Summary

RIT Capital Partners is the personal investment vehicle of Lord Jacob Rothschild and allows ordinary investors to invest right alongside the legendary banking family.

The fund has had a phenomenal track record of beating its benchmark index and preserving capital in times of market turmoil.

The company is invested in many untraded assets that ordinary investors would otherwise not have access to but can deliver outsized returns.

The company also invests in securities from top companies from around the world, providing global diversification.

RIT Capital Partners currently trades at a discount to NAV and may be worth adding to your portfolio.

When it comes to long-term wealth accumulation and preservation, few families have a longer track record than the Rothschilds. This long and highly successful track record makes the idea of investing right alongside them rather appealing. There is, in fact, a way to do this by investing in a company called RIT Capital Partners (OTCPK:RITPF). But is now the right time to do this? We will discuss that in this report.

RIT Capital Partners was founded by Lord Nathaniel Charles Jacob Rothschild as a company meant to manage the British branch of the family's investments outside of the investment bank N. M. Rothschild & Sons. In 1980, Jacob and Evelyn de Rothschild had a falling out and the latter withdrew all of the money that he had invested in RIT Capital Partners. Jacob Rothschild then assumed sole control of the company. In 1988, Lord Rothschild took the company public but Lord Rothschild still retained approximately 21% of the shares, which he still holds to this day. Thus, an investor in RIT Capital Partners is literally investing right alongside Lord Rothschild.

RIT Capital Partners has a long track record of successfully managing its portfolio. Over the March 31, 1989 - December 31, 2014 period, the company has grown its portfolio from £344.2 million ($523.0 million) to £2.2996 billion ($3.49 billion). This represents a company annual growth rate of 9.31%. At the same time, the average annual return since inception has been 12.7%. The company has performed even better over the past ten years, with its net asset value more than doubling. This greatly outperformed the MSCI All Countries World Index over the same period.

Source: RIT Capital Partners

By most indications, the company has done quite well this year too, with its net asset value per diluted share increasing by 5.45% in the first six months of the year. During the first nine quarters of this year, the company's net asset value increased by only 2.9%, but this still beat the benchmark MSCI ACWI index, which declined by 4.3% over the same time period. Thus, the company has still done quite well at managing its portfolio.

As can be expected from an investment management company, RIT Capital Partners has a very diverse portfolio, including many assets that an average investor could not otherwise gain access too. This is due to the fact that, as of the most recent financial report for the period ended June 30, 2015, just under 23% of the portfolio was invested in private investments. For example, RIT Capital Partners holds ownership stakes in Dropbox and Infinity Data Systems. These direct holdings of not public companies currently make up 10.3% of the portfolio's NAV. In addition, approximately 12.5% is invested in private equity and venture capital funds. These include Augmentum I, Thrive Capital Funds, and Summit Water Development, a water rights fund. Investments such as these can be very profitable, but they are also quite illiquid. In the United States, a person must be an accredited investor to get access to them, which puts them out of reach of most people. An investment in RIT Capital Partners indirectly gives access to these investments to everybody.

RIT Capital Partners also provides some access to real estate and other hard assets. The company owns the Spencer House in London along with a few other properties. The firm also has some money in gold and other precious metals via the BlackRock Gold & General Fund and the Baker Steel Precious Metals Fund. In total, the company has invested 3.9% of its portfolio into real assets.

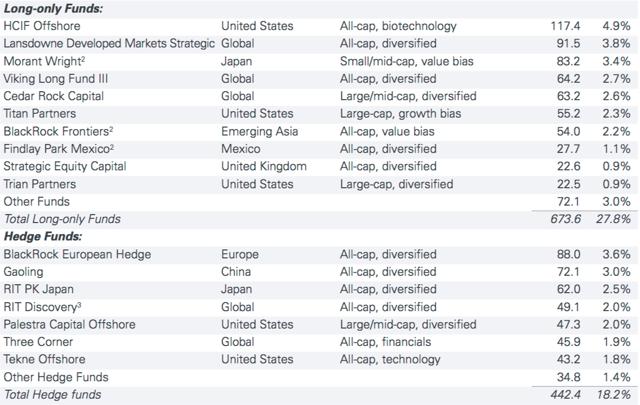

The remainder of the company's portfolio is invested in a variety of publicly traded securities, including a variety of long-only funds and hedge funds. As of June 30, 2015, approximately 18.2% of the portfolio's net asset value is invested in hedge funds including BlackRock European Hedge (an all-cap diversified fund), Palestra Capital Offshore (a diversified large- and mid-cap fund), Three Corner (an all-cap financials fund), and Tekne Offshore (an all-cap technology fund). In addition to these hedge funds, an additional 27.8% of the portfolio is invested into long-only funds, some of which would also commonly be called hedge funds but are technically not. These include HCIF Offshore (a biotechnology fund), Lansdowne Developed Markets Strategic (a globally diversified fund), Morant Wright (a Japanese small- and mid-cap fund) and Titan Partners (a United States large-cap growth fund).

Source: RIT Capital Partners

In addition to investing in the capital markets through funds, RIT Capital Partners directly invests in publicly traded stocks of companies around the world. These publicly traded stocks include investments in eBay (NASDAQ:EBAY), Samsung Electronics (OTC:SSNLF), Comcast (NASDAQ:CMCSA), Walt Disney (NYSE:DIS), Alibaba Group (NYSE:BABA), and Devon Energy (NYSE:DVN). As is clearly apparent, this is a diversified portfolio.

Source: RIT Capital Partners

As can be expected from an investor such as Lord Rothschild, one of the guiding principles of this portfolio is not only the growth of capital but also the preservation of it. One way that it accomplishes this is through small positions in both derivatives and government bonds. As the chart earlier in this article shows, the company has largely succeeded at this mandate as the company's net asset value has not declined as much as its benchmark index during periods of market turmoil such as the latter half of 2008 and first quarter of 2009. Thus, investors in RIT Capital Partners also gain some degree of protection against market downside.

Unlike fellow family investment company Investor AB (OTC:IVSXF), RIT Capital Partners does not offer a significant dividend. As of the time of writing, RIT Capital Partners pays a dividend of £0.30 compared to a stock price of £16.09. This gives the company a current dividend yield of 1.86%. While this is comparable to the trailing dividend yield on the Standard & Poors 500 Index, it is still not sufficiently high enough to be truly appealing to an income-focused investor. Thus, the appeal here is growth and preservation of capital as opposed to income.

One of the most important things to consider when evaluating an investment is the price at which it is purchased. This is because the best way to earn an outsized return is to purchase it when it can be obtained at a discount to its fair value. In some cases, the fair value of an investment is not easy to determine. However, in the case of an investment management company like RIT Capital Partners, we can simply compare the net asset value per share to the current share price. Simply defined the net asset value per share is the amount of money that a shareholder will receive if all of the assets of the fund were liquidated, all debt are paid off, and the remainder is distributed to the shareholders.

Given this, the best time to buy a company like this is when the share price is below the net asset value per share (the same is true of a closed end mutual fund). Unfortunately, this does not appear to be the case at present. As already mentioned, the share price as of the time of writing is £16.09 ($24.45). However, the net asset value per share as of the end of September 2015 (the most recent figure available) is £15.11 ($22.96). Thus, the company is currently trading at a premium to net asset value of approximately 6.49%. This has not always been the case, though. For example, on September 30, 2015, the company's stock traded for £14.99 ($22.78) per share, giving the company a discount to net asset value of 0.8%. Historically, there have been times when it has traded with a much larger discount. Therefore, it may pay to wait for a better entry point before investing in the company.

Given this, the best time to buy a company like this is when the share price is below the net asset value per share (the same is true of a closed end mutual fund). Unfortunately, this does not appear to be the case at present. As already mentioned, the share price as of the time of writing is £16.09 ($24.45). However, the net asset value per share as of the end of September 2015 (the most recent figure available) is £15.11 ($22.96). Thus, the company is currently trading at a premium to net asset value of approximately 6.49%. This has not always been the case, though. For example, on September 30, 2015, the company's stock traded for £14.99 ($22.78) per share, giving the company a discount to net asset value of 0.8%. Historically, there have been times when it has traded with a much larger discount. Therefore, it may pay to wait for a better entry point before investing in the company.

With that said, however, the argument could be made that the company's net asset value has increased since September 30, 2015. Unfortunately, due both to the presence of many unquoted investments in the portfolio and the fact that RIT Capital Partners only reports its net asset value quarter, we do not know exactly how much it has increased. The benchmark MSCI ACWI index that the company compares itself against increased by 7.8% over the September 30, 2015 to November 20, 2015 period. If we assume that RIT Capital Partners' net asset value increased by the same amount then we get a net asset value of £16.32 ($24.79) per share. This would put the share price at a discount to net asset value of 1.38%. It is not inconceivable that the portfolio has increased by value by more than it index as it historically has, but there is no way to know for certain. Regardless, it may represent a value at this point but it has at times traded for a larger discount to net asset value so it may pay to wait for a better entry point.

All currency conversion numbers are as of the time of writing. Please note that London traded stocks are often quoted in pence, as RIT Capital Partners is. To make this article easier to understand for an American audience, I have converted all stock prices and per share prices into pound sterling and dollars. American investors can purchase this company on the OTC market in the United States under the ticker symbol RITPF.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

By Power Hedge,

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment