Retail Holdings is trading at a sizable discount that will eventually close, because the company is liquidating itself.

Investors should expect the first sizable dividend in 2016.

The closing of the discount could produce a 20% IRR over a five-year horizon.

Two years ago, I started the tradition to pick at the end of the year my best current idea, and present it to the Seeking Alpha community. My 2014 pick was Conduril that returned 37%, while Ming Fai Holdings, my 2015 pick, has just returned 6% year to date. Not exactly hitting the ball out of the park yet, but not too shabby either. Let's hope that third time's is really the charm!

While the story of Retail Holdings has been known for years, I think that 2016 will finally be the year where investors stand to make an excellent return. The reason for this is twofold:

- Sewko Holdings, the 54.1%-owned subsidiary of Retail Holdings has monetized some big assets in the past year. This week Retail Holdings announced that the cash will be distributed to Sewko shareholders and that Retail Holdings will make an announcement in January with regards to the ultimate distribution of these funds.

- Retail Holdings is currently trading at a discount that is higher than its historical average. For the past few years, the company has been trading at a discount to NAV that has varied around 40%, while the discount is currently above 50%. The discount reverting to its historical average would result in a sizable gain.

Valuation

Valuing Retail Holdings is a straightforward exercise, and that is part of what makes this idea attractive. I think too many investors are attracted to the intellectual challenge of deciphering mind-blowing complex businesses, while the market only rewards investors for being right. When you start with a thesis that is easy to comprehend you also increase the odds that you are right.

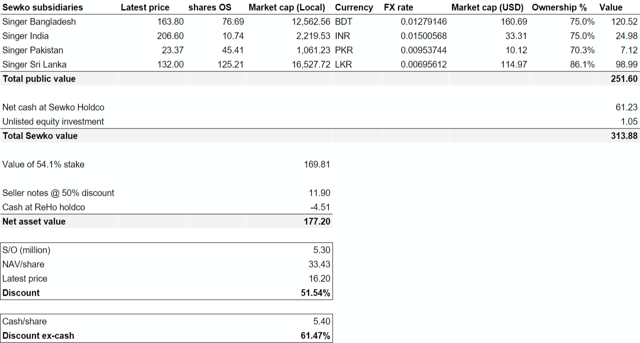

Valuing Retail Holdings is easy because the majority of their assets are publicly traded while cash and a note receivable are the only other assets. Sewko Holdings owns majority stakes in Singer Bangladesh, Singer India, Singer Pakistan and Singer Sri Lanka. Because Sewko Holdings owns the controlling stake their stake is presumably more valuable than the price implied by the market value of the publicly traded minority stakes, but the flipside of that coin is that their stakes are a lot harder to sell. When we base our NAV calculation on the prices of the publicly traded subsidiaries, the following picture emerges.

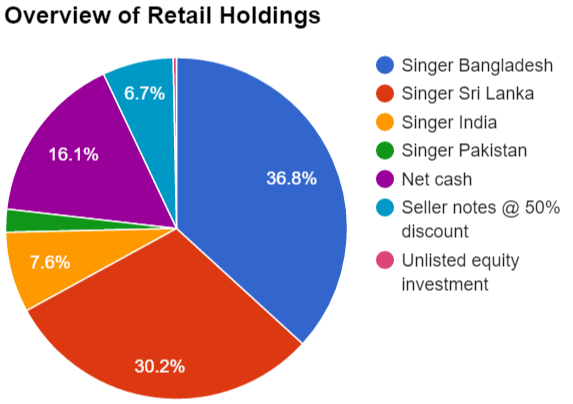

The above table is available as a Google Docs sheet that is updated in realtimehere. Retail Holdings is trading at more than 50% discount to NAV, while more than 76% of its value is derived from stakes in publicly traded businesses. The most important pieces are the stakes in Singer Bangladesh and Singer Sri Lanka, accounting for respectively 37% and 30% of Retail Holdings value. The third biggest component is the $60 million cash balance at Sewko Holdings, of which $33 million is attributable to Retail Holdings (approximately 19% of NAV).

The only other item that is worth discussing are the Seller notes. In 2004, Retail Holdings sold the Singer Sewing business and received a part of the process in notes that were originally due in 2010. Because the buyer isn't in the best financial position, these notes were never fully paid off, and this year Retail Holdings took the step to write down their value to 50% of par. Since the notes don't represent a significant portion of Retail Holdings' NAV anymore, I think taking book value is a decent enough estimate of fair value, but if you want to be more conservative, you could easily write them down all the way to zero without impairing the thesis for Retail Holdings one bit. The notes will now mature in 2018.

