- Deutsche Bank dropped their guidance on American Airlines with a staggering $20. American Airlines plunged on this news.

- Although I'm not expecting American Airlines to hit this year anywhere near $65 or higher, it should be able to get back to its 52-week high. That's 15% potential.

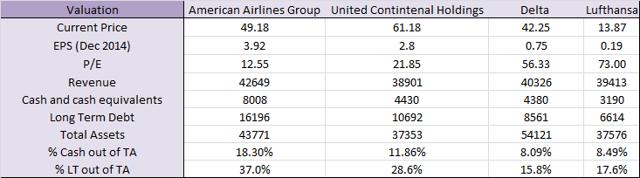

- In comparison to its competitors, American Airlines is a strong value play.

- With the new IATA March report coming out and corporate results in a few weeks, now is a good buy opportunity.

I have covered many airline stocks before; as I believe they are a vital part of everyone's diversified portfolio: EasyJet (OTCQX:ESYJY), Ryanair(NASDAQ:RYAAY), Air-Berlin and Hawaiian Holdings (NASDAQ:HA).

Analyst recommendations: why look at it?

Source: 4traders.com

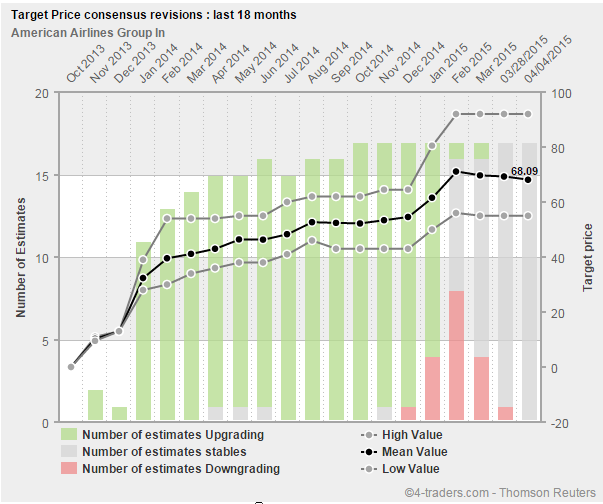

The histogram above clearly depicts the story that the amount of analysts upgrading the stock has come to a standstill since February this year. As you can tell from the histogram, the Mean Value of American Airlines Group still stands at a respectable $68, which is still a premium of 38% above its current value of around $50.

Source: 4traders

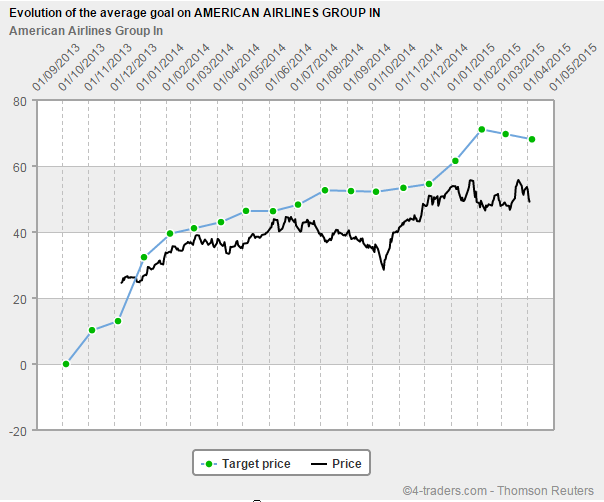

Looking at the "evolution of the average goal" in the line chart above, it once more depicts the story that analysts have a lagging tendency when it comes to buy/hold/sell recommendations. When target price and actual price come quite close to each other, the target price by analysts shoots up. How come?

When a large institutional bank gives advice to its clients about certain stock positions, it's always walking across a borderline of issues concerning what information to share. This, as most banks have their own trading divisions which make substantial amount of profits. Unfortunately, when individual traders look at the personal recommendation of an analyst, they see a different perspective. It doesn't match. For example, in the top 25 analystsranked by tipranks.com, there is no analysts to be found from Goldman Sachs, this while their trading division performs relatively well. The highest ranked Deutsche Bank analyst at the time, was ranked 18th.

My view on this is that analysts' recommendations (no matter whether they are useless or not) should never be ignored. Many firms nowadays are part of an index fund or a large pension fund and the latter still cares significantly about the analyst recommendations from large institutional banks.

Fundamentals

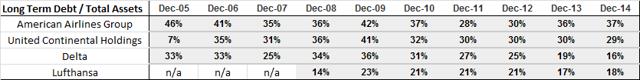

Let's do a comparison between the top 4 airlines in the world, American Airlines Group, Lufthansa (OTCQX:DLAKY), Delta (NYSE:DAL) and United Continental Holdings (NYSE:UAL).

Source: Author's own calculations

The table depicts a clear story in favor of American Airlines Group. Although it can be interpreted in many ways, for example the large percentage LT debt/Total Assets could smell troublesome. But airline stocks are known for their relatively high debt/assets ratio as shown underneath:

Source: Author's own calculations

A clear trend is shown on how LT Debt/TA has been developing over an extended time frame. It remains relatively stagnant over time. Nevertheless, it always has been a significant number. When as investor, you want to acquire airline stocks, don't be afraid that some of your stocks possess large amounts of debt. It's part of the sector.

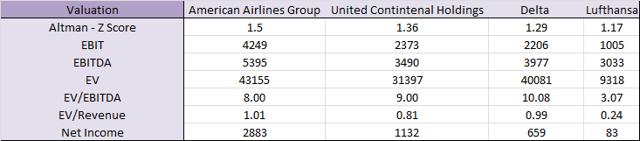

Other valuations: What do I get for 1$?

Source: Author's own calculations

From a multiple perspective, American Airlines yields the best impression. TheAltman - Z score is also in favor of American Airlines Group. Although it's not a frequently used indicator for airlines, but because the industry itself often has financial stability issues I tend to use the Altman - Z score. It offers an alternative look in the financial strength of a firm, if compared with direct peers in the industry.

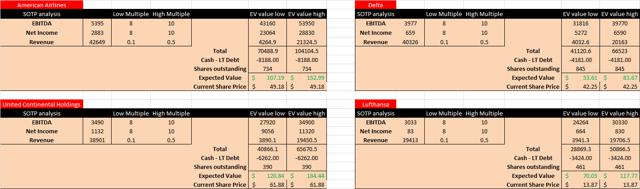

SOTP analysis

In the next analysis I do a SOTP analysis based on the EV multiple of American Airlines (8x) and Delta (10x).

Source: Author's own calculations

A simple like for like comparison tells a clear story, Delta is clearly more fairly valued in comparison to American Airlines & United Continental Holdings. Eventroubled Lufthansa offers a better deal in comparison to Delta. Nevertheless, a SOTP analysis does not have a strong focus on cash; therefore we add another evaluation, this time a simplistic 3-stage DCF model:

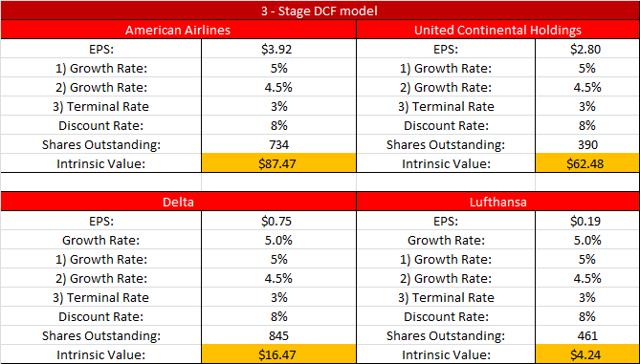

Source: Author's own calculations

Based on a like for like growth example (5%, 4.5% towards a terminal growth of 3%) the intrinsic value depicts a relative similar story as of the SOTP analysis. Once more, American Airlines & United Continental Holdings show a better valuation perspective in comparison to Delta. Lufthansa's depicted scenario is now a lot worse in comparison to the SOTP analysis as a DCF analysis lays more value on its cash flow ability. This double SOTP and DCF analysis is not meant as an exact mathematic analysis but meant to open up a discussion. I kept growth rates similar (ceteris paribus) to keep a fair comparison. Personally, out of these results, I find American Airlines valued as the best contender out of the 4, with the most upwards potential. I realize that by shifting the numbers, the picture might change significantly.

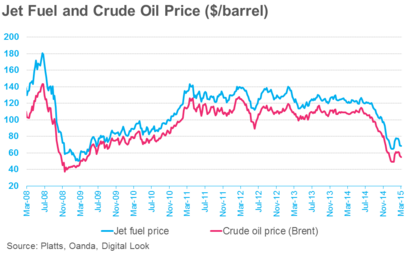

Jet Fuel

Source: iata.org

As everyone knows, Jet Fuel and Crude Oil are highly correlated to each other. As this has significantly dropped over the last year, it's a mutual big plus for the airline industry. It's hard to define this as a stronger benefit to 1 airline in comparison to any other airline; therefore I did not add this in the analysis. Some airlines might have hedged Jet Fuel price years in the future; they will now benefit the least. Nevertheless, if Jet Fuel would rise again, these airlines would benefit more in comparison to the firms hedged the least.

Conclusion

Although Deutsche Bank has lowered its guidance on American Airline Group to $58, in anticipation of the new March Air Passenger analysis by IATA and lower-than-expected earnings in April, I still consider American Airline Group a strong value play. If American Airlines would drop below $47.50, I will definitely pick this up. The next monthly coverage will give us great insight in what to expect 4/24/15 when American Airlines Group posts their latest corporate results.

Additionally, Lufthansa is definitely a worth looking at. The German carrier has lost significant business over the last year due to an excessive amount of strikes by the union. Furthermore, Lufthansa remains under severe pressure as the firm has made mistakes at their daughter carrier Germanwings, which suffered a fatal crash not too long ago in Europe.

No comments:

Post a Comment