- Avago will benefit from increasing RF content in Apple and Samsung’s next-generation smartphones, and from growing sales to the China LTE smartphone.

- The company delivered strong financial results, which were better than analyst estimates and provided second quarter guidance above expectations.

- Although AVGO's stock has gained 295% since the beginning of 2013, and it is trading near its 52-week high, the stock still has more room to grow.

On August 19, 2014, I wrote an article about Avago Technologies (NASDAQ:AVGO), describing the company and recommended the stock. In this article, I will give some update information about the stock.

On February 25, Avago delivered strong first quarter fiscal 2015 financial results, which were better than analyst estimates and announced a significant acquisition. Furthermore, the company provided second quarter guidance above expectations. As a consequence, AVGO's stock surged 14.7% on the next trading day. AVGO's stock has considerably outperformed the market in the last few years. Since the beginning of 2013, AVGO's stock has gained an astounding 295% while the S&P 500 index has increased 44%, and the Nasdaq Composite Index has risen 61.3%. However, in my opinion, the stock still has more room to grow.

Chart: TradeStation Group, Inc.

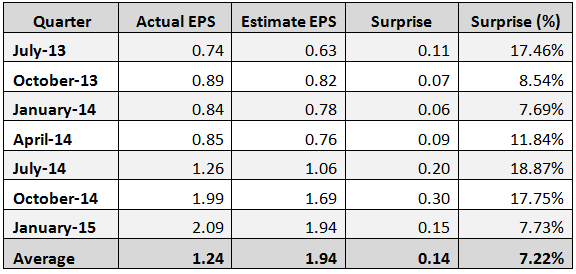

Last quarter was the seventh quarter in a row that Avago beat earnings estimates, as shown in the table below.

Source: Yahoo Finance

Latest Quarter Results

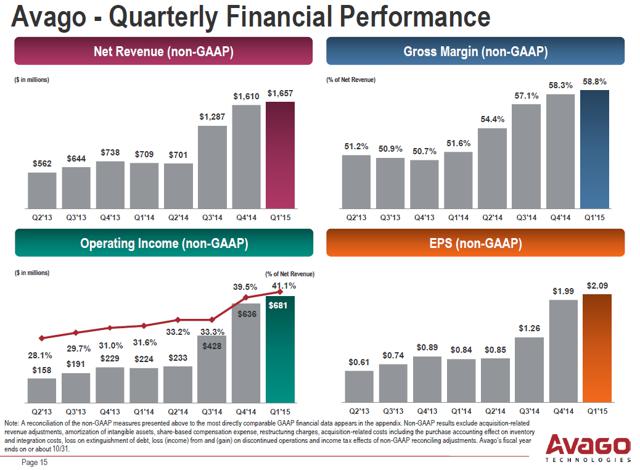

Net revenue from continuing operations was $1,657 million, an increase of 3 percent from $1,610 million in the previous quarter, and an increase of 134 percent from $709 million, in the same quarter last year.

Net income from continuing operations was $596 million, or $2.09 per diluted share. This compares with net income of $556 million, or $1.99 per diluted share last quarter, and net income of $217 million, or $0.84 per diluted share, in the same quarter last year.

The high growth was driven by better shipments of higher margin wireless FBAR filters, which are in use in the very successful Apple (NASDAQ:AAPL) iPhone 6.

Source: Company Overview February 2015

In the report, Hock Tan, President and CEO of Avago, said:

We had a strong start to our fiscal year with better than expected 3 percent sequential revenue growth in the first quarter, driven by our wireless revenues, which grew by 90 percent from the same quarter last year. And we continued to deliver very strong financial results with greater than 40 percent operating margins and $2.09 in EPS.

The company provided second quarter fiscal 2015 guidance above estimates, as strength in other divisions offset the seasonal but better than anticipated quarter-over-quarter decline in the wireless business. Avago expects second quarter sales of $1.6 million, and non-GAAP gross margins of 58.5%, which are $60 million and 120 bps above the Street estimates, and EPS of $1.93, $0.20 above consensus. The company expects a better seasonal decline from wireless as seasonal weakness at its largest OEM customer Apple is offset by silicon content gains at other customers.

Emulex Acquisition

On February 25, Avago announced that they have entered into a definitive agreement under which Avago will acquire Emulex (NYSE:ELX), a leader in network connectivity, monitoring and management, in an all-cash transaction valued at approximately $606 million, or $609 million net of cash and debt acquired. Avago expects to fund the transaction with cash available on its balance sheet.

Avago agreed to pay a premium of about 26% over ELX's February 25, closing price. In my opinion, the price is not exaggerated since the acquisition will contribute to the company's growth. Avago views ELX's Fibre Channel connectivity solutions as a strategic complement to its Enterprise Storage business. Avago expects ELX to generate revenues of $250 million to $300 million annually.

Looking Forward

According to the company, within the last quarter, it saw stronger than expected demand from its large North American Smartphone OEM, apparently Apple. Given these levels of growth, coupled with its expectation for additional FBAR filter content in upcoming smartphone generations, the company expects to remain capacity constrained through the balance of this year even as it continues to grow its FBAR capacity over the next 12 months.

In my view, Avago, the industry leader in FBAR filters, will benefit from increasing RF content in Apple and Samsung's (OTC:SSNLF) next-generation smartphones, and from growing sales to the China LTE smartphone.

Valuation

AVGO's valuation metrics are very good, the forward P/E is low at 13.89, and its quick ratio is very high at 3.30. Furthermore, its PEG ratio is exceptionally low at 0.50.

The PEG ratio - price/earnings to growth ratio - is a widely used indicator of a stock's potential value. It is favored by many investors over the P/E ratio because it also accounts for growth. A lower PEG means that the stock is more undervalued.

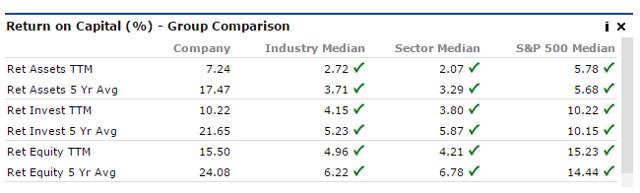

In addition, AVGO's Return on Capital parameters have been much better than its industry median, its sector median and the S&P 500 median as shown in the table below.

Source: Portfolio123

Top Analyst Opinion

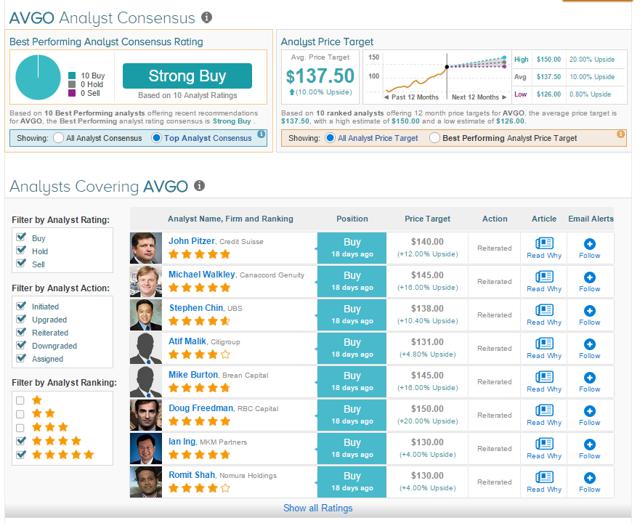

According to TipRanks, a website that ranks experts (analysts and bloggers) according to their performance, among the analysts covering Avago stock there are ten analysts who have the four or five star rating, all of them recommend the stock. The average price target according to the ten top analysts is $137.50, which is a 10% upside for the stock.

Source: TipRanks

Summary

Avago will benefit from increasing RF content in Apple and Samsung's next-generation smartphones, and from growing sales to the China LTE smartphone. The company delivered strong financial results, which were better than analyst estimates and provided second quarter guidance above expectations. Avago has compelling valuation metrics and very high earnings growth prospects, its PEG ratio is exceptionally low at 0.50. Although AVGO's stock has gained 295% since the beginning of 2013, and it is trading near its 52-week high, in my opinion, the stock still has more room to grow.

By Arie Goren

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment