Disclosure: I am/we are long OHI, MPW, VTR.

Summary

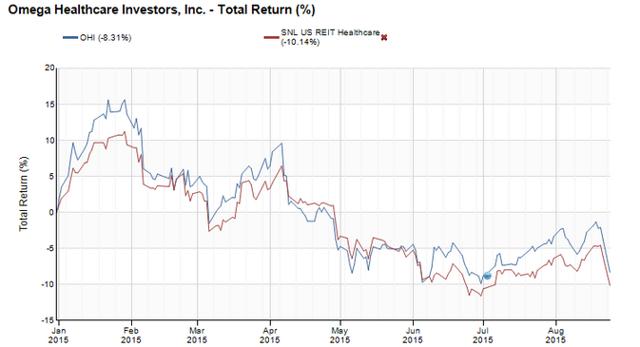

Omega has traded with its sector, not its own fundamentals.

Large dislocation between its price and its value.

Strong fundamentals and a 6.5% yield make OHI a buy.

The buy thesis

Origin of mispricing

There are plenty of excellent companies to invest in, but most are only available at the expensive pricing one would typically expect to pay for a quality company. What makes Omega Healthcare remarkable is that it is an excellent company priced like junk. Following are the market phenomena which afford such a dislocation.

REIT market prices have been susceptible to interest rate swings thus far in 2015. This correlation has been particularly strong among healthcare REITs which fell dramatically when interest rates rose

(click to enlarge)

This chart, in my opinion, makes it quite clear that OHI has been trading with its sector, not its individual fundamentals. Therefore, the sector movements tied to interest rates have translated directly into movements in OHI's price.

The rationality of healthcare REITs trading with interest rates has been widely debated.

The Debate

Those who believe that healthcare REITs are susceptible to interest rates argue that the long-term nature of their triple net contracts prevents them from increasing revenues as interest rates rise. Therefore, their static revenues will become less valuable on a time-discounted basis in a higher rate environment.

On the other side of the debate are those who believe healthcare REITs are not fundamentally susceptible to interest rates, as their long-term fixed rate revenues are matched with long-term fixed rate debt, so profits remain strong regardless of how interest rates move.

In February through June of 2015, it seemed the market was primarily composed of those who believe healthcare REITs are susceptible, as the sector dropped in tandem with rising rates. Based on the market's predominant mentality, it would follow that healthcare REITs would recover their losses when interest rates returned to their January lows. Yet, when rates dipped back down in July and August, the healthcare REITs continued dropping. The beauty of this opportunity is that it no longer matters which side of the debate is correct. Healthcare REITs are opportunistic either way.

If interest rates do not affect healthcare REITs, the drop in the first half of the year was misguided, thereby representing mispricing and the potential outperformance of a return to proper pricing.

If higher interest rates do fundamentally harm healthcare REITs, they certainly should have gone up on August 24th when interest rates plunged to well below 2% on the ten year. Instead, healthcare REITs dropped with the rest of the market.

Sector Fundamentals

I stipulate that the aforementioned price movement was related to interest rates, as there was no fundamental news that could have caused such a drop. In fact, the fundamental news flow was quite positive with the Affordable Care Act getting solidified by the Supreme Court, thereby reducing the chance of adverse legislation on reimbursements. Additionally, much of the sector had strong first- and second-quarter earnings reports, coupled with further increases to dividends.

OHI in particular had strong reports, including the raised guidance parsed below.

There is some concern of oversupply in the senior housing segment, with new construction amounting to 4.2% of inventory. If construction continues at this pace and demand fails to keep up, there could be material declines in both occupancy and rates, thereby harming those companies exposed to senior housing.

Omega Healthcare, however, has no exposure to senior housing as it is a pure-play SNF REIT. Higher acuity healthcare properties are less susceptible to oversupply, as there are 2 substantial barriers to entry.

- Certificates of need may be required to permit construction, and can be difficult or impossible to attain if there is already sufficient supply in the area.

- Advanced medical personnel are required to run an SNF to a far greater extent than are required to run independent living facilities, making affordable staffing a significant barrier to errant construction of SNFs.

While supply of SNFs is limited relative to lower acuity healthcare properties, its demand is benefiting from the same demographic trends.

The market's primary complaint about SNFs is that they are heavily dependent on reimbursement rather than private pay. I consider this to be a good thing, as it makes them less vulnerable to the economy and reimbursement rates have been quite steady for the last 15 years.

Overall, SNFs and hospitals are, in my opinion, the best positioned healthcare properties for the foreseeable future.

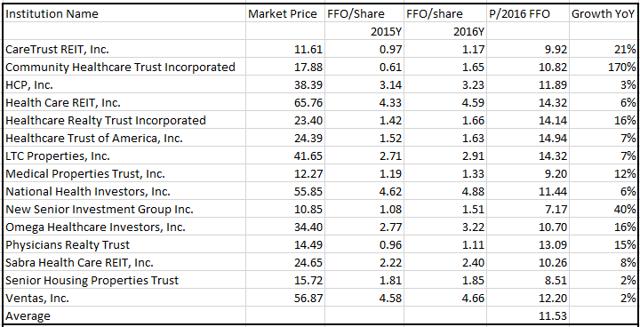

Relative Valuation

Healthcare REITs are down over 10% YTD despite strong growth, leaving multiples very low relative to recent history.

Looking at the gambit of healthcare REITs, OHI stands out as one of the best. At 10.7X 2016 FFO, only 4 companies are cheaper: SNH, SNR, CTRE and MPW.

Senior Housing Properties Trust (NYSE:SNH) and New Senior Investment Group (NYSE:SNR) each have major exposure to senior housing, which as I mentioned has supply concerns. CareTrust (NASDAQ:CTRE) is newer and less proven than OHI as a SNF REIT. The very slight difference in CTRE's multiple and OHI's multiple is not enough to justify losing OHI's track record, size and stability.

Medical Properties Trust (NYSE:MPW) is a screaming buy. I have written about it numerous times so I will not cover it in this article which is about OHI, except to say that there is no reason it cannot be owned alongside OHI. As a pure-play hospital REIT, MPW fits nicely with OHI's SNF portfolio to provide diversification geographically (MPW has substantial European exposure) and by property type without sacrificing dividend yield, growth or value.

From a relative valuation perspective, OHI is the best of both worlds, as its multiple is among the cheapest in the sector, yet its growth at 16% YoY is among the best in the sector. My suggestion that OHI is a great value at 10.7X forward FFO is predicated on its continued strong fundamental performance. Let us take a deeper look.

Fundamental Outlook

Growth and stability at OHI are dependent on 3 things comings true.

- Reimbursement remains secure

- Rent gets paid

- Acquisition pipeline remains open and accretive

I have already touched on the history of reimbursement with the past 15 years showing steady per diem growth. By my analysis, reimbursement is likely to continue growing slowly and steadily.

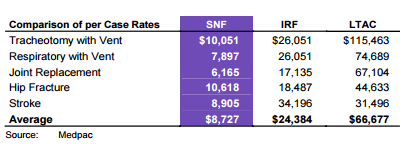

Since SNFs operate fairly high in the acuity spectrum, a majority of the procedures they perform are reasonably deemed necessary. The US government is unlikely to cut funding for necessary procedures, as there would be immediate backlash. If the US government is obligated to fund such reimbursements, the only way SNFs would lose funding is if someone else can perform the same operations for a lower per diem rate.

This seems unlikely as SNFs are the entity which performs at a lower per diem rate. Skilled nursing facilities can execute many common procedures at a fraction of the cost the same procedures incur at other healthcare facilities.

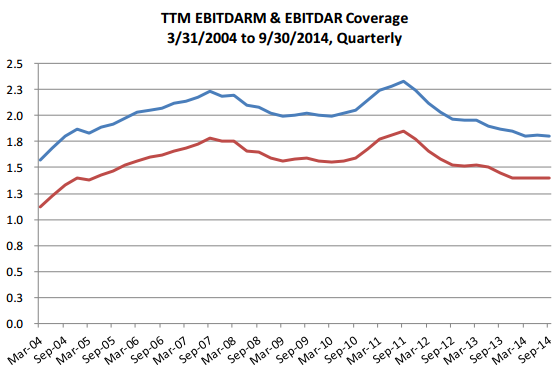

America is getting older and people will always get sick, so demand is growing. Supply is constrained by the aforementioned certificates of need and expense/availability of skilled labor. As measured by EBITDARM, tenant rent coverage has been quite stable, and with favorable demand/supply balance along with secure reimbursements, it follows that rental payments from operators will remain secure.

Healthy reimbursements and collected rent are sufficient to maintain Omega's earnings and dividend. While around 2% annual growth can come from contractual escalators, attaining the projected 16% YoY AFFO growth requires some external acquisition. Historically, OHI has pursued both portfolio acquisitions (the recent purchase of AVIV) and sale leasebacks with operators. Each pipeline appears to still be flowing at cap rates which could be quite accretive.

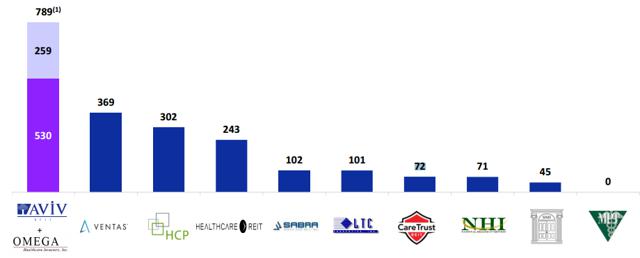

Portfolio acquisition route

While OHI is not considered one of the "big three", which are HCP (NYSE:HCP), Ventas (NYSE:VTR) and Health Care REIT (NYSE:HCN), it is actually the largest player in the SNF space by a substantial margin.

When its size is combined with its conservative leverage and investment grade rating, OHI has a very low cost of debt. This sets Omega up as the natural consolidator in the SNF space, and with the recent drop in healthcare REIT pricing, it may be able to opportunistically take out some peers. Potential acquisition targets for OHI are Sabra (NASDAQ:SBRA) and Care Trust.

Sabra and Care Trust were each formed as a real estate spinoff from their respective larger operators. From these origins, the public REITs are left with an unusually large concentration with a single tenant, and the market seems to be punishing them for it with low multiples. Given their low prices at 10.2X and 9.9X for SBRA and CTRE, respectively, OHI could use its low cost of capital to acquire one or both in a fashion that would be highly accretive on an FFO/share basis.

When the properties of the target are combined with OHI's large portfolio and over 80 operators, the tenant concentration would no longer be an issue.

Smaller acquisitions

OHI's most recent purchase on July 30th is representative of what it does: a $28.5mm purchase of a 300 bed SNF in Virginia at a cap rate of 9.25%. Much of Omega's debt consists of long-term fixed rate senior notes at about a 4.5% coupon. Thus, if acquisitions at these cap rates are levered 1 to 1, return on equity is 14%. Such rates are clearly accretive, and with over 80 operator relationships, OHI does not have trouble sourcing acquisitions.

Between its two pathways, OHI is positioned for steady growth at a moderate pace for years to come.

Magnitude of opportunity

OHI is inherently a defensive stock due to its stable and acyclical earnings. Such stocks tend to trade at premiums, not discounts, since the market as a whole does and should pay up for reduced risk. While it may sound crazy in the current environment, Omega's normal trading multiple should be around 15X, supported by its unique blend of growth and stability. Given 2016 FFO of 3.22, this translates to $48.30 per share, or about 42% upside over the current market price around $34.00. Including dividends at Omega's 6.5% yield, investors who buy now could realize nearly 50% gains over a 1-year holding period.

Return Catalysts

The concept of a return catalyst is a bit tricky at the moment. News items that would typically catalyze returns seem to have no effect in the current market. The traditional catalyst model is shown below.

Positive event Market response shareholder returns

Unfortunately, the market response is broken for the time being. In the past 2 months, we have seen countless companies report fantastic beats on earnings or sizable gains on sale of a property with absolutely no market response. I suspect traditional catalysts will continue to not matter until the market stops flailing and resumes fundamental analysis. Instead, investors may have to rely on a different kind of catalyst which circumvents the market.

Positive event Shareholder returns

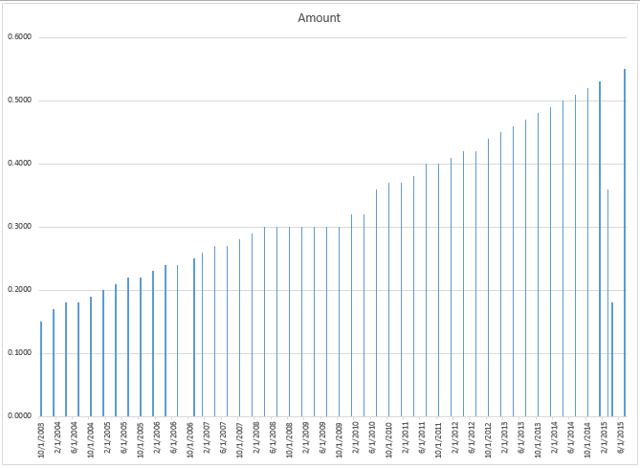

When OHI raises and pays its dividend, shareholders receive cash regardless of how the market is feeling that day. It can continue to build on its track record of dividend growth. Graphed below is OHI's dividend history.

It doesn't look as beautiful as it should because the 2nd quarter dividend got cut into two chunks due to timing of the AVIV merger, but if you sum those two dividends, it makes the full $0.54 quarterly for that nice clean linear dividend growth.

With a 6.5% and growing yield, investors can afford to wait for however long it takes for OHI to return to proper pricing. That being said, there are some reasons to believe OHI could go up rather quickly.

- We are potentially headed into a global growth crisis of near zero growth and inflation. Healthcare should outperform in this environment due to its defensive nature.

- The US yield curve is flattening as the Fed inches ever closer to raising short-term rates, yet the 10-year and 30-year rates are not increasing. Treasury yields are not producing sufficient income so those who need it will have renewed interest in dividend stocks. As a dividend champion with 12 years of consistent dividend growth, OHI will be a likely beneficiary.

- As senior housing supply comes online and the adverse effects become more apparent, money could flood out of the big three healthcare REITs which each have substantial exposure to senior housing and into the pure-play healthcare REITs.

Risks and concerns

While I consider OHI to be a stable company, there are still some risks to consider.

A meaningful portion of demand for SNFs is generated by insurance based reimbursement which reroutes patients requiring a long duration stay into SNFs rather than hospitals due to the lower daily cost. Therefore, SNF demand is contingent upon duration of treatment.

Over recent history, length of inpatient stays has come down materially as medical procedures improved. Further scientific progress in medicine or prevention could exacerbate the decline in length of stay, thereby reducing SNF demand.

I believe the SNF industry is prepared for such developments in that there has actually been negative supply growth of certified beds over the past 10 years.

The bottom line

Omega Healthcare is a high quality, growing and stable REIT that is presently trading at junk prices due to a series of market phenomena. Take advantage of the firesale.

Disclosure: 2nd Market Capital and its affiliated accounts are long OHI, MPW and VTR. I am personally long OHI, MPW and VTR. This article is for informational purposes only. It is not a recommendation to buy or sell any security and is strictly the opinion of the writer.

Source: http://seekingalpha.com/article/3469326-omega-healthcare-quality-at-a-discount

No comments:

Post a Comment