- Breakthrough cholesterol-lowering agents - PCSK9 inhibitors - are one of the most anticipated drug launches in 2015. $10 billion a year projected by analysts in peak sales.

- Regeneron/Sanofi recently moved ahead of Amgen in the race. Thanks to its priority review status, Regeneron's drug should now launch in July/August.

- First-mover advantage in this huge new market could further catalyze Regeneron, already a top-performing biotech.

- Key risks include pricing pushback from PBMs such as Express Scripts.

Regeneron and its partner, Paris-based Sanofi, will probably bring the first new cholesterol-blocking drugs to the U.S. market. (Photo courtesy of Creative Commons, Flickr, Chadica)

U.S. based Regeneron (NASDAQ:REGN), and its Big Pharma close partner, Sanofi (NYSE:SNY), just snagged a spot at the head of the table in what may be the most important drug launch of 2015 - PCSK9 inhibitors.

That news has the cholesterol drug world, one of the largest markets in pharmaceuticals, on the edge of their seats. It's something investors should note as well, because these statin-beating injectables are likely to bring in more than $10 billion a year. Just in terms of Regeneron and Sanofi's piece of the pie, peak consensus sales hover around $3.3 billion.

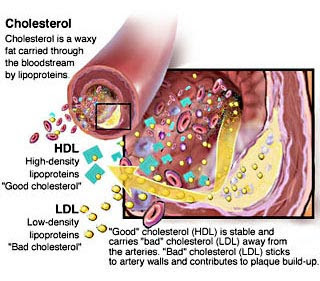

As you may know, PCSK9 limits the liver's ability to remove "bad" cholesterol from the blood. PCSK9 inhibiting drugs are groundbreaking treatments that slash LDL cholesterol in people who've had little success doing so in the past. In particular, Sanofi and Regeneron recently rolled out a post-hoc analysis of study data showing their drug cut the number of heart attacks and strokes by half in high-risk cardiovascular patients.

Up until recently, Amgen's (NASDAQ:AMGN) drug, evolocumab, was widely expected to be the first-to-market. But Amgen lost a key regulatory race at the end of January, opening the door for alirocumab from Regeneron to move ahead in this important new category of cardiovascular treatment.

Seeing the opportunity, Sanofi and Regeneron went an unusual route to get their treatment to the market before Amgen. They purchased a priority voucher from Biomarin Pharmaceutical for $67 million. The FDA has nowaccepted the Sanofi/Regeneron application and set a priority deadline of July 24. The decision sets up alirocumab for that all-important, first-mover advantage in the U.S. market, Meanwhile, Amgen will have to sit it out until the FDA game clock starts up again on August 27.

Once the market realizes Regeneron's opportunity, the stock may find itself with a lot more wind under its wings. What's interesting is that Regeneron's new position in the race seems to be flying under-the-radar, and analysts have yet to move the company's price targets upward. According to Thomson/First call, the recommendation trends for Regeneron have been flat, with 15 analysts rating the stock a buy, 7, a hold, and none, a sell, compared to 16 analysts rating it a buy, and 6, a hold, a month ago.

Of course, Regeneron's stock is already a great performer, reflecting the company's rapid growth. In Q4, the company's revenue was up 31%compared to same quarter last year. But thus far, Regeneron's surging revenue growth has come mostly from EYLEA, its blockbuster treatment for macular degeneration.

Race approaching the finish line, but hurdles ahead

Being first-to-market should catalyze Regeneron, but that depends on a final FDA approval, and there are never any guarantees when it comes to the FDA.

Still, Sanofi/Regeneron conducted nine phase III trials (ODYSSEY) of alirocumab in people with high cholesterol. Primary efficacy endpoints were achieved in all trials. The scores achieved should be good enough for the FDA, which accepts lowered LDL cholesterol as a surrogate signal of cardio improvement.

In addition, Regeneron's early data showed alirocumab cut in half the number of heart attacks and strokes. Regeneron's data was released at the European Society of Cardiology's annual meeting in Barcelona. "To have this result emerge so quickly in this study is very encouraging," said Dr. Jennifer Robinson, a cardiologist at the University of Iowa, who led the study. The study suggests the drug's effect on cholesterol will translate into meaningful outcomes for patients.

Not all is fair in love and pharmaceuticals, and another possible hurdle for Regeneron is ongoing litigation. Claiming Sanofi/Regeneron stepped on its intellectual property with its PCSK9 inhibitor, Amgen has filed a patent infringement lawsuit targeting alirocumab.

How will the legal fight play out? Biospace's short-but-enlightening take on that can be found here. One key issue is that it appears Sanofi/Regeneron can still launch the drug, and that litigation should not affect FDA timelines or decisions. While the litigation is something to keep an eye on, I don't believe it's a major factor for Regeneron - certainly not short term.

Assuming the FDA gives the go-ahead, will being first-to-market catalyze this stock?

When a company launches drugs in developed markets, it's hard to over-estimate the value of being first-to-market. The advantage comes from several sources. First, there is typically pent-up demand. Physicians often defer treatment for patients with available, approved drugs - knowing breakthrough new treatments are about to reach the market.

Second, being the first-mover means the company is able to get prescriptions written for patients who may be reluctant to switch to a competitor's drug later. In this case, that advantage could prove highly significant. Once patients start taking a specific PSCK9 inhibitor, they are likely to be on it for life.

How big is the pool of patients? According to Sanofi, around 12 million people in the U.S., and 21 million worldwide, fail to achieve the expected reduction in LDL cholesterol levels with statins. PSCK9 inhibitors are targeted at three categories: (1) patients with genetically high cholesterol, (2) high-risk patients who do not hit their targets on statins alone, and (3) patients intolerant to statins, whose side effects can include muscle pain. In all of those categories, PCSK9 injectables deliver meaningful improvements.

But with Amgen breathing down its neck, Regeneron will have to move fast with this launch. Fortunately, Regeneron has a history of rapid drug launches. After the FDA nod came for its blockbuster treatment for macular degeneration, EYLEA, the drug was immediately available almost everywhere in the U.S. The quarter following, sales of EYLEA reached $124 million. The subsequent quarter, sales reached $194 million. Sales expanded further to $224 million, the third quarter of 2012. Label expansion for EYLEA also came rapidly, as well as EU approvals.

I also find it encouraging that usually stodgy Sanofi seems unwilling to let any grass grow under its feet with this drug. In an interview with BioPharma, Sanofi EVP Pascale Witz said that the company has already been in talks with payers and is launching an education campaign for doctors and patients.

First-mover advantage often translates into a lift to the stock - as shown by Gilead Sciences' (NASDAQ:GILD) take-off after it won the hep-C drug race. The launch of Gilead's breakthrough hep-C drug Sovaldi sent Gilead's share price soaring. Compared to EYLEA, of course, Sovaldi sales were a rocket ship. It quickly became the fastest selling drug in the world. In fact, in just a matter of weeks, it hit the $1 billion sales mark. Q1 sales after Sovaldi's launch in December 2013, were $2.27 billion.

In terms of Regeneron's launch of this new drug, its much bigger than the opportunity it had with EYLEA. Interestingly, the sizes of the hep-C and PCSK9 inhibitor market are remarkably similar. Both are predicted to reach more than$10 billion in peak sales in ten years.

But market potential can be estimated in countless ways, and I'm not suggesting that this new drug will do as well as Sovaldi. Gilead had a significantly longer head start with its hep-C treatment than Regeneron has.

In addition, the patient population for PCSK9 inhibitors is quite different from the population that made Sovaldi so successful. Many of the patients who are candidates for PCSK9 inhibitors don't feel sick, or think of themselves as being ill. In addition, until the outcomes trials are completed, the FDA might make the label for these inhibitors quite strict, which will temporarily throttle down sales.

Long-term opportunities and pitfalls

Obviously, Regeneron bulls are hoping for a big launch, and the sooner the better. But the good news is that Regeneron's success does not depend on whether or not it retains its first-mover status. PCSK9 inhibitors will be a massive market, with plenty of room for multiple drugs. The major differentiating factor among these drugs will end up being how well each therapy performs in long term, outcomes-focused studies.

The results of those studies are impossible to predict at this point. Thus far, Amgen's fleet of promising data includes a 52-week study in which its drug reduced mean LDL cholesterol by 57% compared to placebo. But Regeneron can boast that it is the only company able to release data suggesting its drug reduces cardiovascular risk - which, of course, is the real goal.

While Regeneron and Amgen hustle along, Pfizer (NYSE:PFE) is a distant third with a rival product. Pfizer hasn't disclosed a regulatory timeline for that candidate, but it has disclosed that it's also working on a preclinical oral PCSK9 drug. Such a drug could someday convey a significant competitive advantage, as all competing drugs are injectables.

Eli Lilly and Roche also have rival products in much earlier stages of development.

Drug pricing is getting a lot more pushback in the U.S., which is probably Regeneron's most significant long-term risk. Last year, activist PBMs went to battle against pricey hep-C drugs, and already, Express Scripts (NASDAQ:ESRX) has declared its intention of playing hardball with PCSK9 inhibitors.

With an eye on pushback from payers, Sanofi's EVP Witz said that the company had incorporated pricing and access into its marketing strategy for alirocumab from the beginning.

While Express Scripts' cost-slashing determination is not to be underestimated, the sky-high cost of last year's hep-C drugs spurred outrage not just from payers, but also from Capitol Hill and the public. Sovaldi was launched with a price tag of $1,000 a pill. By contrast, pricing on the injectable PCSK9 inhibitors is expected to be around $15 per day, comparable to the cost of injectable diabetes drugs.

