Summary

- Micron and Intel have partnered to make NAND Flash, the memory commonly used in smartphones and tablets, since the formation of their joint venture in 2006.

- The joint venture between the two companies is working on 3D NAND technology, which is expected to be an important growth driver for the NAND market.

- Micron, in collaboration with Intel, commenced early 3D NAND samples in Q1 2015 and expects volume commercial production in the second half of calendar year 2015.

Micron Technology (NASDAQ:MU) and Intel (NASDAQ:INTC) have partnered to make NAND Flash, the memory commonly used in smartphones and tablets, since the formation of their joint venture in 2006. In 2012, the two companies expanded this relationship with an agreement for Micron to supply NAND products to Intel and for certain joint venture assets to be sold to Micron. The Micron-Intel partnership has created industry-leading NAND Flash memory technology and developed a robust global manufacturing network. IMFT (Intel Micron Flash Technology), the joint venture between the two companies, is currently working on the 3D NAND technology, which is expected to be an important growth driver for the NAND market.

In this article, we discuss how an early entry in the 3D NAND market can help Micron increase its NAND market share. Currently, the company derives 28% of its revenue and 34% of its valuation (as per our estimate) from the NAND Flash market. Accounting for around 14% of the market, Micron is the fourth largest player in the NAND Flash segment, after Samsung (OTC:SSNLF), Toshiba and SanDisk (NASDAQ:SNDK).

Our price estimate of $32.23 for Micron is at a 15% premium to the current market price.

Transition To 3D NAND To Increase Capacity Expansion

3D NAND is a type of flash memory that stacks memory die on top of each other within a single package using specialized interconnects. The vertical stacking allows for a significantly higher density of memory cells and improves performance and reliability. 3D NAND is a breakthrough in overcoming the density limit currently facing the planar (2D) NAND architecture and floating gates used in conventional flash memory, as well as yielding speed and endurance improvements. 3D NAND has a more dense chip with twice the write performance and 10 times the reliability of planar NAND. [1]3DNANDcellarchitectureenablessignificantperformance and cost improvement relative toplanartechnology.

TrendForce currently projects 3D NAND will account for only 3% of the NAND Flash industry's overall supply, since the majority of the manufacturers are still in the testing and sample delivery phase. However, it expects the 3D NAND market share to reach 20% by 2015. [2] According to IHS research, 3D NAND technology will account for the majority of total flash shipments, equivalent to 65.7% by 2017. [3]

Micron Will Start Commercial Production Of 3D NAND In The Second Half Of 2015; Though Samsung Is Already A Step Ahead, Micron Is Way Ahead Of Other NAND Players

Micron, in collaboration with Intel, commenced early 3D NAND samples in Q1 2015 and expect volume commercial production in the second half of calendar year 2015. While the first generation 3D NAND is on track for production in Singapore, the second generation is under development in Boise.

In its investor meeting in November last year, Intel announced that its 3D NAND solution (in collaboration with Micron) has already reached the prototype stage and the drives will be available by mid-2015. The first drives will likely have capacities in the range of several terabytes and be targeted at enterprise buyers. Though the drives may be very expensive initially, in the long run the technology could drive down prices and make SSDs with one to four terabytes of storage more affordable for consumers. It also could be used to construct physically smaller drives, making it more applicable for laptop and tablets. At its investor conference last month, Micron mentioned that the introduction of this disruptive non-volatile memory architecture will drive exciting new applications. Micron and Intel process architecture targets to achieve the highest bits per square mm of any vertical NAND solution.

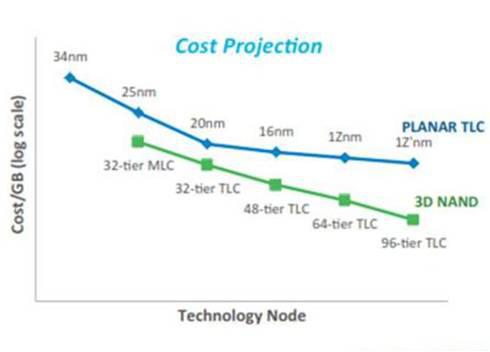

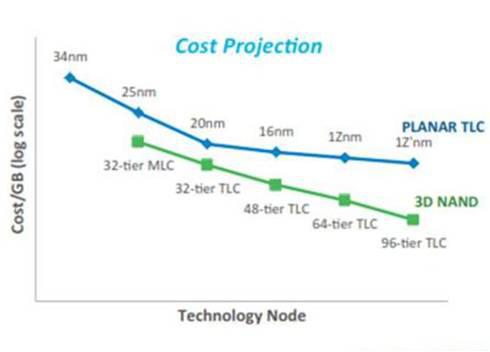

The Micron-Intel 3D NAND solution will be at cost parity with the current 20nm planar node as soon as it's released (see the graph below). The TLC 3D offering will be cheaper than the industry best-of-breed 16nm planar offering. Additionally, the performance of 3D NAND is far better, with more durability (writes of data) and better density in terms of data bits per square millimeter of circuit board space compared to 2D/planar NAND. [4]

Samsung, which accounts for 27.9% of the NAND Flash market, launched its 3D V-NAND storage technology in August 2013 and has already started mass production of the technology. SanDisk (18.2% market share) and partner Toshiba (21.9% market sahre) won't have a 3D NAND offering until 2017. SK Hynix (11.4% market share) has yet to reveal specific 3D roadmaps, methodology and timing. While Samsung clearly has the first mover advantage, Micron too can benefit from the early entry in the 3D NAND technology. By the time SanDisk, Toshiba and SK Hynix come up with a 3D NAND offering, both Samsung and Micron will be several generations ahead and will have solved the teething problems of controller design and other architectural issues.

We believe that an early entry in the 3D NAND market can help Micron increase its share vis-à-vis SanDisk, Toshiba and SK Hynix.

Disclosure: No positions.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

By Trefis

No comments:

Post a Comment