Summary

The biotechnology and specialty Pharma segments offer many attractive bargains.

This article covers 10 candidates in this sector that appear compelling based on valuation.

Bargains happen when a sector becomes unpopular.

Outsized rewards happen when fear subsides.

Introduction

There are many investors that believe that the stock market is currently overvalued. To a great extent, they may be correct as there is a lot of excessive valuation to be found in various segments of the market. However, as I believe it is a market of stocks and not a stock market, not everything in today's stock market is expensive. In fact, there is one sector specifically where bargains galore can be found. That sector is the healthcare sector, and more specifically the subsectors biotechnology and specialty pharmaceuticals.

As I will illustrate in greater detail later, the biotechnology and specialty Pharma segment of the stock market has been very weak over the past year or so. There are a lot of reasons offered as to why this segment has been so weak. Threats of drug price reform seem to be the predominant culprit. Nevertheless, negativity towards this sector has driven valuations to what appear to be absurdly low in many cases. I believe this is especially true for companies with solid profitability and ample cash flow generation.

As a long-term investor extensively focused on valuation, I am always on-the-lookout for bargains. My definition of a bargain is when I can identify a stock that is selling for significantly less than its fundamentals would indicate. In the healthcare sector specifically, there are a lot of small promising biotechnology and pharmaceutical companies that have yet to generate a profit. On the other hand, there are many that are already quite profitable. The focus of this article is on identifying profitable biotechnology and pharmaceutical stocks that appear to be unjustly undervalued by the market.

In a previous article published on June 10, 2016, found here, I presented 5 companies in the sector that I considered attractive long-term investment opportunities. In this article, I am presenting 10 additional exciting looking research candidates within this sector. What follows next is a repost of what I wrote in the introduction of this last article. I am not adding quotes because the words are mine.

Personally, my primary current investment objective is focused on achieving a reliable and growing dividend income stream. That doesn't mean that I don't expect capital appreciation to go along with my dividends, because I do. However, capital appreciation is secondary to what I need right now. Therefore, I am content to allow it to happen over the long run. This means being willing to accept the ups and downs of short-term market volatility that is sure to occur, as long as my dividend income keeps increasing.

On the other hand, I also have discretionary assets that I can invest in/or utilize outside of my core portfolio. So, even though I favor dependable dividend-paying stocks, I still am attracted to examining exciting growth investments with money I am both willing to and can afford to lose. However, even though I'm willing to lose with these discretionary assets, I don't expect to. Instead, my objective is to generate significantly higher total returns than my prudent dividend growth portfolio is realistically capable of achieving.

More simply stated, I still appreciate powerful and exciting growth stocks because I understand they are capable of generating significantly higher returns. However, I am also cognizant of the fact that the risk associated with achieving those returns is also significantly higher. Consequently, I am just as adamantly (or even more so) focused on valuation when investing in growth stocks as I am with prudent, blue-chip dividend-paying stocks.

One of the most difficult things for the value-oriented investor to accept and embrace is the reality that the best value comes from stocks that are temporarily out-of-favor. In this regard, the value investor must also recognize that hitting the perfect bottom can only be accomplished with luck. Therefore, the intelligent value investor is willing to assume some short-term pain in order to achieve long-term gain.

The biotechnology sector contains many exciting growth stocks. But, most importantly, as it relates to this article, the sector has recently been out-of-favor, which I believe has created bargain investment opportunities. Consequently, I offer the following 10 biotechnology and specialty Pharma stocks as attractive looking research candidates primarily for growth or long-term total return. However, the first 3 research candidates in this group do offer intriguing prospects for dividend growth as well. Therefore, I hope the following list of healthcare stocks will offer something for everyone.

