Summary

Neulion has an established position as a dominant player in live sports streaming for major sports leagues.

The company is seizing opportunities to expand its platform into international markets.

It is poised to capitalize on the cord-cutting trend.

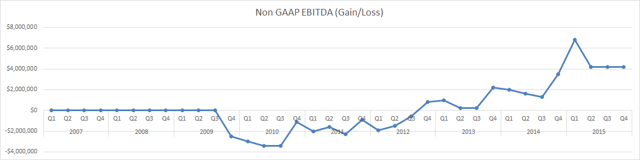

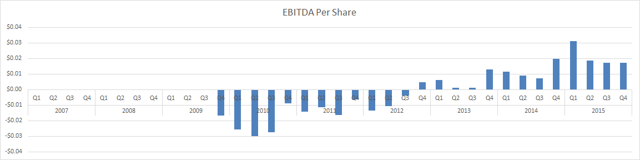

It has consistent quarterly EBITDA and revenue growth, with growing margins.

Neulion is currently trading at prices not seen since Q4 2013, despite stronger balance sheet and DivX acquisition.

(Editor's Note: Investors should be mindful of the risks of transacting in securities with limited liquidity, such as NEUL. Neulion's listing in Toronto, NLN.TO, offers stronger liquidity, with average daily volume of ~$CAD 250K.)

For those who have followed my articles, I've taken a break from commodities and turned my attention to a small cap company whose valuation relative to growth prospects are compelling. For those not familiar with Neulion, it "specialize(s) in digital video broadcasting, distribution and monetization of live and on-demand content, up to 4K, to Internet-enabled devices". What does that mean to the average investor?

If you subscribe to NFL Gamepass, that's Neulion bringing you that HD video stream on your tablet, smartphone or connected device. If you subscribe to NBA League Pass for international markets, tip your hat to Neulion. If you watch college sports, ultimate fighting or major league soccer on your tablet, smartphone or computer, that high-definition live feed is brought to you by Neulion. The company's list of blue-chip clients is not only impressive for the name recognition alone, but for an implicit strategy that I think will pay substantial dividends in the long term. The bread and butter for Neulion is "live and on-demand" professional and college sports. Unlike other streaming video services like Netflix (NASDAQ:NFLX) that purchase, develop and distribute their own content, such as movies or television shows, you may not have heard of Neulion because, for the most part, it is a white-label service. The company licences its technology to brands like the NFL, NBA, UFC, MLS, etc., and those brands use the technology to stream a large library of live and on-demand sports content. While Neulion's Digital Platform is agnostic (that is - its platform could stream movies or television shows), its platform is optimized for live sports content (requirements such as frame rates that would be different from delivering a movie over Netflix) and integrates multiple components:

- Ingest

- Encode

- Edit

- Content Management

- Payment/Ad Insertion

- Digital Rights Management

- Quality Of Stream Analytics

- Multi-Screen Distribution

What does this mean for customers (i.e., cable operators or content owners, for example) who use Neulion?

1) They use a product that can deliver high-quality live video to end-consumers without the capital investment of building in-house infrastructure and maintaining a support team.

2) Customers avoid the implementation risk (execution, technical integration and budget risk, to be exact) that comes with building an in-house solution.

3) Customers can get to market faster with Neulion's solution than building an in-house solution.

4) Customers are able to keep pace with the changing technology landscape with each new release of Neulion's Digital platform and avoid the sunk cost of technology obsolescence. (Think of a customer who paid a great deal of money for live streaming in HD, only to find out in a few short years that investment is obsolete now that streaming has moved to 4K. Neulion's solution addresses this challenge).

5) Cable operators or content owners can provide options to end-subscribers, providing them more choice and flexibility as to how and when they wish to consume the content.

6) Cable operators and content owners are able to recoup their investment for sports broadcasting rights through various monetization options (i.e., subscription fees, ad insertion, etc.)

7) Content owners can monetize their vast libraries of prior-year(s) content for additional revenue streams beyond live sports (i.e., for example, NFL Game Pass lets you watch last year's SuperBowl, end to end, through its streaming on-demand service).

8) Lastly, total cost of ownership using a licensed, best-of-breed product is lower than building in-house or using a competitive solution.

In other words, the value proposition of Neulion's product for the customer is very compelling.

Insider Ownership

I always look for companies whose management teams have "skin in the game". I'm happy when I find companies with insiders owning up to 10% of outstanding common shares. It tells me they are going to look out for shareholders' interests. When insiders own almost 70% of their own stock, as is the case with Neulion, that's a whole new level of comfort. When insiders are willing to take on that level of risk to express their confidence in the company's prospects, I'm happy to tag along for the ride, provided I can validate why they are confident in the prospects. Also, when ownership is highly concentrated, it leads me to believe their only exit strategy is an eventual takeout or sale at what would likely be a substantial premium to current market value.

Cord Cutting

For anyone who is keeping a close eye on the cable television industry, subscribers are leaving in large numbers for streaming video options. To a large extent, the only thing keeping many customers tied to cable subscriptions is sports content, but even that is changing. When Neulion refers to massive industry tailwinds in its investor presentation, what it means is simple - television distribution is changing as we know it. As broadband capacity increases in the coming years, more and more content will be streamed over the internet to the various devices we own today. Moreover, what was once a static TV viewing experience is becoming much more interactive. Sign up for NFL Game Pass (it's a 7-day free trial) to really appreciate how Neulion integrates content delivery and data integration (i.e., real-time player stats, scores, etc.). The company is creating a whole new customer experience that television could never deliver. Live streaming is an industry disruptor that is changing not only how we consume content, but also where and when.

Ultra-High Definition

Do you remember the first time you saw a high-definition TV? Do you remember the "wow" factor when moving from your clunky TV set to 780 and 1080 dpi? I remember it vividly (so much so that I purchased a few televisions built into various rooms in my home). Well, that picture quality is getting even better. Back in the day, there were few programs broadcast in high definition. Today, most programs are broadcast in high definition. User adoption took a few years, but it did eventually come. What's next on the horizon - "4K". To put it simply, it's four times the picture quality of 1080 dpi, or what is referred to today as ultra-high definition. You will need to walk in to your local electronics retail store to watch a demo, since most consumer electronics brands are showing off their latest "4K UHD" television sets. Words will not describe the picture quality you see. To imagine that level of picture quality watching professional football, basketball, soccer or tennis is taking the live sports experience to a whole new level. In response to this emerging trend, Neulion recently released its next-generation platform capable of streaming "4K" video.

If Neulion's specialty is delivering high-quality live sports to tablets, smartphones and computers, what does that have to do with watching 4K television in your living room? Earlier this year, Neulion purchased DivX. Again, without getting technical, what the acquisition enabled the company to do was build a platform that integrates the next generation of 4K video, but also license DivX to consumer electronics manufacturers shipping their latest 4K television sets. The company recently announced that Broadcom will be incorporating DivX into its set-top boxes that will support OTT ("over the top") video to will enable 4K streaming.

If you can piece together what Neulion is doing, you will see a well-executed strategy coming together in anticipation of a well-established trend. As the trend of cord cutting continues, Neulion will be able to stream live or on-demand content into your living room "big-screen" TV in 4K ultra-high definition, or should you choose, your gaming console (Xbox, PlayStation), tablet, smartphone, and computer, taking the consumer experience to a whole new level. They will also capture license revenue from DivX as more consumer electronics manufacturers ship DivX-certified 4K television sets. According toFuturesource, the growth of 4K-enabled sets will grow from 11.4M units in 2014 to over 100M units by 2018.

Neulion hopes to put DivX on most of those boxes to capture the growth as a supplement to its digital platform business.

Financial Metrics

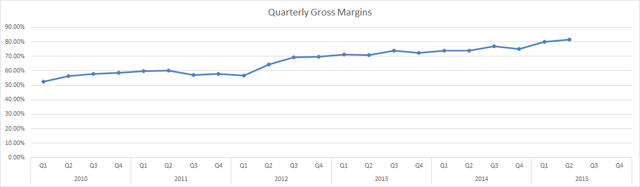

Having invested a great deal of capital building the digital platform and incurring losses over the last few years, the company is beginning to reap the benefits of its investment. As Neulion signs on more customers to its digital platform, its topline grows without incurring additional costs. Even better, as Neulion grows its customer base and content consumption grows, costs begin to decrease (think volume discounts - the more customers there are consuming content on Neulion's platform, the more volume discounts they get from their infrastructure providers). From 2010 through to 2015, the company's gross margins have improved from 50% to almost 81% by Q2 2015!

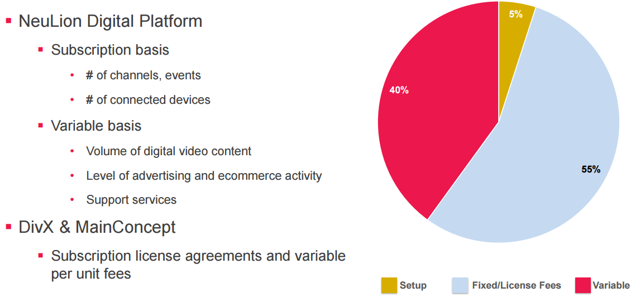

While almost 55% of its revenue is recurring (in the form of license fees for its digital platform and DivX), Neulion gets a piece of the upside potential of the cord-cutting trend as well. As more users consume content on NFL Game Pass, NBA League Pass, UFC Fight Pass, etc., Neulion is compensated accordingly.

Neulion's revenue has been consistently growing, from annual revenue in 2010 of $33.1M to $55.6 million in 2014 - an increase of 68% over 4 years, attributed to its digital platform business. With DivX, the company is already at $44.4M for the first half of 2015. While a good deal of revenue came from North America over the last few years, Neulion is currently growing its international footprint, which will generate a new wave of revenue growth for this relatively untapped market.

(click to enlarge)

So, What Happened To Neulion's Stock Price?

From 2013 to 2015, Neulion's share price virtually tripled. However, on August 4th, 2015, one of its key customers, the NHL, signed a billion-dollar digital rights deal with Major League Baseball Advanced Media, currently known as BAM Tech. As Neulion aptly explains, for the six months ending June 30, 2015, the NHL represented 12% of revenues.

Moreover, the company's "overall growth has significantly outpaced the growth in our NHL business. NeuLion's revenue growth in 2014 was 18%, while revenue from the NHL grew only 3%. For the six months ended June 30, 2015, NeuLion's revenue growth was 69%, while revenue from the NHL grew only 4%".

To reverse-engineer some numbers, the NHL contributed $9.4M in 2013, and grew to $10M in 2014. Assuming, for a moment, that Neulion continues its revenue pattern for 2015, adjusting for seasonality (since a good chunk of its revenues come in during Q4), the company may be on track to generate $80-90M, including revenues associated with DivX licensing. Of this, approximately 33% of year-end revenues would come from DivX, and the remaining 67% from its Digital Platform, or $53-60.3M. Assuming a modest growth rate of 10% associated with its digital platform (almost half of Neulion's current growth projections), 2016 revenue without NHL would come in at $47.3-55.3M. In other words, the net impact of losing NHL, relative to the current growth rates for the Digital Platform, would be a net loss of about $5-5.7M in revenue. On June 25, 2015, the stock was trading at $1.72. As of Friday October 2, 2015, the stock was trading at $0.57 on the TSX.

For an estimated $5.5M loss in future revenue related to one client, excluding all the factors mentioned in this article relating to Neulion's long-term growth potential, industry trends and strategy execution, the market decided to wipe out $281M, or 67% of Neulion's market capitalization relative to their peak on June 25!

With low volume over the last few weeks, the market is waiting for an update that will likely come in November, when Neulion releases its Q3 2015 report.

BAM Tech

I've tried to understand what may have led to such a steep drop in share price implied in the NHL deal. Perhaps the market is concerned with the new BAM Tech spin-off? Should they be? Neulion and MLBAM (now called BAM Tech) have been competing for quite some time. Indeed, BAM Tech would be Neulion's main competition in this space. What changes the game somewhat is BAM Tech's plan to purchase content rights, similar to the NHL deal, now that it's spun off as a separate entity from Major League Baseball. Will BAM Tech be successful with this strategy?

I might argue perhaps in 5-10 years, but not any time soon for two reasons. First, the NHL deal is a 6-year contract, where all told, NHL owners will receive $600M and a 10% equity stake in BAM Tech, currently valued at another $600M for all-in proceeds of $1.2B. Understand, 90% of BAM Tech is currently owned by MLB owners. Will NFL owners want to sign away their digital rights to pad the pockets of MLB owners? Will the NBA owners follow suit? I highly doubt it. Why sign over digital rights to BAM Tech when NFL and NBA are already generating revenue going directly to franchise owners using Neulion's product. I can't imagine that NBA or NFL owners would want to be minority shareholders of an MLB-owned business!

Secondly, BAM Tech will need to raise a great deal of capital to acquire content rights similar to the NHL deal. If NHL rights were close to $1B inclusive of equity and cash, something like the NFL or NBA would be many billions more. It's doubtful that it is going to sign a similar deal with the NFL or NBA any time soon, without billions raised in the capital markets for what remains to be an unproven business model. It's one thing to stream someone else's content (as Neulion does today with NFL and the NBA), and it's another thing to purchase digital rights and stream it to end-users. That's the model BAM Tech will have to prove, given the steep cost of purchasing content rights, which will take some time.

Quick Calculations

Here is a high-level breakdown of some numbers.

- Debt = $0

- Enterprise Value = $143M (market cap based on $0.57 closing price) - $34M (Cash) = $109M

- DivX Acquisition = $62M

- Enterprise Value - DivX Acquisition = Approximate Market Value of Digital Platform Business = $47M

So, roughly speaking, the company's digital platform business, which is on track to generate $50-55M revenue for 2015 and perhaps $50-$55M in 2016 (depending on growth assumptions less the NHL contract), with significantfuture growth given industry trends towards cord cutting, is currently valued at $47M. I'll let you be the judge of whether you think that's a risk worth taking.

Summary

As I always caution, do your own due diligence. However, if you understand what's going on in the content distribution and live sports streaming space over the next few years, and believe Neulion is well poised to capitalize, then simply put, you are getting a substantial discount on what is arguably a high-growth stock with a stronger balance sheet, higher margins and a more diversified revenue base relative to Q4 2013, when the stock was trading at this level.

To quote Carl Icahn, "This is a no-brainer."

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

continue to provide information that is useful to all who visit this blog. a visit back in jaket kulit jakarta.... thank you

ReplyDelete