Summary

Skyworks' success continues with its multi-year winning streak with another series of top/bottom line beats, coupled with stronger-than-expected revenue guidance in the face of extremely bearish sentiment and market conditions.

Management emphasizes abundant IoT-related revenue opportunities across not only the U.S., but also China as well, further hedging its Apple dependency by establishing strong relationships with fast-growing Chinese OEMs.

Huawei has grown unit sales over 70% Y/Y, quickly stealing market share, with 1/4 of the geographic footprint, presenting future issues for Apple, while Skyworks remains hedged against current competitive changes.

Chinese revenue contribution grew 20% Y/Y, with rapidly evolving IoT opportunities and LTE expansion, world-class, integrated connectivity solutions will be required at the system level, leaving SWKS perfectly positioned.

The out-dated, misrepresenting price sensitivity to Apple may continue in the medium term to pressure the stock, but various growth opportunities will eventually change the market's perception of Skyworks' Apple dependency.

Introduction: Not All Apple Suppliers Created Equal

Skyworks Solutions (NASDAQ:SWKS) has delivered yet another strong earnings report, reflecting continued growth, both on the top and bottom line, coupled with soft, but better-than-expected forward guidance (relatively speaking), in the face of the worst cyclical downturn for semiconductors in at least half a decade. The new year brought even more pain with a YTD price drop of over 20%, leaving them down a miserable 48% from their all time high of $112.88 back in June '15. The ecosystem of Apple (NASDAQ:AAPL) suppliers have had their market values in many cases cut almost in half over the last six months, after experiencing massive multi-year growth, with firms like SWKS tripling from 2013 until sentiment reversed in June, 2015. In turn, it has resulted in massive amounts of financial resources to expand product lines, lease and build additional fabrication space, hire top talent to retain a world class reputation for their solutions, as well as expanding into new markets across the IoT space. As hardware innovation progresses, so does the need for more complex, integrated solutions in the RF space as the demand on bandwidth continues to provide plenty of growth potential for world-class suppliers like SWKS, who focus on integrated solutions rather than discrete components. Unfortunately, regardless of how many bullish catalyst exist, or subsequent positive results SWKS produces, Mr. Market is having serious semiconductor indigestion resulting from slowing iPhone unit sales.

Thesis: "When Apple sneezes, SWKS catches a cold"....

"Guilty by Apple Association" accurately reflects the behavior, and relationship between the stock price of SWKS with respect to Apple, along with similar weakness battering other marquee members of the supply chain ecosystem, such as Broadcom Limited (NASDAQ:AVGO), and NXP Semiconductor (NASDAQ:NXPI). Regardless of size, various niche markets outside of Apple, logistical resources, past financial performance, or the % of revenue solely dependent on iPhone sales, Apple's stock price is often swayed by investors trying to use supplier numbers to estimate product growth, not to mention associated upgrades for new features in up coming cycles. The ecosystem of suppliers in turn trade like leveraged Apple derivatives, instead of stand-alone companies. This effect is usually much stronger during periods of extreme sentiment, with the market correcting the divergences once those periods calm down or find balance.

Despite strong overall multi-year growth (including Y/Y growth in Earnings of 82%), the performance of SWKS stock price has been nothing short of frustrating. This is a function and combination of negative sentiment related to slowing iPhone sales, fears of a saturated global smartphone market, and an unpredictable/contracting Chinese economy. In return, the market places heavy emphasis trying to predict iPhone sales through the guidance and performance of players like SWKS, ignoring each firms' true exposure and ability to manage that portion of their revenue stream.

If Apple makes up 25% of SWKS revenue, does a potential 5% decline in iPhone sales really warrant an almost 50% drawdown (measuring from 52 week high to 52 week low)? Five years ago there may have been a stronger case, when SWKS had less than half the current OEMs, half the revenue, and mobile opportunities were the only real growth driver. The SWKS of today is one of the most financially sound firms in the sector, with strong barriers to entry, and an extremely diversified portfolio of customers. This is a direct result of their marquee integrated RF solutions at the system level that can meet extremely complex and dynamic customer designs.

A 10% cash position relative to their total Assets (24% ROA), with ZERO debt (30% ROE), while cutting their iPhone dependence in half over the last 3 years (from 50% to 25%), through pure organic growth, and significantly expanded margins in the process, reinforce the perspective that SWKS should command a much higher earnings multiple to reflect strong barriers to entry, solid growth in RF component demand, and continued growth even while others suffer under the circumstances.

Ultimately, SWKS's long history of solid results, excellent management, world class products, and their wide spectrum of different clients not only in mobile, but their growing presence across various IoT related niche markets, will balance any potential longer-term weakness in iPhone sales through strong client diversity in China (essentially playing both sides of the market), while maintaining premium design wins in the next generation of the iPhone and Galaxy lines.

With all that in mind, we will see in the below analysis how this divergence caused by a variety of factors, one mainly being an outdated correlation to Apple, is really an opportunity for the right type of investor, while also observing forward guidance, and the increased beta driven risks investors face in today's new market environment. I maintain a BUY rating, with an adjusted 12 mo price target of $98.5 (a potential 58% upside), reflecting my position on the unfair systemic risk- related discount applied to what are historically low earnings multiples (11x ttm), which clearly are irrespective of anticipated multi-year double digit run rates at the top and bottom line, not to mention a spotless balance sheet affording them tremendous financial flexibility to adjust as the competitive environment evolves.

Skyworks Solutions - Well Positioned To Shake Off Weakness

Since SWKS is a company I frequently write about on SA, I will refer the reader to a supplementary article that focuses on a variety of important items when considering SWKS as an investment. "Skyworks Solutions: The Secret Sauce To Their Success," discusses what I believe are most of the core qualitative strengths, and unique management strategy that has driven immense shareholder value for the long-term investor, even though the recent secular decline has left many who came late to the party deep underwater. Patience and conviction is required to stay the course, and ride out what will down the road prove to be, a prudent move.

The following are just a fraction of the key items I have repeated through out my coverage, that make SWKS worth consideration for investors:

Previously Covered Positive Catalysts:

- Consistently produced multiple years of best-in-class financial results

- Top-of-the-line technology and fabrication capabilities

- World class logistical system and efficient mid teen tax rate

- Integrated Solutions as opposed to discrete components

- Diversification of revenue as well as balanced and diverse OEM portfolio

- Close relationship at the design stage with many OEMs

- Strong barriers to entry established through years of market share growth

- Chinese Market 80% still below 4G and future 5G rollout by 2018

- Besides Apple; Huawei & Samsung (OTC:SSNLF), among many, all use SWKS

- Growing design wins in various IoT and Automotive applications

Diversification, integration, and financial discipline would be my three key descriptions in terms of strategy for CEO David Aldrich. It was only just a few months ago that the market had priced SWKS as a best in class solution provider, with multiples on their earnings far higher than they are today. The justification for the praise continues as SWKS executes through tough waters, treading waves of bearish secular sentiment, and cyclical factors surrounding important end markets, with strong results. When you have a broad sell-off, there is little you can do, especially in higher beta sectors such as technology.

Expectations of prolonged secular weakness is heavily priced in the stock after breaching the previous 52 week low multiple times this year (currently $57.72). This type of decline is being seen across the board in the sector, and amplified as iPhone worries reached a peak when suppliers Qorvo (NASDAQ:QRVO) and Cirrus Logic (NASDAQ:CRUS), came out with early revenue warnings, confirming much speculated potential Y/Y weakness in iPhone sales in general. SWKS on the other hand had already let investors know of the headwinds they were anticipating in their Q4 CC. Even with some weakness Y/Y was to be expected after Q1, Mr. Aldrich assured that growth in other areas of the firm, would sufficiently balance above average seasonal weakness related to Apple. Lets see how those promises turned out.

Skyworks Earnings Results and Forward Outlook

Below we examine the most recent results from SWKS, and list out the key takeaways from the earnings report.

Q1 Results:

- Revenue: 927M 15% Y/Y

- Non GAAP Gross Margin: 51.4% +470 Bps Y/Y

- Non GAAP Operating Margins: 39.6%

- Non GAAP Net Income: 311 M 27% Y/Y **

** The impact of the 88.5 Million received as a termination fee, making Y/Y comparisons a bit skewed for the quarter. GAAP Net income came in at $355 million, which represents on a GAAP basis a Y/Y increase of 82%.

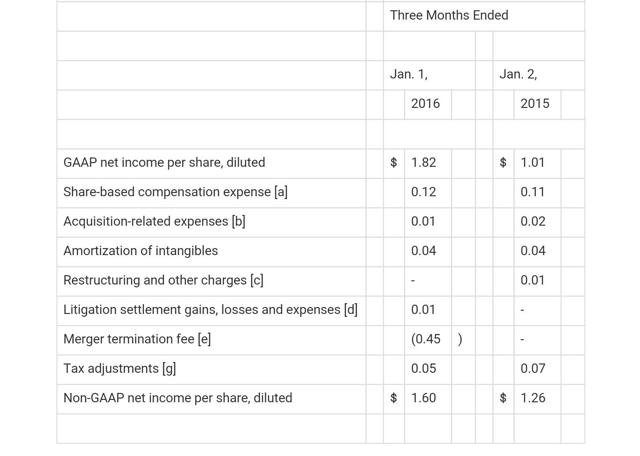

**EPS Reconciliation:

We can see from the above reconciliation, the termination resulting from the failed acquisition attempt of PMC-Sierra (NASDAQ:PMCS) provided a one time break up fee of $88.5 Million, representing an additional 20% to Non GAAP EPS, if one were to add it back to the reported $1.60 figure. Since there was a real economic benefit in cash paid. I believe keeping this additional amount of benefit in consideration (without using it in any comparisons or price estimates) is worth noting, because it is rare when Adj EPS for a quarter, are less than GAAP reported EPS, which make comparisons with consistency, require more judgment.

For our price targets "PT", we will be using $1.60 since this was a one time event, but for the purpose of evaluating the FULL economic benefits received, and bringing to the attention of investors that SWKS received a cash payment equal to 25% of Adj Net Income this quarter, I included the above chart.

Rolling EPS Calculation (source Nasdaq, Finviz, & company reports)

|

The immense growth in EPS Y/Y, with or without the termination fee, is extremely impressive. Furthermore, if this chart were to be extended, you would see the average Adj P/E multiple is somewhere around 20 over the last 3 years (with a rather wide dispersion). March 2015 was the peak at nearly 30x, now trading at just above 11x current EPS, without including the massive 1.2B cash balance, which would lower this figure even more, when taken into consideration (i.e. ex cash).

For the March Quarter, SWKS expects $775M in revenue and $1.24 in adjusted EPS. On the revenue side, that comes in just slightly above last year's Q2 revenue of 766M, while Adj EPS is expected to grow 8% Y/Y, thanks to an expected 400 Bps increase in GM over the same time. For all the noise, the billions in market cap lost, the endless selling and pessimistic outlook referring to SWKS as significantly dependent on the iPhone, SWKS manages to come in with very respectable forward guidance. Lets remember SWKS has a tendency to beat, and even if they do slightly, that will make a significant difference. Flat revenue growth, still will yield at worst an 8% increase in earnings, while inventory channels clear, and the world turns its attention to the iPhone 7. I expect EPS growth for the full year to land somewhere between 30-40%, with revenue growth in the mid to upper teen level.

New Design wins and Business Highlights from Earnings Release:

Q1 2016 Business Highlights:

- Commenced steady volume shipments of telematics solutions at Volkswagen AG (OTCPK:VLKAY)

- Secured first mass production of vehicle-to-vehicle communications sockets at General Motors (NYSE:GM)

- Supported Google Chromecast and Roku set-top boxes for streaming applications

- Won multiple sockets in flagship smartphone platforms at Samsung and other OEMs

- Ramped microcell radio subsystems at leading infrastructure OEM

- Launched IP security camera solutions at Nest

- Powered Huaweis Mate 8 flagship LTE platform

- Enabled the DJI Phantom 3 drone with a suite of 14 semiconductors

- Leveraged ZigBee® and Bluetooth® capabilities for temperature garage door applications in the connected home

- Captured key smart fitness watch design wins at FitBit (NYSE:FIT)

There is no denying their strategy of expanding into a variety of different niche markets, specifically smart home technology, the connected car, wearables such as Fitbit, drones, and even some defense applications are all just the beginning stages precluding a shift in revenue mix that should over time be less reliant on mobile, and even less reliant specifically on the iPhone. The above design wins with leaders in their respective niches are a testimony to SWKS, and the integration capabilities their product lines offer OEMs. By getting involved with OEMs early in the design stage, SWKS continues to execute their strategy of building barriers to entry very few competitors, if any in most cases, can penetrate.

