Summary

Stocks swiftly put the Brexit news aside, staging a big, three-day rally.

Economic news was generally favorable.

The week ahead packs plenty of data into a holiday-shortened week.

There is seasonal support, and plenty of inexpensive candidates for a summer rally.

Much depends on Friday's employment report.

This week's calendar includes plenty of data and a holiday-shortened week. The employment report looms, with many worried about a repeat of the weak May results. With Brexit apparently digested and the Fed on hold, I expect some attention to the possible upside. The financial media will be asking: Is it time for the summer rally?

Last Week

Brexit was the big story. The market rebound was surprising to many, forcing a change of perspective. The economic news was mostly good, but got short shrift.

Theme Recap

In my last WTWA, I predicted another week about Brexit, with emphasis on the possibility of a market turning point. That is certainly how the week started. CNBC even bumped Shark Tank and the West Texas guys from the 7PM EDT slot for another round of Markets in Turmoil. After stocks moved higher, the schedule went back to normal.

Last week's "Final Thoughts" section was also on target, suggesting a weak Monday, but emphasizing the need for investors to consider the plausible range for the week's trading.

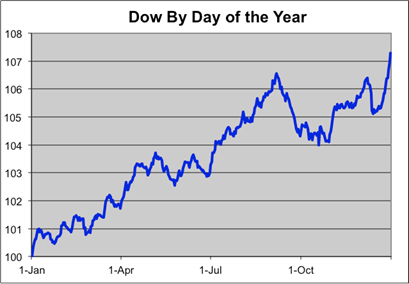

The Story in One Chart

I always start my personal review of the week by looking at this great chart from Doug Short. You can clearly see the exciting path for the week - early weakness from the continuing Brexit selling, a big, three-day rally, and a flat Friday as people left early for the long weekend. Doug has a special knack for pulling together all of the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis and several other charts providing long-term perspective.

Each week I break down events into good and bad. Often there is an "ugly" and on rare occasion something really good. My working definition of "good" has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news - and you should, too!

The Good

- The ATA trucking index for May was strong up 2.7% on a seasonally adjusted basis and 5.7% year-over-year. (Calculated Risk).

- Congress and the President managed enough cooperation to pass Puerto Rico relief legislation. (The Hill).

- Consumer confidence increased significantly to 98 versus the prior reading of 92.4. This beat estimates by over 5 points, but some noted that the survey preceded the Brexit news.

- Personal spending increased 0.4% m-o-m and almost 5% over the prior year. This will be a positive for Q2 GDP.

- Fed stress tests were positive, as was the case last week. This week the question was whether banks could execute plans for dividends and stock buybacks. Nearly all passed, but Morgan Stanley was a notable exception. (MarketWatch).

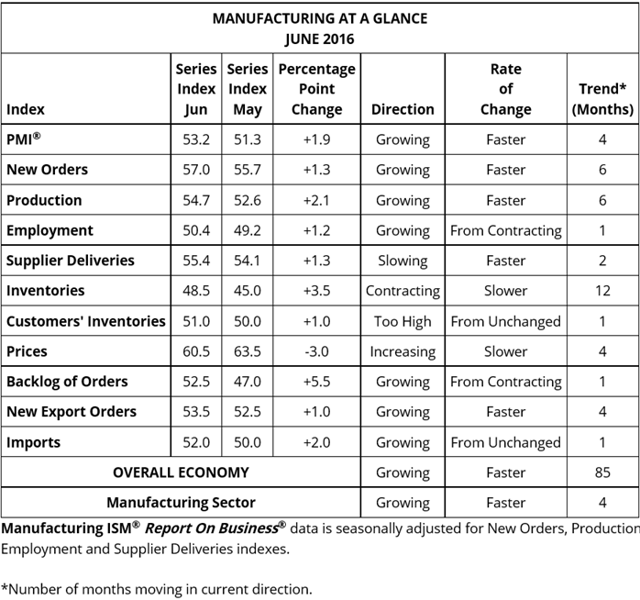

- The ISM report was strong. The index reading of 53.2 (if annualized) is consistent with GDP growth of 3.2%. Scott Grannis illustrates this relationship.

Looking at the sub-categories provides some useful color.

The ISM also has a separate report on expected Brexit effects. I found them to be surprisingly small. The Chicago PMI also showed a very strong increase. (Calculated Risk).

The Bad

- The rail contraction continues although the rolling averages are improving a bit. Steven Hansen has the update.

- Pending home sales decreased 3.7% in May and 0.2% y-o-y. (Calculated Risk).

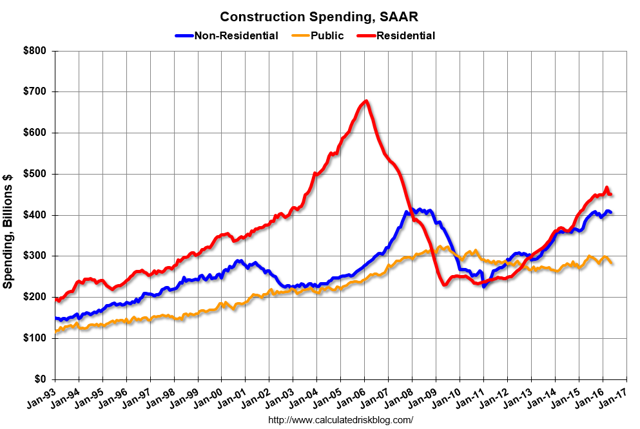

- Construction spending decreased 0.8% in May. Calculated Risk notes that this is mostly from public spending, illustrating with this chart:

The Ugly

Rio Olympics. The stories are starting to mount, with the WSJ calling it a perfect storm of problems. The recession has crushed budgets for public services. Violence and pollution have grabbed headlines. Zika is causing some athletes to reconsider participation. It is a shame that a great tradition is threatened.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. This week's winner is CNBC anchor Sara Eisen, for her first-rate, myth-busting interview with Fed Vice-Chairman Stanley Fischer. (Transcript and video via CNBC). One-by-one she asked all of the key questions in the current debate over Fed policy - potential for negative rates, Brexit impact, does the Fed make decisions based the economic impact abroad, the state of the economy, recession potential, employment, George Soros, and the strong bond market. Whether or not you agree with Vice-Chairman Fischer, it is important to know what he thinks.

Sara Eisen displayed first-rate journalism, as expected from a Medill Schoolgraduate. Unlike so many other financial interviewers she did not argue with her subject nor push her own agenda. She did raise all of the current Fed misperceptions common in the trading community. Her preparation and poise helped us all learn important information. It was well worth turning off my mute button and dialing back the TIVO.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a big week for economic data, and only four days of trading. I expect it to start slowly culminating in the biggest news on Friday. In my calendar I highlight only the most important items, helping us all to focus.

The "A" List

- Employment report (NYSE:F). Deserved or not, this is always the biggest news of the month. Rebound expected.

- FOMC Minutes (NYSE:W). You might wonder how this could provide fresh news. The punditry will find a way.

- The ISM Services Index . Will strength match the manufacturing index?

- ADP Private Employment (Th). A good alternative to the "official" numbers.

- Initial claims (Th). The best concurrent indicator for employment trends.

The "B" List

- Factory orders (NYSE:T). Volatile May data, but an important sector

- Trade Balance . Also May data, but a factor in gauging GDP.

- Crude inventories . Often has a significant impact on oil markets, a focal point for traders of everything.

The week may start a bit slowly as participants return from the long weekend. There is plenty of FedSpeak for those needing a fix. More Brexit commentary and predictions will also be a feature, with emphasis on European markets and specific companies.

Next Week's Theme

After two weeks of Brexit stories, market participants seem ready to move on. We have a pretty busy week for economic data, with the news occurring over only four days and a sleepy start on Tuesday. Friday's employment report will be the big story of the week, and might be a multi-day theme.

Despite this, I am intrigued by two posts from my blogging friend Eddy Elfenbein. (Eddy seems to have scored a regular appearance gig on CNBC. His comments are always on target, and they should give him more time. I turn off the mute and TIVO back whenever I see him).

First, Eddy noted that the market has been in an extremely tight trading range for almost two years.

Second, he crunched some data showing one-day results for every day of the year for a 120-year period.

The two-month period beginning right now has historically provided about half of the annual stock gains. Eddy wisely warns that this is interesting, but not a basis for prediction. I agree, but the theme should attract some attention.

In addition, the Fed is expected to remain on hold and Brexit worries digested. Many will be asking:

Is it time for the summer rally?

Feel free to join the discussion in the comments, but here are the key themes I see.

Bearish

- The rally has created an overbought market.

- Market valuation is extended and earnings are weak.

- Brexit remains important - more than people realize.

- There is a real threat of global recession.

Bullish

- The Brexit story seems to have a favorable ending. Ed Yardeni writes:The Brexit vote didn't change my secular bullish stance. That's because I don't believe it will cause a recession in the US. I expect that earnings growth will resume during the second half of this year and that interest rates will remain as low as they are now for the foreseeable future.

- Earnings may well be at a turning point. (Brian Gilmartin, with some support from FactSet).

- Recession odds (judged by the best methods) remain very low. Stock prices erroneously reflect high macro worries.

- Low interest rates make stock returns attractive to many investors.

Quant Corner

We follow some regular great sources and also the best insights from each week.

Risk Analysis

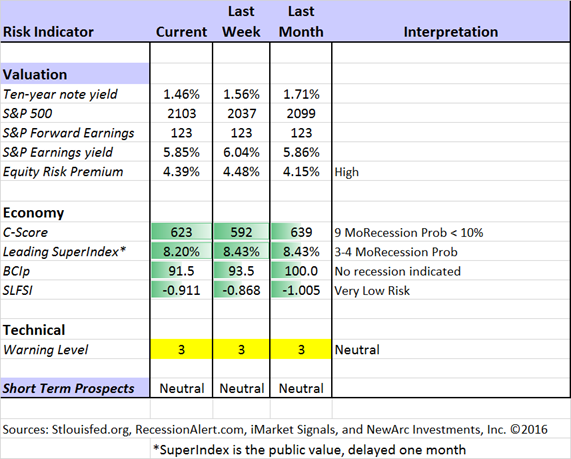

Whether you are a trader or an investor, you need to understand risk. Risk first, rewards second. I monitor many quantitative reports and highlight the best methods in this weekly update.

The Indicator Snapshot

The Featured Sources:

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies. This week he expresses more confidence about growth in earnings.

Bob Dieli: The "C Score" which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). His subscribers get Monthly reports including both an economic overview of the economy and employment.

This week the recession odds (in nine months) have nudged closer to 10%. This does not completely reflect Brexit effects, so we may get a further revision.

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

Doug Short: The Big Four Update, the World Markets Weekend Update (and much more).

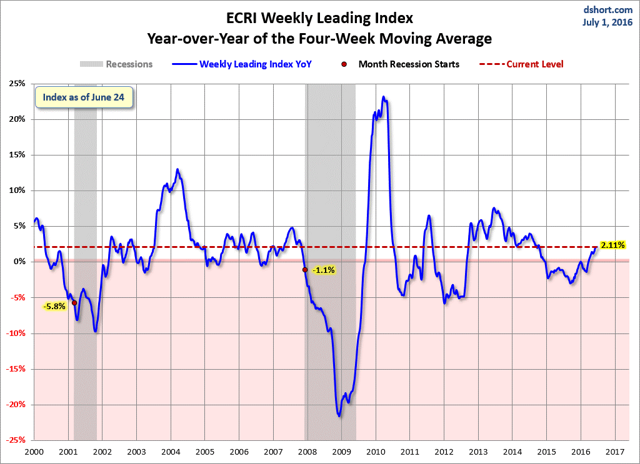

The ECRI has been dropped from our weekly update. It was not so much because of the bad call in 2011, but the stubborn adherence to this position despite plenty of evidence to the contrary. Those interested can still follow them via Doug Short and Jill Mislinski. The ECRI commentary remains relentlessly bearish despite the upturn in their own index.

Georg Vrba: The Business Cycle Indicator, and much more. Check out his sitefor an array of interesting methods. His latest update describes the elements of the indicator we cite every week.

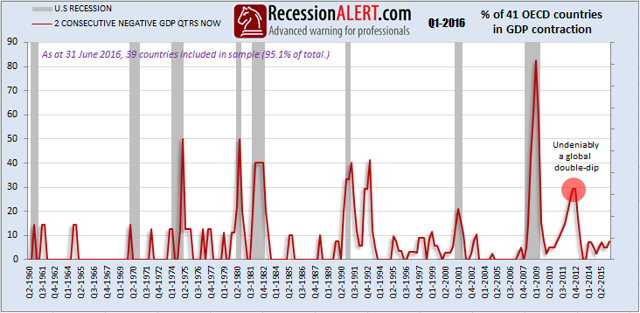

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature his recession analysis, Dwaine also has a number of interesting approaches to asset allocation. Dwaine's most recent update, shows the increase in the number of countries with back-to-back quarters of losses in GDP.

