Summary

- Epsilon Energy is a profitable energy company with a pristine balance sheet.

- The company has two profitable and growing segments (upstream and midstream).

- It is drilling the sweet spot of the Marcellus shale.

- Epsilon's stock is a sleeper and the company's current valuation is irrational.

- Epsilon's stock has to soar to come in line with the peers' valuation.

(Editors' Note: Epsilon Energy trades on the Toronto Stock Exchange under the ticker symbol EPS.TO, with ~$CAD 200K average daily volume)

Introduction

There are three certainties in life: death, taxes and grossly undervalued or overvalued stocks. And thanks to these grossly undervalued or overvalued stocks, the savvy investors make money. These investors are always open to an impartial assessment of the risks and rewards attached to a highly neglected energy company, while being ready to capitalize on its gross undervaluation, given that the company has a proven management team and low-risk acreage in a prolific Basin. All they do is selectively and intelligently buy these obscure companies that are poised to rise a lot once a catalyst occurs.

In the present article, I will detail why Epsilon Energy (OTCPK:EPSEF) is one of them, explaining the tremendous disconnect between its share price and its underlying value.

Epsilon trades on the main Toronto board (ticker EPS) and there is a secondary listing in the US (ticker EPSEF). Epsilon is a Canadian company with US-based assets. In fact, it is a hybrid company because it has an upstream and a midstream asset, both located in the US. And the hybrid nature of the asset base reminds me of Chinook Energy (OTC:CNKEF), another hybrid company whose stock has risen more than 200% since I recommended it in December 2013 in another "Top Idea" article, as shown here.

The Assets

Epsilon's ongoing business strategy involves a focused approach on low risk natural gas exploitation and gas gathering/compression within the Marcellus Shale in Pennsylvania. The company's new management team made a wise decision and sold its Canadian assets while keeping its US-based operations. The sale of the Canadian assets largely completed the restructuring initiatives undertaken by the new management team who decided to focus on the Marcellus shale in Pennsylvania instead. The company's crown jewel currently is its upstream and midstream assets in the "sweet spot" of the Marcellus shale gas field in Pennsylvania.

Despite this strategic shift, Mr. Market is completely unaware of the company's assets largely due to the non-existent brokerage coverage to date. This is nothing new of course and this is a typical signal of market inefficiency. Therein lies the opportunity.

There is only one fellow SA contributor (Nawar Alsaadi) who wrote an articleabout Epsilon Energy in late 2013, while there is not one single analyst covering Epsilon Energy to date. The analysts are lined up to cover the popular stocks instead.

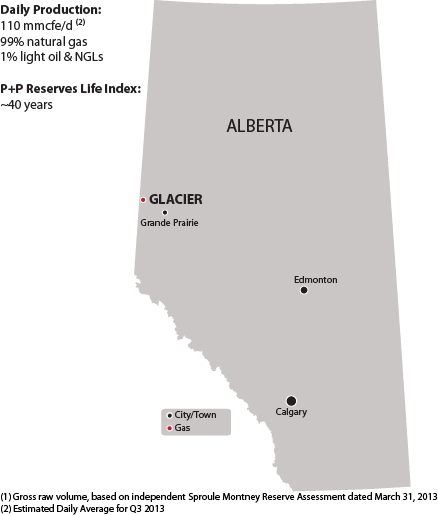

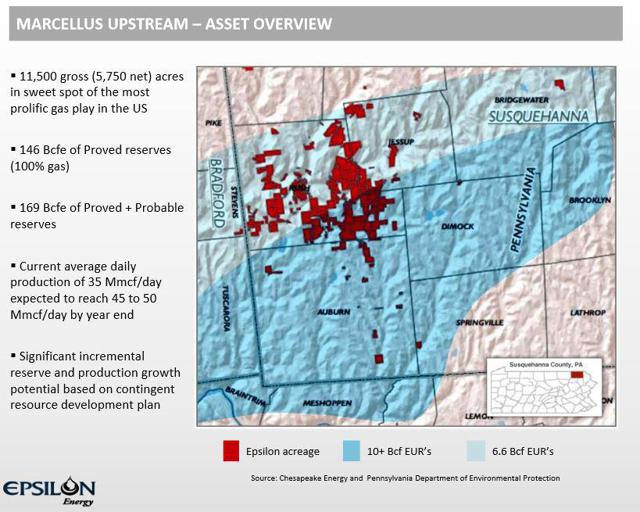

1) The Upstream Asset: The company holds 5,750 net acres in Susquehanna County, the most prolific shale gas producing county in the Marcellus field, as illustrated below:

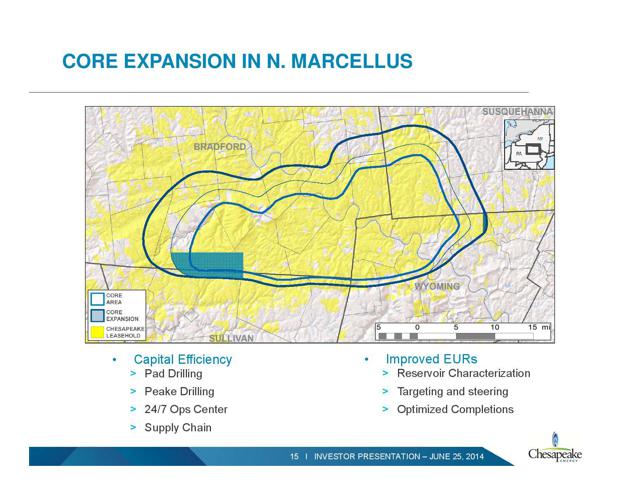

The company's acreage is operated by Chesapeake Energy (NYSE:CHK) that owns significant acreage in that area, as illustrated below:

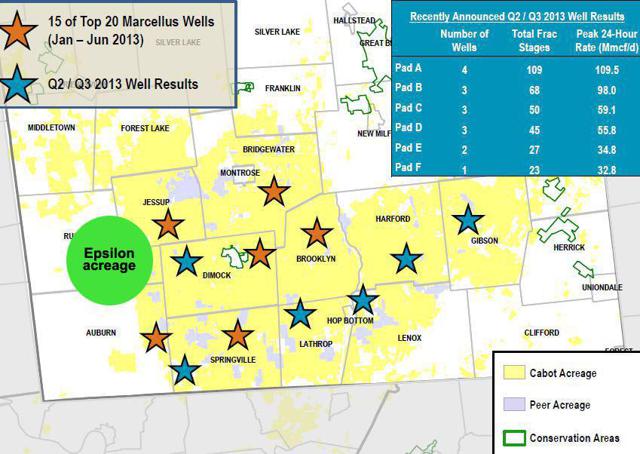

It must also be noted that Epsilon's core operating area is located mainly in the township of Rush immediately adjacent to Dimock and Springville townships, where Cabot Oil & Gas (NYSE:COG) has achieved its best well results, as illustrated below:

"Source: Cabot website - Epsilon green area added"

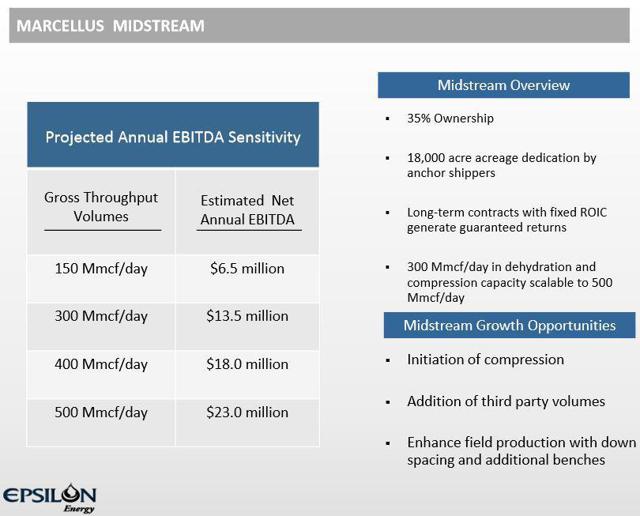

2) The Midstream Asset: Epsilon Midstream owns 35% of the Auburn Gas Gathering System (GGS) in Susquehanna County, Pennsylvania with partners Chesapeake Midstream Partners and Statoil (NYSE:STO).