In addition to the above, last month Business Wire highlighted the expansion of SWKS' marquee SkyLiTE suit of front end solutions for LTE devices. I advise readers to take a quick look at the article, which also highlights a couple very bullish estimates with respect to the total addressable market for IoT related connected devices. Here are a three figures worth noting:

- The total number of connected devices is expected to grow at a compound annual rate of 26% to one billion connections by 2020

- Automotive market will see 100M cars shipped by 2020 with connectivity, up from 20M today

- LTE will represent nearly 50% of all mobile devices in 2016, up dramatically from 26% in 2014, as China and EMs continue to expand

These figures above highlight the giagantic "Broad Market" applications, and opportunities that fit directly into SWKS core strengths, reinforcing their strategic evolution as a company with respect to their overall business model.

In addition to the above design wins, and business updates from the press release, below are some key points from the latest Earnings Call:

- 33% ROIC demonstrates very effective cap ex allocation, especially R&D

- Stressed mid single digit run rate for mobile phones (double for their class of products at the higher tier)

- Huawei & Xiaomi saw accelerated growth as revenue consolidation begins to occur as top tier Chinese OEMs continue to gain market share

- 80% of China still on 3G, transition to 4G leading to 20% Y/Y growth in Chinese related revenue, despite the broad economic contraction

- 20% of revenue was from China, being lifted by expanding IoT opportunities in wearables and other niche markets

- TC SAW integrated capabilities are considered best-in-class, even in the face of Qualcom's (NASDAQ:QCOM) new venture competing in the RF space

- SWKS expects strong back half of 2016, maintaining long-term 6-8Q $8.00 Adj EPS target

SWKS has one very impressive book of business, with the world's top OEMs in their respective markets, and a variety of other players that make up a large majority of all mobile devices sold in the world. A very important item to keep in mind is back in 2007, the US and Europe were largely the only viable smartphone markets, leaving China and the rest of the world playing catch up, in turn fueling much of today's growth, as the US becomes even more saturated (evident by flat Y/Y US sales for Apple). When investors consider that now a strong portion of Chinese citizens will also fuel IoT related growth, the combination with expanding 4G LTE availability, is a serious growth driver, that potentially will drive years of growth for SWKS as they continue to be a global leader in the space of all things connectivity.

In an article by Rueters, we got a look into how powerful of a client Huawei is for SWKS. China makes up 20% of SWKS sales, and Huawei has become a serious competitor for Apple, growing unit sales to over 108M, which represents a whopping increase of 77% Y/Y, and roughly 7% of the global market, compared to Apple's share of 15%. This is absolutely crucial to the basis of our thesis, as we point out the immense opportunities in both mobile and IoT in China (not just the USA and EU), as well as India (down the road). As Apple faces their own company specific competitive growth issues, while companies like Huawei are clocking in massive gains, SWKS providing content for both OEMs allows them to hedge out a significant amount of individual product risk. We see how revenue diversity for SWKS is working in a harmonious fashion, as major customers face intense heat, while other customers face intense growth.

Apple - Huawei Results, Challenges, & Impact on SWKS

After months of speculation, built up drama, the usually emotional bipolar views, heated investor debates about the future ability of Apple to sustain growth, and the overall life cycle of the global smart phone market, Apple finally reported results on 01/26, with a mixed bag of outcomes that only further stirs the pot in this often emotionally driven, complex-for-no-reason investment outlook. For the sake of brevity, I will assume everyone on the planet knows Apple, so I will be brief with my overview of their results, and focus more on how they will affect SWKS.

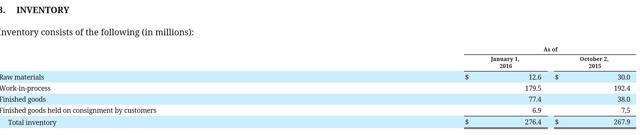

Before we go over Apple's results, lets take a quick look at the inventory backlog for SWKS:

As we can see, inventory sequentially hasn't changed in total. Instead a more than (50%) drop in Raw Materials, about (6-7%) drop in Work-in-Process, and a 50% increase in Finished Goods, represent a built up backlog, with production runs significantly lower (making less chips to clear inventory and meet lowered demand), which in turn impact the top line. Mr. Aldrich repeated that this should clear by the crucial back half of the year, as Apple will be entering most likely their iPhone 7 cycle. Thanks to world-class logistics capabilities, and very deep market insight, SWKS is able to effectively manage their inventory, without letting the total figure grow much larger on the balance sheet.

Apple Q1 Results and Q2 Guidance -

As expected, Apple met their Q1 guidance, but at the same time finally had to admit that rumors of slowing iPhone sales were true, especially mid cycle into Q2, guiding toward the worst quarter on a Y/Y basis since the 2007 iPhone release. The drop from best to worst quarters exhibits why so many pundits are pointing at a potential long term top in growth for the company. Since smartphone sales globally are expected to still grow in the mid single digits, Apple will have a low hurdle in terms of expectations, and the room to surprise to the upside by just coming in slightly higher than expected is also a good thing for SWKS. If they manage to show the slightest bit of Y/Y growth, I expect once again the saga to make another zag in sentiment.

Product line performance Highlights

- iPhone revenue (68% of total revenue) +1% Y/Y to $51.6B, $75.9B Total revenue + Y/Y

- iPhone units up fractionally to a record 74.8M.

- Services (iTunes/App Store, Apple Music, Apple Pay, AppleCare) +26% to $6.1B.

- Other products (Apple Watch, iPod, Beats, Apple TV, peripherals) +62% to $4.4B

- China grow 17% Y/Y constant currency - India 77% Y/Y, albeit small but growing quickly, large upside potential

- March Quarter first ever Y/Y drop in revenue expected since the 2007 release of the first iPhone (58-60M devices expected)

- Revenue drop next quarter could be up to (5%)

So here is where the analysis comes together, and paints a much different picture then how the market has treated SWKS.

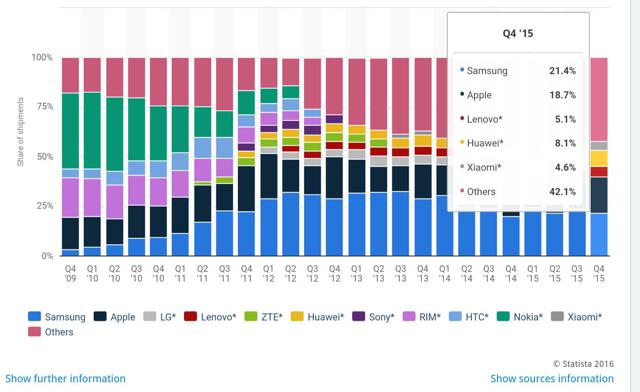

Thanks to Statista, above we have a detailed breakdown of the global smartphone market by OEM. Since this article isn't focused necessarily on individual OEM success, but rather how: 1) how much will a decline in iPhone sales potentially impact SWKS, and 2) how SWKS has cast such a wide net, that Apple has become a lot less significant compared to the last cyclical downturn in 2011, I elected to focus on where we stand today. Above we see that SWKS has components that span across over 60% of the global market, with most likely a fair share of RF content in the "others" categories as well. This balance with expected total growth globally still expected on a full year basis, Apple can continue on a path to slower growth, while SWKS can in turn easily find a way to make up the difference. Most likely, Apple would need to lose in the Chinese market to local makers, thus lost Apple revenue being paid out of the competitions' success.

Without having to even bust out a calculator, one can easily see that as long as smartphone sales meet their expected mid single digit expected growth rate for the year (double the growth rate for LTE enabled smartphone revenue), than SWKS will not only continue to grow, but it may end up benefiting in some ways from slowing iPhone sales, especially when considering the kind of growth we just saw out of Huawei and China.

Risks In A Competitive Environment for RF Components

SWKS produces world class, GaAs based TC SAW filters, years ahead of the competition in terms of integrated system level capabilities. Their chips ensure the highest quality connectivity, in a world where increasing bandwidth due to streaming music, and all the other functions we perform with our smartphones, is rapidly driving filter complexity. For this reason, regardless of future price competition that may drive hardware ASPs down, and force OEMs to make manufacturing decisions, RF components are most likely going to hold their value. Why would a firm sacrifice the quality of your connection, thus hindering the performance of the mobile device, especially when the cost is generally very low, compared to say a processor. In a fiercely competitive, and maturing market, not only SWKS, but competitors like AVGO are forecasting steady double digit growth in RF dollar content per device, as bandwidth demand continues to drive the need for the most integrated and highest quality components. This ensures continued design wins from Apple, which despite of a potential peak in iPhone sales, will continue to move massive amounts of units. The same theory in terms of design holds true for Huawei, and other Chinese OEMs who are converting 3G customers to 4G LTE by the droves (as we saw in their most recent results), and many times beating Samsung and Apple by meeting a very fine line between expected functionality, and retail price.

QCOM for years has been trying to meaningfully enter the space, and recently announced a JV with Japan's TDK, to begin producing integrated front-end modules and RF filters, which is a testament to the continued expected growth in the space. Personally I am not worried as I don't believe OEMs will want to add further content space to QCOM, diluting the competition, and providing QCOM with too much negotiation leverage at the table. SWKS management also claims QCOM won't nearly be able to match the quality that SWKS produces at the system level in time, before SWKS comes up with their next generation chip. Mr. Aldrich had these answers to questions from the conference call:

Question: But could you just refresh our memory, before the JV was announced, were you seeing Qualcomm in any of the competitions for any of the RF in any of the major players? I know they've been doing RF360 for like three years now. And so I just want to get kind of a snapshot before we lose our minds on the JV on what was going on with Qualcomm and before thenAnswer: TDK and Qualcomm have been working closely together and fielding designs for a long time. We've competed very successfully against those designs. So there hasn't been a lot of traction in the sweet spot of what we do. There have been other RF360 components of that system, in which we don't compete, where they've had success. But these decades of gallium arsenide performance and driving switch technologies, and multi-chip module technology, and beginning to put our own high-performance filters, has really given us a system-level performance that has not been easy for competition to replicate.We know TDK very well. We've used them in the past in mostly SAW. They've got some limited capability in BAW. But remember, I think as your question alluded to, our customers are wanting business based purely on performance and on configurability and what it does at the system level. And we have a clear advantage at the system level over anybody. We've not seen the combination of Qualcomm TDK to be any meaningful threat over the last three years.

So there you have it folks, since Mr. Aldrich can say it better than I can, he laid out the likely result of QCOM's move, at least in terms of disrupting SWKS.

What this may do, is result in an attempt down the road to flat out acquire SWKS, since QCOM can't seem to do anything right these days. Personally I feel SWKS is preparing for another go at an acquisition. In a future article, I will discuss various competitors I feel are up for grabs, and can add significant accretive earnings, while helping further cement the strong barriers to entry that SWKS has created around their integrated solutions in the connectivity space. My gut feeling comes from SWKS lack of buybacks this quarter, after repurchasing above their 40% FCF payout target last quarter. I criticized the move, as I believe growth companies like SWKS should be using cash instead of paying it out, in order to keep the moats around their business somewhat deep. Well this quarter SWKS avoided buybacks, while management had this to say about future M&A and the lack of buybacks at such low levels:

We didn't do any buybacks this quarter. I mean, we also balance it about what's going on in potential M&A activity, what we're looking at and those things. And bottom line is that 40% will continue to do. So stay tuned.