As we review the weekly indicators it is important to maintain perspective. A 20% chance of a recession would be average. It is not a reason for fear, since it says that a recession is very unlikely. There will be a time to exercise more caution, but we are not yet close to that point.

How to Use WTWA

In this series I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. For most readers, they can just "listen in." If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide a number of free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!) Free reports include the following:

- Understanding Risk - what we all should know.

- Income investing - better yield than the standard dividend portfolio, and also less risk.

- Felix and Holmes - top artificial intelligence techniques in action.

- Why 2016 could be the Year for Value Stocks - finding cheap stocks based on long-term earnings.

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions or suggestions for new topics.)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and also the best advice from sources we follow.

Felix and Holmes

We continue our neutral market forecast. Felix remains almost fully invested but with somewhat more cautious choices. This was good for most of the week. The more cautious Holmes is still fully invested, in selections that dodged the Brexit fallout pretty well. Holmes uses a universe of nearly 1000 stocks, selected mostly by liquidity. Even when the overall market is neutral, there will often be some strong candidates. That is what we see now. It is not a resounding endorsement of the overall market, but a vote for opportunistic trading.

Top Trading Advice

One of the reasons I enjoy and learn from Brett Steenbarger is the unique quality of his insights. He often discusses a topic that you might think is simple and obvious in retrospect. The value is that no one actually follows the key process in real time! His recent post on Confusion and Clarity in Trading is an excellent example. How many times are you in a situation where you simply do not know? How often do you admit it?

Adam H. Grimes also has simple but powerful advice: Take notes! Use them to identify biases and action points.

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read this week, it would be Josh Brown's first-rate warning about the latest round of financial scams. Josh has street cred on helping investors - often by revealing what is going on behind the scenes. I reviewed his book Backstage Wall Street, noting that it would save reader thousands of dollars. I have also often cited hissecond book, written with Jeff Macke, on several occasions. What he writes is colorful, fun, and always adding to his main theme of helping the individual investor.

This week's post emphasizes that intelligent and prominent people can be victims. It happens even if you are dealing with a prestigious firm. It can easily happen to you. There are many good points, but here is the conclusion:

Peter Lynch said that "Far more money has been lost by investors preparing for corrections than has been lost in corrections themselves." If your advisor's answer to the potential for corrections or volatility is to sell you silly (OP: ahem - stuff) from outer space, then your follow up question should be whether or not he or she gets paid for the privilege of your having bought it.

[Jeff] Sadly, I often see such complicated and illiquid assets in the accounts of new clients, usually after a big commission has already been paid and there is no cheap escape.

Stock Ideas

Barron's mentions Volkswagen, big U.S. banks, and Southwest airlines as candidates for major moves.

Chuck Carnevale ventures a bit out of his wheelhouse, using his typical valuation methods on a more speculative stock sector - biotech. This is very interesting reading, with plenty of ideas and suggestions.

John Buckingham of the Prudent Speculator has plenty of ideas worth considering.

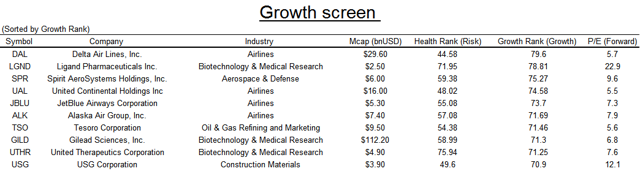

It is always interesting to compare the results from different research processes and screens. Here is Value Walk's growth screen for June.

Brexit Reprise

- Brexit selling might already be over. The story is getting boring. This was from Tuesday!

- Brexit might not really occur. Readers might recall that I predicted this a few weeks ago, suggesting that the referendum result might wind up as a negotiating ploy. It was a Barron's story this week, and others are joining in.

- Economic predictions are already suspect. I started to quote the culprits, but decided not to. What is the point. Beware of writing when you are reaching outside of your "happy zone." The basic economic effects on the U.S. will be modest. Most of the dire predictions relate to falling dominoes, an easy and typical scare tactic.

