The company produced a bot for Facebook Messenger which allows users to place an order in under 5 minutes.

Having a bot handle orders should save on labor costs and allow for higher margins.

The company's gourmet food segment is growing very strongly, and looks to be a real growth engine in future quarters.

We believe there is 10% upside over the next 12 months. But if the bot is more successful than we imagined, this could take the share price higher.

We have been following 1-800 Flowers.com (NASDAQ:FLWS) for a few months now and we've been pleased with the progress it has made. Now with Mother's Day just under a week away we have decided to look at the progress it has made and recent developments that we believe may allows it to produce bumper revenue growth next year.

Since we invested in the company there was an exciting development which we believe will be a great boost to sales in the future. In truth it may take some time, but eventually we see the potential for big things from the company's decision to build a bot for Facebook (NASDAQ:FB) Messenger. This will allow users to order flowers directly from inside the app via the bot. We were very impressed with the company's innovation and look forward to seeing how it performs in the future. The fact that Mark Zuckerberg showed it off as part of his keynotes speech was a nice bit of promotion for the company also.

The world of chatbots may be relatively new to a lot of us, but many believe it will be the next big thing in technology. Whether it be transferring money to friends or booking travel tickets, the future of bots looks like making life and technology ever more integrated. TechCrunch suggested Facebook Messenger's Bot Store could be the most important launch since the Apple's App Store. Although there will be numerous competing bot platforms, we feel Facebook has a real advantage at present with Messenger already heavily in use. We have little doubt Facebook has plans to monetize this in the future, possibly by taking a cut of any sales, and thus we feel sure it will help bot makers like 1-800 Flowers gain the valuable exposure they need to grow revenue through it.

(Source: Marketingland)

The company already has a strong presence on Facebook, which we feel it should be able to leverage to grow its bot use. We should hopefully learn more about 1-800 Flowers' bot in the next quarterly update in August. We certainly are very keen to hear how it is progressing and any projections the company has. From what we have read so far from those that have used it, thefeedback is very positive with reports that it takes around 5 minutes to place a personalized order. If this does take off, the savings that 1-800 Flowers will make on labor will be a big boost to margins.

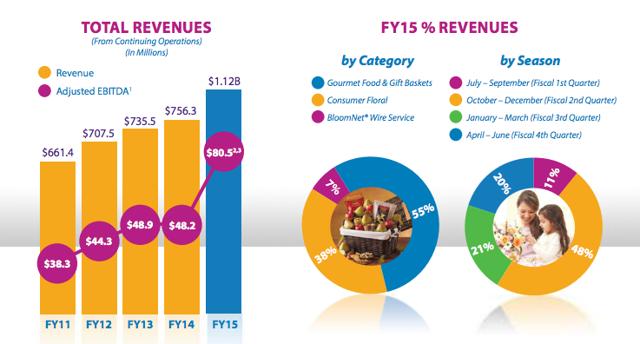

Despite the company's name, 1-800 Flowers.com is far more than just flowers. We believe there is a great deal of growth in its Gourmet Food and Gift Baskets segments. It posted impressive quarterly results recently. In its third quarter the segment grew sales by 6.6% year-over-year to $99.1 million, making it account for 42.3% of its sales in the quarter dominated by Valentine's day. This was especially pleasing considering the weak US retail sales data. We expect to see the segment continue its strong performance in the fourth quarter, with Mother's Day being especially busy.

(Source: Company Presentation)

We feel the rise of 1800-Flowers' gourmet food segment is very promising for the company. As the charts above show, the business is largely seasonal. But because gourmet food can be enjoyed all year around, rather than flowers which tend to sell most at key events such as Valentine's day and Mother's day, eventually revenue may be more evenly spread throughout the quarters.

We still believe a price to sales ratio of 0.45 is fair for the company. Eventually we feel investors will be willing to pay upwards of 0.6 times sales, but for now 0.45 is the right fit in our eyes. We have maintained our full year sales forecast of $1.178 billion, which gives us a price target of $80.20. This is based on the assumption of there being 64.7 million shares outstanding at the end of the fiscal year.

Looking to next year we think the positive momentum from its gourmet foods segment will keep sales growing and the Facebook chatbots growth will come into play, helping ramp up full year earnings to $1.25 billion. Based on the same assumptions as before, this gives us a price target for FY 2017 of $8.69 - a 10.7% return.

We believe the Messenger bot could be a real game changer for the company and give it a competitive advantage over every other florist in the United States. A great investment today, in our opinion.

Disclosure: I am/we are long FLWS.

By Collective Investment Co.

No comments:

Post a Comment