The Auburn GGS encompasses approximately 18,000 acres and is operated by Access Midstream Partners (NYSE:ACMP). This is a gathering system that surrounds and services the company's upstream asset. It gathers and processes all of the gas produced by the Epsilon-Chesapeake JV, as well as any third party gas produced within the gathering area.

The midstream system began operating in September 2011 and construction of the compression facility was completed in July 2012. Epsilon initiated compression at the Auburn facility in 2013 and exited 2013 at compression capacity of 330 Mmcf/day with pipeline gathering capacity of 550 Mmcf/day.

Auburn Midstream Facility averaged approximately 320 MMcf/d and 311 MMcf/d in January 2014 and Q1 2014 respectively. Epsilon is going to expand the system capacity from current levels of 330 MMcf/d to 550 MMcf/d, in response to increasing demand from third parties for gathering and compression services in its operating area. Epsilon plans to begin this project in H2 2014, because it anticipates throughput volumes to grow meaningfully through 2014 and 2015.

Epsilon Is Drilling The Sweet Spot Of The Marcellus Shale

Epsilon's benefits of production from the sweet spot of the Marcellus shale are clearly visible. By drilling the sweet spot of the dry gas window, Epsilon gets the strongest EURs and the biggest bang for the buck, given that the low development cost drives best in class recycle ratios.

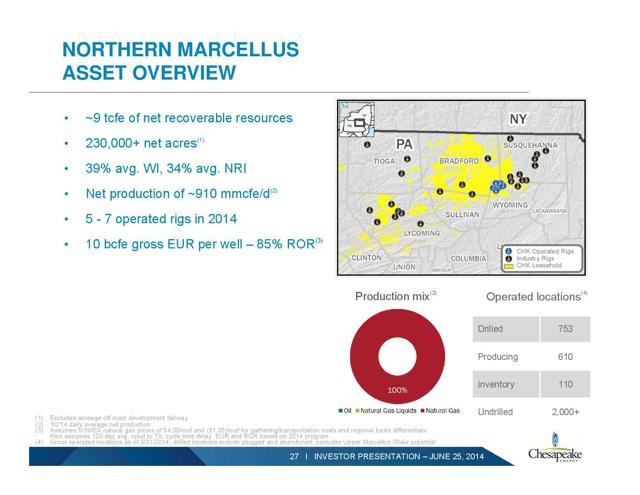

To give you an idea about this, please see Chesapeake's results from that area, given that Epsilon's acreage is operated by Chesapeake. Chesapeake's ROR for wells drilled in that area has been as high as 85%, based on NYMEX natural gas price of $4.00/Mcf, as illustrated below:

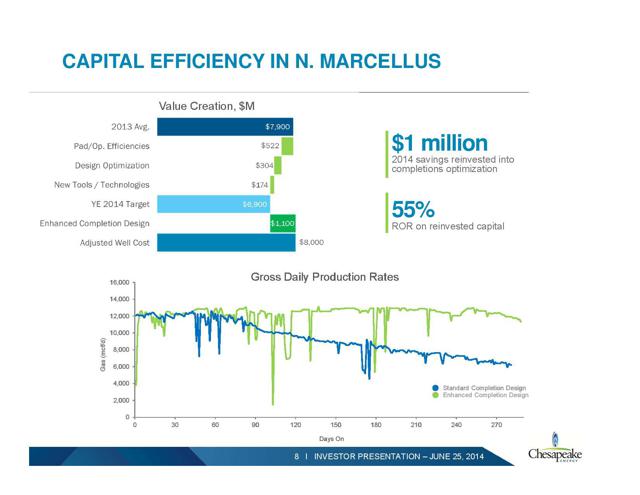

Chesapeake has been working on using its capital more efficiently, as illustrated below:

To achieve this target, Chesapeake has transitioned to pad drilling since 2013. This means better completion results, leading to lower well costs and higher EURs for Epsilon.

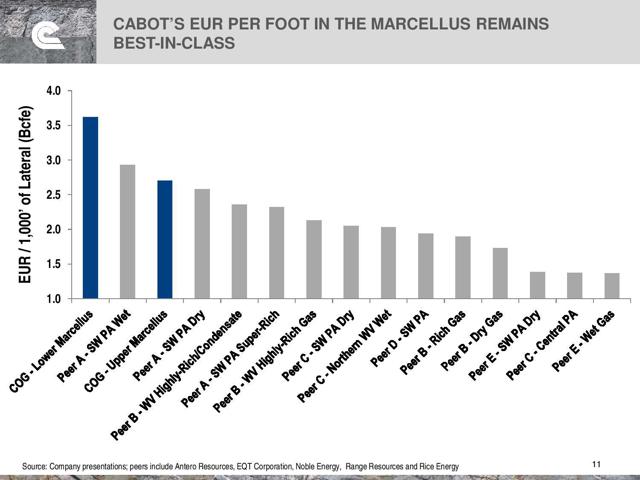

And Chesapeake is not alone in Epsilon's core operating area. Cabot Oil & Gas has approximately 200,000 net acres in the sweet spot of the dry gas window of the Marcellus Shale, primarily in Susquehanna County, Pennsylvania, and Cabot's success provides another excellent read through to Epsilon. Since the inception of Cabot's horizontal drilling program in 2008, Cabot's Marcellus Shale position in northeast Pennsylvania has developed into the cornerstone asset of its portfolio and has been the primary driver of record production and reserve growth during this period.

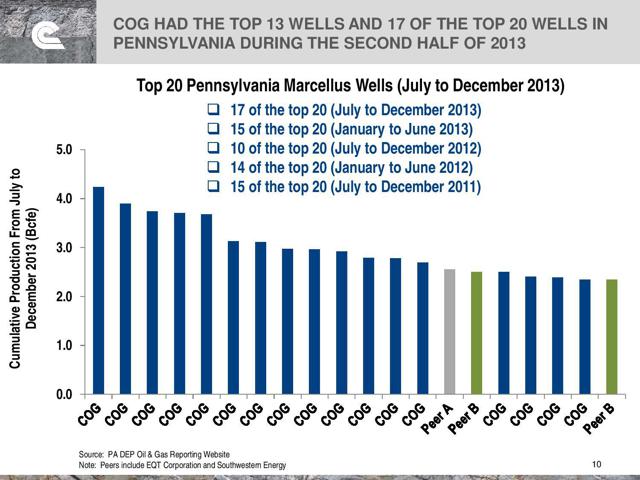

Cabot had the Top 13 wells and 17 of the Top 20 wells in Pennsylvania during H2 2013, as illustrated below:

"Source: Cabot Oil and Gas website"

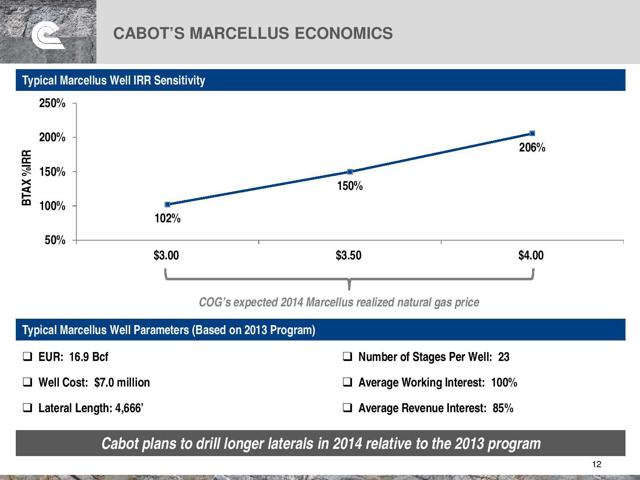

The superior productivity for Cabot's natural gas wells in Susquehanna county coupled with drilling and completion costs of $5.8 million per well have resulted in very high ROR, as illustrated below:

"Source: Cabot Oil and Gas website"

and below:

"Source: Cabot Oil and Gas website"

It must also be noted that the Marcellus shale has multi-stacked pay potential (Upper Marcellus, Lower Marcellus). For instance, this is what Cabot Oil & Gasnoted in December 2013: "Two Upper Marcellus wells were completed on the pad with a total of 37 frac stages with an IP rate of 32 Mmcf per day and a 30-day production rate of 24 Mmcf per day. These wells were spaced 1,000' apart in the Upper Marcellus and were offset 500' by a Lower Marcellus well. We continue to monitor these wells to evaluate the productivity of the Upper Marcellus. However, based on the results to date, we continue to believe that the Upper Marcellus across our acreage position will provide rates of return that rival or exceed most unconventional resource plays."

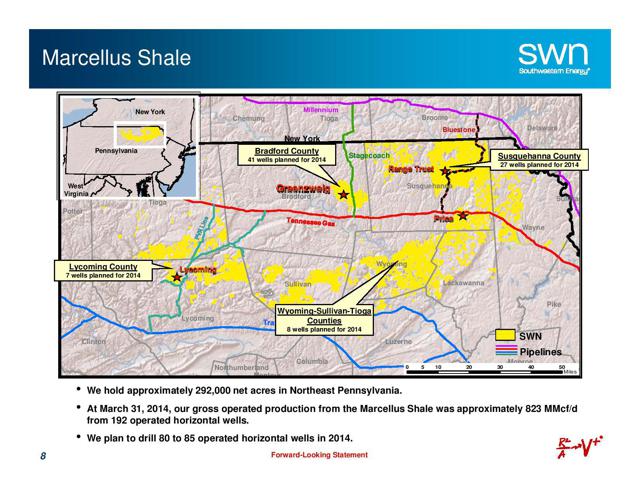

Southwestern Energy (NYSE:SWN) is another company that holds 292,000 net acres in Northeast Pennsylvania, and most of that acreage is very close to Epsilon's core operating area, as shown below:

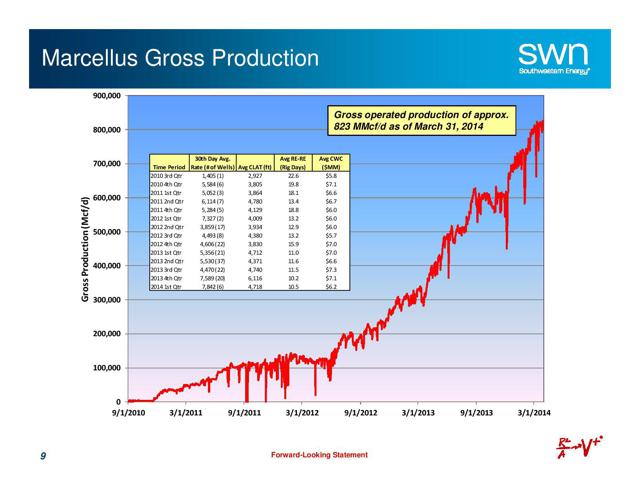

Southwestern's natural gas wells in that area are no different and their superior productivity is illustrated below:

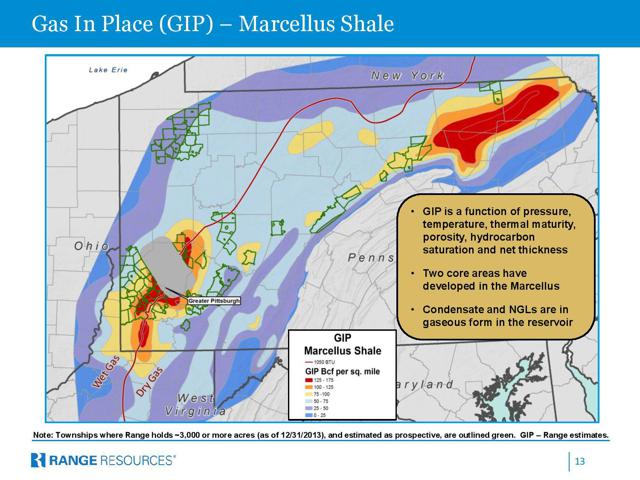

And the good news about Epsilon's core operating area goes on. Range Resources (NYSE:RRC) has approximately 1 million net acres in Pennsylvania (NE, NW, SW), while Gas In Place (GIP) is a function of pressure, temperature, thermal maturity, porosity, hydrocarbon saturation and net thickness.

The greatest GIP in the Marcellus shale is found in Epsilon's core operating area (Susquehanna County) and ranges between 125 and 175 Bcf per square mile, as shown below:

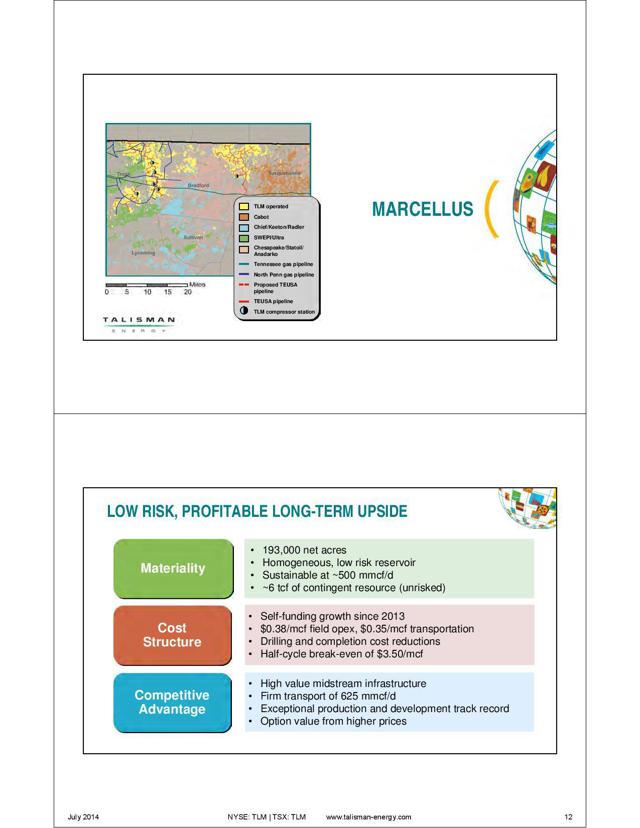

Furthermore, Talisman Energy (NYSE:TLM) has a significant position (193,000 net acres) in NE Pennsylvania, including its core acreage in Susquehanna County. Given that Talisman is drilling the sweet spot of the Marcellus shale in NE Pennsylvania, it has experienced a self-funding growth since 2013 with a break-even price of just $3.50/Mcf, as illustrated below:

After all, it was not surprising when Warren Resources (NASDAQ:WRES) acquired some producing Marcellus assets in Wyoming County, Pennsylvania in early July 2014, and characterized that area as the "core-of-the-core" of the Marcellus Shale, noting that this area includes some of the top performing Marcellus wells drilled to date.

