line growth should be highly desirable in a moderate macro-growth environment.

Excess Free Cash Flow Means More Dividends and Buybacks

Secondly Schlumberger has excess free cash flow. The company's capex is frozen around $4.0 billion, while investments in SPM and multi-client can add another $1.0 billion. Against this $5.0 billion annual capex figure, Schlumberger should continue to generate $10-$13 billion in cash flow from operations. Schlumberger generated ~10.0 billion in cash flow from operations in 2013 and an additional $4.2 billion in the first six months of 2014. This compares to $3.8 billion for the first six months of 2013.

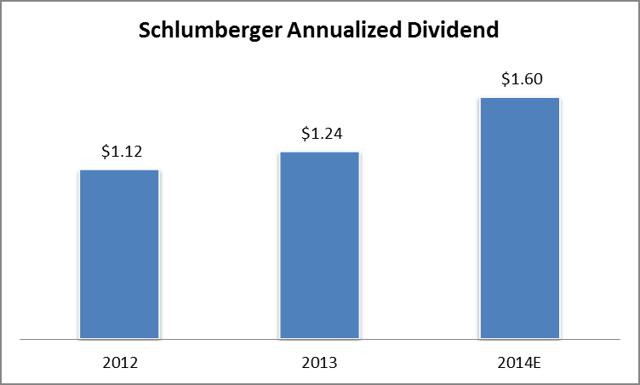

This leaves Schlumberger with ample cash flow for share buybacks (~$4.0 billion a year), dividends (~2.0 billion a year and rising at 20%+), and acquisitions. Schlumberger has a dividend yield of 1.4%. In comparison Halliburton (NYSE:HAL) has a dividend yield of 0.8% and Baker Hughes (NYSE:BHI) of 0.9%. Schlumberger's current quarterly dividend of $0.4 (annualized $1.6) represents an annual increase of more than 28%.

Source: Dividata

Schlumberger's superior EPS growth is partly driven by its ability to buy back shares at an impressive clip. The company repurchased $1.2 billion worth of shares in the second quarter. The prime objective of Schlumberger is to increase cash flow generation and give more of that cash flow back to shareholders. The company plans to bring its capex down to 10% of revenue over the next few years. This is 200 bps lower than the historical 12% level.

This frees up additional cash flow for distribution. Free cash flow is expected to be ~75% of earnings, with 60-65% of this free cash flow being returned to shareholders. These projections allow for continued growth via mergers and acquisitions and organic growth due to the strong capital efficiency measures underway.

Source: Company Documents

Superior Margin Growth

Schlumberger's introduction of new technologies and self-help initiatives are leading to strong incremental margins. The company expects to increase margin and ROCE by increasing revenue from new technologies and integrated services. New technologies are expected to contribute more than 25% of revenue by 2017. Moreover, activity with some element of integration should exceed 30% ofrevenue.

Because new technologies are differentiated, they allow Schlumberger to charge a premium-price and attract higher margins. Integration, on the other hand, creates cost savings both through lower SG&A, as you do not have to sell every single product every single time, and through operation cost efficiencies. Both, new technologies and integration, will aid Schlumberger in achieving the projected long-term 40% incremental margin.

Incremental margins in 2Q14 were 39% Y/Y. International incremental margins were an impressive 75% Y/Y. While the company expects some moderation in international incremental margins in the second half of the year, the strength of Schlumberger internationally should allow incremental margins to persist higher than those seen in North America. International incremental margins have averaged 65% for 1H14.

Acquisitions Also Adding To Growth

Both Schlumberger and Baker Hughes have posted revenue increase over 2013, as North American activity picked up in 2014. However, Schlumberger is way ahead of its peer in this case. Schlumberger posted an impressive Y/Y growth of 14% in North America in 1H14, compared to 6.4% growth of Baker Hughes during the same period.

While the latest technologies have contributed to this growth as Schlumberger took market share across businesses, a bunch of smaller acquisitions have also added to this growth. Most of these acquisitions have been concentrated in the field of Artificial Lift, specifically Rod Lift technology, where SLB has increased its footprint and it plans to innovate in this segment on over the next 12-18 months.

Conclusion

If you want to invest in a large cap growth company and want a long-term return above markets, Schlumberger is the stock for you. The company is well positioned to post high-teens EPS growth over the next few years. Schlumberger's excess free cash flow allows it to return more cash to shareholders in the form of dividend increases and share buybacks. Finally, the company's introduction of new technologies and self-help initiatives are leading to strong incremental margins.

By Price Point

No comments:

Post a Comment