Summary

The key differentiator for CCI is its 100% focus on serving the U.S. wireless market.

The U.S. wireless market has one of the most compelling wireless investment stories in the world.

CCI does not have the riskier global mix as AMT, and for income-oriented investors the key differentiation is the reliable income that is generated by U.S.-based cell towers.

Last week, I decided to begin researching the Cell Tower sector and I published the following articles:

Also, I wrote an article on American Tower (NYSE:AMT), the largest cell tower landlord and the first company to begin trading as a REIT. I concluded the article with the following HOLD recommendation:

I find AMT to be an attractive growth REIT; however, I believe that much of the growth has been priced in. I would like to own shares in this stock, but I do not feel as though there's an adequate margin of safety. I will be looking for a pullback and I will also take a closer look at CCI."

As referenced, I will now explore the second largest cell tower company and recent REIT participant, Crown Castle (NYSE:CCI).

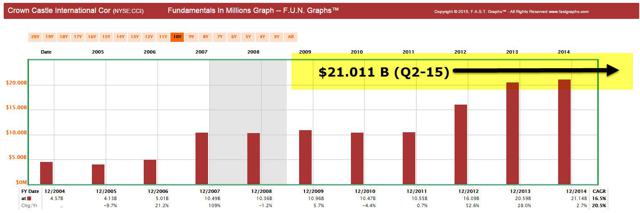

The History of Crown Castle

Like AMT, CCI is a wireless infrastructure landlord and the company commenced operations in 1994. On January 12, 2007, CCI completed the acquisition of Global Signal Inc., a rival U.S. tower operator based in Sarasota. Then in 2011, CCI purchased NextG Networks for around $1 billion. In September 2012, CCI entered into a lease agreement with T-Mobile USA (NYSE:TMUS) and another deal with AT&T (NYSE:T) in 2013. Here's a snapshot of CCI's growth in assets.

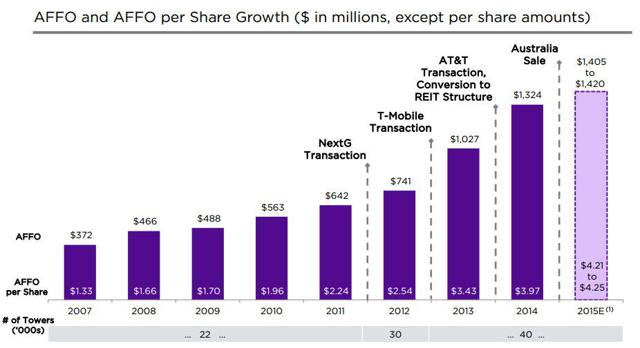

The historical timeline below provides an illustration of CCI's AFFO per share growth; however, note the transactions referenced such as NextG, T-Mobile, AT&T, and the more recent disposition of the Australia assets.

As referenced, CCI completed the $1.6 billion sale of its Australian assets in May 28, 2015. At the time of the sale, the Australian portfolio was 77.6% owned by CCI and the REIT generated net proceeds of around $1.3 billion. CCI currently operates and manages approximately 40,000 towers in the U.S.

CCI is the only Cell Tower REIT that focuses exclusively on U.S. assets.

The Balance Sheet

As referenced above, CCI generated around $1.3 billion in proceeds on the Australian transaction and the company expects to utilize approximately $1 billion of its approximately $2 billion net operating loss (or NOL) carry forward to fully offset the tax gains from the sale of our Australian subsidiary.

Additionally, as a result of the sale, CCI expects a significant portion of its common stock dividend distributions during 2015 to be characterized as capital gain distribution.

During Q2 2015, CCI issued $1 billion of securitized notes to refinance indebtedness. The notes were issued at a weighted average interest rate of 3.5% and a weighted average expected maturity of nine years. Today, CCI's weighted average cost of debt stands at 4.2% with a weighted average maturity of six years with no meaningful maturities until 2017.

CCI's total net debt to last quarter annualized adjusted EBITDA is 5.2x. The company continues to maintain target leverage at 5x hoping to achieve investment grade ratings from all agencies. Fitch recently upgraded CCI to investment-grade, a step towards the goal of accessing the investment-grade, unsecured bond market.

Fitch said the ratings acknowledge the "strong" recurring cash flows generated from the company's leasing business, the scale of its tower portfolio and "robust" EBITDA margins. These factors provide cash flows with considerable stability and result in reduced business risk profile compared with most typical corporate credits, the rating agency added.

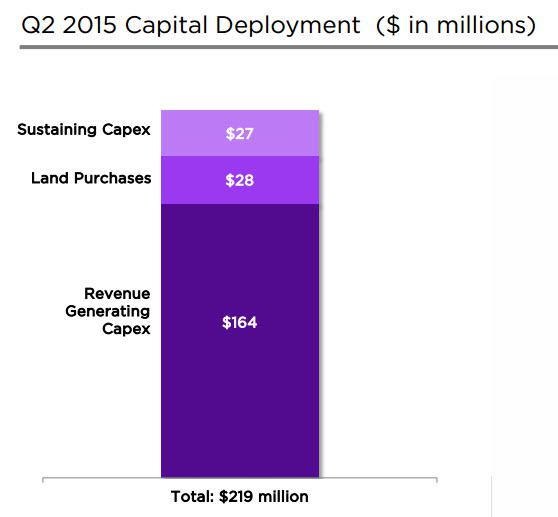

In Q2 2015, CCI deployed around $219 million in capital:

This Key Differentiator

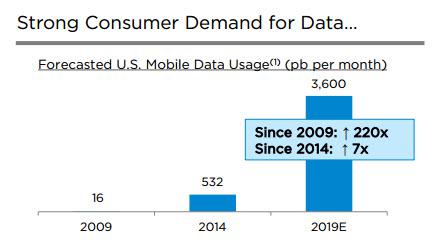

The key differentiator for CCI is its 100% focus on serving the U.S. wireless market. While the company does not have the same international growth opportunities as AMT, it opts to maintain a disciplined approach to co-locating its inventory to generate organic profits. Here's a snapshot illustrating the strong demand for U.S. mobile data usage:

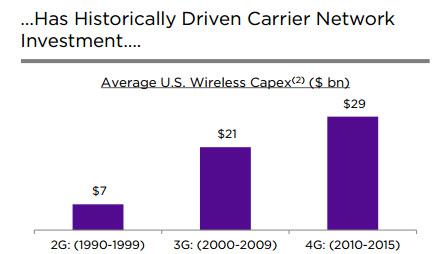

During the 1990s or the 2G technology cycle, average annual U.S. wireless capital expenditures across all the wireless carriers totaled $7 billion. During the 3G cycle of the 2000s, which can be characterized as the era of basic mobile, e-mail and web browsing, average annual U.S. wireless capital expenditures increased to $21 billion across the carriers. And since 2010 with the deployment of 4G and LTE products for mobile broadband, annual U.S. wireless capital expenditures have averaged $29 billion.

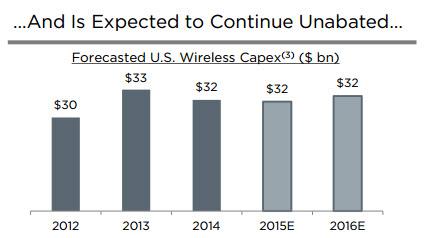

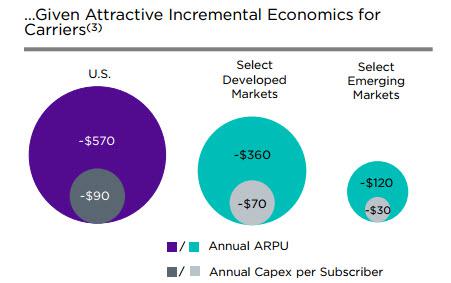

Looking forward over the next several years, the current level of investment by U.S. wireless carriers will be sustained. The U.S. wireless market has one of the most compelling wireless investment stories in the world. With strong unit economics and relatively high ARPU reflecting U.S. consumers' demand for mobile data and their willingness to pay for mobile services, U.S. carriers were able to generate positive incremental returns on their capital investments.

The carriers are driven to increase this investment because as has been true since the early days of wireless, network quality continues to be the market differentiator for carriers' success. Based on this long-term need to invest by the U.S. carriers, CCI has focused its investments over the last several years in the U.S. market.

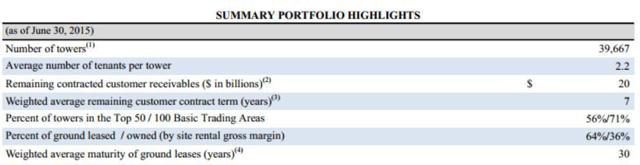

CCI's towers are well located, but over 70% of the portfolio is in the top 100 markets and has significant runway for additional growth with only two tenants on average per tower (or a 50% occupancy rate).

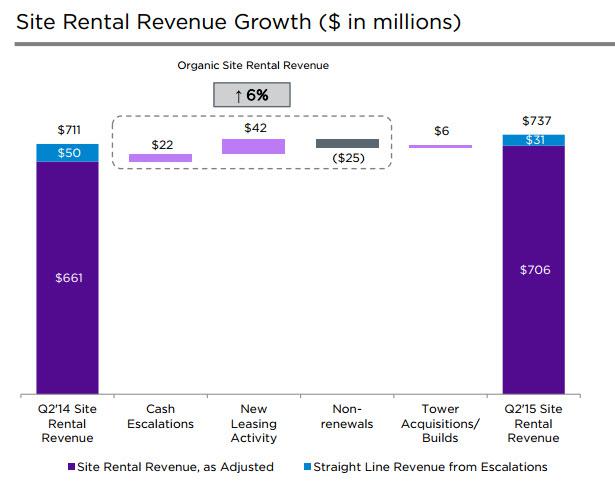

Towers are the most efficient and cost-effective way for CCI to add network capacity and coverage to support CCI's organic growth model. See the following snapshot: CCI's 6% organic site rental revenue growth comprised ~10% growth from new leasing activity and escalations, net of 4% from non-renewals.

The Latest Results

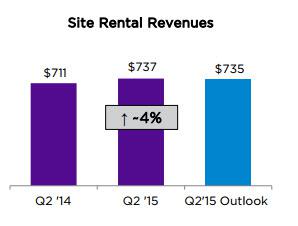

As illustrated below, CCI's site rental revenue in Q2 2015 grew 4% year over year, from $711 million to $737 million. Organic site rental revenue grew 6% year over year, comprised of approximately 10% growth from new leasing activity and cash escalations, net of approximately 4% from non-renewals.

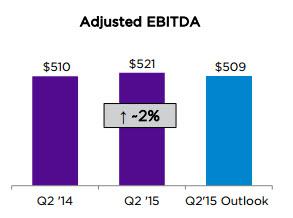

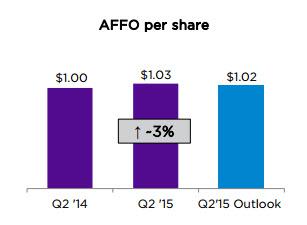

CCI's adjusted EBITDA and AFFO exceeded the high-end of the previously provided second quarter 2015 outlook, driven by higher-than-expected network services gross margin contribution, inclusive of $7 million of equipment decommissioning fees.

In Q2 2015, CCI's AFFO per share was $1.03, up 3% from the same quarter in 2014.

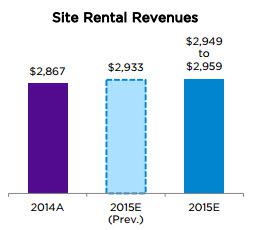

As illustrated below, CCI increased its full-year expectations for the operating results of its business. Compared to the previously-provided outlook adjusted for the disposition of Australia, CCI has increased the midpoint of full-year 2015 outlook for site rental revenue as follows:

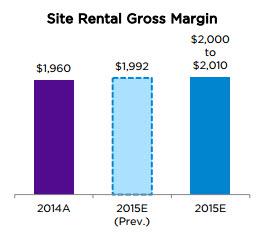

Also, full-year site rental gross margin were raised:

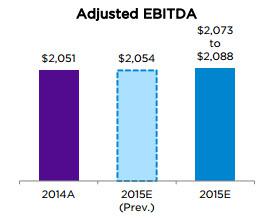

Also, full-year adjusted EBITDA was raised:

Finally, full-year AFFO guidance was raised:

I Prefer the "More Focused" Cell Tower REIT

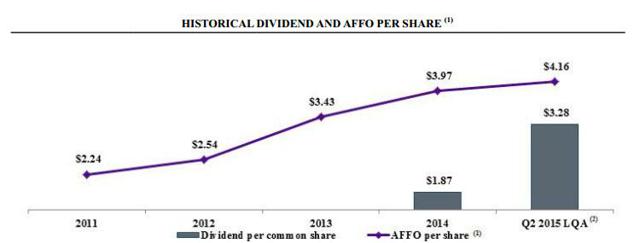

As illustrated below, CCI has a strong history of earnings (of AFFO) and dividend growth:

Here's a snapshot of portfolio highlights:

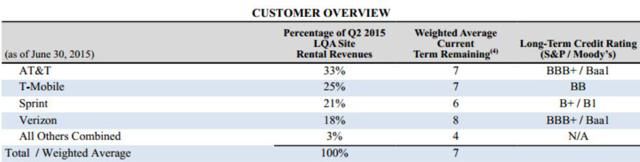

As evidenced by the snapshot below, CCI has a sound list of tenants:

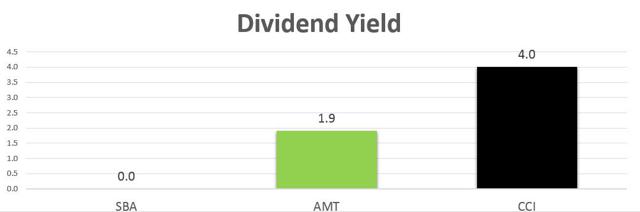

Last year, CCI elected to raise its dividend significantly and the company is currently paying $3.28 per share which is 75% of AFFO. Compared with AMT, CCI pays out substantially more of its AFFO and that's why you see a higher dividend yield:

CCI is on track to generate annual AFFO growth of 6% to 7% organically and according to the CEO:

we did that very purposefully to help investors and the analyst community sort of triangulate back on, okay every time they sort of would model the business going forward, let's sort of stay grounded in what that looks like, 6% to 7%, plus the dividend yield of about 4%, so a total return based on current valuation in the sort of 10% to 11% area.

In other words, CCI does not have the riskier global mix as AMT and for income-oriented investors, the key differentiation is the reliable income that is generated by the stable U.S.-based cell tower assets. Here's how CCI compares utilizing the FAST Graph below:

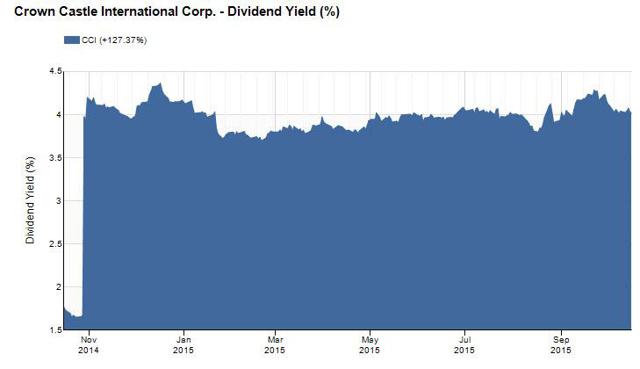

To be honest (and also greedy), I would like to obtain a 5% dividend yield, but based on historical trends, I'm not sure if I'll get that yield any time soon.

Yet, I do like the stability of CCI's platform, and given the organic growth prospects identified, I consider the potential for stable income and growth to be sound.

By managing CCI's tower assets, the company should be able to extrapolate value, allowing multiple carriers to locate on each structure without competition. CCI's collection of cell tower assets offers unique solutions for the carriers to fill in the gaps and add coverage in high-traffic areas.

In conclusion, I am initiating a BUY rating on Crown Castle with a target price of $72.89 (backing into a 4.5% dividend yield). I prefer CCI over AMT, yet, I would like to see a wider margin of safety before purchasing shares in CCI. One can obtain a higher yield by investing in Realty Income (NYSE:O), a much safer alternative that offers similar growth attributes.

Sources: SNL Financial and CCI Investor Presentation.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

No comments:

Post a Comment