I think it's safe to say SWKS realizes that their squeaky clean balance sheet, while a great item for value investors, is viewed as under utilizing your resources in the tech world. Returning value to shareholders is important, but after heavier-than-guided buybacks at the end of Q4, SWKS may be shopping, and they couldn't be doing so at a better time with many targets trading at 30-40% discounts (if otherwise, at these levels SWKS would have been buying back stock hand over fist). A sizeable acquisition for SWKS after missing out on PMCS would make it more difficult for QCOM or any other player to then come in and buy SWKS out. We are looking at a company with a solid 5 year outlook, investors don't need to be bought out at this point to earn a healthy return on their investment, but the possibility always remains the case, at least until SWKS makes a move that leverages their financial resources.

We've Seen This Before: Remember 2011?

Semiconductor stocks are notoriously cyclical, so as one would guess, this isn't the first time SWKS has experienced this kind of pain. There is no question that SWKS investors have taken significant hits, with their hopes getting smashed after both quarters after delivering their usual top and bottom line beats, staying the course of a near perfect multi year report record. In this article, we discussed why there are so many different factors that will dictate the future success of SWKS, that are not directly related to the iPhone. If someone were to look at a chart of SWKS from 2009-2012, they would notice a very similar looking chart, as the one from 2013-Present.

January 2009 - Present

If historic data has any relevant significance, and if cyclical businesses ever actually go through "cycles", then the above chart certainly paints a pretty clear picture for us in terms of expectations. SWKS has been through this exact same type of cycle, for different reasons of course (no time to get into the details of each time period), but never the less came out the other side twice as strong. Both cycles have max draw downs of around 50% from their respective highs, and also collapsed after strong multi-year runs where the value of SWKS more than tripled each time in the bullish phase of the cycle, only to see them significantly pull back, around the same time we saw significant weakness across global equities (seem familiar?).

After their 2011 acquistion of SiGe, who's front-end RF Module technology became the stepping stone upon which SWKS built their top of the line integrated solutions platform, it was off to the races gaining one design win after another, leveraging the explosion of the smart phone world. With some hints that a future acquisition could be in the works for SWKS, I would expect them to leverage whatever technology they can to ensure they have the same success in the IoT space, as they have had with mobile RF solutions. De Ja Vu to come? I think so, after surviving this long, and growing in value from 2009 over 10x your dollar, it's good to know statistics are on your side.

Based on a comparison of the two time periods, it looks like SWKS has a downside that can reach about $50 a share (already reached $58.50 just a couple weeks ago). I believe the majority of pain has already been significantly priced into the stock, with the remaining downside just a function of market mechanics. Due to the powerful combination of a growing dividend paying stock, with a market cap exceeding 10B, while a member of the S&P500 index, and valuation metrics that would certainly put them in the value category, along side growth characteristics that also paint a robust 5 year outlook, they are on a lot of trading desk radars.

To say the least, they are a fit for a variety of fund strategies, both index and managed, and as a result, I am sure a lot of the downside we have experienced is partly due to a 7% short float, mutual fund and hedge fund liquidity, as well as an easy short term target to ride as markets show no sign of stability. As many say, this too shall pass, leaving investors at these levels with a solid risk/reward ratio, and immense upside potential for undertaking a rather volatile, and a bit risky short term outlook. If prudent investors buy in increments, and exhibit patience both in terms of buying and in terms of holding, than chances are in the long run you'll be rewarded generously.

Arriving At a Price Target:

To arrive at my price target, I apply the mid point of my bottom line growth expectations (35%) to Annualized Adj EPS of $5.61, and arrive at $7.57 by this time next year. At a conservative 13x multiple, you arrive at the midpoint of my price target - $98.5 by end of Q1 2017. At their all time high, they were trading at 30x earnings, and now at their lowest point, roughly 11x, so a slight expansion in the earnings multiple, and PEG ratio significantly under 1 (somewhere close to .5).

I believe a new long term average P/E of 15x-17x earnings is very achievable ($115-$125), when market conditions improve, especially in the last quarter of the fiscal year (September). Since market conditions in my opinion will remain choppy at best, with a full year personal estimate of at best, mid single digit growth for the S&P, I am keeping my estimates rather conservative, anticipating an earnings multiple of 13x, with an expected growth rate of 35% on the bottom line.

