Disclosure: I am long CHC.

I last wrote about China Hydroelectric Corporation (CHC) on December 10th. There I described a bullish price consolidation that looked poised on the verge on a breakout. Today, shares of CHC are trading in line with their breakout momentum and are poised to take out the $3 level. I believe China Hydroelectric, an independent niche operator of small-scale, minimally invasive, hydro-powered electricity generators, can trade much higher than that. Let me explain.

About the Company

China Hydroelectric Corporation was founded in 2006 and began trading on the NYSE in January, 2010. In a nation where the government largely controls the power grid, China Hydroelectric stands out as one of one of the few independently owned hydroelectric power producers. Though a Chinese company, its management team is international, including two Americans, a Canadian. Most on the team were educated and have work experience in the U.S..

CHC sports a miniscule market cap of $144M, a float of only 54M shares, and a current annual sales figure of $77M. It has grown revenues in each of the past 5 years at an average annual pace of +104%. EPS is nearing the breakeven mark, growing at a +37% annual clip over the past 5 years. There was a slip in EPS in 2013 but this was due to rainfall about 35% below average in the region the company services, not anything systemic.

The company currently owns and operates 26 diversion-type and reservoir-impounding type power plants, of which it acquired 22 and built 4. Together these have a total power capacity of 548 MW. By comparison, Hoover Dam pumps out 2,000 MW. But even that pales by comparison to the megalithic 3 Gorges Dam, owned and operated by the state-run "China 3 Gorges Corporation," which produces over 22,000 MW of energy. But the huge grid-cruncher dams are not what CHC is going after. Their niche is to acquire and operate micro-generators in hydro-rich regions that are not presently served by the mammoth dams the government is building.

Reservoir Impoundment Generator Facility in Wangkeng, China

(photo from Chinahydroelectric.com)

CHC and The Green Edge

China is currently in a panicked rush to ramp up its hydroelectric production. Too many prime-time shots of a smoggy Beijing during the 2008 Olympics have forced the government to confront its growing pollution problem. All that coal and oil they burn to feed its growing economy and population has wreaked havoc on the air and on health. It is little wonder that lung cancer rates have risen 465% over the past 30 years. The government blames smoking, but surely all that smog has something to do with it too.

(click to enlarge)

One consequence of the attention drawn to China's pollution problem has been a state-driven, dam building program of a magnitude unmatched by any nation in human history. As Chinese historian, Charlton Lewis, recently wrote in the Yale Environment 360,

"The government is now engaged in a new expansion of dams in great staircases, reservoir upon reservoir - some 130 in all across China's Southwest. By 2020, China aims to generate 120,000 megawatts of renewable energy, most of it from hydroelectric power. The government declares that such dams are safe, avoid pollution, address future climate change, control floods and droughts, and enhance human life. These assertions are largely untrue. Instead, China's mega-dams block the flow of rivers, increase the chances of earthquakes, destroy precious environments and shatter the lives of millions of people."

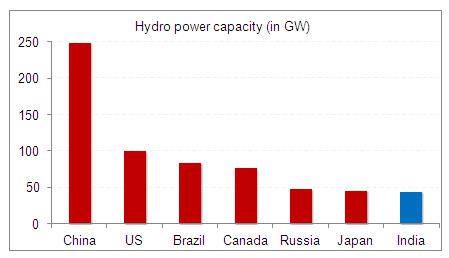

China's program has been so successful that China is now, by far, the largest hydroelectric producer in the world. China has a power generation capacity from hydro that is 2.5x that of the U.S. (see chart below).

But, while replacing a percentage of coal and fossil-fuel energy production with hydroelectric can certainly reduce carbon emissions --China's stated goal is a 40% reduction by 2020 -- it poses a number of environmental and health risks of its own, as Prof. Lewis states. Besides the problem of displacement and the destruction of farmland, dam breaks in the country with the world's worst safety record have killed approximately 300,000 people. Evidence suggests that one particular project, the Zipingpu Dam, likely triggered the devastating 2008 earthquake in Sichuan province. Dams have also taken a huge toll on China's biodiversity, causing fisheries to suffer and driving several rare species to extinction.

Here is where China Hydroelectric has a keen edge. The smaller dams financed and run by CHC, some of which work with water flow rather than impede it, pose far less a threat to the environment than the mega-dams the government is building, even as they help the growing nation begin, in small measure at least, to reduce its carbon footprint.

The Virtue of Independence

It is no secret that the mega-dam building the government is sponsoring has been fraught with corruption. Back in 1999, Britain's The Guardiannewspaper carried a number of reports of officials involved in the 3 Gorges project pocketing money that had been earmarked for displaced villagers. Of the 95 reported cases of corruption during the 3 Gorges construction, 16 involved the use of inferior building materials in order to cut costs. It was revealed that a bridge collapse upstream from the dam was directly related to a lack of quality control.

Enter CHC: while independent companies in China are not exempt from the temptation to bribe and cheat their way to the top, public companies beholden to their shareholders are much less likely to be so.

The NewQuest Offer

There is an interesting backstory, only recently revealed, to the CHC edge. On the most recent earnings conference call (11/26/13) it was announced that CHC had received an offer on September 4th from private equity firm, NewQuest Capital Partners, to buy all outstanding shares at a price of $2.97 (a 38% premium to where they were trading at the time). A special, independent committee has been formed to assess this offer. There was no further comment from any of the management team concerning this offer, but it was affirmed that the offer is considered "inadequate" and that the Committee is charged with doing what is in the best interests of its shareholders. Elsewhere, CHC management stressed that the offer was "non-binding" and that "talks could end without a deal".

To me that sounds like the initial offer will be rejected, in which case there could be a higher bid offered. Onyx rejected Amgen's initial $10B offer earlier this year, then bit on a sweetened deal. Men's Wearhouse pushed off Jos. Bank's $2.3B offer, sending the perpetual suit discounter back to Goldman Sachs looking for more money. Perhaps the Hong Kong-based NewQuest, backed by its $400M fund, will come back to the table with a higher offer.

Moreover, CHC and NewQuest have history. NewQuest already owns 49.8% of CHC's outstanding shares and has been active in trying to manage new Board appointments. CHC has asserted its legal rights in this instance, but was forced in late 2012 by a New York court to settle and allow NewQuest to replace the incumbent Board with its own slate of directors. Within this context, it seems likely that CHC will not give in without a fight. On its part, NewQuest certainly has the resources to bid higher for the outstanding shares.

The Technical Roadmap

The weekly chart of CHC shows the effect of rising revenues on shares since hitting bottom in 2012. The stock broke up decisively from a bullish Inverted Head&Shoulders pattern in Q1 of 2013. It has been consolidating for 3 quarters since then, hampered by the prevailing drought conditions in the regions in which it operates its power stations. But the strongly rising On Balance Volume indicator at the bottom of the chart suggests that investors have been loading up during this constructive period of price movement.

(chart courtesy of Stockcharts.com)

The 3 Possibile Paths

The $3 price level will act as strong resistance until a decision is made on the NewQuest offer. That could come any day. As I see it, there are only three possibilities where the share price of CHC can go from here:

a) either NewQuest raises its bid ($3.25 is certainly doable) and CHC accepts, causing shares to rise +20% overnight to meet the new valuation,

b) or CHC is forced to accept the $2.97 bid, in which case, shares rally from their current price to fill in the +10% spread,

c) or NewQuest is turned down flatly, in which case CHC is free to rally (or not) on its own terms as it grows its need-fulfilling service of providing clean, environmentally friendly (relatively speaking) energy to a growing and increasingly energy-dependent population.

There are no risk-free trades. But CHC seems to me to be virtually assured of a decent bid going forward. All are welcome to do their own due diligence and share what is learned in our comments section below. Thanks for reading!

By Dr. Thomas Carr

No comments:

Post a Comment