12 Winning Streak Stocks With Significant Insider Buying

Do you like to trade with a stock's momentum trends? For ideas on how to start your search, we ran a screen.

We began by screening for stocks with the support of their company insiders, with significant net insider purchases over the last six months. We then screened for those on winning streaks, measured by a persistence of days in which the stock outperformed the S&P 500 and little persistence of days in underperforming the index.

We measured this by the ratio of the longest winning streak (in days) divided by the longest losing streak.

Interactive Chart: Press Play to compare changes in analyst ratings over the last two years for the top six stocks mentioned below. Analyst ratings sourced from Zacks Investment Research.

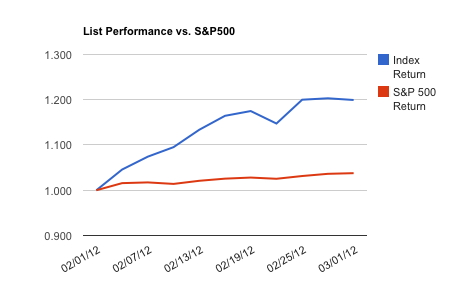

We also created a price-weighted index of the stocks mentioned below, and monitored the performance of the list relative to the S&P 500 index over the last month. To access a complete analysis of this list's recent performance, click here.

Do you think these stocks will continue to outperform? Use this list as a starting point for your own analysis.

1. BioCryst Pharmaceuticals, Inc. (BCRX): Designs, optimizes, and develops small-molecule pharmaceuticals that block key enzymes involved in infectious diseases, cancer, and inflammatory diseases. Over the last six months, insiders were net buyers of 15,458 shares, which represents about 0.04% of the company's 39.01M share float. The stock's average daily alpha vs. the S&P500 index stands at 1.38% (measured close to close, over the last month). During this period, the longest winning streak lasted 5 days (i.e. the stock's daily returns outperformed the S&P 500 for 5 consecutive days). The longest losing streak lasted 2 days (i.e. a win streak / losing streak ratio of 2.5).

2. Star Scientific, Inc. (CIGX): Engages in the development, implementation, and licensing of tobacco curing technology that prevents the formation of carcinogenic toxins present in tobacco and tobacco smoke, primarily the tobacco-specific nitrosamines. Over the last six months, insiders were net buyers of 250,000 shares, which represents about 0.24% of the company's 103.97M share float. The stock's average daily alpha vs. the S&P500 index stands at 0.98% (measured close to close, over the last month). During this period, the longest winning streak lasted 5 days (i.e. the stock's daily returns outperformed the S&P 500 for 5 consecutive days). The longest losing streak lasted 2 days (i.e. a win streak / losing streak ratio of 2.5).

3. Interline Brands Inc. (IBI): Operates as a direct marketer and distributor of maintenance, repair, and operations products in the United States, Canada, and Central America. Over the last six months, insiders were net buyers of 6,000 shares, which represents about 0.02% of the company's 28.78M share float. The stock's average daily alpha vs. the S&P500 index stands at 0.78% (measured close to close, over the last month). During this period, the longest winning streak lasted 8 days (i.e. the stock's daily returns outperformed the S&P 500 for 8 consecutive days). The longest losing streak lasted 2 days (i.e. a win streak / losing streak ratio of 4).

4. Spark Networks, Inc. (LOV): Provides online personals services in the United States and internationally. Over the last six months, insiders were net buyers of 569,433 shares, which represents about 5.72% of the company's 9.96M share float. The stock's average daily alpha vs. the S&P500 index stands at 0.89% (measured close to close, over the last month). During this period, the longest winning streak lasted 8 days (i.e. the stock's daily returns outperformed the S&P 500 for 8 consecutive days). The longest losing streak lasted 2 days (i.e. a win streak / losing streak ratio of 4).

5. Metalico Inc. (MEA): Engages in scrap metal recycling and lead metal products fabricating activities primarily in the United States. Over the last six months, insiders were net buyers of 87,500 shares, which represents about 0.21% of the company's 41.48M share float. The stock's average daily alpha vs. the S&P500 index stands at 1.49% (measured close to close, over the last month). During this period, the longest winning streak lasted 8 days (i.e. the stock's daily returns outperformed the S&P 500 for 8 consecutive days). The longest losing streak lasted 2 days (i.e. a win streak / losing streak ratio of 4).