Upcoming cash distribution

The big reason that I think Retail Holdings will be a timely investment for 2016 is the upcoming cash distribution. Earlier this month the company issued a short press release saying that Sewko Holdings would have approximately $60 million in cash at the end of the year, and that Sewko intends to distribute most of the cash to its shareholders. So that will mean that the cash will become available at the corporate level of Retail Holdings. I expect that the company will most likely decide to pay a large dividend, since they have a history of paying large liquidating dividends, but perhaps they will decide on another mechanism such as a tender offer. The company promises in the press release to make a formal announcement in January "regarding the ultimate distribution of its share of the funds to be received".

| Year | Dividend | Shares outstanding | Total payment |

| 2015 | $1.00 | 5,300 | $5,300,000 |

| 2014 | $1.00 | 5,300 | $5,300,000 |

| 2013 | $1.00 | 5,295 | $5,295,000 |

| 2012 | $2.50 | 5,307 | $13,267,500 |

| 2011 | $2.50 | 5,307 | $13,267,500 |

| 2010 | $0.80 | 5,286 | $4,228,800 |

| 2009 | $0.20 | 5,266 | $1,053,200 |

| 2008 | $0.75 | 5,227 | $3,920,250 |

| 2007 | $1.00 | 5,140 | $5,140,000 |

Because Retail Holdings is trading at a ~50% discount, but with a large amount of cash that will soon be distributed to shareholders the effective discount is actually a lot bigger. When cash is distributed to shareholders, there will be no discount on it anymore. The company will receive 54.1% of the $60 million that is held at Sewko Holdings, which translates to more than $6 per share (a big deal for a $16 stock!). Since Retail Holdings is in a slow-motion liquidation, all dividend distributions have been characterized as a "return of capital", which means that no dividend taxes are payable.

Presumably they are not going to distribute every last cent to shareholders, so let's say that they are going to pay a $5 dollar dividend. This would reduce NAV from $176.0 million to $149.5 million. If the share price would also be reduced by $5 dollar the discount to NAV would increase from the current 51.7% to 61.7%. Considering that the 50%+ discount is already above Retail Holdings historical average I can't imagine that the 60%+ discount will persist for a very long time. If the stock would go back to trading at a 50% discount after the dividend payment shareholders stand to make a 19% return. If the stock would go back to trading at a 40% discount, which it historically often traded at, the return would be 37%. I think that is fantastic for an idea that only requires the completion of an already announced (although not in a lot of detail) corporate action and a bit of mean reversion.

Future

While I expect that the cash distribution next year can act as a catalyst to propel the stock higher I also think that it is attractive to hold it for a longer time frame. The sale of Singer Thailand and some smaller businesses in Sri Lanka previous year that make next year's cash distribution possible are just the first steps towards the complete liquidation of the company. Shareholders have been promised a liquidation for years, but never got it. In 2013 an IPO of Sewko Holdings was cancelled because the company didn't think it would be able to realize fair value and in 2011 a deal to sell their Bangladesh subsidiary was also cancelled.

So it's fair to say that we shouldn't expect a fast or smooth liquidation of the remainder of the company, but I do think that the sales earlier this year demonstrate that the company is still committed to their strategy to liquidate itself and maximize value for shareholders. Since the company is in the habit of paying sizable dividends every year we are getting paid while something is being done to shrink the discount. At the same time, since the discount is so big we can still make an excellent return even if it takes 5 or 10 years for the company to liquidate. Shrinking a 60% discount to zero would still mean a 20% compounded annual return over a 5 year period and a 10% return over a 10 year period. And this is a return in addition to the return that the underlying business will generate. The company itself states that it is targeting a three to five year time horizon to liquidate itself. From the latest annual report:

"The company will seek to grow, to enhance the profitability of, and to increase the liquidation value of Sewko, with the objective of monetizing ReHo's investment in Sewko within three to five years, either through a listing and subsequent sale of the Sewko shares, a sale of Sewko, or a sale of the shares of the Sewko public company subsidiaries, either in a single transaction or in a series of such transactions."

With the CEO, Stephen H. Goodman, owning 16.5% of the outstanding he will have the right incentive to maximize value for shareholders while liquidating RHDGF.

Conclusion

The thesis for Retail Holdings is deliciously simple: you are buying assets at a big discount, and eventually this discount will disappear when the company is liquidated. Investors have apparently lost faith that this is going to happen, or have simply forgotten about the company, but I don't think this neglect is warranted. While Retail Holdings has actually liquidated a part of itself this year, and committed to returning capital to shareholders, it is trading at an historical-high discount. I would expect that the dividend in 2016 will act as a catalyst to start the shrinkage of the discount, but investors will probably need to be more patient to see the whole story play out.

No comments:

Post a Comment