10 Undervalued Biotechnology and Specialty Pharma Stocks

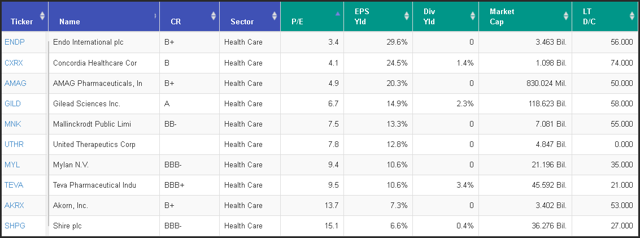

The following portfolio review lists the 10 research candidates offered in this article in order of lowest P/E ratio to the highest P/E ratio. Consequently, I asked that the reader focuses on the P/E ratio column to gain a perspective and insight into just how undervalued many of these companies truly are.

Dividend Growth and Total Return

These first 3 candidates do pay a dividend; however, their dividends may not be attractive enough for the conservative dividend growth investor. Nevertheless, I believe each of them offers a compelling opportunity in their own right - but not without risk. I have presented a short description of each of these candidates, as well as all the other candidates in this article courtesy of S&P Capital IQ. I have also included an earnings and price correlated FAST Graph to illustrate how significantly undervalued many of these names are.

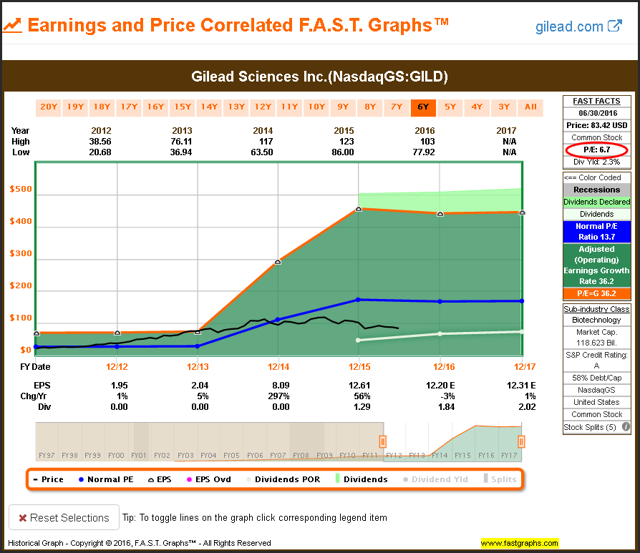

Gilead Sciences, Inc. (NASDAQ:GILD)

In addition, the company provides other products, such as AmBisome, an antifungal agent to treat serious invasive fungal infections; and Macugen, an anti-angiogenic oligonucleotide to treat neovascular age-related macular degeneration.

Further, it has product candidates in various stages of development for the treatment of HIV/AIDS and liver diseases, such as hepatitis B virus and hepatitis C virus; inflammation/oncology; serious cardiovascular; and respiratory conditions, as well as diabetic nephropathy and ebola.

The company markets its products through its commercial teams and/or in conjunction with third-party distributors and corporate partners. Gilead Sciences, Inc. has collaboration agreements with Bristol-Myers Squibb Company, Janssen R&D Ireland, Japan Tobacco Inc., and Galapagos NV. The company was founded in 1987 and is headquartered in Foster City, California."

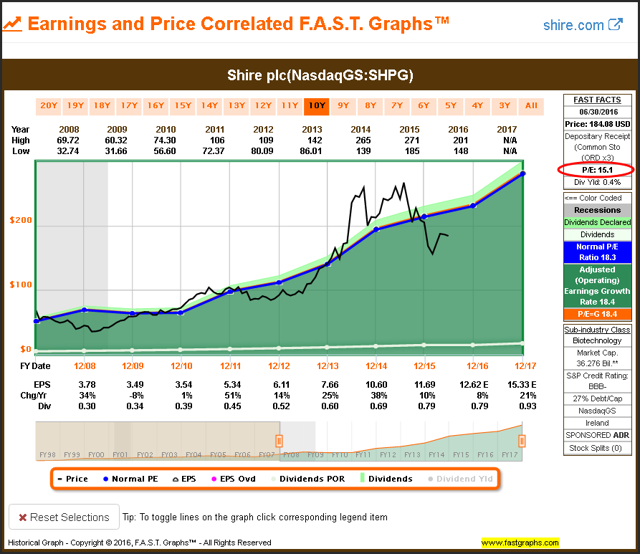

Shire plc (NASDAQ:SHPG)

"Shire plc, a biotech company, together with its subsidiaries, engages in the research, development, licensing, manufacture, marketing, distribution, and sale of medicines for patients with rare diseases and other select conditions.

Its principal products for the treatment of attention deficit hyperactivity disorder [ADHD] and binge eating disorder include VYVANSE/VENVANSE/ELVANSE/TYVENSE/ELVANSE VUXEN/ADUVANZ, as well as ADDERALL XR and INTUNIV for the treatment of ADHD; and LIALDA/MEZAVANT for the treatment of ulcerative colitis. The company also offers REPLAGAL for the treatment of Fabry disease; ELAPRASE for the treatment of hunter syndrome; VPRIV for the treatment of type 1 Gaucher disease; FIRAZYR and CINRYZE C1 esterase inhibitor for the treatment of hereditary angioedema; GATTEX/REVESTIVE for the treatment of short bowel syndrome; and NATPARA/NATPAR used to control hypocalcemia in patients with hypoparathyroidism.In addition, it provides Fosrenol for the treatment of hyperphosphatemia in end-stage renal disease. Further, the company licenses its patented antiviral products for human immunodeficiency virus and hepatitis B virus.Additionally, it focuses on its development resources on projects in various therapeutic areas, including rare diseases, neuroscience, ophthalmics, hematology, and gastrointestinal disorders; and early development projects, primarily on rare diseases. Shire plc markets its products through wholesalers and pharmacies.The company has collaboration and licensing activities with ArmaGen Inc.; Sangamo BioSciences, Inc.; and Shionogi Pharma, Inc. Shire plc was founded in 1986 and is based in Dublin, Ireland."

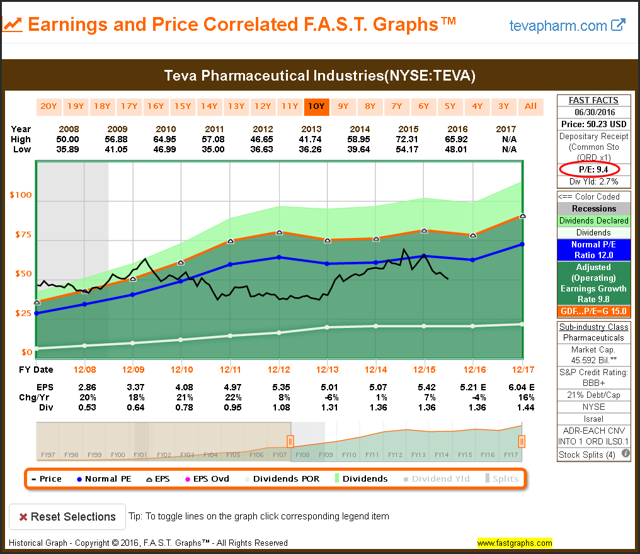

Teva Pharmaceutical Industries Limited (NYSE:TEVA)