6. NuPathe, Inc. (PATH): Focuses on the development and commercialization of branded therapeutics for diseases of the central nervous system, including neurological and psychiatric disorders. Over the last six months, insiders were net buyers of 37,500 shares, which represents about 0.81% of the company's 4.65M share float. The stock's average daily alpha vs. the S&P500 index stands at 1.56% (measured close to close, over the last month). During this period, the longest winning streak lasted 5 days (i.e. the stock's daily returns outperformed the S&P 500 for 5 consecutive days). The longest losing streak lasted 2 days (i.e. a win streak / losing streak ratio of 2.5).

7. Palomar Medical Technologies Inc. (PMTI): Designs, manufactures, markets, and sells lasers and other light-based products, and related disposable items and accessories for use in dermatology and cosmetic procedures. Over the last six months, insiders were net buyers of 150,000 shares, which represents about 0.97% of the company's 15.54M share float. The stock's average daily alpha vs. the S&P500 index stands at 0.83% (measured close to close, over the last month). During this period, the longest winning streak lasted 6 days (i.e. the stock's daily returns outperformed the S&P 500 for 6 consecutive days). The longest losing streak lasted 2 days (i.e. a win streak / losing streak ratio of 3).

8. Quad/Graphics, Inc. (QUAD): Provides print and related services in the United States, Canada, Latin America, and Europe. Over the last six months, insiders were net buyers of 77,723 shares, which represents about 0.29% of the company's 26.41M share float. The stock's average daily alpha vs. the S&P500 index stands at 1.12% (measured close to close, over the last month). During this period, the longest winning streak lasted 7 days (i.e. the stock's daily returns outperformed the S&P 500 for 7 consecutive days). The longest losing streak lasted 3 days (i.e. a win streak / losing streak ratio of 2.33).

9. Rentrak Corporation (RENT): Provides content measurement and analytical services to companies in the entertainment industry. Over the last six months, insiders were net buyers of 26,101 shares, which represents about 0.28% of the company's 9.37M share float. The stock's average daily alpha vs. the S&P500 index stands at 0.82% (measured close to close, over the last month). During this period, the longest winning streak lasted 7 days (i.e. the stock's daily returns outperformed the S&P 500 for 7 consecutive days). The longest losing streak lasted 2 days (i.e. a win streak / losing streak ratio of 3.5).

10. R.R. Donnelley & Sons Company (RRD): Provides pre-media, printing, logistics, and business process outsourcing products and services to private and public sectors worldwide. Over the last six months, insiders were net buyers of 206,200 shares, which represents about 0.12% of the company's 176.23M share float. The stock's average daily alpha vs. the S&P500 index stands at 0.82% (measured close to close, over the last month). During this period, the longest winning streak lasted 7 days (i.e. the stock's daily returns outperformed the S&P 500 for 7 consecutive days). The longest losing streak lasted 2 days (i.e. a win streak / losing streak ratio of 3.5).

11. Synovus Financial Corp. (SNV): A diversified financial services and bank holding company, provides commercial and retail banking, financial management, insurance, and mortgage services in Georgia, Alabama, South Carolina, Florida, and Tennessee. Over the last six months, insiders were net buyers of 375,800 shares, which represents about 0.05% of the company's 774.15M share float. The stock's average daily alpha vs. the S&P500 index stands at 0.81% (measured close to close, over the last month). During this period, the longest winning streak lasted 7 days (i.e. the stock's daily returns outperformed the S&P 500 for 7 consecutive days). The longest losing streak lasted 2 days (i.e. a win streak / losing streak ratio of 3.5).

12. Sonic Corp. (SONC): Operates and franchises a chain of quick-service drive-in restaurants in the United States. Over the last six months, insiders were net buyers of 12,215 shares, which represents about 0.02% of the company's 56.76M share float. The stock's average daily alpha vs. the S&P500 index stands at 0.77% (measured close to close, over the last month). During this period, the longest winning streak lasted 5 days (i.e. the stock's daily returns outperformed the S&P 500 for 5 consecutive days). The longest losing streak lasted 2 days (i.e. a win streak / losing streak ratio of 2.5).

*Price data sourced from Yahoo! Finance, all other data sourced from Finviz.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment