- After a recent selloff, Genworth shares are now trading at just about 5 times earnings.

- Genworth appears to be significantly undervalued based on book value and other metrics.

- Too much short-term and negative thinking has turned Genworth into a bargain that investors should buy now.

- Genworth's turnaround is still on track and recent insider buying is another sign this stock is too cheap to ignore.

Genworth (NYSE:GNW) shares have recently been hammered and now trade for just about $5. Let's go through some of the negatives that the skeptics will want to talk about, which include: concerns about management credibility, the recent charges and challenges facing the long term care business, the fact that this stock has performed terribly and is trading at about one-third of the 52-week high, etc. I get all of this and would fully agree if these concerns were not already very well-known as well as priced into the stock. All of this is yesterday's news and the stock is not trading at rich levels or even fair levels at this point. In fact, the valuation has become absurdly cheap, especially relative to the rest of the market as well as when compared to the insurance industry. This is not the first time I have become interested in buying Genworth after a big plunge to around the $5 level. In July, 2012, when Genworth was trading at $4.83 per share, I wrote an article titled "3 Reasons To Buy Genworth For A Possible Double". Subsequently, shares of Genworth actually doubled and even more than tripled in value. Let's take a look at my top ten reasons for buying Genworth shares now:

Reason #1: Genworth shares are absurdly cheap when considering the PE ratio:

Analysts expect Genworth to earn $1.02 per share for 2015 and see profits rising by nearly 10% to $1.11 per share in 2016. Furthermore, in spite of the recent stock price decline, Genworth posted an operating profit of 24 cents per share for the second quarter of 2015, which is roughly equivalent to these earnings estimates when annualized. So, let's just go back to all the negatives that skeptics can throw at this company and then realize that even with what some view as a lousy long-term care business, and concerns over management credibility, etc., at the end of the day this company is a money maker. If I were to screen for all the $5 stocks in this market, I could find a lot of oil companies that are losing money, or companies that are barely making a profit, but I would be hard-pressed to find a company that is earning about $1 per share. That puts the price to earnings at just about 5 times earnings. Meanwhile the S&P 500 Index is trading for roughly 18 times earnings.

Reason #2: Genworth shares are cheap when considering book value:

Genworth shares have a current book value of about $27.55 each. Just to please the skeptics, let's cut that value by nearly half to about $15 per share. Even after that, we have a stock that is trading for about one-third of that value, while the rest of the market is trading for (on average) nearly 3 times book value. That disparity is just way too big to ignore. Furthermore, Genworth's book value could grow over time as the company earns profits.

Reason #3: The CEO and another insider just bought Genworth shares:

After Genworth's big recent plunge, I was expecting (and wanting) to see some insiders buy this stock bargain and that is exactly what has happened. On August 7, 2015, the CEO, Thomas J. McInerney bought 30,000 shares and as shown below, another insider bought 15,000 shares. I think it is always good to see insider buying, especially after a big drop in the share price because it could mean that management sees a bargain. It's worth noting that insiders generally already often have a significant amount of stock and/or options. So, when you see executives and directors using their own cash to buy more stock, it can be a significant sign of a buying opportunity that other investors should follow. Data below provided by Yahoo Finance.

| Date | Insider | Shares | Type | Transaction | Value* |

|---|---|---|---|---|---|

| Aug 7, 2015 |

MCINERNEY THOMAS(Officer)

| 30,000 | Direct | Purchase at $5 per share. | 150,000 |

| Aug 7, 2015 | KLEIN MARTIN (Officer) | 15,000 | Direct | Purchase at $4.99 per share. | 74,850 |

Reason #4: Trading volume shows capitulation:

The data below provided by Yahoo Finance shows that prior to August 5, Genworth shares traded just a few million shares per day. However, after the recent earnings report was released, the trading volume surged to over 37.5 million shares on August 5, and then nearly 26 million shares were traded on the following day. That is a major increase in volume and it is the type of heavy trading that is typically seen when a stock hits rock bottom in a capitulation-like selloff. More recently, the volume has calmed down and begun to normalize to just a few million shares per day. This means the selling pressure is dwindling and now the stock is even starting to bounce off of recent lows. I believe this stock will see a significant rebound in the coming days and weeks as investors look for value in the market.

| Prices |

|---|

|

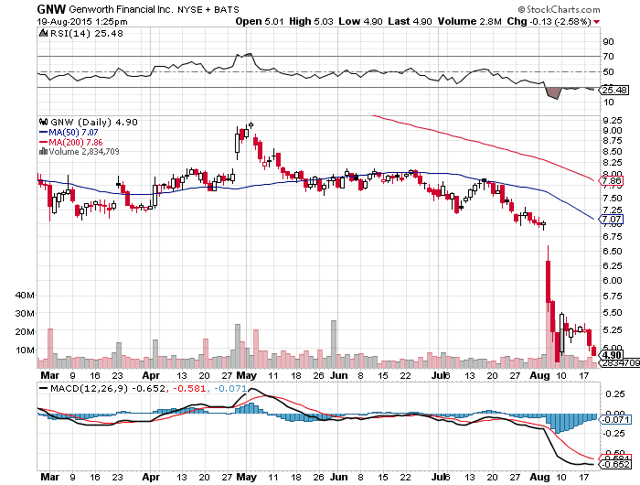

Reason #5: Genworth shares are oversold:

As the chart above shows, Genworth shares were trading for about $7 and now trade for just about $5. The Relative Strength Index or "RSI" is now just 29 which indicates this stock is at oversold levels. This suggests a potential rebound could be in order because the recent selloff has gone too far.

