4 Biotech Stocks Trading At A Steep Discount To Target Price

Do you consider yourself a value investor? For ideas on how to start your search, we ran a screen.

We screened the biotech industry for stocks trading at the biggest discounts to their target prices, which we use as a proxy for fair value. Because analyst target prices tend to be inflated due to excessive optimism, we found the stocks trading at the steepest discounts to even their lowest (most pessimistic) target prices.

Interactive Chart: Press Play to compare changes in analyst ratings over the last two years for the stocks mentioned below. Analyst ratings sourced from Zacks Investment Research.

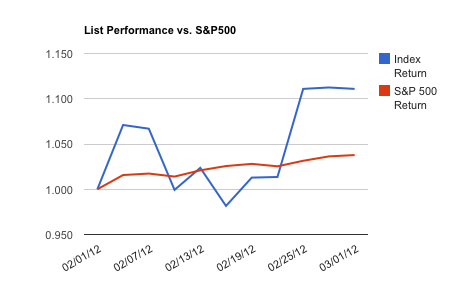

We also created a price-weighted index of the stocks mentioned below, and monitored the performance of the list relative to the S&P 500 index over the last month. To access a complete analysis of this list's recent performance, click here.

Do you think these stocks should be trading higher? Use this list as a starting point for your own analysis.

1. Corcept Therapeutics Inc. (CORT): Engages in the discovery and development of drugs for the treatment of severe metabolic and psychiatric disorders. Of the 7 analysts that have set a target price on the stock, the lowest price target stands at $5.00. This implies a current upside of 24.07% from current levels around $4.03.

2. Curis Inc. (CRIS): Focuses on the research and development of cancer therapeutics. Of the 9 analysts that have set a target price on the stock, the lowest price target stands at $6.00. This implies a current upside of 32.45% from current levels around $4.53.

3. OncoGenex Pharmaceuticals, Inc. (OGXI): Engages in the development and commercialization of new cancer therapies that address treatment resistance in cancer patients. Of the 5 analysts that have set a target price on the stock, the lowest price target stands at $20.00. This implies a current upside of 23.46% from current levels around $16.20.

4. Questcor Pharmaceuticals, Inc. (QCOR): Provides prescription drugs for central nervous system and inflammatory disorders. Of the 8 analysts that have set a target price on the stock, the lowest price target stands at $49.00. This implies a current upside of 25.16% from current levels around $39.15.

*Target price data sourced from Yahoo! Finance, all other data sourced from Finviz.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment