Summary

- Pure Storage specializes in installing flash-based solid state data centers for commercial purposes.

- The company has seen tremendous growth and is poised for even more growth as businesses continue to invest in data center upgrades.

- Pure Storage has plenty of valuation potential. Investors should expect a lofty IPO.

Overview

Value Proposition and Growth

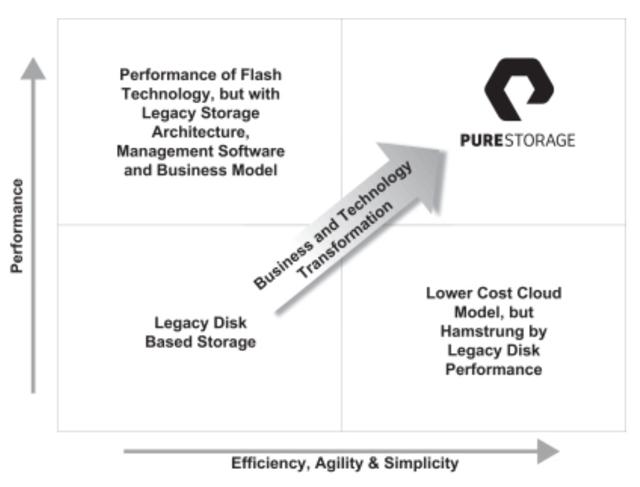

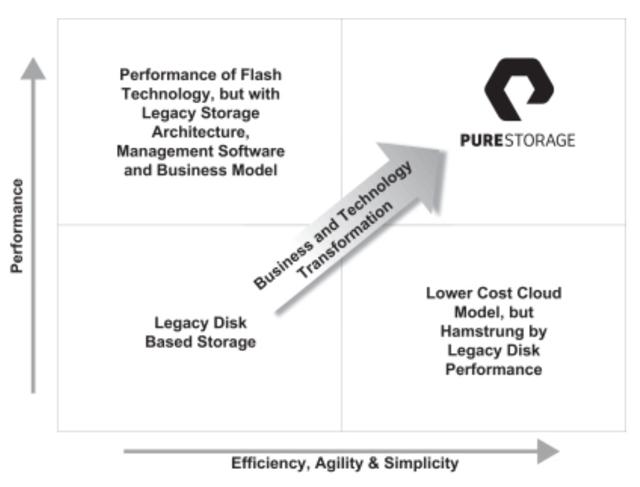

Pure Storage's basic mission is to replace existing disk drive data centers and servers with flash-based drives. The company then supports the drives with their proprietary software to manage the drive networks. Pure Storage's product is a direct competitor of cloud servers. However, there are times when companies want to keep the data and servers local vs. cloud-stores, and that's where Pure Storage's solution comes in. The flash-based system represents a considerably faster, more energy-efficient, smaller solution vs. traditional disk-based systems. By installing flash-systems, companies can reduce their cost to run servers and size of their data centers. The local flash systems also allow for greater speed and control versus cloud servers. Flash systems also have a lower on-going running costs but a greater setup costs compared to cloud computing.

(click to enlarge) Source: Pure Storage S-1

Source: Pure Storage S-1

Source: Pure Storage S-1

Source: Pure Storage S-1

The company has been rapidly growing fields by increasing demand for flash systems. Companies first converted servers and data centers to cloud networks largely because of the lower cost of entry. However, in certain situations companies elected to keep some systems locally managed. As disk drive servers continue to age, companies are slowly swallowing the billet and investing the immediate capital in the update to networks. As more companies make the conversion this will fuel the company's growth.

Finances

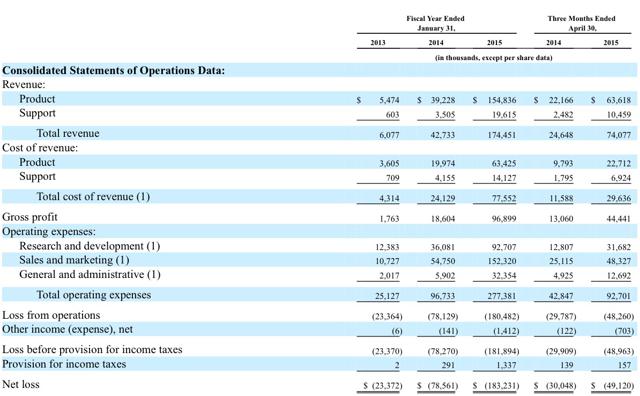

Pure Storage's growth is evident in their historic revenue trend, which increased 30x in two years from 2012 to 2014, and nearly tripled from Q1 2014 to Q1 2015. Despite strong revenue growth, the company has not managed margins very well. Net loss widened by almost 8x from 2012 to 2014. The decking performance is largely due to large increases in operational expenses, especially sales and marketing.