Production And Reserves Growth

Epsilon's production and reserves keep growing YOY and this trend is going to continue over the next months. Here are some key details:

1) Significant Upward Reserves Revision Coming in December 2014: As of December 2013, Epsilon increased by 10% its proved and probable reserves to 172 Bcf and its proved reserves rose to 148 Bcf.

The thing is that the current 2P PUD reserve appraisal of 84 Bcf was based on older completion methods. After completing an engineering study in 2014, Epsilon expects that recent completion methods could provide up to a 50% increase in expected EUR/well (or 42 Bcf more than currently booked) for the remaining undeveloped (PUD) Lower Marcellus locations utilizing Short Stage Length.

This is a very interesting excerpt from the company's NR as of March 2014:

"Our operating partner is now implementing a new design on the Lower Marcellus completions which should materially enhance recovery from all of our PUD locations. Accordingly, we anticipate that the company's true reserve potential for its Lower Marcellus assets will become more apparent in 2014 and should meaningfully exceed our current bookings assuming gas prices remain constructive."

On that front, the company updated its shareholders in April 2014 with additional encouraging news, as quoted below:

"Previously we noted that our upstream operating partner had begun implementing a new design for Lower Marcellus completions which should materially enhance the recovery of Epsilon's proved undeveloped reserves. Five recently completed wells had average frac spacing intervals of 288' versus 522' for the older design. Furthermore, early indications are that completion costs for these wells are comparable to the older design despite having almost twice the number of stages. Based on the results of an independent engineering study commissioned by Epsilon on our well data, it is our expectation that these and future wells will have higher initial production rates and commensurately higher EURs than our previous well completions."

I must also point out that Epsilon has not included yet any reserves from the other formations, primarily the Upper Marcellus shale. As linked above, Epsilon noted that:

"The reserve estimates did not include any proved undeveloped or probable locations for the Upper Marcellus, Purcell Limestone or Utica Shale which are being drilled and tested by various operators in the region. We believe that there is significant untapped potential from the Upper Marcellus as we have one well currently producing from this interval and offset operators are producing several more in adjacent areas."

And these are three additional positive facts about the Upper Marcellus shale:

A) Cabot Oil & Gas has already been producing from the upper Marcellus shale. Cabot has seen very strong results in the Upper Marcellus, which are highly competitive in terms of economics and re-confirm that the Marcellus in its "core of the core" in Susquehanna and Bradford Counties is essentially a two-bench play.

B) Epsilon's CEO highlighted in his August 2013 Enercom presentation that a one well test in the upper Marcellus has shown that production from this Marcellus layer on the company acreage is economic.

C) Aside from the 2P reserves, Epsilon has a potential contingent resource estimated at 240 Bcf in the Upper Marcellus.

2) Robust Production Growth QoQ: Epsilon's upstream segment continues with its rapid growth trajectory. Epsilon produced 38 Mmcf/d in November 2013 and exited 2013 at 47 Mmcf/d. Epsilon produced 52 Mmcf/d in March 2014 and exited Q1 2014 at 60 Mmcf/d.

The Balance Sheet Is Pristine

Epsilon is profitable with both its segments making money. In Q1 2014, pre-tax income was $3.9 million and adjusted EBITDA was $11.4 million. Upstream EBITDA was $8.7 million and midstream EBITDA was $2.7 million.

Regarding the company's debt, the news is very good too. In fact, Epsilon does not face any debt problem. Epsilon's debt (approximately $32 million) is held in convertible debentures due 2017, and the company's Net debt to annual EBITDA ratio is obviously very low standing below 1x.

It must also be noted that the estimated CapEx to upgrade the midstream asset to 500 Mmcf is $15 million to $20 million, and the expansion will take approximately 6 months to be completed. Based on the mid-point of $17.5 million as a cost projection, this expansion is fully funded by the company's annual operating CF and Epsilon does not need to load any bank debt. For the remainder of 2014, Epsilon has already budgeted approximately $13.4 million that will be allocated to the expansion of Auburn Gas Gathering system. As a result, Epsilon has ample liquidity to pursue acquisitions and/or other growth initiatives, given that its credit line of $100 million is currently undrawn.

Furthermore, Epsilon hedges portions of its expected production volumes to increase the predictability of its cash flow and to help maintain a strong financial position. For the remainder of 2014, Epsilon has entered into NYMEX natural gas swaps for 30,000 mmbtu per day at an average price of $4.02.

In Q1 2014, realized prices were negatively impacted by a differential to NYMEX that averaged ($1.49). However, this differential narrowed considerably (less than $1.00) in Q2 2014. Rex Energy (NASDAQ:REXX) that is also targeting the Marcellus shale, noted that the natural gas price differentials was approximately $0.50-$0.70 below Henry Hub index prices in Q2 2014.

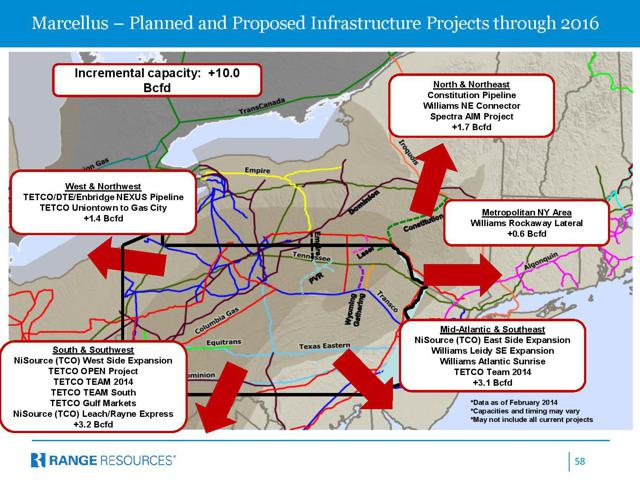

Epsilon's CEO expects pipeline capacity expansions to provide additional northeast Marcellus takeaway capacity to be realized by mid-2015. Such capacity expansion should reduce the long term Marcellus transportation costs and pricing differentials. On that front, the planned and proposed infrastructure projects in Epsilon's area through 2016 are illustrated below:

and below:

"Source: Cabot Oil & Gas - Bentek"

For instance, MarkWest Energy Partners (NYSE:MWE) has completed 25 major infrastructure projects in the last two years in the Marcellus shale, and will complete five additional projects in the Northeast in the remaining six months of 2014. MarkWest is also constructing eight additional projects, that are scheduled to begin operations in 2015 and beyond.

The New Management Team

In 2013, John Lovoi, managing partner of the energy focused advisory firm JVL Advisors along with the $10 billion asset manager Advisory Research Inc. acquired a 30% ownership stake in the company (at prices ranging from C$3 to C$4 a share).

Mr. Lovoi has been the company's Chairman since JVL Advisors took control of Epsilon in H2 2013. For the last 25 years, John Lovoi has held a number of positions in the global oil and gas business, primarily in the areas of investment banking and equity research, including its position as Head of Morgan Stanley's (NYSE:MS) Global Oil and Gas investment banking practice.

Mr. Raleigh, Epsilon's CEO, does not collect a cash salary and his compensation is entirely based on the appreciation in the stock price or the return of value to shareholders. For the last 35 years, the company's CEO has held a number of positions in the global oil and gas industry, and his experience ranges across North and South America, the UK North Sea, Russia, the Caspian area and the Middle East.

Mr. Dougherty is a Managing Director of Advisory Research Inc. This is an investment management firm founded in 1974 with more than $10 billion in assets under management, a significant portion of which is invested in N. American E&P and midstream companies.

After all, Epsilon is an energy company managed by shareholders for shareholders. Given their high stake in the company, the insiders are highly motivated to assist the company in creating greater shareholder value, and I am a strong believer that this experienced management team will maximize shareholder returns over the next months.

The Buyback Program Is Going On And A Dividend Is Very Likely

In line with its newly adopted shareholder centric approach, Epsilon initiated abuyback program in September 2013. Epsilon acquired and cancelled approximately 500,000 shares between September 2013 and December 2013, and continued in Q1 2014 by repurchasing an additional 70,500 common shares at an average price C$3.60.

Epsilon continued its buyback program in Q2 2014, and I enjoy the fact that the company keeps buying big chunk of shares on a daily basis at the current price of approximately C$4.1, as shown here.

Last but not least, the management team has expressed its intention to continue its buybacks going forward or initiate a dividend in the future. Upon taking control of the company, the new board and management issued thefollowing comments on July 16th:

"The Board intends to continue to encourage the development of Epsilon's non-operated position in the heart of the Marcellus Shale. As this valuable asset matures, the Board will explore opportunities to return the free cash flow from the Marcellus to shareholders in the most tax efficient manner possible, on a time frame to be determined depending on a number of factors, including the operator's pace of development at the field level."

The Valuation For The Midstream Asset

To estimate Epsilon's midstream asset, let's see first what is going on with the peer group and the M&A activity of the sector. There are several publicly traded MLPs with assets similar to the Auburn GGS. According to an insightful analysisfrom Morgan Stanley as of April 2013, the "Processing and Gathering" peer group includes companies like: Access Midstream Partners , Crestwood Midstream Partners (NYSE:CMLP), EQT Midstream Partners (NYSE:EQM), Crosstex Energy (NASDAQ:XTEX), Copano Energy (NASDAQ:CPNO), DCP Midstream Partners (NYSE:DPM), Markwest Energy Partners , Targa Resources Partners (NYSE:NGLS), Atlas Pipeline Partners (NYSE:APL), Regency Energy Partners (NYSE:RGP), Summit Midstream Partners (NYSE:SMLP), Southcross Energy Partners (NYSE:SXE), and Western Gas Partners (NYSE:WES).

In addition, most of these midstream peers have significant operations in the Marcellus shale like Williams Partners, Crestwood Midstream, Regency Energy Partners, MarkWest Energy Partners, and EQT Midstream Partners to name a few.

According to that detailed study from Morgan Stanley, the average EV/2013 EBITDA multiple of the peer group was almost 15 times back in April 2013, but most of these stocks have risen at least 50% since April 2013. However, their 2014 EBITDA rises at a slower pace than 50%, which results in an average EV/2014 EBITDA ratio that currently stands at approximately 18 times, as shown below:

Company

|

EV ($ million)

|

2014

EBITDA ($ million)

|

EV/2014 EBITDA

|

MarkWest Energy

Partners

|

16,500

|

800

|

20.63

|

EQT Midstream

Partners

|

5,300

(*)

|

260

|

20.38

|

Regency Energy

Partners

|

17,000

(***)

|

850

|

20

|

Summit

Midstream

Partners

|

3,700

(**)

|

200

|

18.5

|

Western Gas

Partners

|

11,000

|

600

|

18.33

|

DCP Midstream

Partners

|

8,200

|

510

|

16.07

|

Crestwood

Midstream

Partners

|

6,400

|

420

|

15.24

|

Access

Midstream

Partners

|

15,800

|

1,050

|

15.05

|

(*): Pro forma the latest offering (April 2014).

(**): Pro forma the latest senior notes (July 2014).

(***): Pro forma the latest senior notes (July 2014).

Furthermore, here are three additional helpful facts:

1) Crosstex Energy was acquired by Devon Energy (NYSE:DVN) in October 2013. Given that Crosstex realized adjusted 2013 EBITDA of $214.9 million and its EV was $8.6 billion at the time of the acquisition, Crosstex Energy was acquired for 40 times its 2013 EBITDA.

2) Copano Energy was acquired by Kinder Morgan in early 2013. Given that Copano Energy realized adjusted 2012 EBITDA of 242.6 and its EV was $5 billionat the time of the acquisition, Copano Energy was acquired for 20.6 times its 2012 EBITDA.

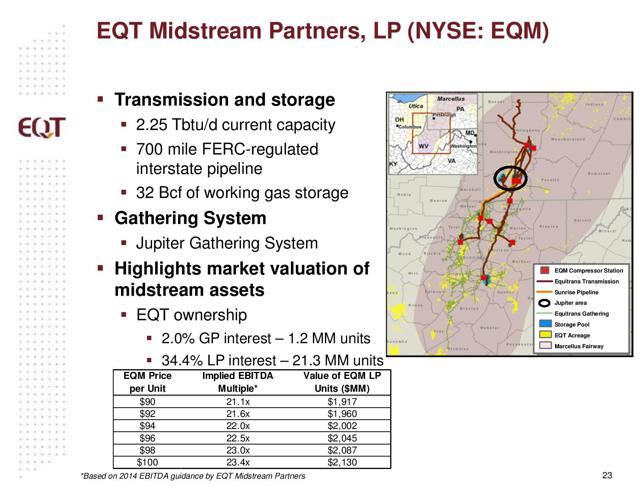

3) EQT Midstream Partners is a partnership formed by EQT Corporation (NYSE:EQT) to own, operate, acquire, and develop midstream assets in the Appalachian Basin. The Partnership provides midstream services to EQT Corporation and third-party companies through its transmission, storage, and gathering systems that service the Marcellus and Utica regions. The Partnership owns 700 miles and operates an additional 200 miles of FERC-regulated interstate pipelines. In addition, it owns more than 1,600 miles of high- and low-pressure gathering lines.

To estimate the value of its ownership in EQT Midstream Partners, EQT Corporation does not give it anything less than 21 times EBITDA, as illustrated below:

At 300 Mmcf, Epsilon's asset is projected to generate $13.5 million annual EBITDA. At its maximum upgraded 500 Mmcf gathering capacity, this midstream asset will generate $23 million in annual EBITDA by 2016. The gathering system volume should ramp up to 400 Mmcf by year end ($18 million annual EBITDA), followed by an eventual increase to 500 Mmcf in 2015 ($23 million annual EBITDA), as illustrated below:

It is apparent that Epsilon's midstream asset has turned into a veritable cash cow for Epsilon Energy, and all indicators point to a continuation of this trend.

To estimate the midstream asset's fair value, I will use the lowest estimate of $13.5 million annual EBITDA, based on the current gathering capacity of 300 Mmcf. Based also on the peers' valuation, it is reasonable to assume that Epsilon's midstream EV should trade at 15 times its EBITDA. At 15 times multiple, this asset is worth:

$13.5 X 15 = ~$203 million.

And this is obviously a very conservative estimate, given that the imminent upgrade will ramp up the gathering volume to 400 Mmcf ($18 million annual EBITDA), and an eventual increase to 500 Mmcf will be completed by 2015 ($23 million annual EBITDA).

It must also be pointed out that the company has already received expressions of interest for a total gathering volume of up to 500 Mmcf, so the upgrade to 500 Mmcf could likely be completed by year end, given also that this expansion is fully funded by the company's CF.

The Valuation For The Upstream Segment

In this paragraph, I will use two different methods to calculate the fair value for Epsilon's upstream segment that currently produces 10,000 boepd (100% natural gas) and owns 24.67 MMboe of Proved reserves.

Both the peers' valuation and the key metrics of the latest heavily natural gas weighted deals provide a real-time valuation benchmark for substantial dry gas properties, and help any potential investor estimate as accurately as possible the value of Epsilon's own acreage in the Marcellus play.

1) The Peers' Valuation: In this paragraph, I will evaluate Epsilon Energy compared to the peer group. Epsilon Energy is an intermediate producer whose production was 10,000 boepd (100% natural gas) in late March 2014 and is going to rise further by year end. Furthermore, Epsilon's assets are in the US.

As such, the peer group includes companies with assets in the US and Canada, given that the Henry Hub/AECO spread has shrunk and the natural gas price is about the same in both countries. The following peers are not oil-weighted producers and they do not have any assets in Asia or South America or Europe or Africa. Needless to mention that these competitors do not have any offshore assets either.

In addition, Epsilon's production is 100% natural gas. However, there are not many intermediate producers with 100% natural gas-weighted production. To overcome this third parameter, I will compare Epsilon to the heavily natural gas weighted intermediate producers, whose production is more than 85% natural gas. At the end of my calculations, I will make some small adjustments to eliminate the minor oil/liquids impact.

After all, here are Epsilon's peers:

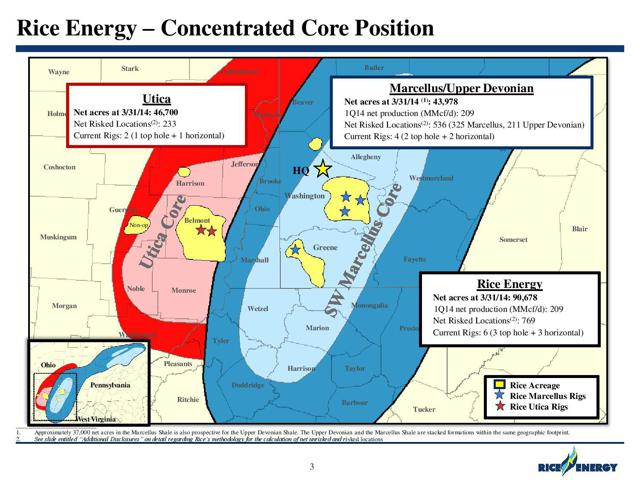

A) Rice Energy (NYSE:RICE) has producing assets in the Appalachian Basin, targeting the Marcellus shale in Pennsylvania and the Utica shale in Ohio, as illustrated below:

B) Advantage Oil & Gas (NYSE:AAV) has producing assets in Alberta, targeting the Montney formation, as illustrated below:

"Source: Advantage Oil website"

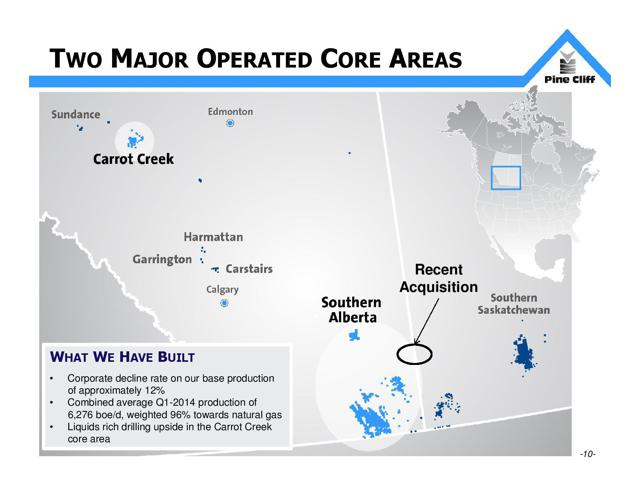

C) Pine Cliff Energy (OTC:PIFYF) has producing assets in Alberta, as illustrated below:

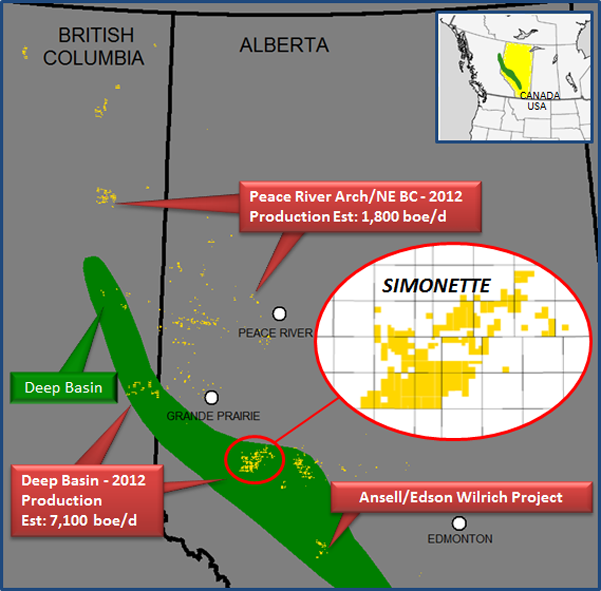

D) Cequence Energy (OTCPK:CEQXF) has producing assets in British Columbia and Alberta, as illustrated below:

"Source: Cequence Energy website"

E) Painted Pony Petroleum (OTCPK:PDPYF) has producing assets in British Columbia and Saskatchewan, targeting the Montney formation, as illustrated below:

"Source: Painted Pony Petroleum website"

And I have to point out that:

A) I took into account the working capital (surplus or deficiency) to calculate the Net Debt and the Enterprise Value accurately ($1 = C$1.07).

B) Rice Energy has a midstream subsidiary (Rice Poseidon Midstream) whichdoes not contribute any revenue or earnings at the company's top or bottom lines, as of Q1 2014. Given that Rice's midstream subsidiary acquired Marcellus shale gathering assets for $110 million in February 2014 and plans to spend an additional ~$265 million on midstream infrastructure in 2014, I estimated Rice's midstream subsidiary at $500 million (rich estimate). As a result, the amount of $500 million has not been included in Rice's EV mentioned below.

After all, let's proceed now with the calculations of the following key metrics:

A) Per EV/Production: This is the table with the first key metric:

Company

|

EV

($ million)

|

Current

Production (*)

(boepd)

|

EV

---------

Current

Production

($/boepd)

|

Rice

Energy

|

3,500

(***)

|

~39,000 (***)

(100% natural gas)

|

89,744

|

Painted Pony

Petroleum

|

1,000

(*****)

|

14,000 (*****)

(89% natural gas)

|

71,429

|

Advantage Oil

& Gas

|

1,100

|

22,500

(99% natural gas)

|

48,889

|

Cequence

Energy

|

460

(****)

|

10,400 (****)

(86% natural gas)

|

44,231

|

Pine Cliff

Energy

|

440

(**)

|

11,000 (**)

(98% natural gas)

|

40,000

|

(*): Estimate, based on the latest corporate news.

(**): Pro forma the recent acquisition in Alberta.

(***): Pro forma the recent deal with Chesapeake that will be funded by a combination of cash on hand, borrowings under the revolving credit facility and a potential equity offering.

(****): Pro forma the Ansell sale.

(*****): Pro forma the Saskatchewan sale.

Based on the data above, I get:

Average

(Rice, Painted Pony, Cequence,

Advantage, Pine Cliff)

| |

$/boepd

|

58,859

|

Based on the average metric above, Epsilon's enterprise value for the upstream asset would be: $58,859/boepd X 10,000 boepd (Epsilon's current production)= ~$588 million.

B) Per EV/1P Reserves: Here is the table with the second key metric:

Company

|

EV

($ million)

|

Proved

Reserves

(MMBoe)

|

EV/1P

($/boe)

|

Rice

Energy

|

3,500

(**)

|

102 (**)

(100% natural gas)

|

34.31

|

Pine Cliff

Energy

|

440

(*)

|

25.1 (*)

(98% natural gas)

|

17.53

|

Painted Pony

Petroleum

|

1,000

(****)

|

58.7 (****)

(89% natural gas)

|

17.04

|

Cequence

Energy

|

460

(***)

|

53 (***)

(86% natural gas)

|

8.68

|

Advantage Oil

& Gas

|

1,100

|

172.3

(96% natural gas)

|

6.38

|

(*): Pro forma the recent acquisition in Alberta linked above.

(**): Pro forma the recent deal with Chesapeake linked above.

(***): Pro forma the Ansell sale linked above.

(****): Pro forma the Saskatchewan sale linked above.

Based on the data above, I get:

Average

(Rice, Painted Pony, Cequence,

Advantage, Pine Cliff)

| |

$/boe

|

16.79

|

Based on the average metric above, Epsilon's enterprise value for the upstream asset would be: $16.79/boe X 24.67 MMboe (Epsilon's 1P) = $414 million.

C) Per EV/EBITDA: Let's check out the table below with the third key metric:

Company

|

EV

($ million)

|

2014 EBITDA (*)

($ million)

|

EV

----------

2014 EBITDA

|

Painted Pony

Petroleum

|

1,000

(*****)

|

65

(*****)

|

15.38

|

Rice

Energy

|

3,500

(***)

|

300

(***)

|

11.67

|

Pine Cliff

Energy

|

440

(**)

|

65

(**)

|

6.77

|

Cequence

Energy

|

460

(****)

|

80

(****)

|

5.75

|

Advantage Oil

& Gas

|

1,100

|

200

|

5.5

|

(*): Estimate, based on the company's production and guidance.

(**): Pro forma the recent acquisition in Alberta linked above.

(***): Pro forma the recent deal with Chesapeake linked above.

(****): Pro forma the Ansell sale linked above.

(*****): Pro forma the Saskatchewan sale linked above.

Based on the data above, I get:

Average

(Rice, Painted Pony, Cequence,

Advantage, Pine Cliff)

| |

EV/EBITDA

|

9.01

|

Based on the average metric above, Epsilon's enterprise value for the Upstream asset would be: 9.01 X $45 million (Epsilon's 2014 Upstream EBITDA)= ~$405 million.

To sum it up:

Fair EV

(Upstream)

($ million)

| |

Per Production

|

588

|

Per 1P Reserves

|

414

|

Per EBITDA

|

405

|

Average

|

469

|

Average (Discounted by 20%)

|

375

|

As shown above, I took the decision to discount the average EV for Epsilon's upstream asset by an overly generous 20% to eliminate any impact from the two (out of 5) heavily natural gas weighted companies (Painted Pony Petroleum, Cequence Energy), whose production has 11% and 14% oil and liquids respectively.

2) The Key Metrics Of The Deals: I have summarized below all the latest natural gas weighted deals (85% natural gas or higher) in the US and Canada, although it was hard to find them because few of them were completed over the last twelve months. All of them are 100% natural gas weighted and two of them took place in regions very close to Epsilon's core operating area in the Marcellus shale. As such, they are very helpful for my calculations:

A) In July 2014, Rice Energy paid $336 million and acquired producing properties located in the sweet spot of the Marcellus shale in western Greene County, Pennsylvania, from Chesapeake with approximately 3,333 boepd (100% natural gas) and approximately 10 MMBoe of Proved Reserves (100% natural gas). The acquisition metrics of that deal was $100,810/boepd and $33.6/boe of Proved reserves.

B) In July 2014, it was Warren Resources that also bought assets in Epsilon's area, targeting the Marcellus shale. Warren paid $352.5 million to acquire 13,666 boepd (100% natural gas) and 34.72 MMboe of Proved reserves (100% natural gas). The acquisition metrics of that deal was $25,793/boepd and $10.15/boe of Proved reserves.

What also sounds great for Epsilon Energy is the statement from Warren's Chairman and CEO: "We are acquiring some of the most economic wells in the 'core-of-the-core' Marcellus, directly south of Cabot's position. Our technical teams are optimistic about the potential to identify additional reserves, both in the Lower and Upper Marcellus, and we believe that we can achieve strong production results in both of these zones."

C) In July 2014, Pine Cliff Energy paid $100 million cash and acquired assets in Alberta and Saskatchewan with 5,300 boepd (100% natural gas) and 10.7 MMboe of Proved Reserves (100% natural gas). The acquisition metrics of that deal was $18,870/boepd and $9.38/boe of Proved reserves.

Rice

Deal

|

Warren

Deal

|

Pine Cliff

Deal

|

Average

| |

$/boepd

|

100,810

|

25,793

|

18,870

|

48,491

|

$/boe

(1P Reserves)

|

33.6

|

10.15

|

9.38

|

17.71

|

Given that Epsilon produces 10,000 boepd (100% natural gas) and owns 24.67 MMboe of Proved reserves, this is an average estimate for Epsilon's upstream asset based on the key metrics of the latest 100% natural gas weighted deals:

- Per Production: $48,491/boepd X 10,000 boepd = ~$485 million.

- Per Proved Reserves: $17.71/boe X 24.67 MMboe = ~$437 million.

- Average: $485 million + $437 million = 922/2 = ~$461 million.

3) Let's summarize all the results above at the following table:

Fair EV

(Upstream)

($ million)

| |

Per the Peers' Key Metrics

(Discounted by 20%)

|

375

|

Per the Key Metrics Of The Deals

(100% nat gas weighted, 0% discount)

|

461

|

Average

|

418

|

Grossly Undervalued As A Combination Of The Upstream And The Midstream Assets

Let's summarize now all the aforementioned results at the following table:

Valuation

($ million)

| |

Midstream Asset

(Low Estimate)

|

203

|

Upstream Asset

(Low Estimate)

|

418

|

Total EV

(Low Estimate)

|

621

|

Given that the Net Debt is $38 million (March 2014) and the company has 50.2 million outstanding shares, the market cap should be now at $583 million or$11.61 per share (low estimate). This translates into an upside of 210%, based on the current price of $3.8 (US listing, EPSEF ticker).

The Low Estimate Of $11.61 Per Share And The Icing On The Cake

To emphasize further on the fact that the estimate of $11.61 per share is the low estimate for Epsilon's assets (upstream and midstream), I will mention a transaction for a similar hybrid asset (upstream and midstream) that took place just one month ago. In June 2014, Cequence Energy sold to Bonavista Energy(OTCPK:BNPUF) its entire interest in its non-operated assets located in the Ansell area in Southern Alberta for $141 million.

The Ansell Assets consist of 18,800 net acres of land, current production of 1,600 boepd (90% natural gas) and a 49% working interest in a 120 MMcf/d sales pipeline and a 30 MMcf/d compressor station.

In other words, Cequence's upstream asset produced 1,600 boepd (90% natural gas) and the midstream asset was a 60 MMcf/d sales pipeline and a 15 MMcf/d compressor station. Cequence's asset also held 3.6% of Cequence's total 2P Reserves that translates into 4.06 MMboe (84% natural gas) of 2P Reserves, while Epsilon's 2P Reserves are 28.67 MMboe (100% natural gas).

Apparently, Cequence's asset was roughly one sixth of Epsilon's assets (without including any additional production growth from the Upstream segment and any Midstream upgrade).

If I extrapolate the implied valuation from this transaction onto Epsilon's assets, the EV would be: $141 million X 6 = ~$846 million.

Given that the Net Debt is $38 million (March 2014) and the company has 50.2 million outstanding shares, the market cap should be now at $808 million or$16.1 per share. This translates into an upside of 320%, based on the current price of $3.8 (US listing, EPSEF ticker).

Reasons For The Mispricing

The huge disconnect between the company's current price and its fair value is primarily attributed to the perfect combination of the following reasons:

1) Extremely Low Awareness: Epsilon is literally having no analyst coverage, and a potential investor cannot find a detailed and fundamental analysis for both company's assets in any online financial publication as of today.

This awareness problem was also "supported" by the fact that the company was a small junior producer (production less than 10,000 boepd) until the end of 2013.

