Summary

- Bojangles had yet another outstanding quarter, with solid growth in almost all key metrics.

- The company is well on its way to achieving its long-term goal of 1,000 restaurants.

- Fundamental investors might consider waiting for the stock to deflate just a bit more, but they will need to act before the market corrects for Bojangles’s growth potential.

With the release of Bojangles' (NASDAQ: BOJA) Q2 financial results, investors were greeted with another excellent quarter. Comps rose 4.4%, top line growth was 13.1%, 13 new restaurants were opened, pro forma net income grew by a fantastic 43.1%, and adjusted EBITDA shot up 21.6%. All-in-all, not bad for such a rapidly growing company.

Source: Stockcharts.com

And yet, investors were not satisfied with this level of performance, as evidenced by the general downward pressure the stock experienced in the days following the release of the company's Q2 results. Of course, with the company having IPOed just a few months ago, this is understandable. Investors are not yet confident that the company can own up to their expectations even with these excellent results.

With the company's new, raised annual guidelines, investors are looking at even more rapid growth for the company. Bojangles now has about 90 new restaurant openings in the pipeline, and it plans to open about 59 to 63 system-wide restaurants for the full 2015 fiscal year. With a new top line guidance of $483.5M to $487.5M, investors can expect about a 12.4% year-on-year increase in revenue.

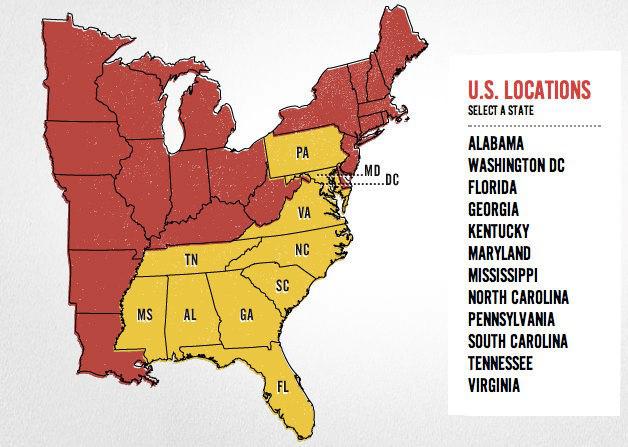

Recall the company's current store locations. Bojangles is still a relatively small restaurant chain, as exemplified by its $750M market cap. The company's stores are concentrated in the southeast, shown in the chart below.

Source: BOJA Investor Website

All that red space in that chart is potential... potential for the company to expand to new heights. The states that the company currently has stores in have a decent target population, but states like Texas, California and New York offer enormous markets that the company has yet to tap into. With the growth potential that the company has to offer, a slight overvaluation of the company would still make Bojangles a great GARP investment.

Although this company still has a lot to prove, the growth that the company has accomplished thus far gives a fair amount of evidence to investors that it's capable of reaching its 1,000 unit goal by 2020. With the 379 restaurants it has opened thus far, this represents more than a 2.5x increase in restaurants over the next five years.

Given the amount of space the company has to expand toward and the outstanding results this quarter, I continue to issue a buy recommendation for investors. Although fundamental investors looking to open a position in this company might consider waiting for any straggling speculators to leave, it won't take long for the market to realize this company's potential.

No comments:

Post a Comment