"Teva Pharmaceutical Industries Limited develops, manufactures, markets, and distributes generic medicines and a portfolio of specialty medicines worldwide. The company operates in two segments, Generic Medicines, and Specialty Medicines.The Generic Medicines segment offers generic medicines, such as sterile products, hormones, narcotics, high-potency drugs, and cytotoxic substances in various dosage forms, including tablets, capsules, injectables, inhalants, liquids, ointments, and creams. This segment also develops, manufactures, and sells active pharmaceutical ingredients.The Specialty Medicines segment provides branded specialty medicines for use in the central nervous system and respiratory indications, as well as the women's health, oncology, and other specialty businesses. Its products in the central nervous system area comprise Copaxone for multiple sclerosis; Azilect for the treatment of Parkinson's disease; Nuvigil for the treatment of excessive sleepiness associated with narcolepsy and certain other disorders; Fentora/Effentora for the treatment of breakthrough pain in opioid-tolerant adult patients with cancer; and Zecuity, a prescription transdermal system for the acute treatment of migraine with or without aura in adults.This segment's products in the respiratory market include ProAir, ProAir RespiClick, QVAR, and Duoresp Spiromax for the treatment of asthma and chronic obstructive pulmonary disease, as well as Treanda, Granix, Trisenox, Synribo, Lonquex, Myocet, Eporatio, Tevagrastim/Ratiograstim, and Trisenox products in the oncology market.This segment also offers a portfolio of products in the women's health category, which includes ParaGard, Plan B One-Step, OTC/Rx, Zoely, Seasonique, and Ovaleap, as well as other products.Teva Pharmaceutical Industries Limited has alliances and other arrangements with Takeda Pharmaceutical Company Limited and Procter & Gamble Company. The company was founded in 1901 and is headquartered in Petach Tikva, Israel."

Speculative Capital Appreciation Potential and Growth

This next group of companies is offered as speculations with an eye towards outsized capital appreciation. Each company on this list has earnings growth, and most of them are significantly undervalued based on those earnings. Consequently, the primary opportunity here is for outsized returns as a result of potential future P/E ratio expansion. Many of these names appear extremely undervalued.

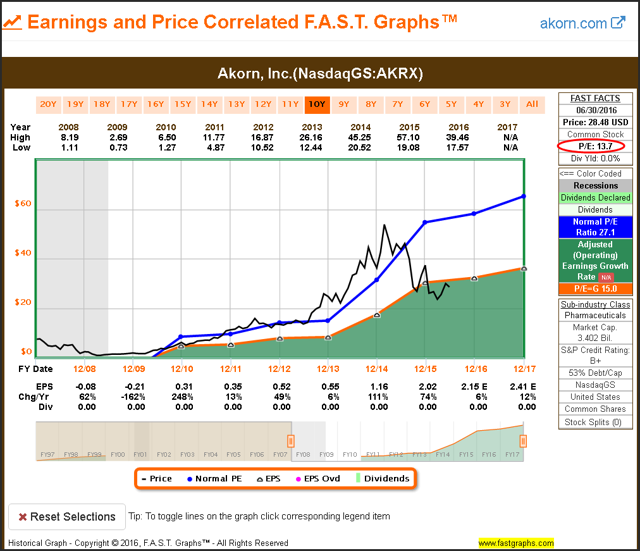

Akorn, Inc. (NASDAQ:AKRX)

"Akorn, Inc., a specialty generic pharmaceutical company, develops, manufactures, and markets generic and branded prescription pharmaceuticals, as well as private-label over-the-counter (OTC) consumer health products and animal health pharmaceuticals in the United States and internationally. It operates in two segments, Prescription Pharmaceuticals, and Consumer Health.The Prescription Pharmaceuticals segment markets generic and branded ophthalmics, injectables, oral liquids, otics, topicals, inhalants, and nasal sprays. This segment's generic products include Atropine Sulfate Ophthalmic Solution; Clobetasol Propionate Ointment; Dehydrated Alcohol Injection; Ephedrine Sulfate Injection; Hydralazine Hydrochloride Injection; Lidocaine Ointment; Methylene Blue Injection; Myorisan Soft Gelatin Capsules; Nembutal Sodium Solution; and Progesterone Capsules.The Consumer Health segment markets branded and private label animal health products, as well as OTC products for the treatment of dry eye under the TheraTears brand name. This segment also markets other OTC consumer health products, including Mag-Ox, a magnesium supplement, as well as the Diabetic Tussin line of cough and cold products.Akorn, Inc. was founded in 1971 and is headquartered in Lake Forest, Illinois."

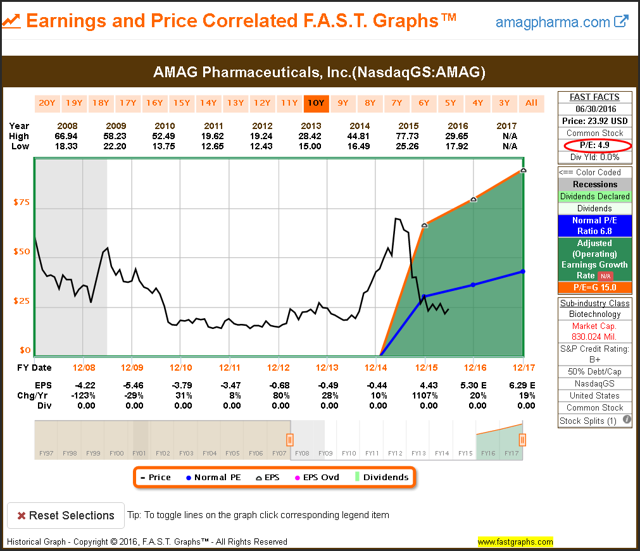

AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG)

"AMAG Pharmaceuticals, Inc., a specialty pharmaceutical company, provides products and services with a focus on maternal health, anemia management, and cancer supportive care in the United States.It markets Makena, a hydroxyprogesterone caproate injection to reduce the risk of preterm birth in women pregnant with a single baby who have a history of singleton spontaneous preterm birth; Feraheme (ferumoxytol) injection for use as an intravenous (IV) iron replacement therapy for the treatment of iron deficiency anemia in adult patients with chronic kidney disease; and MuGard Mucoadhesive Oral Wound Rinse for the management of oral mucositis/stomatitis and various types of oral wounds.The company also offers Cord Blood Registry services that are related to the collection, processing, and storage of umbilical cord blood and cord tissue units. In addition, it has a license agreement with Velo to acquire the rights to digoxin immune fab, a polyclonal antibody in clinical development for the treatment of severe preeclampsia in pregnant women.The company sells Feraheme to authorized wholesalers and specialty distributors. AMAG Pharmaceuticals, Inc. was founded in 1981 and is headquartered in Waltham, Massachusetts."

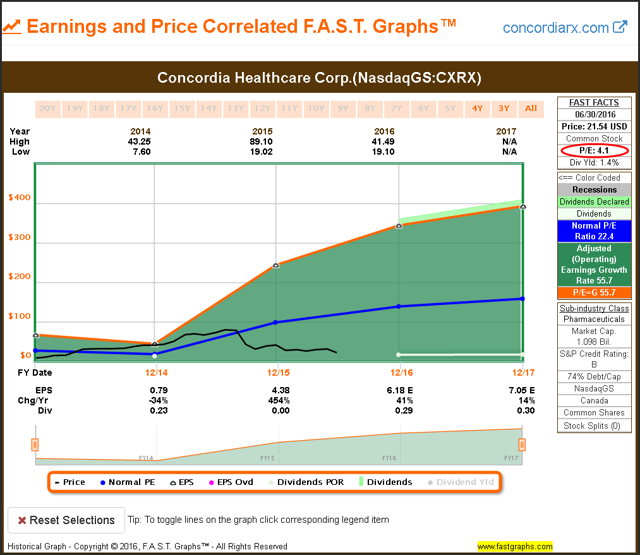

Concordia International Corp. (NASDAQ:CXRX)

"Concordia International Corp., a specialty pharmaceutical company, owns a portfolio of branded and generic prescription products in the United States and internationally.The company's Concordia North America segment has product right sales of pharmaceutical products primarily in the United States. This segment offers a portfolio of branded and generic products, including Donnatal for the treatment of irritable bowel syndrome; Zonegran for the treatment of partial seizures in adults with epilepsy; Nilandron for the treatment of metastatic prostate cancer; Lanoxin for the treatment of mild to moderate heart failure and atrial fibrillation; and Plaquenil for the treatment of lupus and rheumatoid arthritis.The company's Concordia International segment engages in the acquisition, manufacture, licensing, and development of off-patent prescription medicines.Its Orphan Drugs segment produces and distributes Photofrin, an orphan drug for the treatment of esophageal cancer, Barrett's esophagus, and non-small cell lung cancer.The company also provides products for the treatment of attention-deficit hyperactivity disorder, head lice infestation, and pulmonary diseases such as asthma; and control of severe or incapacitating allergic conditions such as atopic dermatitis, and seasonal and perennial allergic rhinitis.The company was formerly known as Concordia Healthcare Corp. and changed its name to Concordia International Corp. in 2016. Concordia International Corp. is headquartered in Oakville, Canada."

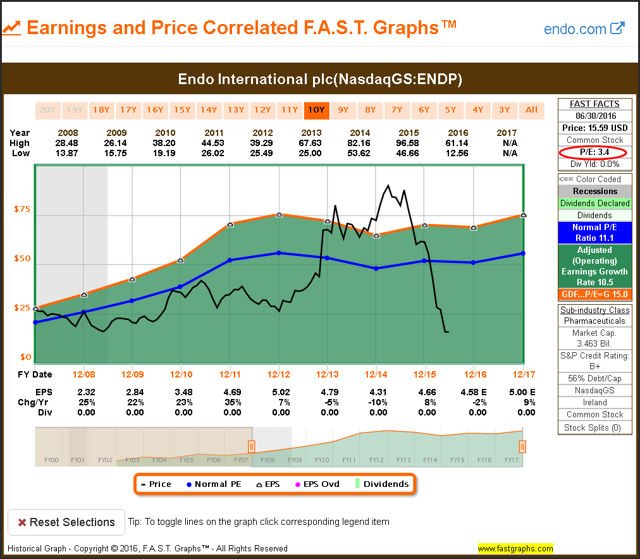

Endo International plc (NASDAQ:ENDP)

"Endo International plc develops, manufactures, and distributes pharmaceutical products and devices worldwide. Its U.S. Branded Pharmaceuticals segment offers chronic pain management products, such as BELBUCA, OPANA ER, and Percocet; Lidoderm for opioid analgesics; and Voltaren gel for osteoarthritis pain, as well as XIAFLEX for treating Peyronie's and Dupuytren's contracture diseases.This segment also provides Supprelin LA for central precocious puberty treatment; testosterone replacement therapies, such as Aveed and TESTOPEL, as well as Fortesta and Testim gels; Frova and Sumavel DosePro for migraine headaches; Valstar, a sterile solution for intravesical instillation of valrubicin; and Vantas for the palliative treatment of prostate cancer.The company's U.S. Generic Pharmaceuticals segment provides tablets, capsules, powders, injectables, liquids, nasal sprays, ophthalmics, and transdermal patches for pain management, urology, central nervous system disorders, immunosuppression, oncology, women's health, and cardiovascular disease markets.Its International Pharmaceuticals segment offers specialty pharmaceutical products in various therapeutic areas, including attention deficit hyperactivity disorder, pain, women's health, and oncology; generic, branded generic, and over-the-counter products in the areas of dermatology and anti-infectives; injectables for the treatment of pain, anti-infectives, cardiovascular, and other therapeutics areas; and healthcare services, products, and solutions to hospitals, pharmacies, and practitioners, as well as for government healthcare programs.The company also provides Monarc subfascial hammock to treat female stress urinary incontinence; and Elevate transvaginal pelvic floor repair system for the treatment of pelvic organ prolapse.It sells its branded pharmaceuticals and generics directly, as well as through wholesale drug distributors. Endo International plc is headquartered in Dublin, Ireland."