2) The Hybrid Nature Of The Asset Base: The hybrid asset base requires an extensive analysis which makes an objective evaluation for both assets more difficult and time-consuming.

Catalysts

The following catalysts that can push Epsilon's stock much higher, bringing the valuation in line with peers:

1) Monetization Event Or Initiation Of A Dividend: The management has expressed openness to consider a transaction once the upstream and midstream assets are fully optimized, as indicated in the Q3 2013 earnings report:

"In our opinion, the optimal time to approach the divestiture market is when both the upstream and midstream assets have been optimized. We will continue to pursue a monetization strategy that is accretive to shareholders for the foreseeable future."

2) Increasing Awareness And/Or Analyst Coverage: This is the second article about Epsilon and I will continue writing about this gem to update my thesis over the next months.

In addition, the production will continue growing by leaps and bounds over the next months thanks to the sweet spot of the Marcellus shale, while the company is going to upgrade its midstream asset by year end.

After considering all these factors, I believe the awareness cannot go anywhere but up, and I expect the first US-based and Canadian analysts to show up over the coming months.

3) Takeover Target: Epsilon operates among several major producers as mentioned above, while its midstream partners (Chesapeake, Statoil, Access Midstream Partners) are also major players in the energy sector with ample liquidity and desire to grow their business. So a buyout for the entire company is always looming, although this is a speculative scenario and an investor had better not make his investment decisions based on such a speculative scenario.

Risks

By investing now in Epsilon Energy, an investor faces the following risks:

1) Commodity risk: Epsilon drills the sweet spot of the Marcellus shale, as indicated not only by its own excellent drilling results and the geological map of the area, but also the results of several major producers in that area like Chesapeake, Cabot, and Southwestern Energy. As such, the exploration and/or development risk is almost non-existent.

However, there is the commodity risk which is actually typical for all the energy companies. Natural gas price is likely to weaken further in the coming years, or the Marcellus regional market prices may continue to be depressed due to a failure for the upcoming take away capacity to relieve the bottleneck. Severely depressed natural gas prices could impair the value of the producing reserves and render undeveloped reserves uneconomic to develop.

Nevertheless, an investor needs to bear in mind that:

A) Epsilon drills the sweet spot of the Marcellus shale where the wells are economic even at prices between $3.5/MMbtu and $3.8/MMbtu, as shown above.

B) The natural gas price in the US will bottom out somewhere at the current levels, for several reasons. The first reason is the natural gas exports given that the Asian countries currently pay triple what North Americans pay. In China and Japan, for instance, natural gas consumers are paying approximately $12/Mcf, which is three times the amount that North American consumers are paying.

The second reason is coming from the power generation sector. Utilities are gradually using more gas versus coal, and EIA estimates that by 2035 natural gas will surpass coal as leading electricity source.

The third reason is coming from the transportation sector. With natural gas vehicles being 25% cleaner, fuel costs 50% less and new refueling stations being added across the U.S., the number of U.S. natural gas vehicles is expected to increase significantly over the next years. Meanwhile, several fleet managers are gradually converting all or parts of their fleets to natural gas, while the three largest U.S. truck manufacturers are now producing dual-fuel CNG trucks.

C) The differential between the regionally produced Marcellus gas and NYMEX will narrow further over the coming months as new takeaway capacity is coming online, as shown in the previous paragraphs. Epsilon management shares the same outlook, according to the Q3 2013 earnings report:

"The price differential (the difference between price paid to Epsilon and NYMEX) for our operating region remains stubbornly high due to infrastructure constraints and the productive nature of the sub-surface rock. We believe the current differential will narrow significantly in coming quarters as new infrastructure projects become operational. In the longer term, we believe gas will trade between $3.50 - $4.50/mcf. In this environment, our two assets will generate attractive levels of cash flow which will provide management the opportunity to repurchase additional shares or pay dividends to shareholders."

2) Non-operator: Epsilon is not an operator of its acreage, so the company does not control the pace of development. In case, Chesapeake slows down drilling at the sweet spot of the Marcellus shale, Epsilon's cash flow will be affected negatively.

In addition, if Epsilon's midstream partners do not upgrade the mid-stream asset by year end, Epsilon's operating CF from the midstream asset will not increase, as anticipated.

However, Epsilon's partners have not expressed a wish to slow down development drilling or to postpone the upgrade of the midstream asset. And if they do, Epsilon's management can plow cash flows into buybacks until development is resumed.

3) The Midstream Asset And The Disruptions: Fortunately, the Marcellus shale is the most prolific natural gas weighted formation in the US and optimization techniques will be used to achieve better drilling performance, while improving the economics of the wells over the next years.

In addition, the development of the stacked pay zones, which is currently in its infancy, will give an additional boost to the Marcellus' production, ensuring that the nat gas production in that area will remain high over the next decades.

After all, the risks for the midstream asset are limited only to the typical disruptions that can occur in any plant. And these potential disruptions (seasonal disruptions for maintenance or other reasons) will have only a temporary effect on Epsilon's operations.

My Takeaway

I always strive to be ahead of the curve on my calls in order to do a lot of bottom-up stock picking. And I typically wander outside of the usual tightly-controlled channels, investing in grossly undervalued companies before there is analyst coverage, as shown in my previous "Top Ideas." As such, I decided to capture this opportunity because the magnitude of the potential reward is staggering thanks to the following reasons:

1) Epsilon is in a very solid financial footing, does not carry any financial leverage while having ample liquidity to fund its operations going forward, to pursue acquisition opportunities and to further support the share buyback program.

2) This profitable company is blessed with the exposure to Susquehanna's generous geology. Being at the sweet spot of the Marcellus shale, Epsilon's wells have exceptional productivity, while high initial production rates drive high EURs. Since Chesapeake, Epsilon's partner, has been continuously perfecting its frac design, the productivity of these wells may also surprise to the upside over the next months.

3) Epsilon is on a strong growth trajectory with experienced operators as JV partners (upstream and midstream).

4) Given the high insiders ownership of 30%, Epsilon has a significantly streamlined and aligned management team and Board of Directors focused on maximizing the value of the midstream and upstream assets.

5) The demand for Epsilon's midstream services is growing rapidly, given that several monster wells are drilled in its core operating area.

6) A significant increase for the company's reserves is very likely by 2015. Based on a recently completed engineering study, Epsilon expects that Chesapeake's new completion methods could provide up to a 50% increase in expected EUR/well (or 42 Bcf more than currently booked) for the remaining undeveloped (PUD) Lower Marcellus locations utilizing Short Stage Length. In addition, Epsilon believes that, thanks to the new completion method, its future wells will have higher initial production rates than its previous well completions.

7) The natural gas price has limited downside from the current levels of $3.7/MMbtu for the reasons mentioned above, while it is important to understand the cyclical nature of the commodity markets.

8) A takeover is always looming, given that Epsilon is surrounded by major energy players, drills the sweet spot of the most prolific natural gas weighted formation in the US, while having a profitable and growing midstream business.

After all, Epsilon is the next multi-bagger in the energy sector. Epsilon is a no-brainer bargain, and it is obvious that very little, if anything, is priced in its current valuation of C$4.1 (Toronto listing) or $3.8 (US listing).

Epsilon's should be at $11.61 (low estimate, US listing) now although this calculation may prove conservative well before 2015. In fact, the price of $16.1(US listing) will not surprise me at all, given the recent transaction between Cequence Energy and Bonavista Energy, as explained above.

Disclaimer: The opinions expressed here are solely my opinion and should not be construed in any way, shape, or form as a formal investment recommendation. Investors are reminded that before making any securities and/or derivatives transaction, you should perform your own due diligence. Investors should also consider consulting with their broker and/or a financial adviser before making any investment decisions.

Editor's Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks.

By Value Digger

No comments:

Post a Comment