Summary

- Gilead offers tremendous growth at a compelling value.

- Sovaldi launch, impending approvals and pipeline promise a bright future for the company.

- The company is undervalued and a price target of $125 to $150 is not unreasonable.

Gilead Sciences (NASDAQ:GILD), Inc., a Foster City, California biopharmaceutical company, discovers, develops, and commercializes medicines for the treatment of life threatening diseases. The company markets their products in North America, South America, Europe, and the Asia-Pacific. The company's products include treatments for HIV/AIDS, liver, cardiovascular and respiratory disorders, as well as cancer. In addition, Gilead has several promising compounds at various stages in its pipeline, including several at stage 3 of clinical trials and impending regulatory approval.

Latest Quarter Performance

Performance Outlook Moving Forward

The company is scheduled to report third quarter results ending September 30th at the end of this month.

Earnings Est

|

Current Qtr.

Sep 14 |

Next Qtr.

Dec 14 |

Current Year

Dec 14 |

Next Year

Dec 15 |

Avg. Estimate

|

1.93

|

2.29

|

8.05

|

9.52

|

No. of Analysts

|

25.00

|

25.00

|

26.00

|

28.00

|

Low Estimate

|

1.53

|

1.77

|

7.20

|

7.57

|

High Estimate

|

2.47

|

2.87

|

9.16

|

12.45

|

Year Ago EPS

|

0.52

|

0.55

|

2.04

|

8.05

|

Chart courtesy of Yahoo Finance

Of the 25 analyst polled, the consensus EPS estimate for Q3 2014 is $1.93, with 28 analyst expecting full year earnings for 2014 to be $8.05 and 2015 earnings to come in at $9.52. Revenues are predicted to grow 117% from the second quarter to just over $6 billion, and full year 2014 revenues are expected to be $24 billion, also representing a 117% increase from year ago sales.

The company has delivered an earnings surprise each of the last four quarters, with an average surprise beat of 28%. Over the last 90 days, the company's earnings estimates have been revised upward. Second quarter earnings estimates are now $1.93 compared to $1.50 three months ago. The year-end numbers have also been revised upward from $6.31 ninety days ago to the current estimate of $8.05. This is an important point because stocks that have recently had their estimates revised upward by analysts tend to outperformthe market over the near term. Given its history of earnings surprises and analysts' upward revisions, I would not be surprised if Gilead delivers yet another beat when they announce earnings at the end of this month.

Valuation

Gilead's shares currently trade at 24 times earnings, compared to an industry average of 60. The stock offers compelling valuation based on near-term revenue and earnings growth estimates. The stock trades at just 13 times 2014 estimated earnings and just 11 times 2015 estimates. This compares favorably to the S&P forward PE of approximately 16, and the S&P has projected earnings growth of only 13% versus Gilead's projected growth rate of 18%. If the market recognizes the fantastic growth of this company and rewards the shares the forward S&P 500 multiple of 16, this would equate to a price of roughly $128 based on 2014 earnings and $152 based on 2015 earnings. Considering these numbers and a PEG of only .52, Gilead shares are just plain cheap. It is difficult, if not impossible to find another S&P 500 company with a market cap of $161 billion and phenomenal earnings growth priced so cheaply. As these earnings and revenue estimates come to fruition, I expect the market will reward Gilead a much higher valuation, perhaps in the $125-$150 per share range, or an 18% to 42% premium over the current price of $106.

Price Action

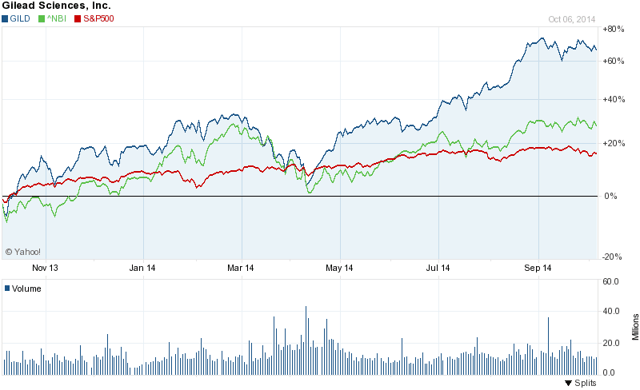

Gilead's stock has increased an astonishing 69% over the last year and 42% so far in 2014. Shares have substantially outpaced the S&P's 16% annual return and 7% year to date return. In addition, the stock has beaten the Nasdaq Biotechnology Index (^NBI), which has an annual return of 50% and a year to date return of 37%.

Chart Courtesy of Yahoo Finance

Recently, the stock has been stuck in a trading range of roughly $100-$110 a share. There have been several days recently where the overall market has tanked, bringing Gilead down with it. The stock has touched the 97-101 range several times over the last month. I think dips like these offer great entry points or a chance to add to a current position.

Technicals

The shares of Gilead have enjoyed a strong uptrend since the biotech correction in the spring. The share price has consistently traded above the 50, 100 and 200 SMA, and I believe these averages offer strong support for the stock at the $102, $93 and $85 levels respectively.

Summary

Gilead Sciences offers tremendous growth at a great value. With the launch of their Hepatitis C drug Sovaldi, the company has essentially provided the world a cure for this hideous disease, and has only begun to penetrate this huge, global market. The company's HIV/AIDS franchise continues to perform well and the company has an extensive, promising late-stage pipeline. Finally, Gilead is a $161 billion company with triple digit quarterly growth selling at a five year PEG of just .52 and a forward PE of 11. The future is bright for this company and its shareholders. One would be wise to pick up some shares before the stock price more accurately reflects the true value of this great company.

Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in GILD over the next 72 hours.

By Tim Harrison

Hello!! I’m indeed very happy for the great help that Dr.egoro rendered to me, I was a HIV patient my husband also was a HIV patient, we saw a blog whereby Dr. egoro cured HIV, we (Me and My Husband) decided to contact him which we did, he asked us to buy some items, unfailingly we sent him the money he will need in buying the items required, He casted the spell and asked us to go for check-up after three days of casting the spell, Luckily for us we were tested HIV negative, now I believe all these Testimonies about him on the internet, he is truly a great man, if you want to discuss with the great Herbalist and a spell caster contact him on dregorothegreathealer@gmail.com

ReplyDelete