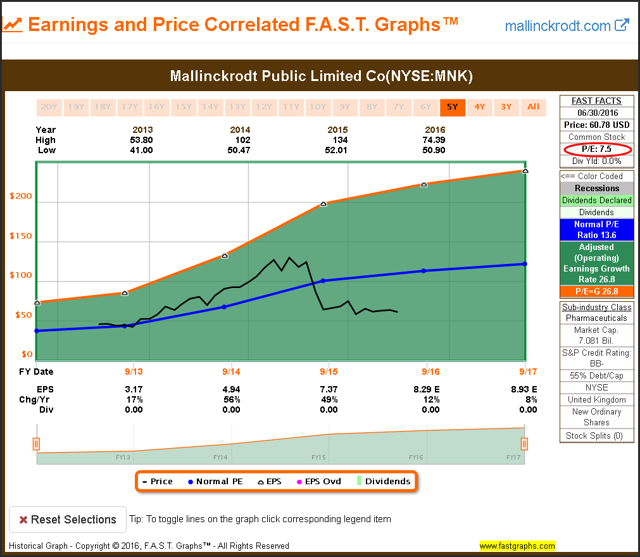

Mallinckrodt Public Limited Company (NYSE:MNK)

"Mallinckrodt Public Limited Company develops, manufactures, markets, and distributes specialty pharmaceutical and biopharmaceutical products, and nuclear imaging agents in the United States, Europe, the Middle East, Africa, and internationally.

The company's Specialty Brands segment markets branded pharmaceutical and biopharmaceutical products for autoimmune and rare diseases; immunotherapy and neonatal respiratory critical care therapies; and central nervous system drugs.This segment offers Acthar, an injectable biopharmaceutical drug for various indications, such as neurology, rheumatology, nephrology, and pulmonology; Ofirmev, an intravenous formulation of acetaminophen for pain management; Inomax for inhalation; Therakos, an immunotherapy treatment platform; and Exalgo, a form of hydromorphone.Its Specialty Generics segment provides specialty generic pharmaceuticals and active pharmaceutical ingredients (APIs) consisting of hydrocodone and hydrocodone-containing tablets; oxycodone and oxycodone-containing tablets; methylphenidate HCl extended-release tablets; and other controlled substances, including acetaminophen products.The company's Nuclear Imaging segment offers Ultra-Technekow DTE, a Tc-99m radioisotope generator; and Octreoscan, a molecular imaging agent for the localization of primary and metastatic neuroendocrine tumors. Mallinckrodt Public Limited Company markets its products to physicians, pharmacists, pharmacy buyers, hospital procurement departments, ambulatory surgical centers, specialty pharmacies, radiologists, and radiology technicians through wholesale drug and specialty pharmaceutical distributors, retail pharmacy chains, hospital networks, ambulatory surgical centers, and governmental agencies.It also sells and distributes APIs directly or through distributors to other pharmaceutical companies, and markets and distributes nuclear imaging products to radio-pharmacies and hospitals. The company is based in Chesterfield, the United Kingdom."

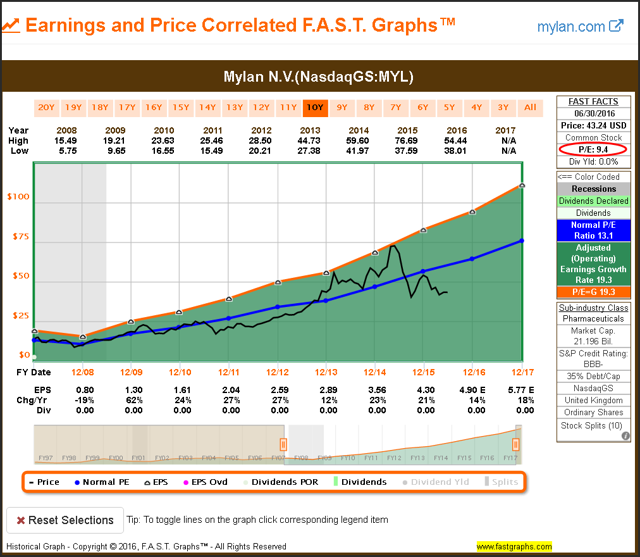

Mylan N.V (NASDAQ:MYL)

"Mylan N.V., together with its subsidiaries, develops, licenses, manufactures, markets, and distributes generic, branded generic, and specialty pharmaceuticals worldwide. The company provides generic or branded generic pharmaceutical products in tablet, capsule, injectable, transdermal patch, gel, cream, or ointment forms, as well as active pharmaceutical ingredients (APIs).It is also involved in the development of APIs with non-infringing processes for internal use and to partner with manufacturers; and manufacture and sale of injectable products in antineoplastics, anti-infectives, anesthesia/pain management, and cardiovascular therapeutic areas.In addition, the company produces finished dosage form and oral solid dose products; and offers antiretroviral therapies to third parties. Further, it manufactures and sells branded specialty injectable and nebulized products comprising EpiPen Auto-Injector to treat severe allergic reactions; Perforomist Inhalation Solution, a formoterol fumarate inhalation solution for the maintenance treatment of bronchoconstriction in chronic obstructive pulmonary disorder patients; and ULTIVA, an analgesic agent used during the induction and maintenance of general anesthesia for inpatient and outpatient procedures.It sells generic pharmaceutical products to proprietary and ethical pharmaceutical wholesalers and distributors, group purchasing organizations, drug store chains, independent pharmacies, drug manufacturers, institutions, and public and governmental agencies; and specialty pharmaceuticals to pharmaceutical wholesalers and distributors, pharmacies, and healthcare institutions.Mylan N.V. has a collaboration agreement with Momenta Pharmaceuticals, Inc. to develop, manufacture, and commercialize Momenta Pharmaceuticals, Inc.'s biosimilar candidates. The company was formerly known as New Moon B.V. Mylan N.V. was founded in 1961 and is based in Hertfordshire, the United Kingdom."

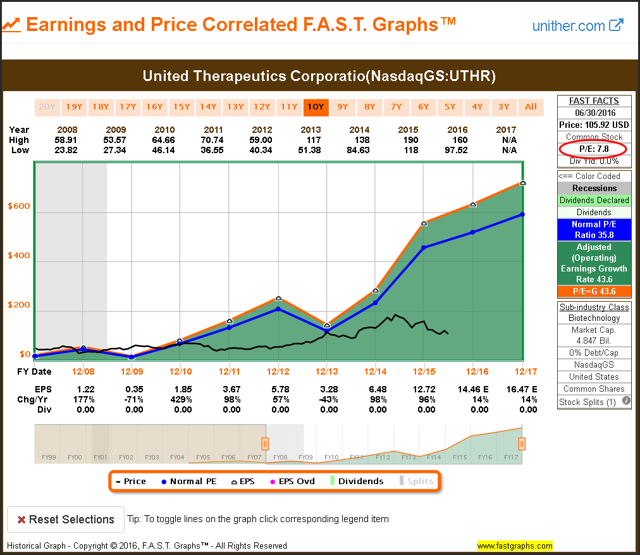

United Therapeutics Corporation (NASDAQ:UTHR)

"United Therapeutics Corporation, a biotechnology company, develops and commercializes products to address the unmet medical needs of patients with chronic and life-threatening diseases worldwide.The company's principal therapeutic products and product candidates include Remodulin, an injection used for the treatment of pulmonary arterial hypertension [PAH]; Tyvaso, an inhaled prostacyclin therapy for PAH; Adcirca, a once-daily oral therapy for PAH; Orenitram, a prostacyclin analog for PAH; Unituxin, an antibody that binds to cancerous tumors and destroys the cancer cells; and engineered lungs and lung tissue that can be transplanted into patients suffering from PAH and other lung diseases.

United Therapeutics Corporation was founded in 1996 and is headquartered in Silver Spring, Maryland."

Summary and Conclusions

A true bargain manifests when a company or a set of companies is being misappraised by the market usually due to some fear of a pending crisis in the industry. Drug pricing reform has been the primary catalyst that I believe has hurt these stocks over the past year. At this point in time, those fears have yet to be realized. Nevertheless, I believe that the reader should do their own research and due diligence on each of these candidates. What I have offered here is certainly not without risk, however, with higher risk comes potential high reward.

Disclosure: Long GILD, TEVA, UTHR, MYL

No comments:

Post a Comment