(click to enlarge)

Source: Pure Storage S-1

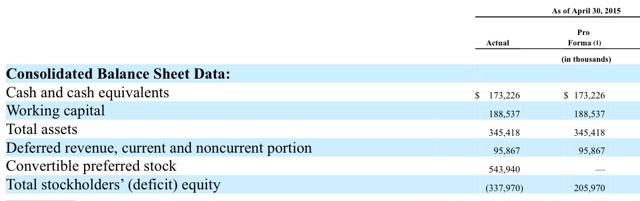

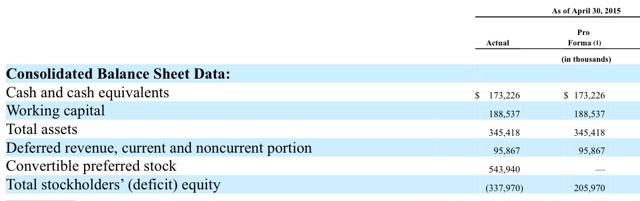

The company has a reasonably strong balance sheet for a young, rapid-growth company. The company has almost $189 million in cash at the end of Q1 2015. The company also filed IPO paperwork to raise up to $300 million in additional capital. The proceeds are expected to go directly toward funding growth and operations. The company does have a large amount of convertible preferred stock in its balance sheet, which does dilute the book value of equity.

(click to enlarge) Source: Pure Storage S-1

Source: Pure Storage S-1

Source: Pure Storage S-1

Source: Pure Storage S-1Valuation

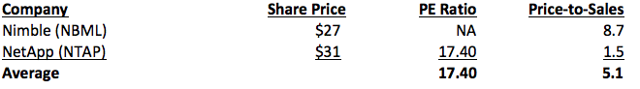

Source: Google Finance

There are really only two publicly traded companies that operate somewhere in the flash-based data center industry. The most comparable company in terms of growth and business model is Nimble Storage (NYSE:NMBL). Nimble currently trades at a 8.7x price-to-sales multiple. If you annualized Q1 2015 sales, the 8.7x multiple would convert to almost $2.2 billion market cap. If investors can buy in below that valuation then there's plenty of short- and long-term upside potential.

Risk

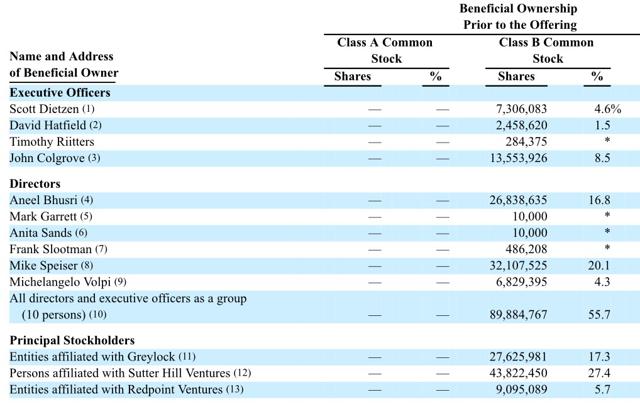

Pure Storage carries two key risks. First, competitive risk from established cloud using companies could render flash storage obsolete. Companies could continue to show greater preference for cloud networks as they become more familiar with using and integrating them into operations. The second risk is the timing of the venture capital owner's exit. The company has become large enough for the VCs to exit, but they clearly have chosen now to maximize their returns. They could either be trying to time the stock market or they may know that the company's growth is about to slow.

Source: Pure Storage S-1

Summary

Pure Storage is well positioned for growth and has considerable valuation potential. Early investors should look to snag shares at a reasonable valuation, but not to overpay if hype drives the price up. There's still a lot to shake out in the industry, and changes in preference or technology could threaten growth potential.

No comments:

Post a Comment