Summary

As expected, last week was split between the FOMC meeting and Brexit news.

The early and brief positive reaction to the FOMC announcement swiftly turned negative. The ranks of Fed critics grew.

Economic news tilted slightly positive, especially retail sales.

The Brexit story will continue to dominate next week - so many possible outcomes and so hard to estimate the effects.

The referendum represents a compelling story, but finding a trading or investment edge is a challenge. Sometimes doing nothing is best.

This week's economic calendar is a little light on data, but it packs plenty of important news. Last week I suggested that the Brexit build-up would become the dominant theme. Nothing has changed. Expect daily stories on three Brexit themes:

- What UK voters should do;

- Predictions about the result; and

- Consequences for financial markets.

While financial media will cover all, my attention will be on the third. What Will the Brexit Result Mean for Financial Markets?

Last Week

There was little economic news. The biggest change was the reaction to the FOMC meeting.

Theme Recap

In my last WTWA, I predicted a week divided between two themes - first the Fed, and then Brexit. It was indeed a two-story week, with an overlap in the middle. The Fed decision was greeted positively for a few minutes, and then the tide shifted.

The Story in One Chart

I always start my personal review of the week by looking at this great chart from Doug Short. You can clearly see the slightly delayed reaction to the Fed announcement. Doug has a special knack for pulling together all of the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis and several other charts providing long-term perspective.

The News

Each week I break down events into good and bad. Often there is an "ugly" and on rare occasion something really good. My working definition of "good" has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news - and you should, too!

The Good

- Sea container counts are showing some rebound from the recent soft patch, but we remain well off the highs. (Steven Hansen at GEI).

- Earnings estimates are strengthening. Check out Brian Gilmartin's analysis for a detailed look at which sectors and by how much.

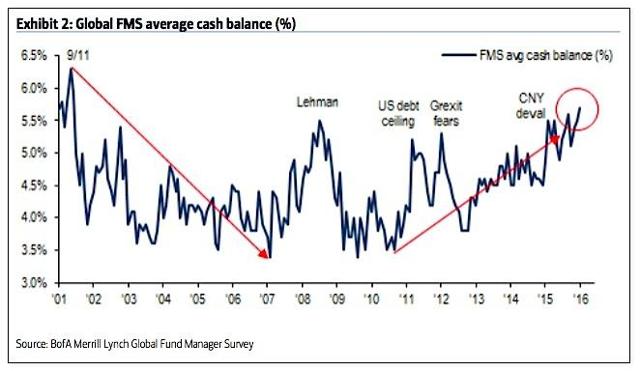

- Fund manager asset allocations to equities remain near an eight-year low. On a contrarian basis, this is bullish for stocks. (Urban Camel).

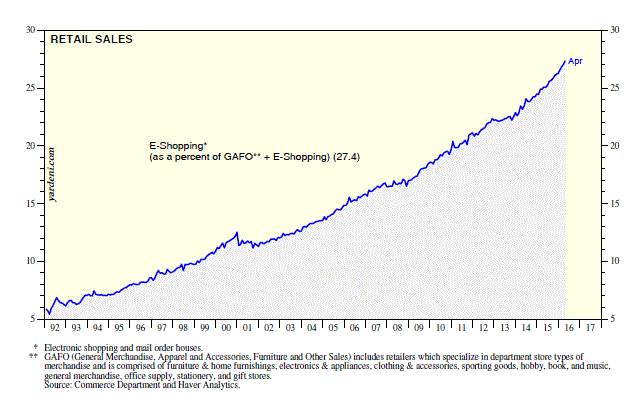

- Retail Sales were strong, in both real terms and per capita (New Deal Democrat). More people are shopping online, which makes interpretation of sales more challenging. Doug Short has multiple charts and a "Big Four" update. Ed Yardeni has the online story.

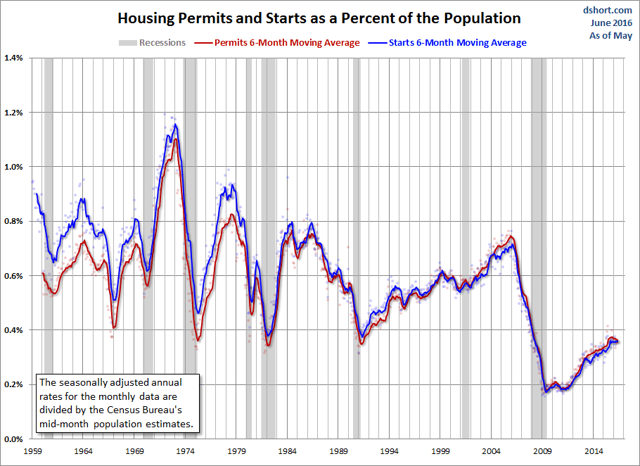

- Housing showed strength. The picture remains complicated and a bit mixed.

- Housing starts met expectations, had revisions for prior months, and an increase of 9.5% over last year. (Calculated Risk)

- Doug Short analyzes the secular trends in both building permits and housing starts.

- NAHB builder confidence increased to 60, up from 58 and well above the expansion signal of 50. (Calculated Risk)

The Bad

- Industrial production fell 0.4%. This remains the weak spot in the economic data.

- Foreigners are selling U.S. equities. The pace is an all-time high according to Torsten Sløk, Ph.D., Deutsche Bank Securities via Barry Ritholtz. Check out the chart.

- The rail contraction continues. Steven Hansen at GEI has his regular update on this story.

- Jobless claims edged higher. But still reasonable at 277K.

- Lowered Fed expectations recognize slower growth. Most market participants do not expect lower interest rates to solve this problem.Bloomberg has a good summary of the Yellen conference, including various viewpoints.

The Ugly

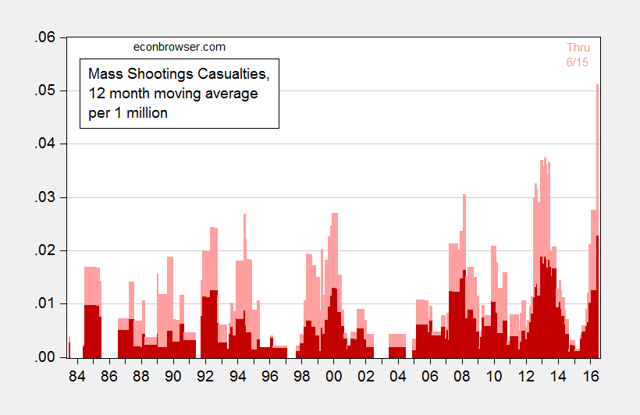

Continuing violence and terror. The mass shooting casualties have beengetting worse.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. No award this week. Nominations are always welcome.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a relatively light week for economic data, but a big one for news. I highlight only the most important items, helping us all to focus.

The "A" List

- The Brexit vote (F). The vote is Thursday, but results will not be available until Friday trading.

- New home sales (Th). Can recent strength continue?

- Michigan sentiment. Good indicator for employment and spending - remains near highs.

- Initial claims (Th). The best concurrent indicator for employment trends.

The "B" List

- Existing home sales (W). Less direct impact than new home sales, but a good read on the housing market.

- Durable goods (Th). A decline is expected in this volatile series, but how big?

- Bank stress test results (Th). Mostly important to a few banks, but also a measure of overall financial health.

- Crude inventories. Often has a significant impact on oil markets, a focal point for traders of everything.

Chair Yellen will provide her semi-annual Congressional testimony to the Senate on Tuesday and the House on Wednesday. The question periods will be closely watched. You might think there is nothing left to learn after last week's FOMC decision and press conference, but any fresh hints will get attention. We also have a resumption of appearances by other Fed participants.

Next Week's Theme

Anyone whose breath can fog a mirror is being asked about his or her opinion of what the Brits should do. That is a lively topic, but not one for us.

The outcome of the vote is important, but the prospects seem to change daily. Again, not a good topic for us.

While the financial media theme for the week ahead will be broader, the key point will be:

What does the Brexit vote mean for financial markets?

I have read scores of articles on this topic, watched webinars from experts, and listened to (some of) the punditry. While it is part of my job, most investors do not want to do this. I will try to provide a few key points as background. Read some of these links, draw your own conclusions, and compare them with mine at the end of this post.

1. How does Brexit compare to other perceived crises? Josh Brown notes the $140 billion of net equity outflows and compares the VIX level to prior incidents. Concerns are higher than for interest rate hikes or the Presidential election. (Bloomberg)