I expect earnings multiples to remain weak, unless there is a change in market sentiment. With all that in consideration, I reiterate my Buy recommendation, with a 1 year price target of $95-$100, I anticipate the back half of the year to show continued strength resulting from the various catalysts discussed through out the article. Caution should be used in determining if the nature of SWKS as a company suits your investment profile. With volatility, potential disruption, out-of-favor sentiment, the ride won't be smooth back to redemption, and isn't considered a "low risk" investment. Investors need to have a very long term outlook, past the current weakness that will at some point reverse.

Where SWKS trades will largely be a function of the overall market's performance, sentiment related to the iPhone 7 cycle, and executing on their growth initiatives in the IoT space while expanding 4G LTE customer bases globally. With 13 out of 13 analyst giving it a Buy recommendation, and average price target of $94 according to TipRanks, (a decline since my last report from an average of $115 in November), it seems that the majority of Wall Street, (including most recently Goldman Sachs (NYSE:GS)) maintain a Buy Rating on

the stock.

Conclusion: Today's Pains May Be Tomorrow's Gains

The below says it all, as we see SWKS has been on nothing but a steady decline, with widening gaps between moving averages, while also making newer, and newer lows for the year. There is no shortage of short term selling pressure, and it doesn't look like it is going to reverse over night. Instead, I believe we will see a choppy recovery over the course of the year, resembling closely the recovery seen post 2011, where a similar cyclical downturn cut SWKS in half over the course of a year (more to come on past cycles).

So far the price has bounced off the $58/$60 support level, after making an attempt to recover now that the market has seen the latest earnings report, and guidance. To be fair, the likelihood it recovers quickly without the overall market making a miracle reversal, is very low. The above downward trending price channel is pure testimony to the associated sentiment related to both micro and macro specific factors, which in turn also have a significant influence on indexes, including the S&P 500.

Technology is trending downwards, overall markets are trading one day gains for three days of losses, and the fundamental global macro concerns are all indicating pain. It takes courage and conviction in your core thesis, the fundamentals of the company, your belief in management capabilities, and the long term outlook for their growth story, in order to stick with a difficult investment. Watching long periods of price deterioration, wondering if the markets will ever turn, is where good investors make their bread and butter. Good news is, if you believe that markets eventually get it right (semi efficient), then right now the above chart is nothing more than a great company with solid fundamentals, trading at significant discounts to historical levels.

There's no question market conditions these days are down right brutal. There are very few places to find safe growth. My basic underlying thesis stated that the correlation between SWKS and Apple is overrepresented in the price, when taking into account the abundance of different positive catalysts SWKS continues to show quarter after quarter, outside of iPhone related revenue. Yes, if Apple were to end their relationship with SWKS, it would have a devastating impact, but not fatal.

SWKS isn't as Apple dependent as the price reflects, but yet they continue to trade like the future is solely based on Apple's overall success, especially related to the number of iPhone units sold, when in reality, their diverse customer base allows them to make money either way, and LTE expansion couldn't be healthier. By covering such a large portion of available OEMs, SWKS not only has a deep understanding of the competitive environment, but the necessary technology, and abundant resources to further develop break-through solutions. It is very important SWKS maintains design wins across as many segments as possible, and in addition to which, should be done through M&A, especially with their balance sheet, and a low rate environment.

The future looks bright behind the clouds from my perspective, as I solely focus on results, and my personal interpretation of management's strategy, and overall success in their market. I maintain my buy rating, and suggest investors consider options as way to hedge. There are many different strategies, from covered calls, to buying or selling puts, as a way to hedge or take advantage of temporary downside weakness. The bottom line is, that regardless of the prolonged weakness in the sector, semiconductor companies are the back bone of our entire future. We see where technology is heading, and there is a chip for everything that needs to be done, especially chips that connect things. At the end of the day SWKS remains a fundamentally sound example of a great company, with solid results reflecting strong current and future growth potential, suffering from bad association syndrome, in return creating opportunity for those who understand the trends of the future.

For More On The Space :

The above articles are examples of similar companies in the same space, suffering from the same macro related weakness.

By SevenSeas Investment Research

Disclosure: I am/we are long SWKS.

No comments:

Post a Comment