Summary

- Exit from a troubled loss-making division coupled with continued growth of a highly profitable segment portend large increase in earnings at Hallmark.

- Insiders own 30%+ of company and have been buying.

- Company is well capitalized and has ample growth opportunities.

- Selling at just 75% of book value and less than 6x normalized earnings, shares could appreciate 60% over the next 12-18 months as turnaround becomes evident.

Though Hallmark Financial Services (NASDAQ:HALL) has produced strong results in its core specialty commercial business, group results have been overshadowed by a poor decision to enter the Florida personal lines business in 2009. The Floridian personal lines segment has been a bleeder which has led to muted book value growth between 2010 and 2012 and share price underperformance (vs. Russell 2000 over past 3 years). However, Hallmark has now largely exited Florida while continuing to grow the company's highly profitable specialty commercial lines business. Assuming continued strength in the specialty business, earnings are likely to increase significantly over the next 12-18 months. While insiders have accumulated shares, the market has yet to recognize the many positive attributes of the business, including:

- Following a change in strategy, the company has seen a meaningful improvement in operating results over the past twelve months. While revenue has decreased, Hallmark's combined ratio is significantly lower than it had been historically. This is driven by an exit of the problematic Floridian personal lines business as well as continued strength in the company's growing specialty commercial business.

- Insiders own over 30% of Hallmark shares. In addition, insiders have recently been buying additional shares. While there are many reasons insiders sell, there is generally only one reason they buy. Insider ownership is particularly important for financial services companies as it prevents management from taking on unprofitable business for the sake of growth.

- With a market capitalization of just $180 million and a free float of only $125 million, Hallmark is off the radar screen of most institutional investors.

- While 2014 results to date have been considerably better than they had been historically, profitability has been masked by high levels of catastrophe losses. If these normalize, 2015 profitability could be significantly better than 2014.

- Despite the aforementioned positives, Hallmark trades at just 78% of book value (95% of tangible book value) and less than 7x my estimate of 2015 earnings. Were the company to trade in line with micro-cap insurance peers, shares could rise 60%.

- Solid balance sheet - equity capital to net earned premium is a solid 50%. Garners an A- rating from AM Best. The company could return capital to shareholders or instantly expand net underwritten premium by 20% with no new capital.

- Significant exposure to growing Texas market - Hallmark should be able to profitably outgrow peers over the next 5 years.

When the turnaround does become visible to investors, shares could appreciate 60%. Similarly, with shares selling at a 25% discount to book value (and selling at 1x tangible book value), downside is relatively limited.

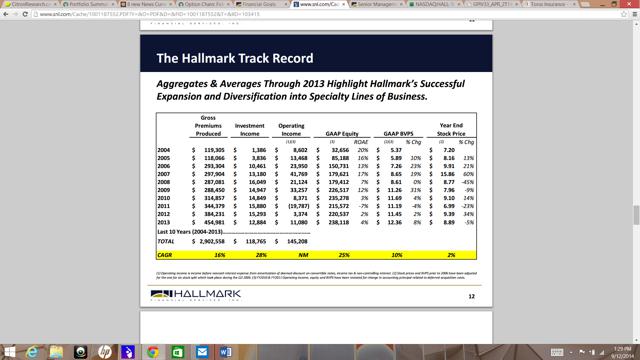

As you can see below, Hallmark produced very strong underwriting results from 2002-2009 (2002-2006 benefited from a post 9/11 hard market). Hallmark has a highly profitable specialty commercial insurance business which sells excess and surplus insurance for commercial automobile, general liability, commercial property targeting middle-market customers. Excess and surplus insurance is purchased when those who needed insurance coverage are unable to secure it from the standard carriers (or admitted carriers) due to a variety of reasons (e.g., new entity or one that does not have a adequate loss history; one that has unique coverage requirements; or a loss record that does not fit the underwriting requirements of a standard carrier).

As you would expect, given the higher risk profile of the insured, this insurance is more expensive and requires a higher level of expertise on the part of the underwriter. The specialty segment also sells general aviation and workers compensation insurance. While writing specialty insurance successfully requires a high level of expertise, the barriers to entry are low (requires capital and distribution but distribution can be outsourced via insurance brokers). Thus the most important factor in producing strong returns on capital over time is management discipline and experience. Fortunately, the management of this segment has a long tenure at Hallmark.

While the core specialty commercial business has been a stable producer of profits, in late 2009, Hallmark made an ill-fated decision to enter the Florida personal lines business. This led to a significant increase in the company's combined ratio and led to minimal profitability between 2010-2012:

As you can see above, there was a marked spike in Hallmark's combined ratio following its entry into Florida in late 2009. While the company continued to produce solid combined ratios in its core specialty commercial business between 2010-2012 (average combined ratio of 92% during this period), the personal lines business suffered tremendous losses - its combined ratio peaked in 2011 at 135%! Hallmark began winding down the Florida business in 2011 and its overall contribution to earnings has shrunk significantly. In addition to the losses in Florida, the company's standard commercial business suffered from lower rates. While the Florida losses are unlikely to recur, the standard commercial business will see ups and downs as the business is very cyclical. The good news is that Hallmark has increased its focus on the specialty commercial business (now represents 70% of the business vs. 50% in 2011) which has demonstrated exceptional long-term profitability. As such, even with occasional difficulty in the standard commercial segment, Hallmark should be able to produce double-digit ROEs.

source: Hallmark investor presentation

As shown below, if the company can get back to a low to mid 90s combined ratio (I chose 94%) and generate 3-4% investment returns, I expect that Hallmark can earn $1.59 per share which implies a 12.5% return on equity. A 94% combined ratio doesn't require any heroic assumptions. As long as Hallmark can continue to operate its specialty commercial segment at a combined ratio of 90-92%, and manage to keep the cross-cycle combined ratio of its standard commercial segment under 100% (which it has done), this is very achievable. A small but well-run insurance company like Hallmark should trade for somewhere around 10-12x earnings or 1.3-1.8x book value. Comparable companies like Atlas Financial Holdings (NASDAQ:AFH) and First Acceptance Capital (NYSE:FAC) sell for 1.6x and 1.4x book value, respectively. Pricing Hallmark at 10x earnings and 1.1x estimated 12/15 book value, I arrive at a share price of nearly $16, or 62% above today's share price.

Hallmark Financial Services

| |||

in $ million

| |||

Net Earned Premium

|

400

|

A

| |

Combined ratio

|

94.0%

| ||

Underwriting Profit

|

24

|

B

| |

Float as a % of Premium

|

95.0%

| ||

Capital to Premium

|

46.3%

| ||

Total Earning Assets/ Premium

|

141.3%

|

C

| |

Assumed Return on Invested Assets

|

3.5%

|

D

| |

Investment Earnings

|

19.8

|

E=A*C*D

| |

Total pre-tax earnings

|

44

|

=B+E

| |

Less Taxes

|

-13

|

30%

| |

Net Income

|

31

| ||

Implied ROE

|

12.5%

| ||

Shares outstanding

|

19.3

|

million

| |

EPS

|

1.59

| ||

Multiple

| |||

8

|

12.70

| ||

9

|

14.29

| ||

10

|

15.88

|

Equivalent to 1.3x 6/14 book value ((BV)); 1.0x estimated 12/2015 BV

| |

11

|

17.46

| ||

12

|

19.05

| ||

While I believe that Hallmark is a solid investment at these levels, it is important to highlight risks associated with an investment in the company:

- Insurance is a competitive (almost perfectly competitive) business where the only barrier to entry is capital (and reinsurance companies can be created in a matter of months). As such, long-term industry returns are low.

- Like all insurance companies, Hallmark has a sizeable investment portfolio and the company's earnings and profitability will be impacted by overall declines in equity and bond prices.

- Similarly, as with most insurance companies, Hallmark is subject to large losses from catastrophes.

- While I believe management has learned its lesson following Hallmark's misadventure in Florida, it is always possible that the company decides to enter a new business segment which proves to be unprofitable.

- Source:http://seekingalpha.com/article/2497085-turnaround-at-hallmark-financial-services-could-drive-60-percent-upside

Great post. This article is really very informative & effective. I think its must be helpful for us.

ReplyDeleteSocial Bookmarking Sites List | Directory Submission List

Thanks for sharing valuable information.

ReplyDeleteCentury Textiles and Industries Ltd

Asian Paints Ltd

Bajaj Finance Ltd

Stock Market