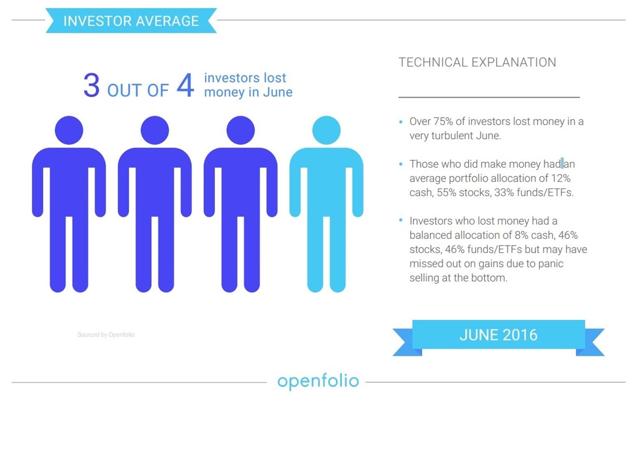

- Most investors lost money. (MarketWatch).

Personal Finance

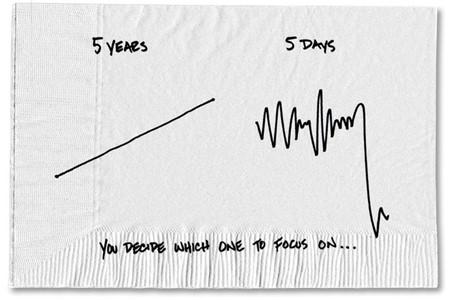

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read AR every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. There are always several great choices worth reading, and I have two favorites this week. The first, from Josh Brown, is reported above. The second is a brief and cleverly-written story by Carl Richards. It is difficult to quote it without spoiling, so please take a few seconds to read it yourself. Here is the Sketch Guy's chart:

Kurt Feuerman has a similar story about the news barrage from perma-bears whenever markets turn volatile. It is well worth reading his account of past crises, looking at the charts, and enjoying the picture of a nasty-looking bear. Here is a key quotation:

Right now, for instance, is a good example of when to exert your objectivity. Fear is running high. Along with that, there's a pervasive distrust of equities. But let's look a little closer. The yield on equities is roughly 2.2% versus the 10-year Treasury yield of 1.5%. Once again, there's a mad dash to safety assets, so the rates on Treasuries continue to fall. Yet the current situation actually creates a double positive for stocks: interest rates are likely to stay lower for longer, which helps support equity valuations while also providing investment-grade issuers with the ability to borrow cheaply and increase shareholder value.

Watch out for….

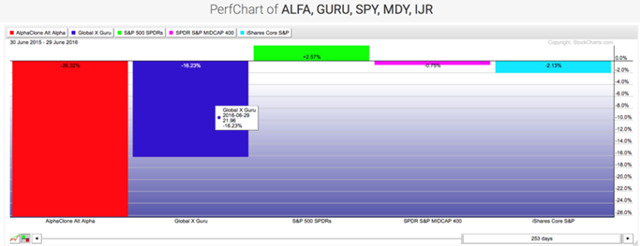

Chasing performance from last year's best hedge funds. Abnormal Returnstakes two successful funds with completely different strategies. Here is how they are now doing:

Final Thoughts

I doubt that I can match my "final thoughts" from the last two weeks. I hope readers were helped in weathering another round of macro news with plenty of speculation about U.S. stocks.

The potential trading range I laid out two weeks ago was pretty much on target. The preliminary expectations about the vote led to a larger reaction than would otherwise have occurred. Media milked this for all it was worth, taking the prior Thursday close as the correct starting point, despite the run-up. Just staying cool can be a challenge!

What about a summer rally? It is a good guess about the theme for the week. As is often the case for the weekly theme, I don't know the answer and neither does anyone else. That said, I rate the possibility higher than most, and therefore another good contrarian play. We have had a long-time tight trading range, so a breakout would be meaningful for many. Rightly or wrongly, much will depend on the employment report.

The economy is the key to future earnings. Recession odds are low, earnings are improving, the oil issue has stabilized, and the Fed is on hold. Many "trading range worries" are now behind us.

Disclosure: I am/we are long GILD.

By Jeff Miller

No comments:

Post a Comment