Since those price points are already accepted, I believe PBMs and insurers will have a hard time getting support from public outrage or Congress, which should reduce their opportunity to gain significant price-cutting concessions out of the major players in the field.

The very worst case is that payers may try to hold out for longitudinal results, before agreeing to cover the new cardio drugs. But that's highly unlikely, because drug companies are getting smarter at playing that game. Many of the Phase III trials for these new drugs were designed not just for FDA approval, but to prove the drug is worth the money. The upshot? Since PCSK9 drugs could be a valuable new weapon against heart disease, it's going to be very difficult for reimbursement parties to deny coverage. The risk/benefit profile just won't support it.

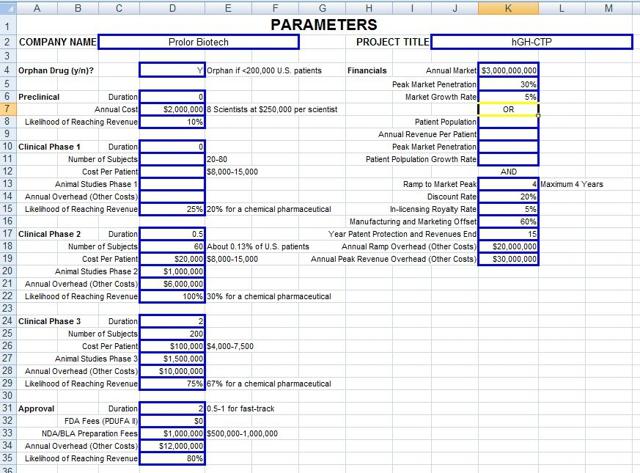

In terms of launch costs/risks/analysis, the chart below displays breakdowns for a drug with a similar peak revenue target as alirocumab.

What about Sanofi?

Sanofi is not an investable stock to me at this point. The company has had very little to brag about when it comes to new product launches in the past five years, other than its R&D partnership with Regeneron.

While Sanofi's flat growth should get a much-needed shot in the arm from PCSK9 inhibitors, the overall impact will be significantly less than its impact on Regeneron. (Sanofi's market cap is $129 billion, compared to Regeneron's $42.6 billion.)

Sanofi has other problems. Sanofi's former CEO, Chris Viehbacher, was ousted in October after a tussle with Sanofi's highly "assertive" (to put it politely) board of directors. Under Canadian-German Viehbacher's tenure, shares in this company climbed to record levels. Viehbacher being sacked, as well as forecasts for flat sales of diabetes drugs in 2015, spurred a huge three-day decline in Sanofi and wiped out $22 billion in investor money.

Sanofi's board returned to their tradition of picking a CEO with a French heritage for their new top dog: Olivier Brandicourt. Brandicourt will seize Sanofi's helm on April 2, 2015. Seize is the indicative word. If Sanofi storms the U.S. market with the new cholesterol drug the way Pfizer did with Lipitor, not only will Regeneron likely take off, Sanofi could find itself on a healthy pathway again.

A better-than-even chance will happen. Brandicourt has extensive industry experience. He was formerly the head of healthcare at Bayer. Before that, he oversaw the introduction of the cholesterol treatment Lipitor at Pfizer, which, of course, became the best-selling drug in history.

But Sanofi also has to find a way to slash jobs and negotiate cost cuts withoutdisrupting labor unions in France, a very tall order. Viehbacher put Sanofi on the global stage, but alienated its board. We'll all have to wait and see how well his successor does.

Does Regeneron have other catalysts?

The short answer is "many." Three additional ones are listed below.

- There has been continuing speculation that Sanofi will try to buy Regeneron. Fueling the speculation recently was news that Sanofi planned to raise its stake in Regeneron by buying more shares. According to a 2007 agreement, Sanofi can't increase its holding to more than 30%. Sanofi is currently Regeneron's biggest shareholder with a 17% stake.

- Revenues from Regeneron's flagship drug EYLEA are still rapidly escalating. A few days ago, news from a head-to-head study sponsored by the National Institute of Health showed that the drug bested Roche's meds, Lucentis and Avastin, in a head-to head study. Label expansion is also still ongoing. Regeneron expects net sales of EYLEA to be 30% higher this year than in 2014, when the drug raked in $1.74 globally.

- Regeneron also has a very promising asthma treatment. The drug, dupilumab, has been shown to be effective in treating severe eczema, chronic sinusitis, and asthma with patients who have a significant disease burden. If approved, this drug clearly has a blockbuster market waiting for it. A win here would be another big catalyst for Regeneron, as peak annual sales potential has been estimated at $2.8 billion by Leerink Swann analyst Joseph Schwartz.

One final word: biotech investing is highly risky, but then safety in the stock market is a myth. I've found the key to success in investing is not to avoid risks, but to identify them, control those you can, and keep moving forward.

No comments:

Post a Comment