Summary

Airlines remain under heavy pressure as unit revenue and economic fears scare away investors.

This comes despite sizeable profits and capital returns among major carriers.

Delta combines strong fundamentals with a rock-bottom valuation.

This investment is for long-term investors only!

Looking at the stock chart of Delta Air Lines (NYSE:DAL) investors might expect the company to be encountering severe financial difficulties. But while the market runs from Delta's stock, the company continues to be a cash cow and is plowing the cash into debt reduction, dividends, and share repurchases.

At its current valuation I find Delta shares attractive for four key reasons.

Slashing the debt

While investors have heavily criticized Delta's rival American Airlines Group(NASDAQ:AAL) for its large debt load, both airlines continue to trade at similar valuations. And although there is much more to American's debt load than just the headline number, Delta's pattern of cutting debt puts the airline in a better position to weather an industry downturn.

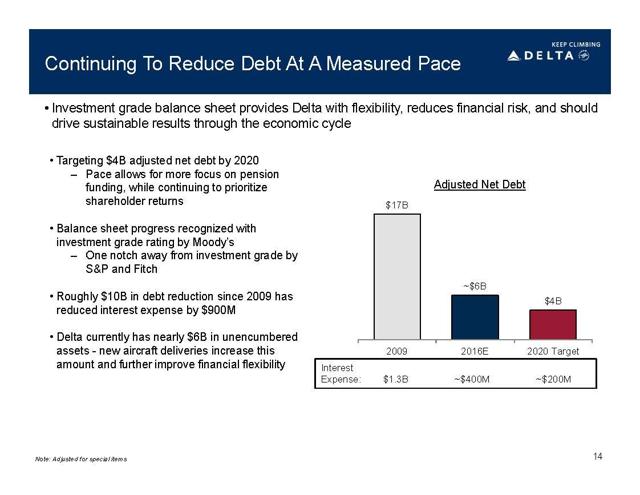

image source: Delta Air Lines (May presentation)

As Delta notes, adjusted net debt has been slashed from $17 billion in 2009 to under $7 billion today with a target of $4 billion by 2020. Lower debt levels have also brought lower interest expense through both less total debt to pay interest on and credit ratings upgrades from all three major agencies that have reduced interest rates for Delta.

While the market is clearly not appreciating the de-risked nature of Delta right now, it does position the airline to be one of the leaders of the rebound if market sentiment shifts and investors look first for the highest quality carriers.

Valuation at low altitude

It's no secret that the market isn't exactly a fan of airlines right now with major carriers facing substantial share price pressure and the U.S. Global Jets ETF (NYSEARCA:JETS), an ETF made to generally track the airline industry, down about 10% year-to-date.

But this isn't because airline profits are disappearing, in fact they are surging. This disconnect between profit generation and share price appreciation has left the major U.S. carriers with mid single digit P/E ratios. Delta's recent dip into the $30 range now has shares trading at just 6.1x est. 2016 EPS and 5.9x est. 2017 EPS.

But even these P/E ratios understate the actual earnings power of Delta. Delta's EPS figures are reported with a tax expense based on the 35% U.S. corporate tax rate but the airline does not actually pay these taxes as it has roughly $9 billion of net operating losses on track to offset these taxes until 2018. At that point Delta may take advantage of the mobile nature of its assets and partnerships with foreign carries in lower corporate taxed countries including Netherlands-based Air France-KLM (OTC:AFRAF) and U.K. based Virgin Atlantic to reduce its tax expense further.

Investors may also look at Delta's free cash flow of $3.8 billion for 2015 which has the airline trading at just 7.7x 2015 FCF.

Helped by a low share price

For most investors a falling share price is a disappointment and it would be a rational one if it occurred because of a fundamental change to the company. However, Delta appears strong and getting stronger even as its share price declines thereby establishing an interesting scenario.

Like many other airlines with share prices depressed by similar market forces, Delta has been repurchasing its shares and recently moved up the targeted date of completion for its ongoing $5 billion buyback program. With shares at their current price, it's tough to argue that Delta is overpaying for its shares and Delta shareholders who see value in the stock should be more than happy that the airline would take advantage of the chance to retire more shares for less money.

In fact, as long as Delta is not hurt at a fundamental level, long-term investors stand to benefit from near-term share price weakness as it would allow the airline to retire more shares while being more accretive to EPS and making future dividend increases easier.

Fighting for unit revenue

Agree with the rationale or not, unit revenue has been the primary force driving airline stocks for well over a year and it would take a major change in market sentiment to change this trend. Many investors are afraid airlines will cause price wars that lower industry-wide margins as it has done before the consolidation that took place beginning with Delta's 2008 merger with Northwest Airlines.

To address the unit revenue issue Delta is fighting back in three key ways. First, it has been a leader in reducing future capacity growth in domestic markets and even planning to cut capacity in some weaker international markets. In its May presentation it cut domestic forecasted growth to 2.5% for 4Q 2016 from 4%-5.4% growth planned for the first three quarters. Delta also noted international capacity would be flat to down in the second half of 2016 as it was in the second half of 2015.

Second, Delta has been a leader in launching fare hikes and rarely declines to join a fare hike. It launched the first fare hike of 2016, followed with more attempts during the year and most recently joined in the JetBlue(NASDAQ:JBLU) initiated June fare hike. Despite fare hikes having only about a 50% success rate in 2016 (still a substantial improvement over the 18% rate for 2013-2015) they show the industry, with Delta near the lead, is making efforts to push fares higher and stop the unit revenue decline.

And third, Delta has created more classes of fares to appeal to a larger variety of travelers. While budget travelers may have gone with a discount carrier before, Delta's no-frills offering of Basic Economy can bring some of these travelers to Delta allowing it to fight back against the growth of discount carriers without slashing all fares. From another angle, passengers looking for something a little extra but not willing to shell out for First Class or Delta One can choose Delta Comfort+ for more legroom and provide Delta with slightly more revenue forthose passenger miles. American Airlines and United Continental have since joined Delta in adding a class below normal economy but Delta's headstart could give it an edge and also shows how the airline is working to stay ahead of the curve.

Risks

As with all investments, investors should be aware of the risks of Delta shares. Like other carriers, Delta is exposed to the standard industry risks of oil price spikes, terrorist attacks, and global pandemics. Major airlines like Delta could also be negatively impacted by the growth of ultra-discount carriers like Spirit Airlines (NASDAQ:SAVE) and Allegiant (NASDAQ:ALGT) if these carriers can break into existing markets and take current passengers.

While long-term investors can wait for the market to move from voting machine to weighing machine on Delta shares, shares are likely to remain highly volatile in the near-term and could fall further despite the current valuation if sentiment remains negative. Although it should be quite obvious by looking at the stock chart, it should be noted that Delta shares are not a good place to stash next month's rent/mortgage payment.

Takeaway

Delta shares have been hammered in recent weeks falling into the $38 range even as the airline remains on track for another blowout year of profits. Besides trading at less than 6x est. 2017 EPS, Delta is also attractive for its actions regarding unit revenue and its lowered debt levels. Overall, while I am bullish on Delta I wouldn't mind shares hanging around at this valuation a little longer so the airline can retire more of them while the market remains negative.

Disclosure: I am/we are long AAL, DAL.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

By The Unhooded Falcon

No comments:

Post a Comment