Reason #6: The selloff is a major overreaction:

Genworth has nearly 500 million shares outstanding so the recent drop from just over $7 to about $5 per share means that nearly $1 billion in market capitalization has been wiped out. However, there was nothing in the financial report to warrant this kind of market cap hit, which suggests the steep drop is a completely exaggerated move. Genworth reported operating earnings of 24 cents and revenues $2.16 billion for the second quarter of 2015, which missed analyst estimates of 26 cents per share and revenues estimates of $2.39 billion. That is not commensurate with a $1 billion haircut to the market cap.

Reason #7: Buying Genworth shares after major pullbacks has paid off over the past few years:

Genworth has a history of volatility which has allowed it to trade at much higher levels as it did just over a year ago at about $15 per share. It has also had periods where the shares appeared to be "hated" and was therefore trading in the mid single digits, just as it is now. For example, as noted in this Barron's article, Genworth shares surged in 2013, from the single digits, and went up to around $18. I think Genworth will rise again as it has a solid business model and the fundamentals of this business have not changed as much as the share price has in the past year. Mostly what has changed is investor sentiment, and the current negative investor sentiment has created another major buying opportunity.

Reason #8: Genworth's turnaround plans are on track:

Some investors appear to be disappointed with the slow pace of Genworth's turnaround, but it appears to be on track. Perhaps some investors were hoping for more news in this earnings report on Genworth's plans to sell certain assets or for more progress on a plan to save $100 million per year (which could add about 25 cents per share to the bottom line), but these things take time. Plus, the company is making progress and moving forward with the expected sale of its lifestyle protection business. An analyst at StreetAuthority recently detailed why Genworth was on the "cusp of a major turnaround". A Barron's article detailed this bullish view stating:

"Whether it's a massive share buyback (Hertz) or ongoing asset sales (Genworth) these stocks have catalysts to help them move higher," writes Sterman. "Both are deeply loathed right now, but their respective management teams have articulated clear-cut turnaround strategies. As long as they can execute those plans, investors are bound to re-visit these broken stocks."

Reason #9: Shorts are starting to cover and could help fuel a rebound:

According to Shortsqueeze.com, nearly 17 million shares were short. However, in the most recent reporting period, the short interest went down to just about 15 million shares which shows that some shorts appear to believe this stock has bottomed out. Since Genworth shares typically see just a few million shares per day in trading volume, the remaining 15 million shares that are short could help fuel a rally.

Reason #10: Buy low, sell high:

Everyone wants to buy low and sell high, but this is much harder to do than it is to say because of human psychology. We are naturally wired to avoid pain in order to survive and that is why some investors don't want to buy a stock that is down. When we see a stock that has recently caused pain (losses) for other investors, I think it naturally causes many of us to avoid it as well, even if it is ridiculously cheap or low. That is why many investors passed up buying Bank of America shares at $5, or Hewlett Packard at $12. The current share price for Genworth is completely irrational and I believe it will rebound significantly. I would not be surprised to see this stock trading back at about $15 per share within the next couple of years. At end of the day, concerns about LTC, management credibility, etc., are more than priced in. The bottom line is that this company is solidly profitable and expected to earn more than $1 per share for 2015 and $1.10 in 2016. Plus, there are many other positives that investors are overlooking now, which include ongoing expense reductions, asset sales and spin-off potential. If Genworth succeeds in implementing the $100 million expense reduction plan by 2017, earnings could climb to about $1.40 per share for 2017. A reasonable PE ratio of 11 on $1.40 per share in earnings could put this stock back at about $15 per share by 2017. But let's be skeptical and assume the market still gives Genworth a PE ratio of 6 times these 2017 earnings estimates, and we still have a stock that could double in value. To get notice on future articles on Genworth and other value stock buying opportunities I plan to write, please follow me.

Data is sourced from Yahoo Finance. No guarantees or representations

are made. Hawkinvest is not a registered investment advisor and does

not provide specific investment advice. The information is for

informational purposes only. You should always consult a financial

advisor.

are made. Hawkinvest is not a registered investment advisor and does

not provide specific investment advice. The information is for

informational purposes only. You should always consult a financial

advisor.

By Hawkinvest

No comments:

Post a Comment