2. Some suggest that we should expect chaos - and then damage control. (Bloomberg)

3. The impact on U.S. markets should be modest. (CNBC and also David Merkel)

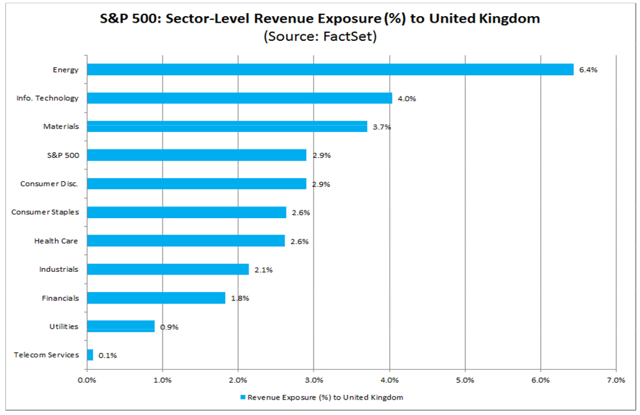

4. Brexit would hurt trade, the global economy and stocks, and especiallyrevenues from certain sectors.

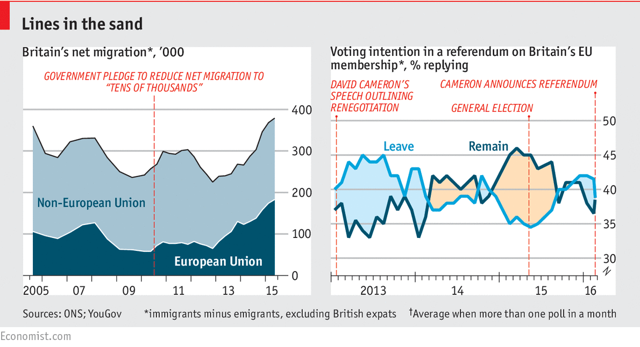

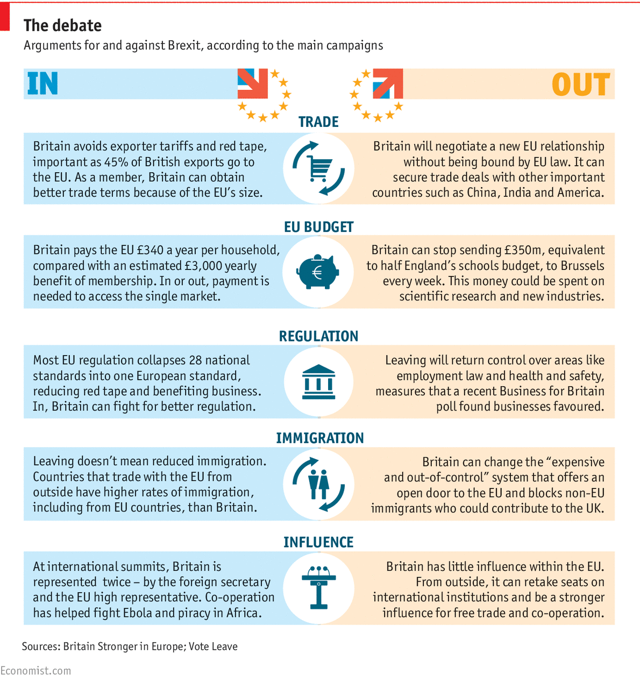

5. Last but certainly not least, a chart-based background guide to Brexit (The Economist) Here is a sample:

And a tabular summary of the issues:

Quant Corner

We follow some regular great sources and also the best insights from each week.

Risk Analysis

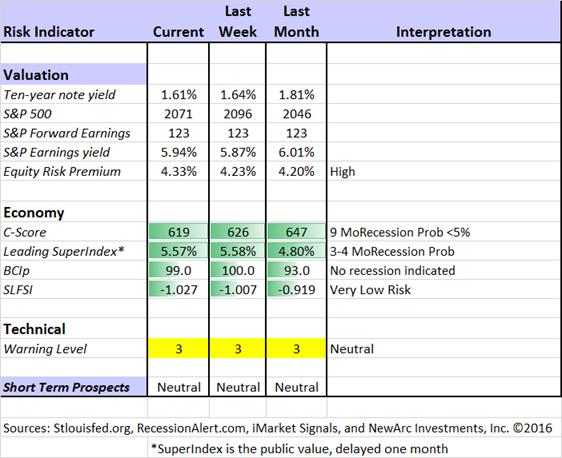

Whether you are a trader or an investor, you need to understand risk. Risk first, rewards second. I monitor many quantitative reports and highlight the best methods in this weekly update.

The Indicator Snapshot

The Featured Sources:

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies. This week he expresses more confidence about growth in earnings.

Bob Dieli: The "C Score" which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). Monthly reports including both an economic overview of the economy and employment.

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting approaches to asset allocation.

Georg Vrba: The Business Cycle Indicator, and much more. Check out his sitefor an array of interesting methods. His latest update features his unemployment rate recession indicator. A recession is unlikely "any time soon."

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

Doug Short: The Big Four Update, the World Markets Weekend Update (and much more).

The ECRI has been dropped from our weekly update. It was not so much because of the bad call in 2011, but the stubborn adherence to this position despite plenty of evidence to the contrary. Those interest can still follow themvia Doug Short and Jill Mislinski. The ECRI commentary remains relentlessly bearish despite the upturn in their own index.

How to Use WTWA

In this series I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. For most readers, they can just "listen in." If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide a number of free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!) Free reports include the following:

- Understanding Risk - what we all should know.

- Income investing - better yield than the standard dividend portfolio, and also less risk.

- Felix and Holmes - top artificial intelligence techniques in action.

- Why 2016 could be the Year for Value Stocks - finding cheap stocks based on long-term earnings.

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions or suggestions for new topics.)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and also the best advice from sources we follow.

Felix and Holmes

We continue our neutral market forecast. Felix is fully invested, but the sector balance has become more aggressive. Many sectors remain in the penalty box. The (usually) more cautious Holmes is once again fully invested. Holmes uses a universe of nearly 1000 stocks, selected mostly by liquidity. Even when the overall market is neutral, there will often be some strong candidates. That is what we see now. It is not a resounding endorsement of the overall market, but a vote for opportunistic trading.

Top Trading Advice

Dr. Brett explains why your trading psychology is reflected in your daily life, and vice-versa. Learn how this can be important to achieving your trading goals. As an example he writes as follows:

I was recently driving on a highway and the road split into two sections, each going the same way. The left fork was a single lane labeled express; the right fork was a double lane labeled local. My trip was several hours in duration but I immediately took….

Which one would he choose, and why?

Adam H. Grimes provides insight on strategy vs. tactics. He defines the difference, but also provides some specific techniques.

In this case, we need to be very precise: tactics refer to how, where, (and maybe why) we execute at the specific prices we choose. Strategy, on the other hand is the big picture perspective. First, get the strategic view right.

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read, it would be "Davidson's" take on Brexit (via Todd Sullivan). Here is the key point:

High fear of financial collapse! Major investors saying "Get out!", 'Brexit' forecasts dire for European economy! In the US, top investors say Fed has lost control and the economy or something will spiral out of control. These are only a few of the current basket of concerns. And then there is our current Presidential election fare and the terrorist attack in Orlando.In reality, this week's concerns have not been much different than what we have seen since the current economic recovery began in 2009.

He then produces charts on a series of key economic measures: employment, real personal income, retail sales, job openings, and the housing rebound. Please check out the charts, supporting the thesis that data trumps sentiment.

The conclusion?

While the world frets and then frets some more, economic activity has continued to expand. Eventually, investors have never failed to turn more optimistic and remain so for several years. It is this period of optimism from which excess economic activity derives. It should be readily apparent that while economic activity continues to expand, optimism and economic excess is not part of the current equation. It could said that "Excess pessimism does not produce excess economic activity!" There is no economic correction on the horizon. This does not mean that we could not have a dip in market prices at any point in time for other reasons. Dips should not matter for long-term investors. I anticipate taking action only once economic fundamentals indicate a correction is likely.

Stock Ideas

David Fish updates the list of Dividend Challengers. There are many specific ideas, so check it out.

Chuck Carnevale emphasizes the importance of valuation on your entry point, even when buying a great dividend stock. He has a great example of how waiting for the right entry point (even though a dividend was missed) actually added to total dividends in the long run.

Energy Perspectives

We have some interesting themes this week. Figuring out the stock implications will require some more thought. I am working on it, and I welcome comments.

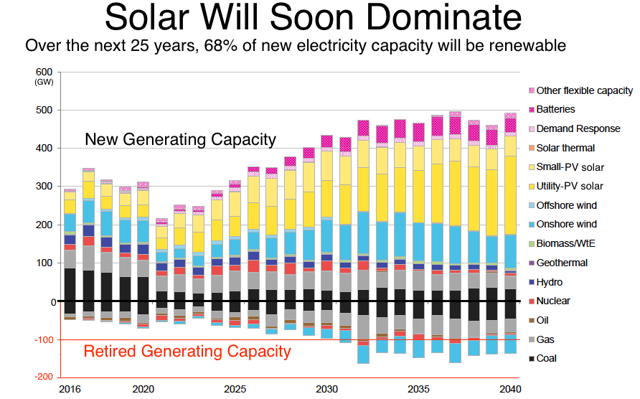

- Peak Fossil Fuels for Electricity, by Tom Randall at Bloomberg. Watch out for both coal and natural gas. Eight key points, including the upcoming domination of solar.

- Billions in proven shale oil reserves suddenly become "unproven." (Bloomberg) Hint: Improved accounting rules.

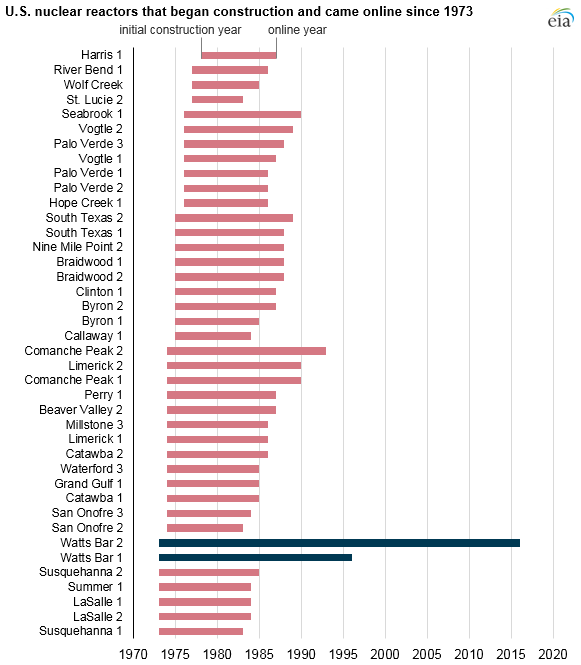

- Don't count on nuclear power. (EIA) The first new reactor just came online after more than 40 years of planning and construction. It is the first new one in twenty years. This chart shows the typical length of time

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read AR every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. There are always several great choices worth reading, but my favorite this week is Andrew Comstock's What is the most important financial advice you would pass to your children. The advice garnered from a number of experts is somewhat inconsistent, but thought-provoking. In general, young people need to balance passion and earnings, current consumption versus the future, and borrowing versus saving. My own thought? You need to look forward to your work if you expect to do well.

For both young and old: 51 Things You Shouldn't Do from John Clements.

For millennials: You need more realistic expectations about future returns.

Watch out for….

Chasing last year's winners via annual sector rotation. Josh Brown has a nice post showing the prevalence of this performance chasing. He emphasizes, "The data is unambiguous." His analysis and charts show why this does not work. (Felix objects that sector rotation works, but a shorter time frame is needed).

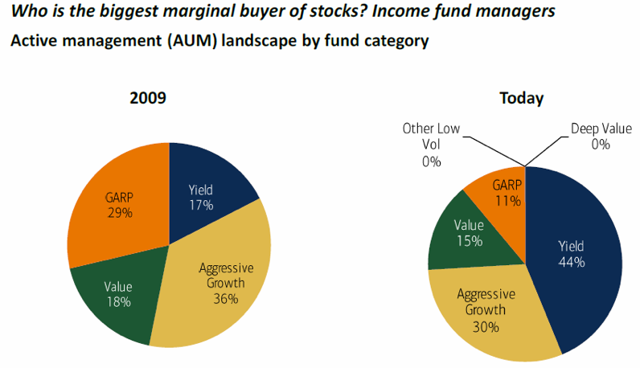

Yield stocks, the crowded trade. William Smead covers this point, while also noting the declining significance of Fed Stress tests and the potential for banks and the housing market.

Final Thoughts

Brexit is not another "Y2K" as Barron's suggested this week, but the uncertainty has had an exaggerated effect. Here are my own conclusions:

- The outcome is approximately a coin-flip, making any planning difficult. Either resolution will reduce volatility.

- The referendum is advisory, which will be emphasized more next week. Members of Parliament will be informed by voter frustration, but may not accede to the specific plan.

- A Brexit would take years of negotiation to accomplish, with many of the agreements most important to the European and world economies re-established.

- The actual stakes are smaller than most think. I get some information from confidential sources, and I respect their restrictions. A strong and popular (but unquotable) source did some polling of experts. Likely immediate S&P 500 range is 2 ½% downside and 2% upside. The extremes might be slightly larger. This range fits my own expectations. It is all guesswork, of course, but probably better than the vague notions about dominoes dropping and world trade ceasing.

- There may be a surprise outcome from a positive vote. British leaders may use it to negotiate some EU rule changes.

And finally, as you navigate the week ahead remember this:

The most newsworthy stories are frequently not the most important for your investments!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment