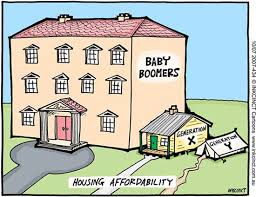

No issue looms larger for the financial advice industry than demographics and the aging of the baby boomers.

Over the next several decades, the biggest and wealthiest generation in U.S. history will transfer roughly $30 trillion in assets to their Gen X and millennial children, and if studies are accurate, most of those children will promptly fire their parents' advisors.

"Studies regularly show that when wealth passes to another generation, in the majority of cases, the heirs change financial advisors," said Gauthier Vincent, head of Deloitte's U.S. Wealth Management practice. "The relationship between assets, asset owners and financial advisors is unraveling before our eyes."

Jonathan Nutt | Getty Images

How advisory firms deal with this long-term trend will determine which succeed in the future and which falter. As the '

great wealth transfer' accelerates — the oldest boomers are now 70 years old — the strengths of some business models will become more apparent and the weaknesses of others more glaring.

"This is a fascinating time from a competitive perspective," said Vincent. "There's going to be winners and losers, and market shares will shift."

He added, "This industry will be very fluid in the next decade."

For an industry that has largely earned its bread serving affluent clients — and avoiding smaller, unprofitable ones — it's been easy to put addressing this huge but slowly unfolding issue on hold.

"It's a question of revenue today versus revenue tomorrow," said Kendra Thompson, North American lead at Accenture Wealth Management Services. "Incumbent players are not by nature nimble and willing to take risk."

"There's a perception in the industry that to be successful, you can only work with people who have at least $1 million in assets. But if you don't work with the next generation, someone else will."-Peter Mallouk, CEO of Creative Planning

There's good reason for the inertia. Next-generation clients with fewer assets may be the future of the industry — every advisor acknowledges the fact — but they won't pay the bills today. Trying to attract and engage them costs money; it takes a lot of people and demands new technologies and service models.

"Is it the right thing to do?" asked Peter Mallouk, CEO of registered investment advisor Creative Planning. "Yes — but you have to be willing to not be profitable with the mass affluent."

He added: "The majority of the industry is not designed to think generationally. Economically, it's not worth it."

Mallouk and his firm, one of the largest and fastest-growing RIAs in the country, have a leg up on most advisors. Their clients are generally high in net worth, they successfully recruit young advisors to the firm, and they offer the high-touch, full-service financial-planning relationships that are most likely to retain assets through generations.

Mallouk said involving the children of clients in financial-planning discussions is the norm at his firm. "There's a perception in the industry that to be successful, you can only work with people who have at least $1 million in assets," he said. "But if you don't work with the next generation, someone else will."

Daisy Medici, managing director of governance and education at GenSpring Family Offices, focuses on engaging all family members of the firm's ultrahigh-net-worth clients. The parents in those families expect it, and working with next-gen clients is an essential part of what a family office does.

"We attract families that worry about the impact of wealth on the next generations," said Medici. "They come to us because we're known for bringing multiple generations of families to the table."

There are no guarantees, but if advisors can bring young family members to the table now, those children are more likely to stick with their parents' advisors down the road when they inherit assets. The trick is building the business model to do that for the future without bankrupting the firm in the present.

"Incumbent advisors have to figure out how to scale high-net-worth advisory services for other customer segments," said Accenture's Thompson. She said that after a long period of denial, firms across the industry are finally taking steps to do that.

The catalyst is — you guessed it — the robo-advisors, or more accurately, the fintech digital experience that is increasingly being demanded by all customer segments.

"It's true that it's not economical to spend a lot of time with small accounts, but this helps create a pipeline of future clients."-Gauthier Vincent, head of Deloitte's U.S. Wealth Management practice

"Every firm we work with is now moving in the direction of digitally led wealth management," said Thompson. "We've come through a very stressful time where there has been widespread resistance to the idea of digital disruption in this industry and executive teams have been frozen.

"In the last 18 months, it's turned like a light switch," she added.

Indeed, firms in all corners of the industry — from banks and wire-house brokerages to asset managers and even insurance companies — have seen the light. They are either building out digital-advice platforms, as Charles Schwab and Vanguard have done, buying them like BlackRock and Northwest Mutual Insurance did, or partnering with online advisors, as UBS recently did with SigFig. The RIAs, most of whom can't make the investments, are accessing the fintech tools through custodians such as Schwab, Fidelity and TD Ameritrade.

They are doing it because investors are demanding it. "In every wealth tier of the market, more and more people are behaving like next-generation investors," said Deloitte's Vincent.

However, that doesn't mean the industry will shift to low-cost automated advice for everyone. Vincent said that surveys consistently show younger investors want the self-directed robo-experience, but they also want access to human advisors.

Furthermore, they want to move seamlessly between different service models and see more clearly what they're paying for. "The model doesn't exist yet, but most firms are working on it," said Vincent.

He calls it a hybrid model, where human advisors use digital tools to help them give customers what they want when they want it. That improves advisors' service to existing clients and makes them more attractive to future next-gen clients. "It's true that it's not economical to spend a lot of time with small accounts, but this helps create a pipeline of future clients," said Vincent.

With the great wealth transfer in its earliest stages, advisors will need it.

— By Andrew Osterland, special to CNBC.com

No comments:

Post a Comment